EXHIBIT 99.2

Published on March 10, 2021

Exhibit 99.2

Fourth Quarter and Year - End 2020 Earnings Call Supplement March 10, 2021 NASDAQ: AMEH

Forward - Looking Statements This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward - looking statements include any statements about t he Company's business, financial condition, operating results, plans, objectives, expectations and intentions, expansion plans, int egration of acquired companies and any projections of earnings, revenue, EBITDA, Adjusted EBITDA or other financial items, such as the Company's projected capitation and future liquidity, and may be identified by the use of forward - looking terms such as “anticipa te,” “could,” “can,” “may,” “might,” “potential,” “predict,” “should,” “estimate,” “expect,” “project,” “believe,” “plan,” “envisi on, ” “intend,” “continue,” “target,” “seek,” “will,” “would,” and the negative of such terms, other variations on such terms or other simila r o r comparable words, phrases or terminology. Forward - looking statements reflect current views with respect to future events and financial performance and therefore cannot be guaranteed. Such statements are based on the current expectations and certain assumptions of the Company's management, and some or all of such expectations and assumptions may not materialize or may vary significantly from actual results. Actual results may also vary materially from forward - looking statements due to risks, uncerta inties and other factors, known and unknown, including the risk factors described from time to time in the Company’s reports to the U.S. Securities and Exchange Commission (the “SEC”), including without limitation the risk factors discussed in the Company's Annu al Report on Form 10 - K for the year ended December 31, 2020, and subsequent Quarterly Reports on Form 10 - Q. Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed or imp lie d in any forward - looking statements, you should not place undue reliance on any such forward - looking statements. Any forward - looking statements speak only as of the date of this presentation and, unless legally required, the Company does not undertake any ob lig ation to update any forward - looking statement, as a result of new information, future events or otherwise. 2 www.apollomed.net

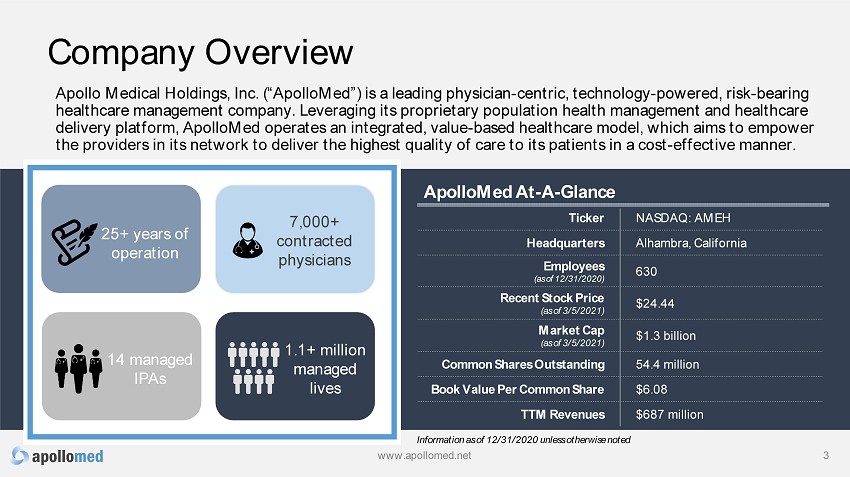

Company Overview Apollo Medical Holdings, Inc. (“ApolloMed”) is a leading physician - centric, technology - powered, risk - bearing healthcare management company. Leveraging its proprietary population health management and healthcare delivery platform, ApolloMed operates an integrated, value - based healthcare model, which aims to empower the providers in its network to deliver the highest quality of care to its patients in a cost - effective manner. 3 ApolloMed At - A - Glance Ticker NASDAQ: AMEH Headquarters Alhambra, California Employees (as of 12/31/2020) 630 Recent Stock Price ( as of 3/5/2021 ) $24.44 Market Cap (as of 3/5/2021) $1.3 bill ion Common Shares Outstanding 54.4 million Book Value Per Common Share $6.08 TTM Revenues $687 million 7,000+ contracted physicians 14 managed IPAs 1.1+ million managed lives 25+ years of operation Information as of 12/31/2020 unless otherwise noted www.apollomed.net

