EXHIBIT 99.2

Published on November 7, 2023

Exhibit 99.2

Powered by Technology. Built by Doctors. For Patients. Apollo Medical Holdings (NASDAQ: AMEH) Third Quarter 2023 Earnings Call Supplement November 7, 2023

Forward - Looking Statements This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward - looking statements include any statements about t he Company's business, financial condition, operating results, plans, objectives, expectations and intentions, expansion plans, int egration of acquired companies and any projections of earnings, revenue, EBITDA, Adjusted EBITDA or other financial items, such as the Company's projected capitation and future liquidity, and may be identified by the use of forward - looking terms such as “anticipa te,” “could,” “can,” “may,” “might,” “potential,” “predict,” “should,” “estimate,” “expect,” “project,” “believe,” “plan,” “envisi on, ” “intend,” “continue,” “target,” “seek,” “will,” “would,” and the negative of such terms, other variations on such terms or other simila r o r comparable words, phrases or terminology. Forward - looking statements reflect current views with respect to future events and financial performance and therefore cannot be guaranteed. Such statements are based on the current expectations and certain assumptions of the Company’s management, and some or all of such expectations and assumptions may not materialize or may vary significantly from actual results. Actual results may also vary materially from forward - looking statements due to risks, uncerta inties and other factors, known and unknown, including the risk factors described from time to time in the Company’s reports to the U.S. Securities and Exchange Commission (the “SEC”), including without limitation the risk factors discussed in the Company's Annu al Report on Form 10 - K for the year ended December 31, 2022, and subsequent Quarterly Reports on Form 10 - Q. Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed or imp lie d in any forward - looking statements, you should not place undue reliance on any such forward - looking statements. Any forward - looking statements speak only as of the date of this presentation and, unless legally required, the Company does not undertake any ob lig ation to update any forward - looking statement, as a result of new information, future events or otherwise. 2

