DEF 14A: Definitive proxy statements

Published on April 29, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| ___________________ | ||

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| ___________________ | ||

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Apollo Medical Holdings, Inc.

| ____________________________________________________________________________________________ | ||

(Name of Registrant as Specified in Its Charter)

| ____________________________________________________________________________________________ | ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

| _____________________________________________________________________________________________________________ | ||

(2) Aggregate number of securities to which transaction applies:

| _____________________________________________________________________________________________________________ | ||

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| _____________________________________________________________________________________________________________ | ||

(4) Proposed maximum aggregate value of transaction:

| _____________________________________________________________________________________________________________ | ||

(5) Total fee paid:

| _____________________________________________________________________________________________________________ | ||

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

| ______________________________________________________________________________________________________________________ | ||

(2) Form, Schedule or Registration Statement No.:

| ______________________________________________________________________________________________________________________ | ||

(3) Filing Party:

| ______________________________________________________________________________________________________________ | ||

(4) Date Filed:

| _________________________________________________________________________________________________________________ | ||

1

1668 S. Garfield Avenue, 2nd Floor

Alhambra, California 91801

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 17, 2021

To the Stockholders of Apollo Medical Holdings, Inc.:

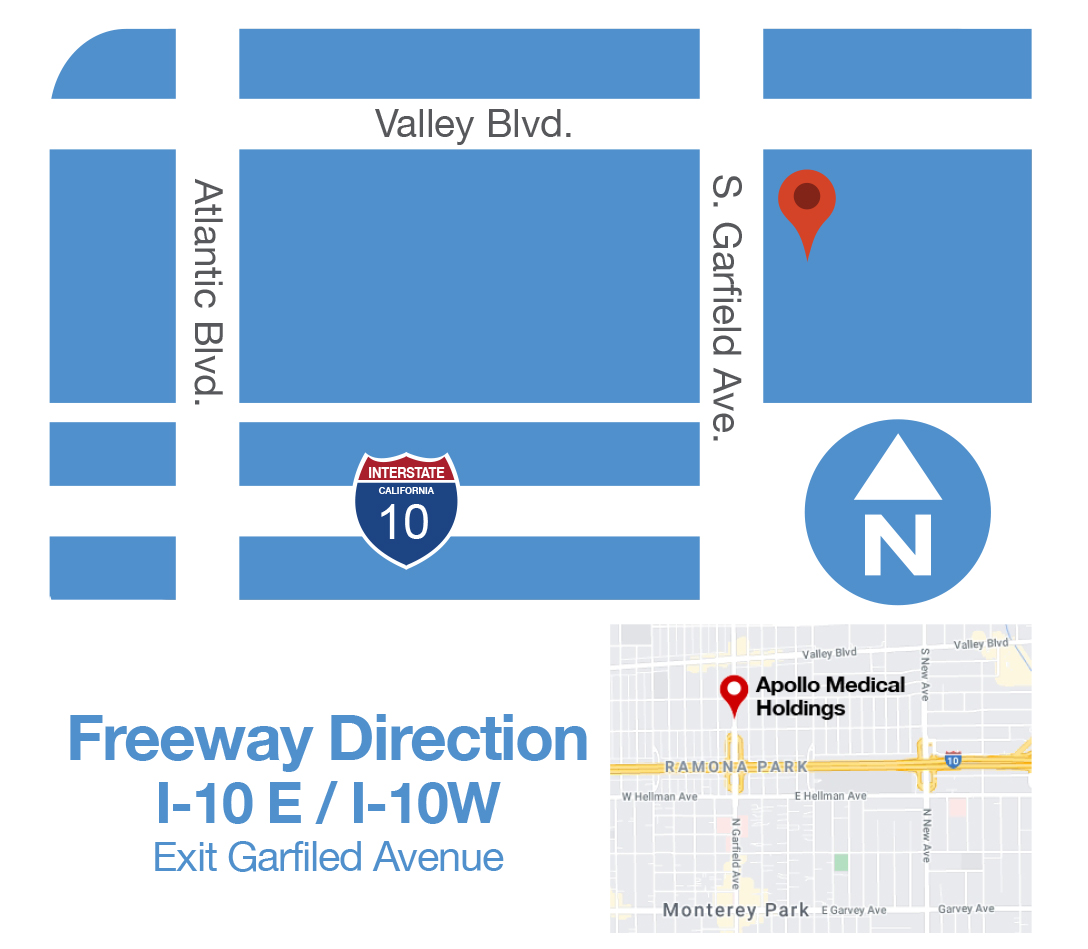

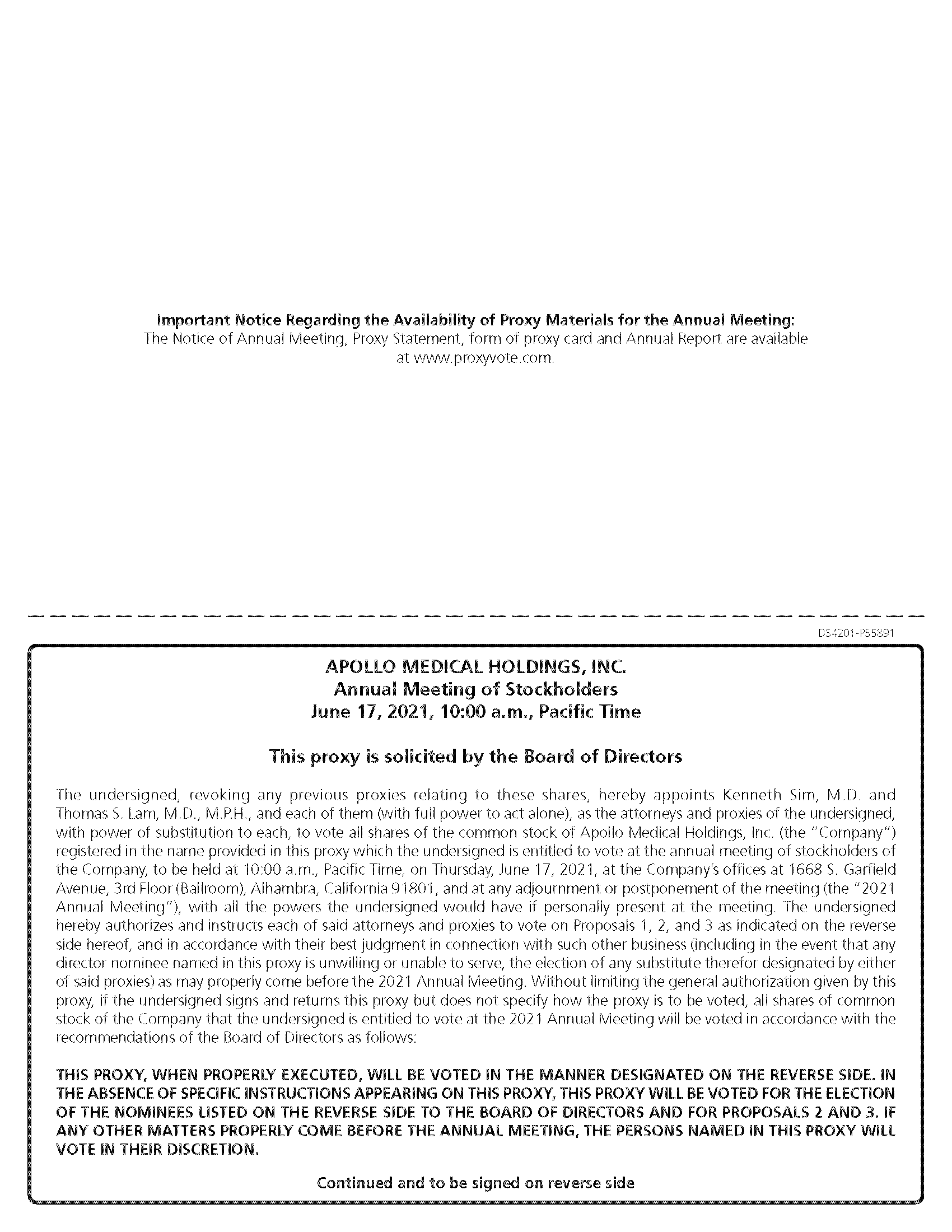

NOTICE IS HEREBY GIVEN that the 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”) of Apollo Medical Holdings, Inc. (the “Company,” “we,” “our,” or “us”) will be held at the Company’s offices located at 1668 S. Garfield Avenue, 3rd Floor (Ballroom), Alhambra, California 91801, at 10:00 a.m., Pacific Time, on Thursday, June 17, 2021 for the following purposes:

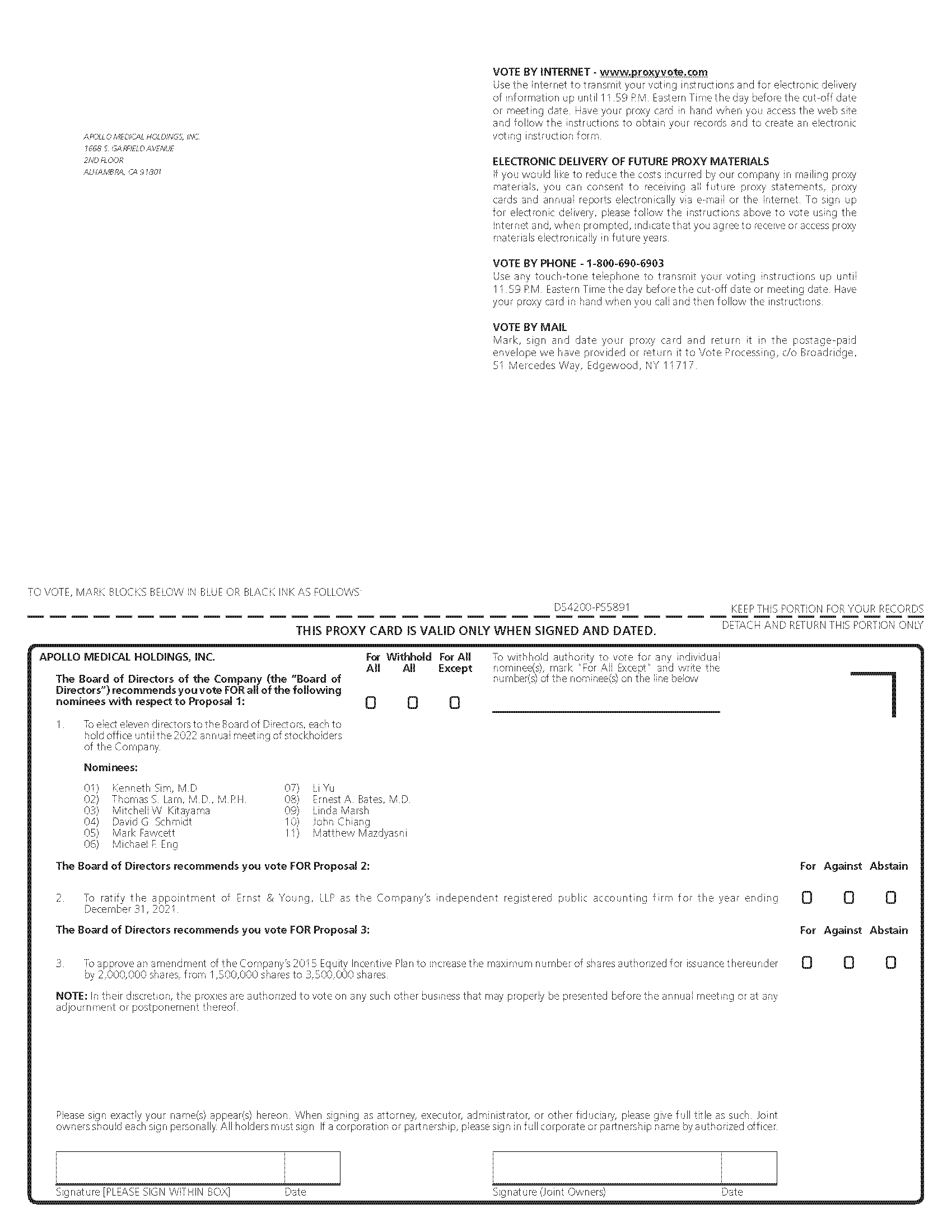

1.To elect eleven directors to our Board of Directors (the “Board”); each to hold office until the 2022 annual meeting of our stockholders (“Proposal 1”);

2.To ratify the appointment of Ernst & Young, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 (“Proposal 2”);

3.To approve an amendment of the Company’s 2015 Equity Incentive Plan to increase the maximum number of shares authorized for issuance thereunder by 2,000,000 shares, from 1,500,000 shares to 3,500,000 shares (“Proposal 3”); and

4.To transact such other business as may properly come before the meeting, or any postponement or adjournments of the meeting.

These matters are described more fully in the proxy statement accompanying this notice. The Board has fixed the close of business on April 28, 2021 as the record date (the “Record Date”) for determining those stockholders who will be entitled to notice of and to vote at the 2021 Annual Meeting. Only stockholders of record at the close of business on the Record Date will be entitled to notice of, and to vote at, the meeting. If you are such a stockholder, you are urged to submit a proxy card as enclosed, even if your shares were sold after such date. If your broker, bank or other nominee is the holder of record of your shares (i.e., your shares are held in “street name”), you will receive voting instructions from the holder of record. You must follow these instructions in order for your shares to be voted. We recommend that you instruct your broker, bank or other nominee, by following those instructions, to vote your shares for the accompanying proxy card.

THE BOARD RECOMMENDS YOU VOTE FOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES AS SET FORTH ON PROPOSAL 1, FOR THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG, LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON PROPOSAL 2 AND FOR THE APPROVAL OF AN AMENDMENT OF THE COMPANY’S 2015 EQUITY INCENTIVE PLAN TO INCREASE THE NUMBER OF SHARES AUTHORIZED FOR ISSUANCE THEREUNDER ON PROPOSAL 3. WHETHER OR NOT YOU PLAN TO ATTEND THE 2021 ANNUAL MEETING, PLEASE PROMPTLY VOTE BY TELEPHONE OR INTERNET AS INSTRUCTED ON THE ACCOMPANYING PROXY CARD OR THE NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS, OR COMPLETE, DATE, SIGN AND RETURN THE ACCOMPANYING PROXY CARD AS INSTRUCTED THEREON.

Please read the accompanying proxy materials carefully. Your vote is important, and we appreciate your cooperation in considering and acting on the matters presented. Even if you plan to attend the 2021 Annual Meeting, we recommend that you vote prior to the meeting to ensure that your shares will be represented.

By Order of the Board,

Kenneth Sim, M.D.

Executive Chairman & Co-Chief Executive Officer

April 29, 2021

Alhambra, California

2

PROXY STATEMENT FOR

2021 ANNUAL MEETING OF STOCKHOLDERS OF

APOLLO MEDICAL HOLDINGS, INC.

To Be Held on June 17, 2021

3

APOLLO MEDICAL HOLDINGS, INC

TABLE OF CONTENTS

| Page | |||||

4

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

General

In this proxy statement, we refer to Apollo Medical Holdings, Inc. as the “Company,” “we,” “our” and “us.” This proxy statement is furnished in connection with the solicitation by our Board of Directors (the “Board”) of proxies to be voted at the 2021 Annual Meeting of Stockholders of the Company (the “2021 Annual Meeting”), which will be held at 10:00 a.m., Pacific Time, on Thursday, June 17, 2021 at 1668 S. Garfield Avenue, 3rd Floor (Ballroom), Alhambra, California 91801, or at adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of 2021 Annual Meeting of Stockholders (the “Notice”). This proxy statement and the proxy card are first being mailed or made available to stockholders on or about April 29, 2021. In addition, stockholders may obtain additional copies of our Annual Report to Stockholders for the year ended December 31, 2020 (“2021 Annual Report to Stockholders”) and this proxy statement, without charge, by writing to us at our principal executive offices at 1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801, Attention: Corporate Secretary, or from our website at https://apollomed.net/sec-filings. Our 2021 Annual Report to Stockholders, which incorporates our Annual Report on Form 10-K for the year ended December 31, 2020 filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 15, 2021, without exhibits, is being provided or made available to stockholders concurrently with this proxy statement. The Annual Report is not to be regarded as proxy soliciting material or as a communication by means of which any solicitation of proxies is to be made.

Outstanding Securities and Quorum

The close of business on April 28, 2021 was the record date (the “Record Date”) for stockholders entitled to notice of, and to vote at, the 2021 Annual Meeting. As of the Record Date, we had 54,996,738 shares of common stock, par value $0.001 per share, issued and outstanding, according to the records maintained by our transfer agent. All of the shares of our common stock, issued and outstanding on the Record Date, and only those shares (collectively, the “Voting Shares”), are entitled to vote on each of the proposals to be voted upon at the 2021 Annual Meeting.