Company exceeded all previously disclosed guidance metrics for full - year 2020 • Revenue • Net income • EBITDA • Adj. EBITDA Achieved record growth in total revenue and net income attributable to ApolloMed in 2020 NGACO’s stellar performance in 2019, resulting in $19.8M shared savings settlement impact on top line, $13.3M impact on bottom line in 2020 Realizing benefits from technologies implemented: >$1M in annual OpEx savings Exceeding all guidance Record growth Shared savings impact Technology at scale Q4 /Year - End and Recent Highlights CAIPA MSO strategic alliance and investment — first step in executing growth strategy Strategic partnerships Promotion of Brandon Sim to COO , appointment of Dr. Jeremy R. Jackson as Chief of Staff Strengthening leadership team www.apollomed.net 4

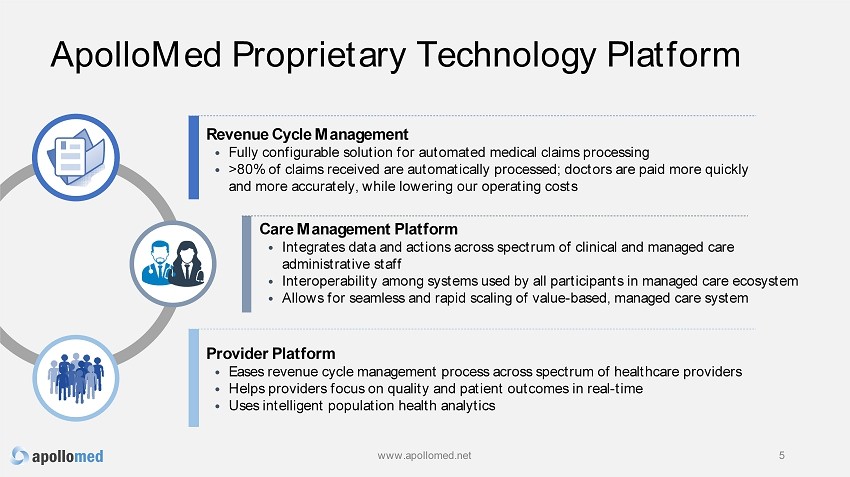

ApolloMed Proprietary Technology Platform Revenue Cycle Management • Fully configurable solution for automated medical claims processing • >80% of claims received are automatically processed; doctors are paid more quickly and more accurately, while lowering our operating costs Provider Platform • Eases revenue cycle management process across spectrum of healthcare providers • Helps providers focus on quality and patient outcomes in real - time • Uses intelligent population health analytics Care Management Platform • Integrates data and actions across spectrum of clinical and managed care administrative staff • Interoperability among systems used by all participants in managed care ecosystem • Allows for seamless and rapid scaling of value - based, managed care system www.apollomed.net 5