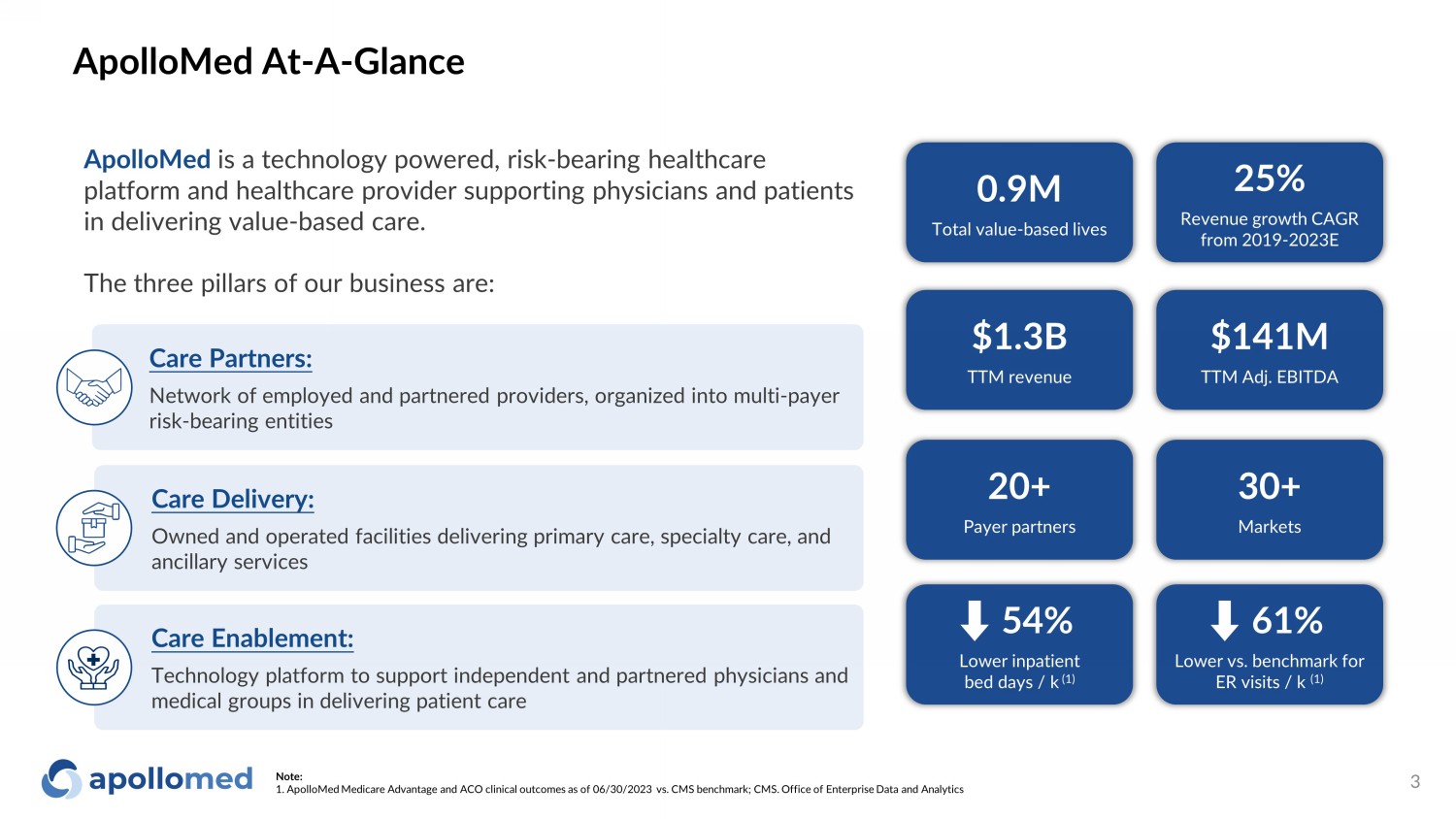

ApolloMed At - A - Glance 3 ApolloMed is a technology powered, risk - bearing healthcare platform and healthcare provider supporting physicians and patients in delivering value - based care. The three pillars of our business are: 25% Revenue growth CAGR from 2019 - 2023E 30+ Markets $141M TTM Adj. EBITDA Care Delivery: Owned and operated facilities delivering primary care, specialty care, and ancillary services Care Partners: Network of employed and partnered providers, organized into multi - payer risk - bearing entities 0.9M Total value - based lives 20+ Payer partners $1.3B TTM revenue Note: 1. ApolloMed Medicare Advantage and ACO clinical outcomes as of 06/30/2023 vs. CMS benchmark; CMS. Office of Enterprise Data and Analytic s Care Enablement: Technology platform to support independent and partnered physicians and medical groups in delivering patient care 61% Lower vs. benchmark for ER visits / k (1) 54% Lower inpatient bed days / k (1)