Our largest stockholder and a consolidated variable interest entity of the Company, Allied Physicians of California, a Professional Medical Corporation (“APC”), held approximately 10,895,193 shares of our common stock as of the Record Date, representing a controlling interest in our Company. Pursuant to a Voting and Registration Rights Agreement that APC and the Company entered into on September 11, 2019 in connection with the consummation of a series of interrelated transactions further described in “Related Person Transactions” below, APC shall only be permitted to vote up to 9.99% of the outstanding shares of our common stock at any time a vote is taken and will grant a proxy to the Company’s management to vote any excess shares in the same proportion as all other votes cast on any proposal coming before the Company’s stockholders.

As of the Record Date, 1,111,111 shares of our Series A preferred stock and 555,555 shares of our Series B preferred stock, par value $0.001 per share, were held by our wholly owned subsidiary, Network Medical Management, Inc. (“NMM”). Pursuant to the Delaware General Corporation Law, such shares held by NMM shall be neither entitled to vote, nor counted for quorum purposes, at the 2021 Annual Meeting.

The presence of the holders of a majority of the Voting Shares, in person or represented by proxy, shall constitute a quorum for the transaction of business at the 2021 Annual Meeting, including voting on each proposal to be voted on at the meeting. Broker non-votes and abstentions by stockholders from voting will be counted towards determining whether or not a quorum is present at the 2021 Annual Meeting, as the Voting Shares so held are entitled to vote at the meeting but do not count as affirmative or negative votes cast.

Voting Procedures

Holders of Voting Shares will have one vote for each such share with regard to each matter to be voted upon. A broker non-vote occurs when shares held by a broker or other nominee are not voted with respect to a particular proposal because the broker or nominee does not have discretionary authority to vote on the matter and has not received voting instructions from beneficial owners. If an executed proxy is returned, indicating that the broker or nominee holding shares in street name does not have discretionary authority as to the shares with respect to a proposal, such shares will be considered present at the 2021 Annual Meeting for purposes of determining a quorum on all matters, but will not be considered to be votes cast. Similarly, abstentions by stockholders from voting and broker non-votes will be counted towards determining whether or not a quorum is present. If your broker holds your shares in its name and you do not instruct your broker how to vote, your broker will only have discretion to vote your shares on “routine” matters.

5

Where a proposal is not “routine,” a broker who has not received instructions from beneficial owners does not have discretion to vote uninstructed shares on that proposal. At the 2021 Annual Meeting, Proposal 2 (the Ratification of the Appointment of Independent Registered Public Accounting Firm) is considered a routine matter. Proposal 1 (the Election of Directors) and Proposal 3 (the Approval of an Amendment to Our 2015 Equity Incentive Plan) are considered “non-routine,” and your broker will not have discretion to vote on these proposals in the absence of your voting instructions.

| Proposal 1: Elect Our Directors |

The directors will be elected by a plurality of the votes cast by the Voting Shares present in person or represented by proxy at the 2021 Annual Meeting, meaning that the nominees receiving the highest numbers of “FOR” votes, up to the number of directors to be elected, will be elected. Because our Series A and Series B preferred stock are held by a wholly owned subsidiary of the Company and thus is not entitled to vote, only shares of our common stock, issued and outstanding as of the Record Date, are entitled to vote on this proposal. In voting on Proposal 1 to elect directors, you may vote either FOR all the nominees, WITHHOLD your vote from all the nominees, or WITHHOLD your vote from any one or more specific nominees and vote FOR any one or more specific nominees. Votes that are withheld and broker non-votes will not be included in the vote tally for the election of the directors, and therefore, will have no effect on the outcome of the election of directors.

|

||||

| Proposal 2: Ratify the Appointment of Our Independent Registered Public Accounting Firm |

In voting with regard to the ratification of the appointment of our independent registered public accounting firm, stockholders may vote in favor of such proposal, vote against such proposal, or abstain from voting. The vote required to approve Proposal 2 is the affirmative vote of a majority of the votes cast affirmatively or negatively on this proposal. Because our Series A and Series B preferred stock are held by a wholly owned subsidiary of the Company and thus is not entitled to vote, only shares of our common stock, issued and outstanding as of the Record Date, are entitled to vote on this proposal. Abstentions, if any, will have no effect on the result of this vote. Brokerage firms and other nominees have the authority to vote uninstructed shares held by them in street name on this proposal. Any broker non-votes, if brokers or nominees do not exercise this authority, will have no effect on the result of this vote. We are not required to obtain the approval of stockholders to appoint our independent registered public accounting firm. However, if our stockholders do not ratify the appointment of Ernst & Young, LLP as our independent registered public accounting firm, the Audit Committee of the Board will reconsider its appointment. |

||||

| Proposal 3: Approve an Amendment of Our 2015 Equity Incentive Plan |

In voting with regard to the approval of an amendment of our 2015 Equity Incentive Plan to increase the maximum number of shares authorized for issuance thereunder by 2,000,000, from 1,500,000 shares to 3,500,000 shares, stockholders may vote in favor of such proposal, vote against such proposal, or abstain from voting. The vote required to approve Proposal 3 is the affirmative vote of the majority of shares present or represented by proxy at the 2021 Annual Meeting and entitled to vote on the matter. Because our Series A and Series B preferred stock are held by a wholly owned subsidiary of the Company and thus is not entitled to vote, only shares of our common stock, issued and outstanding as of the Record Date, are entitled to vote on this proposal. Abstentions, if any, count as a vote against this proposal. Broker non-votes will have no effect on the result of the vote on this proposal.

|

||||

All votes will be tabulated by the inspector of elections appointed for the 2021 Annual Meeting, who will separately tabulate affirmative and negative votes, withheld votes, abstentions and broker non-votes, if any.

6

Voting Methods

If you are a record holder, you can vote by attending the 2021 Annual Meeting and voting in person, or you can vote by proxy in three ways:

•By Internet: You may vote by submitting a proxy over the Internet. Please refer to the proxy card or voting instruction form provided or made available to you by your broker for instructions of how to vote by Internet.

•By Telephone: Stockholders located in the United States that receive proxy materials by mail may vote by submitting a proxy by telephone by calling the toll-free telephone number on the proxy card or voting instruction form provided or made available to you and following the instructions.

•By Mail: If you received proxy materials by mail, you can vote by submitting a proxy by mail by marking, dating, signing and returning the accompanying proxy card.

•In Person at the 2021 Annual Meeting: If you attend the 2021 Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which we will provide you at the meeting. You are encouraged to vote by telephone or Internet or complete, date, sign and return the proxy card provided or made available to you, regardless of whether or not you plan to attend the 2021 Annual Meeting.

With respect to your shares held in “street name,” meaning such shares are held for your account by a broker or other nominee, you will receive instructions from such institution or person on how to vote your shares.

Voting by Proxy and Revocability

Voting Shares represented by proxies submitted over the Internet or by telephone, or for which proxy cards are properly executed and returned to us, will be voted at the 2021 Annual Meeting in accordance with the stockholders’ instructions contained therein. In the absence of contrary instructions, shares represented by such proxies will be voted FOR the election of each of the director nominees named on Proposal 1, FOR the ratification of the appointment of Ernst & Young, LLP as our independent registered public accounting firm on Proposal 2 and FOR the approval of the amendment of our 2015 Equity Incentive Plan on Proposal 3. Management does not know of any matters to be presented at the 2021 Annual Meeting other than those set forth in this proxy statement and the accompanying notice of 2021 Annual Meeting. If other matters should properly come before the meeting, the proxy holders intend to vote all proxies received by them on such matters in accordance with their best judgment. Any stockholder has the right to revoke his, her or its proxy at any time before it is voted at the 2021 Annual Meeting by giving written notice to our Corporate Secretary, and by executing and delivering to the Corporate Secretary a duly executed proxy card bearing a later date, or by appearing at the meeting and voting in person. A beneficial owner of our common stock may revoke or change voting instructions by contacting the bank, brokerage firm, or other nominee holding the shares in street names or by obtaining a legal proxy from such institution and voting at the meeting.