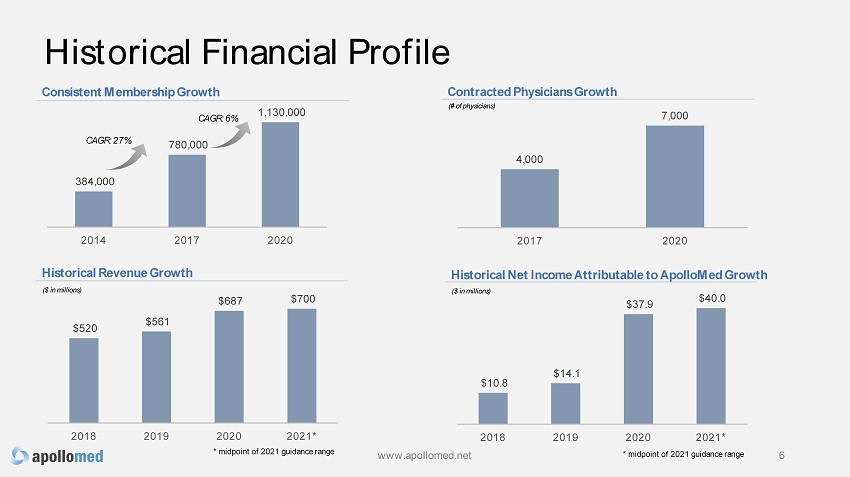

4,000 7,000 2017 2020 384,000 780,000 1,130,000 2014 2017 2020 CAGR: 27% $520 $561 $687 $700 2018 2019 2020 2021* 6 Historical Revenue Growth Consistent Membership Growth Contracted Physicians Growth ($ in millions) (# of physicians) CAGR: 6% * midpoint of 2021 guidance range $10.8 $14.1 $37.9 $40.0 2018 2019 2020 2021* Historical Net Income Attributable to ApolloMed Growth ($ in millions) Historical Financial Profile www.apollomed.net * midpoint of 2021 guidance range

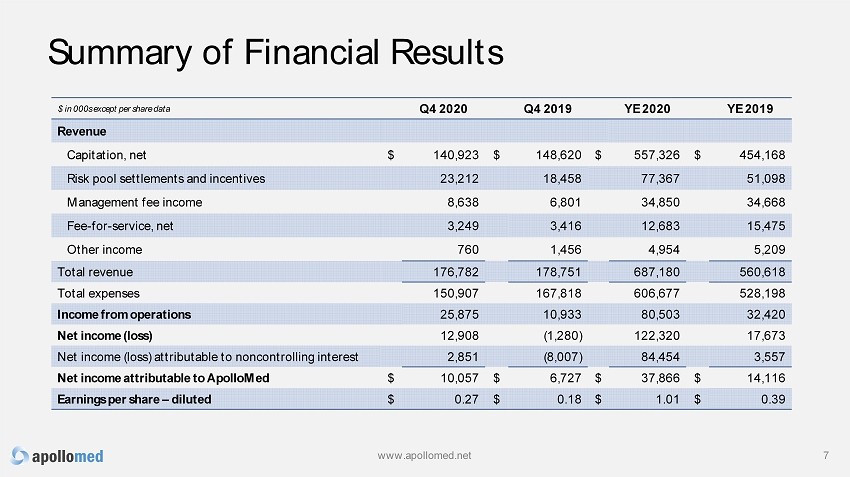

Summary of Financial Results www.apollomed.net 7 $ in 000s except per share data Q4 2020 Q4 2019 YE 2020 YE 2019 Revenue Capitation, net $ 140,923 $ 148,620 $ 557,326 $ 454,168 Risk pool settlements and incentives 23,212 18,458 77,367 51,098 Management fee income 8,638 6,801 34,850 34,668 Fee - for - service, net 3,249 3,416 12,683 15,475 Other income 760 1,456 4,954 5,209 Total revenue 176,782 178,751 687,180 560,618 Total expenses 150,907 167,818 606,677 528,198 Income from operations 25,875 10,933 80,503 32,420 Net income (loss) 12,908 (1,280) 122,320 17,673 Net income (loss) attributable to noncontrolling interest 2,851 (8,007) 84,454 3,557 Net income attributable to ApolloMed $ 10,057 $ 6,727 $ 37,866 $ 14,116 Earnings per share – diluted $ 0.27 $ 0.18 $ 1.01 $ 0.39