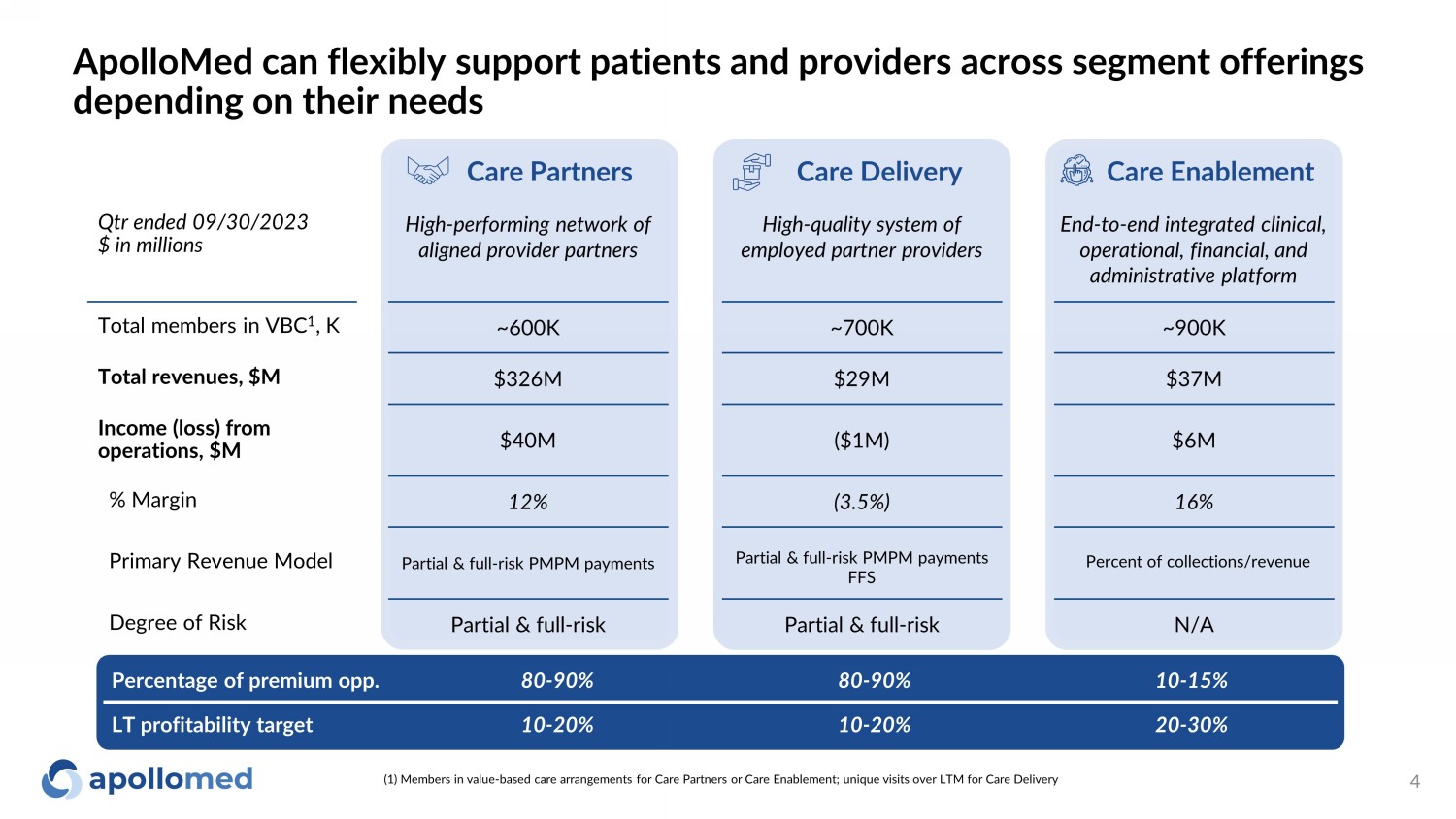

ApolloMed can flexibly support patients and providers across segment offerings depending on their needs 4 Qtr ended 09/30/2023 $ in millions Total revenues, $M Income (loss) from operations, $M % Margin Total members in VBC 1 , K Primary Revenue Model Degree of Risk Care Partners High - performing network of aligned provider partners $326M $40M 12 % ~600K Partial & full - risk Care Delivery High - quality system of employed partner providers $29M ( $1M) (3.5 %) ~ 7 00K Partial & full - risk PMPM payments Partial & full - risk Care Enablement End - to - end integrated clinical, operational, financial, and administrative platform $37M $6M 16 % ~900K Partial & full - risk PMPM payments FFS N/A Percentage of premium opp. 80 - 90% 80 - 90% 10 - 15% LT profitability target 10 - 20% 10 - 20% 20 - 30% Percent of collections/revenue (1) Members in value - based care arrangements for Care Partners or Care Enablement; unique visits over LTM for Care Delivery