Householding of Proxy Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our proxy statement and annual report to stockholders may have been sent to multiple stockholders in your household. Once you have received notice from your broker that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement in the future, or if you and other shareholders sharing your address are receiving multiple copies of the proxy materials and you would like to receive only a single copy of such materials in the future, please notify your broker. You may also call (866) 540-7095 or write to: Householding Department, Broadridge, 51 Mercedes Way, Edgewood, New York 11717, and include your name, the name of your broker or other nominee, and your account number(s). If you share an address with another shareholder and have received only one set of this year’s proxy materials and you wish to receive a separate copy, please notify us in writing at: Apollo Medical Holdings, Inc., 1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801, Attention: Corporate Secretary, and we will deliver a separate copy to you promptly.

7

Internet Availability of Proxy Materials

We are furnishing proxy materials for the 2021 Annual Meeting to all of our stockholders via the Internet by mailing a Notice Regarding the Internet Availability of Proxy Materials (“Notice”), instead of mailing or emailing copies of those materials to our stockholders. However, we may still mail copies of such proxy materials to some stockholders. The Notice directs our stockholders to a website where they can access our proxy materials, including our proxy statement and our 2021 Annual Report to Stockholders, and view instructions on how to vote via the Internet, a mobile device, or by telephone. If you received such a Notice and would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the notice. If you have previously elected to receive our proxy materials via email, you will continue to receive access to those materials electronically unless you elect otherwise.

Attending the Annual Meeting

Only our stockholders as of the Record Date are entitled to attend the 2021 Annual Meeting. If you own our stock as a record holder, your name will be on a list of record holders and you will be able to gain entry with government-issued photo identification, such as a driver’s license, state-issued identification card, or passport. If you beneficially own our stock held in street name, in order to gain entry, you must present a valid legal proxy from a record holder of our stock as of the Record Date and government-issued photo identification. You should contact your brokerage account representative, bank or other nominee to learn how to obtain a legal proxy. All stockholders and proxy holders must register at the reception desk and sign the attendance sheet before entering the room for the 2021 Annual Meeting. In fairness to all attendees and in the interest of an orderly and constructive meeting, we ask that you abide by the rules of procedure for the 2021 Annual Meeting, which will be available to you when you register at the reception desk. Cameras, recording devices, and other electronic devices are prohibited at the meeting.

Stockholder List

A list of our stockholders of record as of the Record Date entitled to vote at the 2021 Annual Meeting will be available for examination by any such stockholder for any purpose germane to the 2021 Annual Meeting during ordinary business hours at our corporate headquarters located at 1668 S. Garfield Avenue, Alhambra, California 91801, for a period of ten days prior to the 2021 Annual Meeting, and also at the 2021 Annual Meeting. Please contact the Company’s Corporate Secretary at (626) 282-0288 or by email at: investors@apollomed.net if you wish to inspect the list of stockholders prior to the meeting.

Persons Making the Solicitation

We are required by law to convene annual meetings of stockholders at which our directors are elected. The Board is soliciting proxies from our stockholders for the 2021 Annual Meeting. The entire cost of soliciting proxies will be borne by the Company. These costs will include, among other items, the expense of preparing, assembling, printing and mailing the proxy materials or notices of Internet availability to our stockholders of record and beneficial owners. Proxies will be solicited principally through mail, but, if deemed desirable, may be solicited personally or by telephone or letters by our officers and regular employees for no additional compensation. We may also solicit proxies by email from stockholders who are our employees or who previously requested to receive proxy materials electronically. Arrangements may be made with brokerage houses and other custodians, nominees and fiduciaries to send proxies and proxy materials or notices of Internet availability to beneficial owners of our stock and obtain their voting instructions, and such persons may be reimbursed for their expenses.

8

PROPOSAL 1

ELECTION OF DIRECTORS

Stockholders will be asked at the 2021 Annual Meeting to elect eleven directors who will constitute the full Board of Directors. Each elected director will hold office until the next annual meeting of stockholders and the director’s successor is duly elected and qualified or until his or her earlier resignation or removal.

The following eleven persons have been nominated by the Board for election to the Board: Kenneth Sim, M.D., Thomas S. Lam, M.D., M.P.H., Mitchell W. Kitayama, David G. Schmidt, Mark Fawcett, Michael F. Eng, Li Yu, Ernest A. Bates, M.D., Linda Marsh, John Chiang and Matthew Mazdyasni. All the nominees are incumbent directors. Additional information about these nominees is provided in “Corporate Governance” and “Board of Directors and Executive Officers” below.

Board Nomination and Election of Directors

Following a rigorous reviewing process, the Nominating and Corporate Governance Committee recommended the eleven incumbent directors for re-election at the 2021 Annual Meeting as they continue to contribute to the mix of experience, skills and qualifications that we seek to be represented on the Board. Each nominee has been nominated by the Board, acting upon the recommendation of the Nominating and Corporate Governance Committee. Unless authority to vote for this nominee is withheld, the shares represented by the enclosed proxy will be voted FOR the election as directors of the eleven nominees.

In the event that a nominee is unable or unwilling to serve as a director at the time of the 2021 Annual Meeting, all proxies received by the proxy holders named on the accompanying proxy card will be voted FOR the election of such other person as either proxy holder may designate in such nominee’s place. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them for each of the nominees listed below, unless instructions are given to the contrary. As of the date of this proxy statement, the Board is not aware of any nominee who is unable or unwilling to serve as a director. If elected at the 2021 Annual Meeting, a director will serve until the annual meeting of our stockholders to be held in 2022 and a successor has been duly elected and qualified, or until his or her earlier resignation or removal.

Vote Required

Pursuant to the Company’s Restated Bylaws, as amended, eleven directors will be elected by a plurality of the votes cast by the Voting Shares present in person or represented by proxy at the 2021 Annual Meeting. Such voting standard means that the nominees who receive the highest number of votes “FOR” their election up to the number of directors to be elected at the meeting, which is eleven, will be elected even if any such nominee receives a greater number of votes “withheld” than votes “FOR” his election. Votes withheld and broker non-votes, if any, will not be treated as votes cast and, therefore, will not affect the outcome of the election of directors at the 2021 Annual Meeting.

Recommendation of the Board

THE BOARD RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” EACH OF THE NAMED NOMINEES ON PROPOSAL 1.

9

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board Recommendation

The Audit Committee has appointed Ernst & Young, LLP (“EY”) as our independent registered public accounting firm, to audit our financial statements for the fiscal year ending December 31, 2021. In deciding to appoint EY, the Audit Committee reviewed auditor independence issues and existing commercial relationships with EY and concluded that EY has no commercial relationship with the Company that would impair its independence for the year ending December 31, 2021. The Board recommends that our stockholders ratify the appointment of EY as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021. While we are not required to have our stockholders ratify the appointment of EY as our independent registered public accounting firm, we are doing so because we value our stockholders’ views on the Company’s independent registered public accounting firm. If the stockholders do not ratify this appointment, the Audit Committee will reconsider whether to retain EY. If the selection of EY is ratified, the Audit Committee, in its discretion, may still direct the appointment of a different independent registered public accounting firm at any time it determines that such a change would be in the best interest of the Company and our stockholders.

Representatives of EY are expected to be present at the 2021 Annual Meeting, will have the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

Change in Independent Registered Public Accounting Firm

The Audit Committee conducted a competitive process to determine the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020, during which EY and BDO USA, LLP, among others, submitted proposals to serve as our independent registered accounting firm for the fiscal year ended December 31, 2020. The Audit Committee evaluated the proposals and considered several factors, including audit quality, the benefits of tenure versus a fresh perspective, engagement teams, potential transition risks, auditor independence and the appropriateness of fees relative to both efficiency and audit quality. As a result of this process, on April 24, 2020, the Audit Committee selected EY as the Company’s independent registered public accounting firm for the Company’s fiscal year ending December 31, 2020. The stockholders of the Company subsequently ratified the selection of EY at the Company’s 2020 annual meeting of stockholders, held on June 15, 2020.

As reported on the Company’s Current Report on Form 8-K filed on April 28, 2020:

• On April 24, 2020, following a competitive selection process, the Audit Committee approved the engagement of EY as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2020 and approved the dismissal of BDO USA, LLP from service as the Company’s independent registered public accounting firm, effective immediately. The Company engaged EY on April 27, 2020.

• During the fiscal year ended December 31, 2019 and through the subsequent interim period through April 24, 2020, there were (i) no disagreements (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between the Company and BDO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to the satisfaction of BDO would have caused BDO to make reference thereto in its reports on the consolidated financial statements of the Companies for such years, and (ii) no “reportable events” (as that term is defined in Item 304(a)(1)(v) of Regulation S-K).