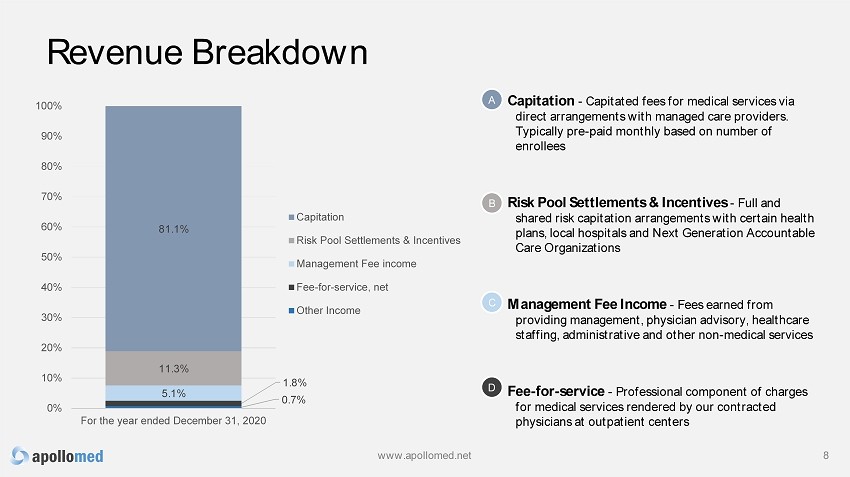

Capitation - Capitated fees for medical services via direct arrangements with managed care providers . Typically pre - paid monthly based on number of enrollees Risk Pool Settlements & Incentives - Full and shared risk capitation arrangements with certain health plans , local hospitals and Next Generation Accountable Care Organizations Management Fee Income - Fees earned from providing management, physician advisory, healthcare staffing, admin istrative and other non - medical services Fee - for - service - Professional component of charges for medical services rendered by our contracted physicians at outpatient centers 0.7% 1.8% 5.1% 11.3% 81.1% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% For the year ended December 31, 2020 Capitation Risk Pool Settlements & Incentives Management Fee income Fee-for-service, net Other Income Revenue Breakdown 8 A B C D www.apollomed.net

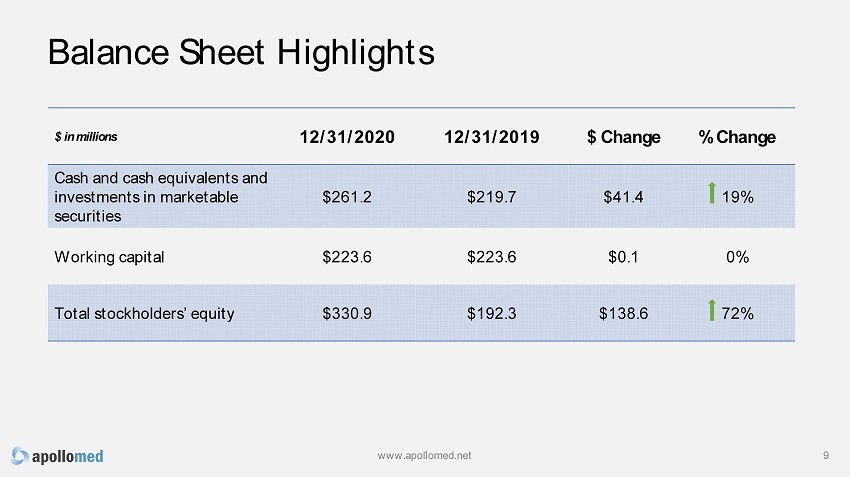

Balance Sheet Highlights 9 $ in millions 12/31/2020 12/31/2019 $ Change % Change Cash and cash equivalents and investments in marketable securities $261.2 $219.7 $41.4 19% Working capital $223.6 $223.6 $0.1 0% Total stockholders’ equity $330.9 $192.3 $138.6 72% www.apollomed.net