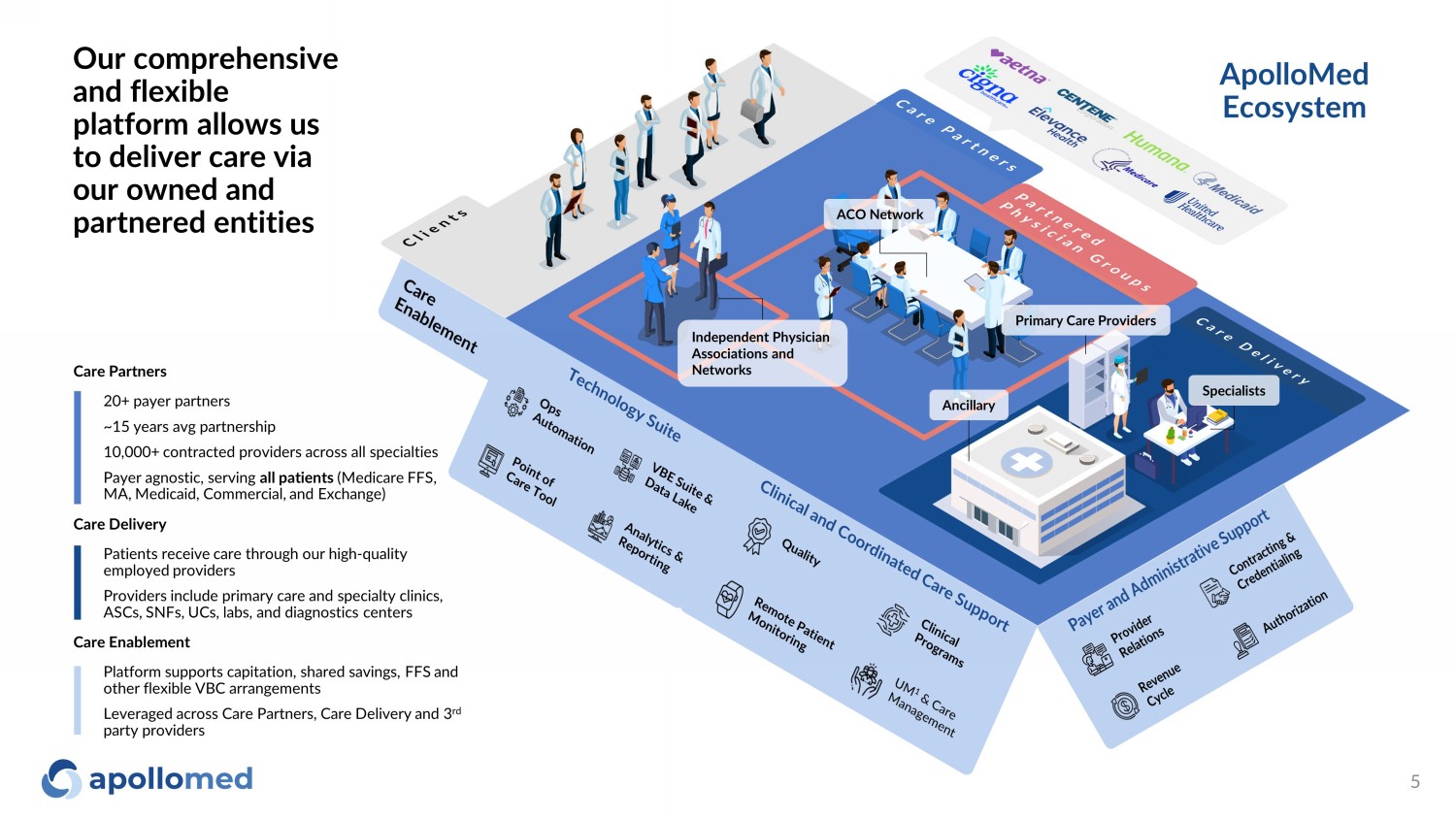

Our comprehensive and flexible platform allows us to deliver care via our owned and partnered entities 5 Specialists Ancillary ACO Network Independent Physician Associations and Networks ApolloMed Ecosystem • Patients receive care through our high - quality employed providers • Providers include primary care and specialty clinics, ASCs, SNFs, UCs, labs, and diagnostics centers • Platform supports capitation, shared savings, FFS and other flexible VBC arrangements • Leveraged across Care Partners, Care Delivery and 3 rd party providers • 20+ payer partners • ~15 years avg partnership • 10,000+ contracted providers across all specialties • P ayer agnostic, serving all patients (Medicare FFS, MA, Medicaid, Commercial, and Exchange) Primary Care Providers Care Partners Care Delivery Care Enablement