• During the fiscal year ended December 31, 2019 and through the subsequent interim period through April 27, 2020, neither the Company, nor any party on its behalf, consulted with EY with respect to either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of the audit opinion that might be rendered with respect to the Company’s consolidated financial statements, and no written report or oral advice was provided by EY to the Company that was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (ii) any matter that was subject to any disagreement (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a reportable event (as that term is defined in Item 304(a)(1)(v) of Regulation S-K).

10

AUDIT AND OTHER FEES

The following table presents fees for professional audit services and other services rendered by EY for the audit of the Company’s annual financial statements for the year ended December 31, 2020, and professional audit services rendered by BDO USA, LLP for the audit of the Company’s annual financial statements for the year ended December 31, 2019:

| 2020 | 2019 | ||||||||||

Audit (1)

|

$ | 1,227,175 | $ | 1,261,291 | |||||||

| Audit Related | — | — | |||||||||

Tax (2)

|

101,441 | — | |||||||||

| All Other Fees | — | — | |||||||||

| Total | $ | 1,328,616 | $ | 1,261,291 | |||||||

(1)Represents aggregate fees charged by EY or BDO USA, LLP in each respective year serving as the external auditor, as applicable, for audit work performed on the annual financial statements and review of quarterly financial statements, as well as work generally only the independent registered public accounting firm can reasonably be expected to provide, such as the provision of consents in connection with the filing of registration statements, current reports on Form 8-K and related amendments and statutory audits.

(2)Tax fees consist of various permissible tax compliance and tax advisory service fees by EY.

The Audit Committee has determined that all services performed by EY and BDO USA, LLP were, and are, compatible with maintaining the independence of EY and BDO USA, LLP, as applicable. The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by our independent registered public accounting firm, which may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval. For additional information concerning the Audit Committee and its activities with EY and BDO USA, LLP, please see “Report of the Audit Committee” below.

Vote Required

The affirmative vote of a majority of the votes cast affirmatively or negatively on Proposal 2 at the 2021 Annual Meeting is required to ratify the Audit Committee’s appointment of Ernst & Young, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021. A stockholder may vote “FOR,” “AGAINST” or “ABSTAIN” on this proposal. This proposal will pass, and the Audit Committee’s appointment of Ernst & Young, LLP as the Company’s independent registered public accountants for the year ending December 31, 2021 will be ratified, if the total votes cast “FOR” Proposal 2 exceed the total number of votes cast “AGAINST” Proposal 2. Brokerage firms and other nominees have the authority to vote uninstructed shares held by them in street name on this proposal. Broker non-votes and abstentions, if any, will not constitute votes cast and will accordingly have no effect on the outcome of the vote on this proposal.

Recommendation of the Board

THE BOARD RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG, LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM AS SET FORTH ON THIS PROPOSAL 2.

11

PROPOSAL 3

APPROVAL OF THE AMENDMENT OF THE COMPANY’S 2015 EQUITY INCENTIVE PLAN

Introduction

The Company’s 2015 Equity Incentive Plan (the “2015 Plan”) authorizes the award of stock-based incentives to eligible employees, officers, directors, and consultants, as described below. On April 26, 2021, the Board approved, subject to stockholder approval at the 2021 Annual Meeting, an amendment of the 2015 Plan, as initially approved by stockholders in 2015, to increase the number of shares authorized for issuance thereunder by 2,000,000 shares from 1,500,000 shares to 3,500,000 shares.

The Company’s directors and executive officers currently are permitted to participate in the 2015 Plan, and therefore they have an interest in this proposal.

The form of the 2015 Plan, as amended (the “Amended 2015 Plan”) is attached as Annex A to this proxy statement.

Reasons for the Amendment to the 2015 Plan

We believe that our ability to award incentive compensation based on equity in the Company is critical to our continued success in remaining competitive and attracting, motivating and retaining key personnel. Offering a broad-based equity compensation program is vital to attract and retain the most highly skilled people in the Company’s industry. In addition, the Company believes that employees who have a stake in the future success of its business become highly motivated to achieve the Company’s long-term business goals and to expend maximum effort in the creation of stockholder value, thereby aligning the interests of such individuals with those of stockholders generally.

As of December 31, 2020, the Company has granted, net of forfeitures, awards representing 1,386,439 out of the 1,500,000 shares presently available under the existing 2015 Plan. The Board believes that increased capacity to make equity awards provided by the amendment is essential to the Company’s continued growth, and therefore in the best interest of its stockholders. In particular, the Board is recommending approval of this increase to facilitate the retention of existing employees, recruiting of new personnel and provide the Company with flexibility to compensate service providers and consultants.

Summary of the Amended 2015 Plan

The following is a summary of the principal features of the Amended 2015 Plan. The summary is qualified in its entirety by reference to the full text of the Amended 2015 Plan.

Purpose. The creativity and entrepreneurial drive of our employees and other personnel who provide services to the Company are important factors in the growth and success of our business. We believe that our broad-based equity incentive program is an effective means of motivating and rewarding the efforts of our employees and other valuable personnel. By giving our employees, consultants and directors an opportunity to share in the growth of our equity, we align their interests with those of our stockholders. Our employees, consultants and directors understand that their stake in the Company will have value only if, working together, we create value for our stockholders. Awards under our equity incentive plans generally vest over a period of time (for example, stock options generally vest over a three-year period), giving the recipient an additional incentive to provide services over a number of years and build on past performance. We believe that our option program has helped us to build a team of high achievers who have demonstrated long-term dedication and productivity and who, in turn, help us to attract like-minded individuals to the Company.

We remain committed to the goals of managing dilution from options and enhancing stockholder value. We have never repriced options, and the Amended 2015 Plan specifically prohibits the repricing of options. In addition, the 2015 Plan prohibits the grant of “discount” options (i.e., options with an exercise price below fair market value).

Number of Shares. Under the Amended 2015 Plan, a total 3,500,000 shares of our common stock (including 2,000,000 new shares), plus rollover shares from previous equity incentive plans of the Company (the “Rollover Shares”), are reserved for issuance under awards. Any shares that are represented by awards under the Amended 2015 Plan that are (i) forfeited, expire, or are canceled or settled in cash without delivery of shares, (ii) forfeited back to us or reacquired by us after delivery for any reason, or (iii) tendered to us or withheld to pay the exercise price or related tax withholding obligations in connection with any award under the Amended 2015 Plan, will again be available for awards under the Amended 2015 Plan. Only shares actually issued under the Amended 2015 Plan will

12

reduce the share reserve. If we acquire another entity through a merger or similar transaction and issue replacement awards under the Amended 2015 Plan to employees, officers and directors of the acquired entity, those awards, to the extent permitted under applicable laws and securities exchange rules, will not reduce the number of shares reserved for the Amended 2015 Plan.

The Compensation Committee, in its discretion, may grant awards that exceed the above limits (other than the limits on incentive stock options).

The number of shares reserved for issuance under the Amended 2015 Plan, and the limits on the number of awards that may be granted to any one participant or of a particular type, as described above, are subject to adjustment to reflect certain subsequent changes to our capital structure, such as stock splits, stock dividends and recapitalizations.

Administration. The Amended 2015 Plan is administered by the Compensation Committee of the Board (the “Compensation Committee”). The Compensation Committee will have full power to administer the Amended 2015 Plan and the decisions of the Compensation Committee will be final and binding upon all the participants.

The Board may delegate the Compensation Committee’s administrative authority to another committee, or the Compensation Committee may delegate some of its authority to the Chief Executive Officer of the Company. Any such delegation may be made only to the extent the law allows. In addition, the Amended 2015 Plan provides that only the Board, or a committee comprised entirely of non-employee directors, may approve awards to individuals who are subject to Section 16 of the Exchange Act. As used herein, the term “Compensation Committee” also includes the Board or other committee that has authority with respect to the approval of awards.

Eligibility. The selection of the participants in the Amended 2015 Plan will generally be determined by the Compensation Committee. Employees and those about to become employees, including those who are officers or directors of the Company or its subsidiaries and affiliates, are eligible to be selected to receive awards under the Amended 2015 Plan. In addition, non-employee service providers, including non-employee directors, and employees of unaffiliated entities that provide bona fide services to the Company as an independent contractor are eligible to be selected to receive awards under the Amended 2015 Plan. Non-employee directors of the Board are eligible for and shall receive grants of options in such amounts and on such terms as determined by the Board as a whole. All other grants must be approved by the Compensation Committee.