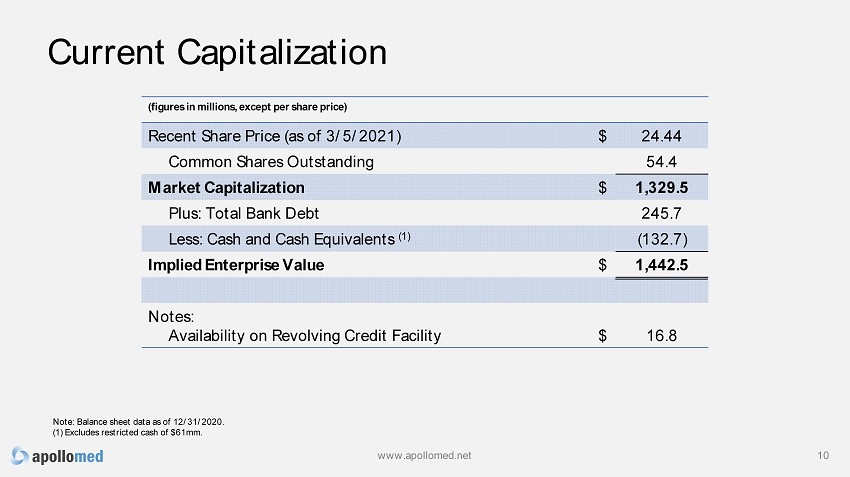

Current Capitalization 10 Note: Balance sheet data as of 12 /3 1 /2020. (1) Excludes restricted cash of $61mm. www.apollomed.net (figures in millions, except per share price) Recent Share Price (as of 3/5/2021) $ 24.44 Common Shares Outstanding 54.4 Market Capitalization $ 1,329.5 Plus: Total Bank Debt 245.7 Less: Cash and Cash Equivalents (1) (132.7) Implied Enterprise Value $ 1,442.5 Notes: Availability on Revolving Credit Facility $ 16.8

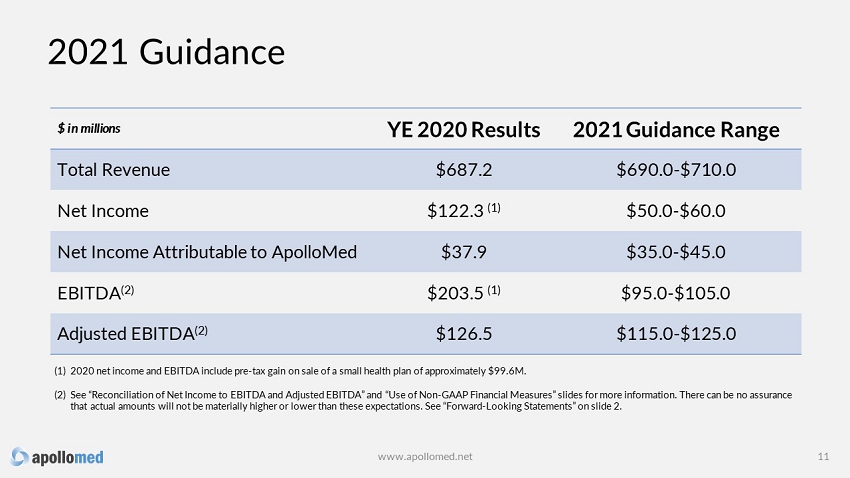

2021 Guidance $ in millions YE 2020 Results 2021 Guidance Range Total Revenue $687.2 $690.0 - $710.0 Net Income $122.3 (1) $50.0 - $60.0 Net Income Attributable to ApolloMed $37.9 $35.0 - $45.0 EBITDA (2) $203.5 (1) $95.0 - $105.0 Adjusted EBITDA (2) $126.5 $115.0 - $125.0 11 (1) 2020 net income includes pre - tax gain on sale of UCI of $99.6M. (2) See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA” and “Use of Non - GAAP Financial Measures” slides for more inform ation. There can be no assurance that actual amounts will not be materially higher or lower than these expectations. See “Forward - Looking Statements” on slide 2. www.apollomed.net