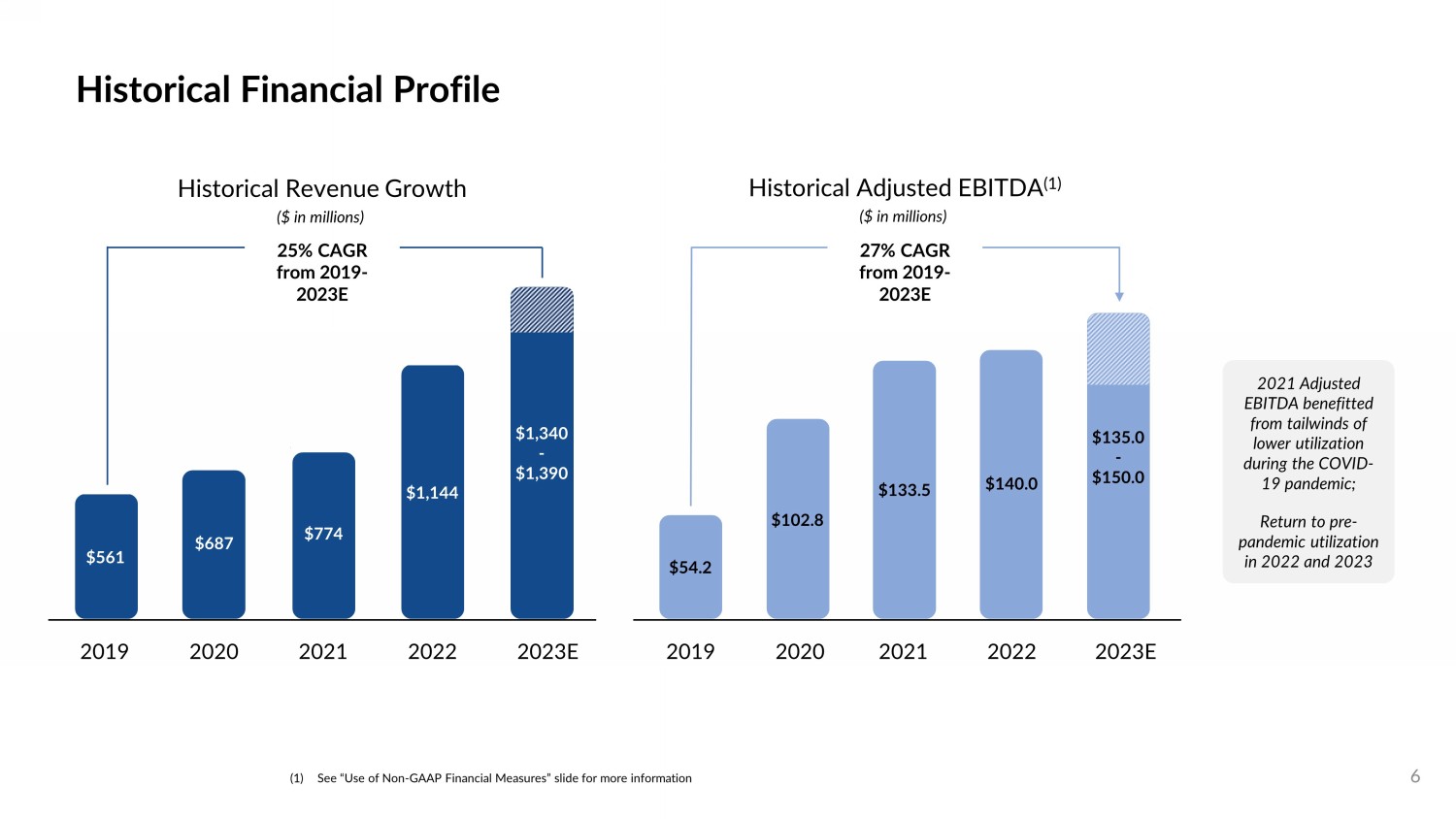

Historical Financial Profile 6 2021 Adjusted EBITDA benefitted from tailwinds of lower utilization during the COVID - 19 pandemic; Return to pre - pandemic utilization in 2022 and 2023 $561 $687 $774 $1,144 $1,340 - $1,390 Historical Revenue Growth ($ in millions) 2019 2020 2021 2022 2023E 25% CAGR from 2019 - 2023E $54.2 $102.8 $133.5 $140.0 ($ in millions) Historical Adjusted EBITDA (1) 27% CAGR from 2019 - 2023E 2019 2020 2021 2022 2023E $135.0 - $150.0 (1) See “Use of Non - GAAP Financial Measures” slide for more information

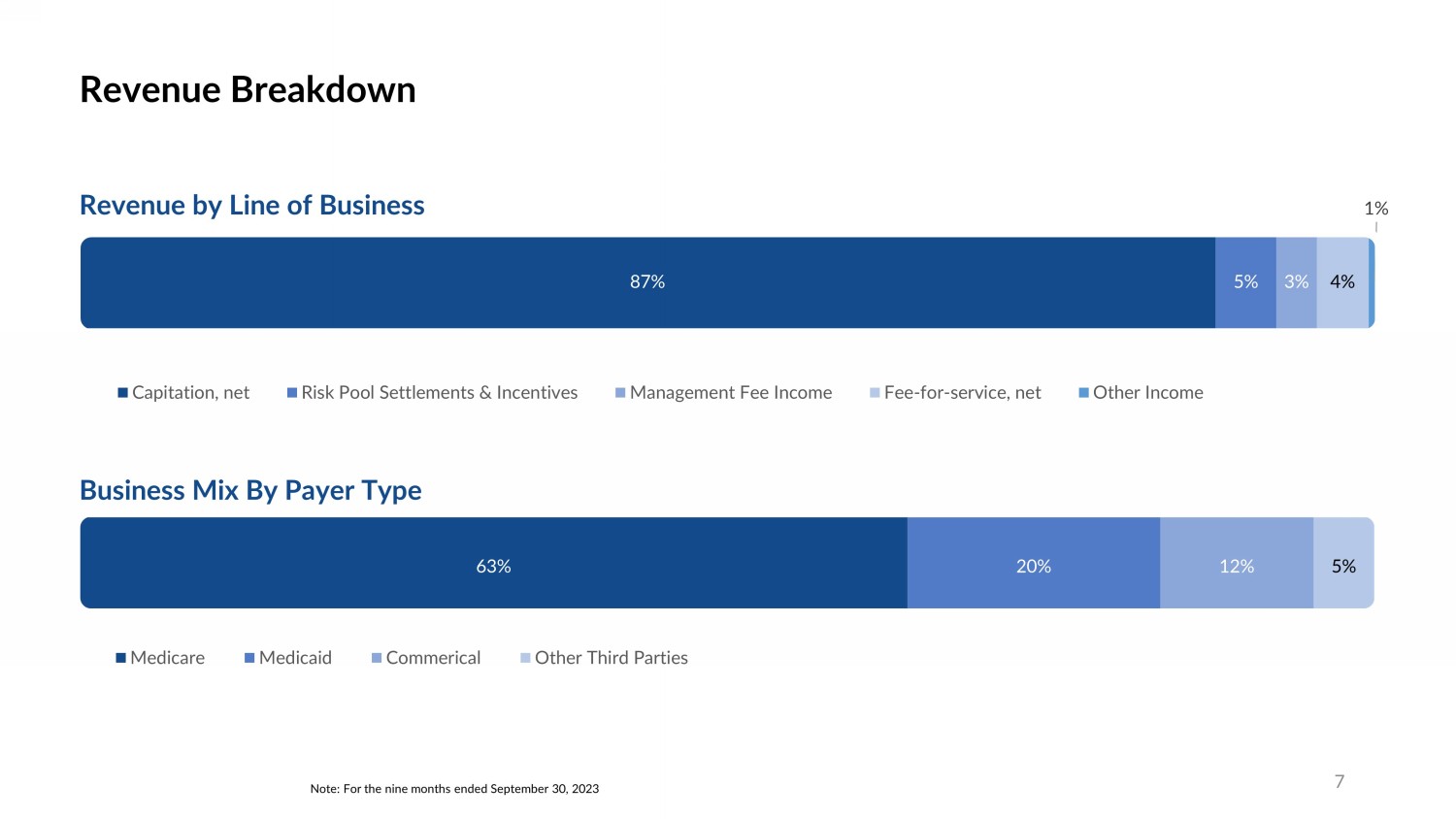

Revenue Breakdown 7 Note: For the nine months ended September 30, 2023 Revenue by Line of Business Business Mix By Payer Type 87% 5% 3% 4% 1% Capitation, net Risk Pool Settlements & Incentives Management Fee Income Fee-for-service, net Other Income 63% 20% 12% 5% Medicare Medicaid Commerical Other Third Parties