As of December 31, 2020, six named executive officers, nine non-employee directors and approximately 624 other employees are eligible to be selected by the Compensation Committee to receive grants under the Amended 2015 Plan.

Types of Awards. The Amended 2015 Plan allows for the grant of stock options, stock appreciation rights, performance awards, restricted stock awards, restricted stock units and dividend equivalent units in any combination, separately or in tandem. Subject to the terms of the Amended 2015 Plan, the Compensation Committee will determine the terms and conditions of awards, including the times when awards vest or become payable and the effect of certain events such as termination of employment.

Stock Options. The Compensation Committee may grant either incentive stock options qualified under IRS Code Section 422 or options not qualified under any section of the IRS Code (“non-qualified options”). All stock options granted under the Amended 2015 Plan must have an exercise price that is at least equal to the fair market value of our underlying common stock on the grant date. As of April 27, 2021, the fair market value of a share of our common stock, based on the closing price per share on that date as quoted on NASDAQ, was $28.39. No stock option granted under the Amended 2015 Plan may have a term longer than ten years, except that under the Amended 2015 Plan the Compensation Committee may extend the term for six months beyond the tenth (10th) anniversary of the date of grant in the event that an option recipient dies prior to the option’s termination date. The exercise price of stock options may be paid in cash, or, if the Compensation Committee permits, by tendering shares of common stock, or by any other means the Compensation Committee approves. Stock options may contain a replenishment provision under which we issue a new option to an option holder (called a “replenishment option”), in order to maintain his or her equity stake in the Company, if the option holder surrenders previously-owned shares to us in payment of the exercise price of an outstanding stock option. The automatic replenishment option grant generally covers only the number of shares surrendered and expires at the same time as the option that was exercised would have expired.

Under the Amended 2015 Plan, each non-employee director is eligible to receive stock option grants in such amounts and on such terms as determined by the Board as a whole.

13

Stock Appreciation Rights. The Compensation Committee may grant stock appreciation rights which provide the recipient the right to receive a payment (in cash, shares or a combination of both) equal to the difference between the fair market value of a specific number of shares on the grant date and the fair market value of such shares on the date of exercise. Stock appreciation rights must expire no later than ten years after their grant date, except that under the Amended 2015 Plan the term may be extended for six months beyond the date of death in the event that a recipient dies prior to the SAR’s termination date.

Performance-Based Awards. The Amended 2015 Plan provides for performance-based awards, the grant or vesting of which is dependent upon the attainment of objective performance targets relative to certain performance measures. Performance targets may include minimum, maximum and target levels of performance, with the size of the award or vesting based on the level attained. Performance measures are criteria established by the Compensation Committee relating to any of the following, as it may apply to an individual, one or more business units, divisions or subsidiaries, or on a company-wide basis, and either in absolute terms or relative to the performance of one or more comparable companies or an index covering multiple companies: income from operations; revenue; earnings before interest, taxes, depreciation and amortization (EBITDA); income before income taxes and minority interests; operating income; pre- or after-tax income; average accounts receivable; cash flow; cash flow per share; net earnings; earnings per share; return on equity; return on invested capital; return on assets; growth in assets; economic value added; share price performance; total stockholder return; improvement in or attainment of expense levels; market penetration; or business expansion and/or acquisitions or divestitures. The Compensation Committee can select other goals not listed here for awards that are not intended to meet the requirements of “qualified performance-based compensation.” The Compensation Committee may specify that the performance-based awards will become payable in whole or in part in the event of the recipient’s termination of employment as a result of death, disability or retirement.

Performance-based awards may be paid in cash, shares or a combination of both, as determined by the Compensation Committee at the time of making an award.

Restricted Stock and Restricted Stock Unit Awards. The Compensation Committee may grant shares of restricted common stock with or without payment of consideration by the recipient or may grant restricted stock units. The Compensation Committee will determine whether restricted stock units will be paid in cash, our common stock or a combination thereof. All or part of any restricted stock or restricted stock unit award may be subject to conditions and restrictions, which the Compensation Committee will specify. There will be a restriction period of at least three years’ duration on stock and unit awards, unless the vesting of such awards is contingent on the attainment of performance goals, in which case the restriction period must be at least one year. The Compensation Committee may specify that the restriction period will lapse in the event of the recipient’s termination of employment as a result of death, disability or retirement. In addition, the Compensation Committee may provide for a shorter restriction period if it determines in its sole discretion that an award of restricted stock or restricted stock units is made in lieu of cash compensation (including without limitation cash bonus compensation).

Dividend Equivalent Unit Awards. The Compensation Committee may grant awards of dividend equivalent units, either alone or in tandem with other awards, but only if the Board of Directors has declared a dividend on our common stock. A dividend equivalent unit gives the recipient the right to receive a current or deferred payment equal to the dividends paid on one or more shares of our common stock as the Compensation Committee specifies.

Payment of Directors’ Fees in Securities. Subject to any restrictions the Board imposes, a non-employee director may elect to receive stock options in lieu of all or any portion of the director’s annual retainer payment from the Company. These options will be issued under and subject to the terms of the Amended 2015 Plan. The number of options to be issued in connection with such an election by a director will be four times the amount of the cash compensation divided by the closing price of our common stock on the date the cash compensation would otherwise have been paid to the director.

Recoupment. Any awards granted pursuant to the Amended 2015 Plan, and any stock issued or cash paid pursuant to an award, is subject to (A) any recoupment, clawback, equity holding, stock ownership or similar policies adopted by the Company from time to time, and (B) any recoupment, clawback, equity holding, stock ownership or similar requirements made applicable by law, regulation or listing standards to the Company from time to time.

Use of Shares to Satisfy Tax Withholding. A participant may satisfy all or a portion of the federal, state and local withholding tax obligations arising in connection with an award by electing to (i) have the Company withhold shares otherwise issuable under the award, (ii) tender back shares received in connection with such award or (iii) deliver other previously owned shares, in each case having a fair market value equal to the amount to be withheld.

14

Adjustment of Awards for Certain Corporate Events. In the event of a stock dividend, stock split or reverse stock split, merger, consolidation, or similar corporate transaction, the Compensation Committee may adjust the number and type of securities subject to awards, and the grant, purchase or exercise price of awards to prevent the dilution or enlargement in benefits under outstanding awards. The Compensation Committee may also (or in lieu of the foregoing) make provision for a cash payment to the holder of an outstanding award in exchange for the cancellation of all or a portion of the award (without the consent of the holder of an award), but in the event of a change of control, the amount of such payment must be at least as favorable to the holder as the amount the holder could have received in respect of such award after the change of control. In addition, in the event of any reorganization, merger, consolidation, combination or other similar corporate transaction, whether or not constituting a change of control (other than any such transaction in which the Company is the continuing corporation and in which the Company’s common stock is not being converted into or exchanged for different securities, cash or other property, or any combination thereof), the Compensation Committee may substitute, on an equitable basis as the Compensation Committee determines, for each share then subject to an award, the number and kind of shares of stock, other securities, cash or other property to which holders of our common stock are or will be entitled in respect of each share pursuant to the transaction.

Change of Control. The Compensation Committee may determine, in its discretion, whether an award issued under the Amended 2015 Plan will become vested or payable, either in whole or in part, upon a change of control of the Company (as defined in the Amended 2015 Plan). In addition, each holder of an option or stock appreciation right, and each holder of shares received under a restricted stock award, restricted stock unit award, performance award or dividend equivalent award, if any, that vested or became payable as a result of the change of control, may, under certain conditions, have the right for a period of 30 days following the change of control to surrender the award or shares for a cash payment equal to:

•in the case of an option or stock appreciation right, the difference between the higher of the fair market value of a share of our common stock on the date of surrender or the date of the change of control, and the grant or exercise price of the award; and

•in the case of shares, the higher of the fair market value of a share of our common stock on the date of surrender or the date of the change of control.

The Compensation Committee may also cancel any options or stock appreciation rights that are not exercised or surrendered during the 30-day period described above.

Transferability of Awards. Awards granted under the Amended 2015 Plan are not transferable, other than by will or pursuant to state intestate laws, unless the Compensation Committee otherwise approves a transfer.