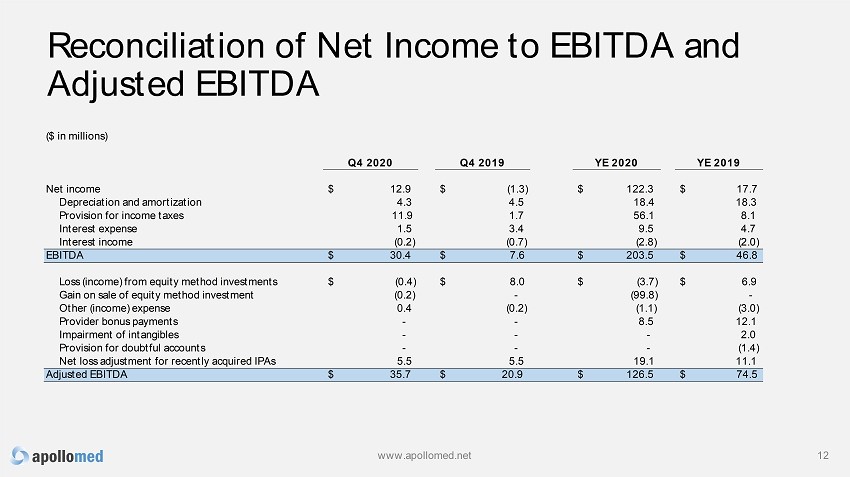

Reconciliation of Net Income to EBITDA and Adjusted EBITDA 12 Q4 2020 Q4 2019 YE 2020 YE 2019 Net income $ 12.9 $ (1.3) $ 122.3 $ 17.7 Depreciation and amortization 4.3 4.5 18.4 18.3 Provision for income taxes 11.9 1.7 56.1 8.1 Interest expense 1.5 3.4 9.5 4.7 Interest income (0.2) (0.7) (2.8) (2.0) EBITDA $ 30.4 $ 7.6 $ 203.5 $ 46.8 Loss (income) from equity method investments $ (0.4) $ 8.0 $ (3.7) $ 6.9 Gain on sale of equity method investment (0.2) - (99.8) - Other (income) expense 0.4 (0.2) (1.1) (3.0) Provider bonus payments - - 8.5 12.1 Impairment of intangibles - - - 2.0 Provision for doubtful accounts - - - (1.4) Net loss adjustment for recently acquired IPAs 5.5 5.5 19.1 11.1 Adjusted EBITDA $ 35.7 $ 20.9 $ 126.5 $ 74.5 ($ in millions) www.apollomed.net

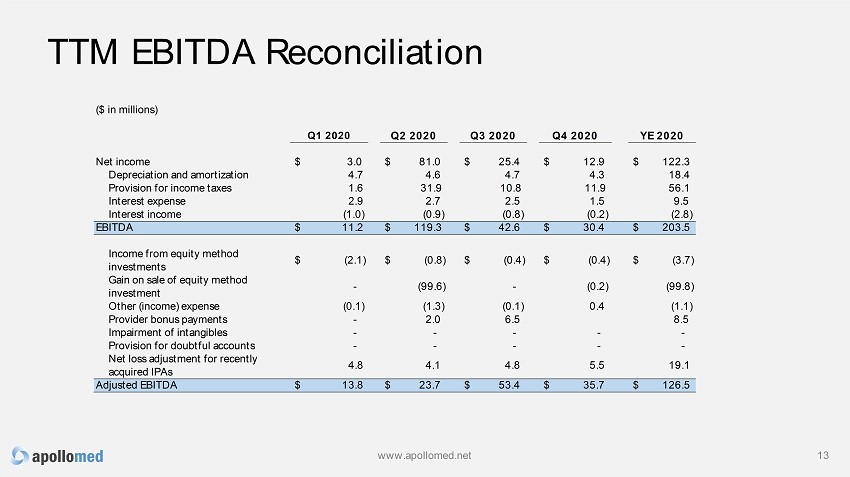

TTM EBITDA Reconciliation 13 Q1 2020 Q2 2020 Q3 2020 Q4 2020 YE 2020 Net income $ 3.0 $ 81.0 $ 25.4 $ 12.9 $ 122.3 Depreciation and amortization 4.7 4.6 4.7 4.3 18.4 Provision for income taxes 1.6 31.9 10.8 11.9 56.1 Interest expense 2.9 2.7 2.5 1.5 9.5 Interest income (1.0) (0.9) (0.8) (0.2) (2.8) EBITDA $ 11.2 $ 119.3 $ 42.6 $ 30.4 $ 203.5 Income from equity method investments $ (2.1) $ (0.8) $ (0.4) $ (0.4) $ (3.7) Gain on sale of equity method investment - (99.6) - (0.2) (99.8) Other (income) expense (0.1) (1.3) (0.1) 0.4 (1.1) Provider bonus payments - 2.0 6.5 8.5 Impairment of intangibles - - - - - Provision for doubtful accounts - - - - - Net loss adjustment for recently acquired IPAs 4.8 4.1 4.8 5.5 19.1 Adjusted EBITDA $ 13.8 $ 23.7 $ 53.4 $ 35.7 $ 126.5 ($ in millions) www.apollomed.net