Grow Within Existing Markets • Continue to build a strong core in the Southern California market with an emphasis on access to care and delivering culturally - aligned care to our communities ApolloMed’s multi - pronged growth strategy 8 Expand Into New Markets • Transform healthcare for local communities across the country by partnering with new provider groups, building care delivery capabilities, and extending payer relationships nationally Deepen Integration Across ApolloMed’s Segments • Increase growth of existing Care Enablement providers as they integrate more deeply into ApolloMed ’s ecosystem as Care Partners Advance Contracts Across Risk Spectrum • Migrate member lives under partial risk contracts into full risk and total cost of care arrangements Identify Opportunities For M&A • Continue to execute on M&A strategy across all segments and lines of business

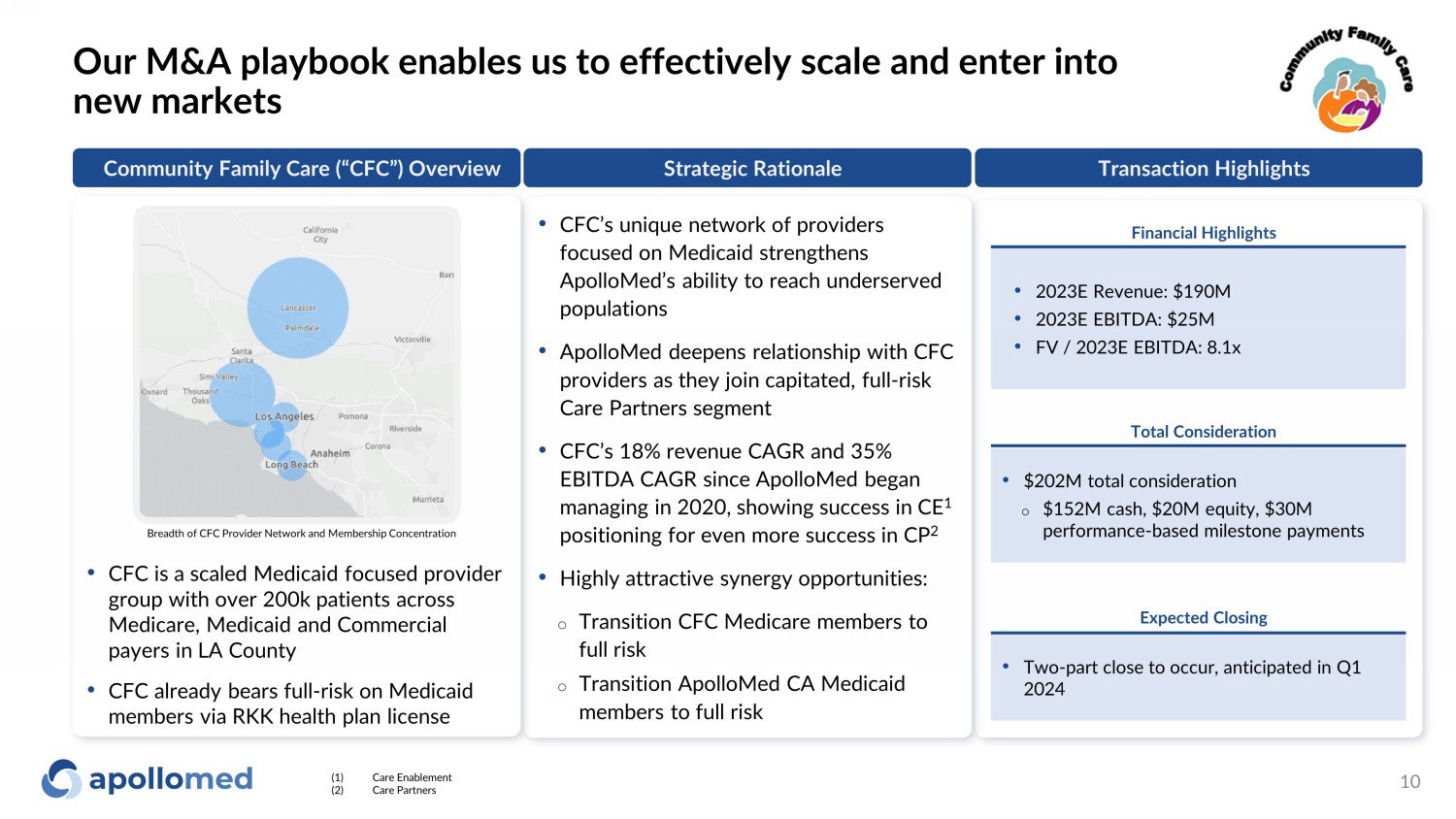

Community Family Care Acquisition

Our M&A playbook enables us to effectively scale and enter into new markets 10 • 2023E Revenue: $190M • 2023E EBITDA: $25M • FV / 2023E EBITDA: 8.1x Financial Highlights Total Consideration • $20 2 M total consideration o $152M cash, $20M equity, $30M performance - based milestone payments • Two - part close to occur, anticipated in Q1 2024 Expected Closing Transaction Highlights • CFC’s unique network of providers focused on Medicaid strengthens ApolloMed’s ability to reach underserved populations • ApolloMed deepens relationship with CFC providers as they join capitated, full - risk Care Partners segment • CFC’s 18% revenue CAGR and 35% EBITDA CAGR since ApolloMed began managing in 2020, showing success in CE 1 positioning for even more success in CP 2 • Highly attractive synergy opportunities: o Transition CFC Medicare members to full risk o Transition ApolloMed CA Medicaid members to full risk Strategic Rationale • CFC is a scaled Medicaid focused provider group with over 200k patients across Medicare, Medicaid and Commercial payers in LA County • CFC already bears f ull - risk on Medicaid members via RKK health plan license Community Family Care (“CFC”) Overview (1) Care Enablement (2) Care Partners Breadth of CFC Provider Network and Membership Concentration