Foreign Participation. The Compensation Committee may provide for such special terms as it may consider necessary or appropriate to accommodate differences in local law, tax policy or custom regarding awards granted to participants employed in foreign countries. In addition, the Compensation Committee may approve such supplements to, or amendments, restatements or alternative versions of, the Amended 2015 Plan as it determines is necessary or appropriate for such purposes. Any such amendment, restatement or alternative versions that the Compensation Committee approves for purposes of using the 2015 Plan in a foreign country will not affect the terms of the Amended 2015 Plan for use in any other country.

Amendments. The Board or Compensation Committee may alter, amend, suspend or discontinue the Amended 2015 Plan at any time, but no such action may be taken without stockholder approval if such approval is required by law or listing requirements, or if such action materially increases the number of shares that may be issued under the Amended 2015 Plan or the annual award limits, or eliminates the prohibition on stock option repricing. The Compensation Committee may alter or amend awards under the Amended 2015 Plan, but no such action may be taken without the consent of the participant if it would materially adversely affect an outstanding award, and no such action may be taken without prior stockholder approval if it would result in repricing a stock option to a lower exercise price other than to reflect a capital adjustment of our stock, such as a stock split. The Company has never repriced options in the past.

Term of 2015 Plan. The Amended 2015 Plan will remain in effect until December 15, 2025, unless it is terminated earlier by the Board or the Compensation Committee.

15

New Plan Benefits

We have not approved any awards that are conditioned on stockholder approval of the Amended 2015 Plan. The Company is unable to currently determine the benefits or number of shares subject to awards that may be granted in the future to executive officers and employees under the Amended 2015 Plan.

Vote Required

The affirmative vote of a majority of shares present or represented by proxy at the 2021 Annual Meeting and entitled to vote on the matter is required to approve an amendment of the Company’s 2015 Equity Incentive Plan to increase the maximum number of shares authorized for issuance thereunder by 2,000,000 shares, from 1,500,000 shares to 3,500,000 shares. A stockholder may vote “FOR,” “AGAINST” or “ABSTAIN” on this proposal. This proposal will pass if the total votes cast “FOR” Proposal 3 exceed the total number of votes cast “AGAINST” Proposal 3. Abstentions, if any, count as a vote against this proposal. Broker non-votes will have no effect on the result of the vote on this proposal.

Recommendation of the Board

THE BOARD RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE AMENDMENT OF OUR 2015 EQUITY INCENTIVE PLAN, AS SET FORTH ON THIS PROPOSAL 3.

16

CORPORATE GOVERNANCE

Code of Ethics and Other Governance Documents

We maintain a corporate governance page on our website at https://apollomed.net/corporate-governance, which includes information regarding the Company’s corporate governance practices. Our Code of Ethics for Directors, Executive Officers and Other Employees (which, among others, covers our principal executive officer, principal financial officer, principal accounting officer or controller, if any, or persons performing similar functions), Audit Committee Pre-Approval Policy, Audit Committee Policy Regarding Complaint Procedures for Accounting and Auditing Matters, Related Party Transaction Policy, charters of the three standing committees of the Board and Insider Trading Policy are available on that page of our website, in addition to the Company’s Restated Certificate of Incorporation, as amended, and Restated Bylaws, as amended. Any changes to these documents and any waivers granted with respect to our Code of Ethics will be posted on our website. In addition, we will provide a copy of any of these documents without charge to any stockholder upon written request made to: Apollo Medical Holdings, Inc. at 1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801, Attention: Corporate Secretary. The information on our website is not, and shall not be deemed to be, a part of this proxy statement or incorporated by reference into this or any other filing we make with the SEC.

Director Independence

The Board has determined that a majority of its current members and a majority of its director nominees for election at the 2021 Annual Meeting meet the independence requirements of the NASDAQ Stock Market (“NASDAQ”). Based upon information requested from and provided by each director or nominee concerning his background, employment and affiliations, including family relationships, the Board has affirmatively determined that Mitchell W. Kitayama, David G. Schmidt, Michael F. Eng, Mark Fawcett, Li Yu, Ernest A. Bates, M.D., and John Chiang would qualify as “independent” as defined in NASDAQ Listing Rule 5605(a)(2). In making such determinations, the Board considered all relevant facts and circumstances, including commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, not merely from the standpoint of a director or nominee, but also from that of persons or organizations affiliated with the director or nominee.

Subject to certain exceptions, NASDAQ Listing Rule 5605(a)(2) provides that a director will only qualify as an “independent director” if, in the opinion of the Board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, and that a director cannot be an “independent” director if (a) the director is, or in the past three years has been, an employee of ours; (b) a member of the director’s immediate family is, or in the past three years has been, an executive officer of ours; (c) the director or a member of the director’s immediate family has received more than $120,000 per year in direct compensation from us within the preceding three years, other than for service as a director or benefits under a tax-qualified retirement plan or non-discretionary compensation (or, for a family member, as a non-executive employee); (d) the director or a member of the director’s immediate family is a current partner of our independent public accounting firm, or has worked for such firm in any capacity on our audit at any time during the past three years; (e) the director or a member of the director’s immediate family is, or in the past three years has been, employed as an executive officer of a company where one of our executive officers serves on the compensation committee; or (f) the director or a member of the director’s immediate family is an executive officer, partner or controlling stockholder of a company that makes payments to, or receives payments from, us in an amount which, in any twelve-month period during our past three fiscal years, exceeds the greater of 5% of the recipient’s consolidated gross revenues for that year or $200,000 (except for payments arising solely from investments in our securities or payments under non-discretionary charitable contribution matching programs). With respect to any relationship not covered above, the determination of whether the relationship is material, and therefore whether a director would be independent, will be made by those directors who satisfy the independence criteria set forth above.

The Board also makes such independence determinations with respect to its committees after taking into account the additional independence standards for members of each such committee, as applicable, pursuant to the rules and regulations of the SEC and NASDAQ listing rules as currently in effect. In order to be considered an independent member of an audit committee under Rule 10A-3 of the Exchange Act, a committee member may not, other than in his or her capacity as a member of the audit committee, the Board, or any other committee of the Board, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the applicable company or any of its subsidiaries or otherwise be an affiliated person of the applicable company or any of its subsidiaries. Based upon information requested from and provided by each director who is currently serving on a committee of the Board concerning his or her background, employment and affiliations, including family relationships, the Board has affirmatively

17

determined that each of its three standing committees consists solely of “independent” directors who meet NASDAQ Listing Rule 5605(a)(2) and all other applicable independence standards.

Board Meetings

The Board held thirteen meetings and acted by written consent once during 2020. Each of our incumbent directors attended 75% or more of the aggregate number of meetings of the Board and the committees on which such director served in 2020. We attempt to schedule each annual meeting of our stockholders at a time and date to accommodate attendance by directors, taking into account the directors’ schedules. Directors are encouraged to attend our annual meetings of stockholders, but the Board has not adopted a formal policy with respect to such attendance. Five directors attended the Company’s 2020 annual meeting of stockholders.

Our independent directors meet periodically in executive session without management present to discuss our operations, policies and practices, as well as other matters relating to us or the functioning of the Board.

Board Leadership Structure and Lead Independent Director

Dr. Sim and Dr. Lam serve as our Co-Chief Executive Officers, while Dr. Sim also serves as our Executive Chairman of the Board and Dr. Lam serves as a director.

Our Board has not taken a position on the desirability, as a general matter, of having two individuals serve as Co-Chief Executive Officer or of combining the roles of Co-Chief Executive Officer and Executive Chairman. Rather, our Board believes that decisions regarding the individuals most appropriate to fill these and other critical senior leadership positions are highly dependent on the specific circumstances of the Company and its leadership at the time of such decisions, including the availability of qualified candidates for the position and the specific talents and experience of the available candidates. The Board believes that the Company benefits from Drs. Sim and Lam’s long-standing experience working together in the healthcare industry, each having gained more than 26 years of senior-level management experience leading the Company and, prior to the merger, NMM and its affiliated physician groups. Accordingly, the Board believes that it is in the best interests of the Company and its stockholders for both individuals to serve as Co-Chief Executive Officers.

The Board believes that independent directors and management have different perspectives and roles in the development of the strategic vision and risk management of the Company. The Company’s independent directors provide experience, oversight, and expertise from outside the Company and the Company’s industry, while the Co-Chief Executive Officers provide Company-specific experience and expertise. The Board believes that the combined role of Co-Chief Executive Officer and Executive Chairman promotes the development and execution of the strategic vision and risk management of the Company, and facilitates information flow between management and the Board, functions that are essential to effective corporate governance. The Board further believes that Dr. Sim is currently the director best situated to serve as Executive Chairman, as he is the director most familiar with the Company’s business and industry and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy.