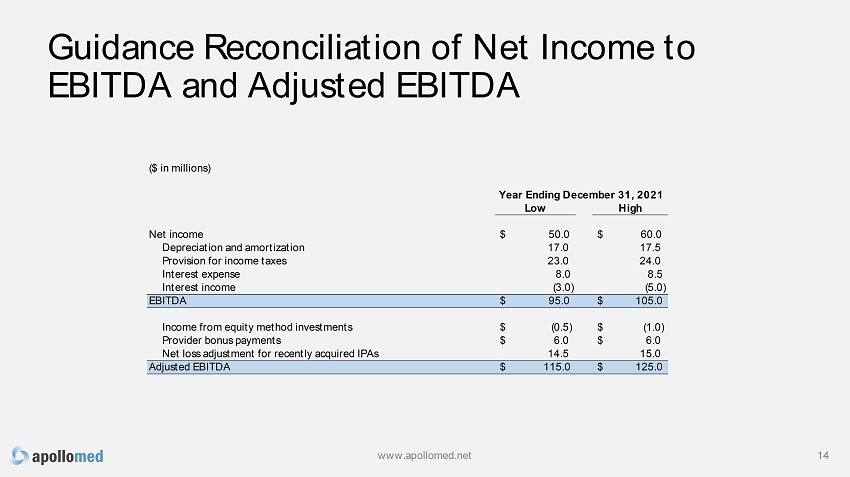

Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA 14 Low High Net income $ 50.0 $ 60.0 Depreciation and amortization 17.0 17.5 Provision for income taxes 23.0 24.0 Interest expense 8.0 8.5 Interest income (3.0) (5.0) EBITDA $ 95.0 $ 105.0 Income from equity method investments $ (0.5) $ (1.0) Provider bonus payments $ 6.0 $ 6.0 Net loss adjustment for recently acquired IPAs 14.5 15.0 Adjusted EBITDA $ 115.0 $ 125.0 ($ in millions) Year Ending December 31, 2021 www.apollomed.net