Q3 2023 Update

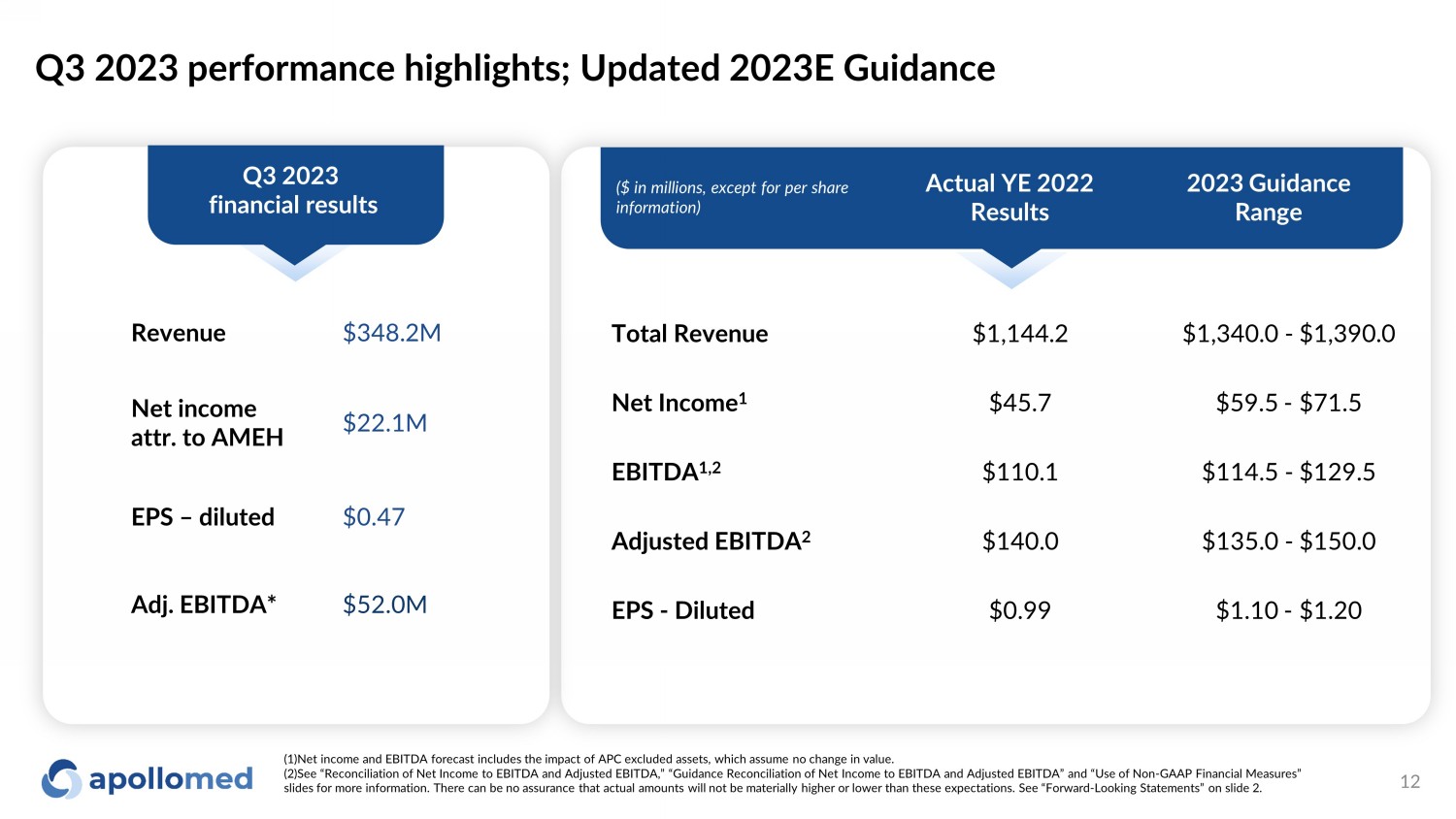

Q3 2023 performance highlights; Updated 2023E Guidance 12 Total Revenue $1,144.2 $1,340.0 - $1,390.0 Net Income 1 $45.7 $59.5 - $71.5 EBITDA 1,2 $110.1 $114.5 - $129.5 Adjusted EBITDA 2 $140.0 $135.0 - $150.0 EPS - Diluted $0.99 $1.10 - $1.20 Q3 2023 financial results ($ in millions, except for per share information) Actual YE 2022 Results 2023 Guidance Range Revenue $348.2M Net income attr. to AMEH $22.1M EPS – diluted $0.47 Adj. EBITDA* $52.0M (1)Net income and EBITDA forecast includes the impact