The Board has designated independent director, Mr. Kitayama, as our Lead Independent Director. Mr. Kitayama presides over executive sessions of the independent directors. As Lead Independent Director, Mr. Kitayama has duties and responsibilities, which include consulting with the Executive Chairman and Co-Chief Executive Officers regarding the schedule and agenda for Board meetings, acting as a liaison between the non-management directors as a group and management, and discharging such other duties and responsibilities as the Board may determine from time to time.

Risk Oversight Function of the Board

The Board has allocated responsibilities for overseeing risk associated with the Company’s business among the Board as a whole and the committees of the Board. In performing its risk oversight function, the Board is responsible for overseeing management’s development and execution of appropriate business strategies to mitigate the risk that such strategies will fail to generate long-term value for the Company and its stockholders or that such strategies will motivate management to take excessive risks. The Board periodically reviews information regarding the Company’s financial, operational and strategic risks, including risks related to the COVID-19 pandemic. Each of the three committees of the Board is responsible for overseeing the management of risks that fall within the committee’s areas of responsibility, including identifying, quantifying and assisting management in mitigating risks. In performing this function, each committee has full access to management, as well as the ability to engage advisors. As set forth

18

in its charter, the Audit Committee is responsible for managing the Company’s major financial risk exposures and the steps management has taken to monitor and control those exposures. In addition, the Audit Committee is responsible for addressing risks associated with related-party transactions and concerns and complaints related to accounting and auditing matters. The Audit Committee provides regular updates to the entire Board. The Compensation Committee is responsible for overseeing the risk management related to the Company’s compensation plans and arrangements. The Nominating and Corporate Governance Committee manages risks associated with the independence of the Board and overall effectiveness of the organization of the Board.

Communications with the Board

The following procedures have been established by the Board to facilitate communications between our stockholders and the Board:

•Stockholders and any interested parties may send correspondence to the Board or to any individual director, by mail to: Corporate Secretary, Apollo Medical Holdings, Inc., 1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801, or by email to: investors@apollomed.net.

•Communications will be distributed to the Board, or to any individual director or group of directors as appropriate, depending on the facts and circumstances outlined in the communications.

•Items that are unrelated to the duties and responsibilities of the Board may be excluded, such as:

•junk mail and mass mailings

•resumes and other forms of job inquiries

•surveys

•solicitations or advertisements.

In addition, any material that is unduly hostile, threatening, or illegal in nature may be excluded, provided that any communication that is filtered out will be made available to the Board or any director upon request.

Board Committees

The Board has a standing Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee, each of which comprised solely of independent directors. The composition, functions and responsibilities of each committee are summarized below.

Audit Committee

The Audit Committee operates under a written charter, a copy of which is available on our website at https://apollomed.net/corporate-governance. The Audit Committee currently consists of Messrs. Schmidt (chairman), Eng and Chiang. The Board has determined that each of the members of the Audit Committee is an audit committee financial expert, as that term is defined in Item 407 of Regulation S-K of the Exchange Act. The Board has determined that all members of the Audit Committee qualify as “independent” directors within the meaning of Rule 10A-3 under the Exchange Act and as defined under NASDAQ listing rules, as currently in effect and applicable to members of audit committees. As required by the Audit Committee charter, no Audit Committee member currently serves on audit committees of more than two other public companies. The Audit Committee met seven times during 2020.

The Audit Committee’s duties include monitoring and ensuring the integrity of our financial statements, compliance with legal and regulatory requirements, the qualifications and independence of our independent auditors, and the performance of our internal audit function and external auditors; preparing the report required to be prepared by the Audit Committee under the rules of the SEC for inclusion in our proxy statement; and overseeing our accounting and financial reporting processes and the audits of our financial results. In addition, the Audit Committee has responsibility for reviewing complaints about, and investigating allegations of, financial impropriety or misconduct. The Audit Committee is also responsible for engaging our independent registered public accounting firm and pre-approving audit and non-audit services performed by the firm in order to assure that the provision of such services does not impair their independence. To these ends, the Audit Committee has adopted an Audit Committee Pre-Approval

19

Policy and an Audit Committee Policy Regarding Complaint Procedures for Accounting and Auditing Matters, which are available on our website. Please also see “Report of Audit Committee” below.

Compensation Committee

The Compensation Committee operates under a written charter, a copy of which is available on our website at https://apollomed.net/corporate-governance. The Compensation Committee currently consists of Messrs. Kitayama (chairman), Fawcett and Chiang. The Board has determined that all members of the Compensation Committee qualify as “independent” directors as defined under NASDAQ listing rules, as a “non-employee director” as defined in Rule 16b-3(b)(3) under the Exchange Act and as an “outside director” as defined in Treasury Regulation 26 CFR § 1.162-27, implementing Section 162(m) of the Internal Revenue Code of 1986, as amended and currently in effect. The Compensation Committee acted by written consent three times during 2020.

The Compensation Committee establishes the compensation and benefits of our executive officers and makes recommendations to the Board regarding director compensation, including for membership on any committee of the Board. The Compensation Committee also administers our compensation plans, including our equity incentive plans.

In establishing executive and director compensation, the Compensation Committee seeks to provide compensation that is competitive in light of current market conditions and industry practices. Accordingly, the Compensation Committee will generally review market data from peer companies and information from nationally recognized published surveys, adjusted for size. The Compensation Committee then considers other factors, such as each executive officer’s individual expertise, experience, and performance, any retention concerns and relevant compensation trends in the marketplace, in making its final compensation determinations. The Compensation Committee has the authority to directly retain the services of independent consultants and other experts to assist in fulfilling its responsibilities. While members of our human resources and finance departments support the Compensation Committee in its work, our executive officers, in general, are not involved in determining the amount or form of executive and director compensation, but may from time to time make recommendations and provide feedback to the Compensation Committee. The Compensation Committee reviews the performance of each executive officer in light of the above factors and determines whether the executive officer should receive any increase in base salary, annual bonus award or discretionary equity award based on such evaluation.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee operates under a written charter, a copy of which is available on our website at https://apollomed.net/corporate-governance. The Nominating and Corporate Governance Committee currently consists of Messrs. Kitayama (chairman), Schmidt and Dr. Bates. All members of the Nominating and Corporate Governance Committee meet the independence requirements of NASDAQ. The Nominating and Corporate Governance Committee acted by written consent once during 2020. The principal ongoing functions of the Nominating and Corporate Governance Committee include developing criteria for selecting new directors, establishing and monitoring procedures for the receipt and consideration of director candidates recommended by management, stockholders and others, considering and examining director candidates, recommending director nominations to the Board, developing corporate governance principles for the Company, overseeing the Company’s compliance with those principles, and establishing monitoring procedures for the receipt of stockholder communications directed to the Board, and periodically evaluating the Board to determine whether the Board and its committees are functioning effectively.

The Nominating and Corporate Governance Committee identifies appropriate candidates to serve as directors of the Company, interviews candidates and makes recommendations to the Board regarding director nominations. In considering candidates to serve as directors, the Nominating and Corporate Governance Committee evaluates them against one or more of the following qualifications: personal integrity, sound judgment, business and professional skills and experience, industry knowledge, financial acumen and the extent to which the candidate would fill a present need on the Board. The Nominating and Corporate Governance Committee also considers additional factors, including the current composition of the Board, the current strategy and future outlook of the Company, the range of experience and skills that would best complement those already represented on the Board and the need for specialized expertise. The Nominating and Corporate Governance Committee has not adopted a formal diversity policy regarding its selection of candidates or consideration of nominations, but will consider issues of diversity in identifying and recommending director nominees to the Board, and strive where appropriate to achieve a balance of backgrounds and perspectives on the Board and its committees.

20

The Nominating and Corporate Governance Committee considers potential candidates recommended by stockholders, directors, officers, advisors, third-party search firms or other appropriate sources. In selecting candidates, the Nominating and Corporate Governance Committee takes into account all factors it deems relevant, such as a candidate’s knowledge, experience, background, independence, possible conflicts of interest and concerns for the long-term interests of our stockholders. Persons recommended by stockholders are generally considered on the same basis as candidates from other sources. If a stockholder wishes to propose a director candidate for consideration by the Nominating and Corporate Governance Committee, the stockholder must follow the procedures and comply with the requirements described in “Stockholder Proposals” at the end of this proxy statement.