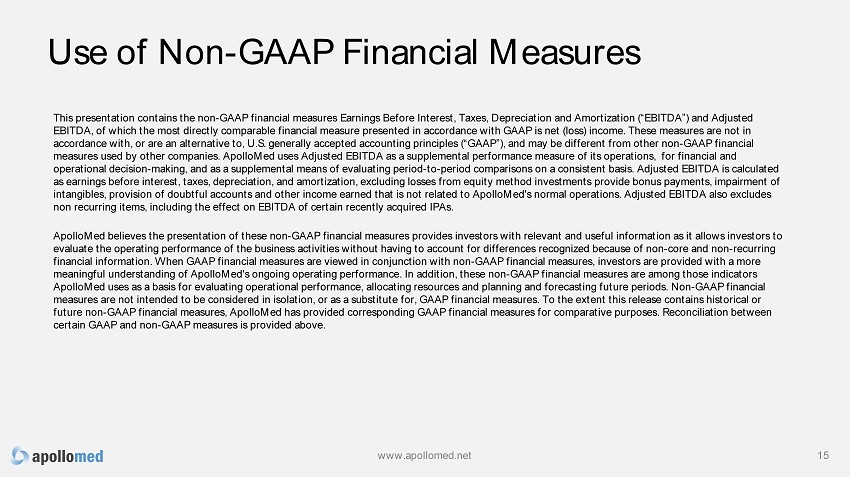

Use of Non - GAAP Financial Measures This presentation contains the non - GAAP financial measures Earnings Before Interest, Taxes, Depreciation and Amortization (“EBIT DA”) and Adjusted EBITDA, of which the most directly comparable financial measure presented in accordance with GAAP is net (loss) income. These me asures are not in accordance with, or are an alternative to, U.S. generally accepted accounting principles (“GAAP”), and may be different from oth er non - GAAP financial measures used by other companies. ApolloMed uses Adjusted EBITDA as a supplemental performance measure of its operations, for f inancial and operational decision - making, and as a supplemental means of evaluating period - to - period comparisons on a consistent basis. Adjus ted EBITDA is calculated as earnings before interest, taxes, depreciation, and amortization, excluding losses from equity method investments provide b onu s payments, impairment of intangibles, provision of doubtful accounts and other income earned that is not related to ApolloMed's normal operations. Adj ust ed EBITDA also excludes non recurring items, including the effect on EBITDA of certain recently acquired IPAs. ApolloMed believes the presentation of these non - GAAP financial measures provides investors with relevant and useful information as it allows investors to evaluate the operating performance of the business activities without having to account for differences recognized because of no n - core and non - recurring financial information. When GAAP financial measures are viewed in conjunction with non - GAAP financial measures, investors are pr ovided with a more meaningful understanding of ApolloMed's ongoing operating performance. In addition, these non - GAAP financial measures are among those indicators ApolloMed uses as a basis for evaluating operational performance, allocating resources and planning and forecasting future pe rio ds. Non - GAAP financial measures are not intended to be considered in isolation, or as a substitute for, GAAP financial measures. To the extent this rel ease contains historical or future non - GAAP financial measures, ApolloMed has provided corresponding GAAP financial measures for comparative purposes. Recon ciliation between certain GAAP and non - GAAP measures is provided above. 15 www.apollomed.net

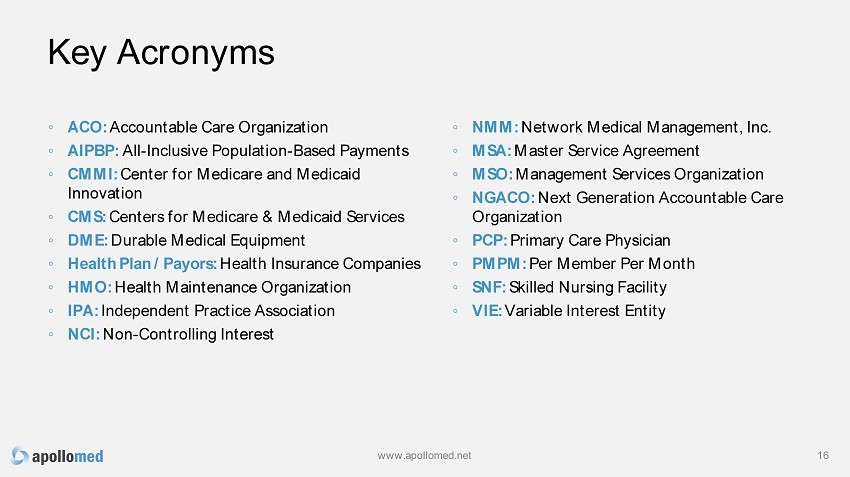

Key Acronyms 16 ◦ ACO: Accountable Care Organization ◦ AIPBP: All - Inclusive Population - Based Payments ◦ CMMI: Center for Medicare and Medicaid Innovation ◦ CMS: Centers for Medicare & Medicaid Services ◦ DME: Durable Medical Equipment ◦ Health Plan / Payors: Health Insurance Companies ◦ HMO: Health Maintenance Organization ◦ IPA: Independent Practice Association ◦ NCI: Non - Controlling Interest ◦ NMM: Network Medical Management , Inc. ◦ MSA: Master Service Agreement ◦ MSO: Management Services Organization ◦ NGACO: Next Generation Accountable Care Organization ◦ PCP: Primary Care Physician ◦ PMPM: Per Member Per Month ◦ SNF: Skilled Nursing Facility ◦ VIE: Variable Interest Entity www.apollomed.net

For inquiries, please contact: ApolloMed Investor Relations Carolyne Sohn, The Equity Group (626) 943 - 6491 (415) 568 - 2255 investors@apollomed.net csohn@equityny.com NASDAQ: AMEH www.apollomed.net 17