of APC excluded assets, which assume no change in value. (2)See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA,” “Guidance Reconciliation of Net Income to EBITDA and Adj ust ed EBITDA” and “Use of Non - GAAP Financial Measures” slides for more information. There can be no assurance that actual amounts will not be materially higher or lower than these exp ectations. See “Forward - Looking Statements” on slide 2.

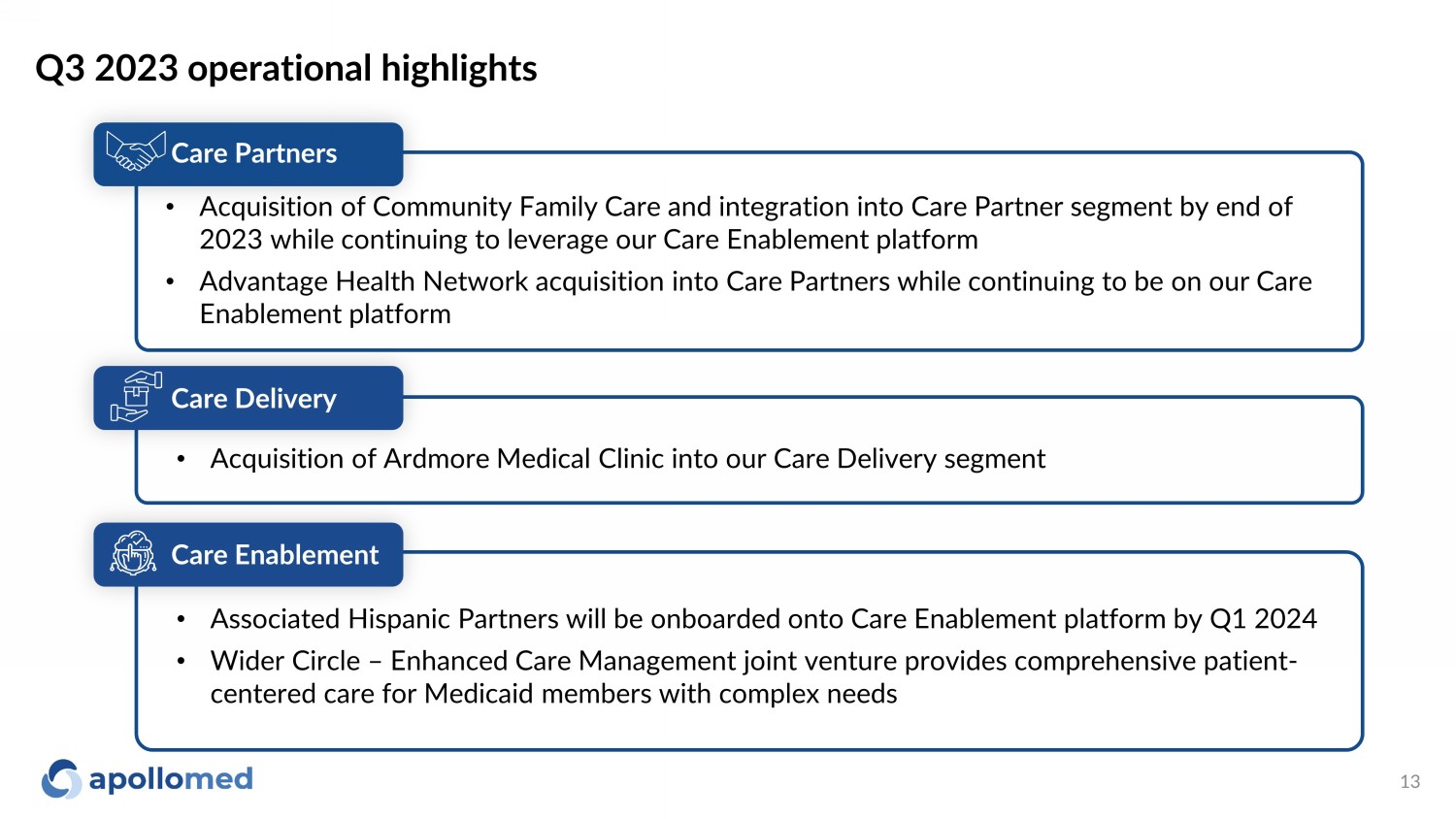

Q3 2023 operational highlights 13 • Acquisition of Community Family Care and integration into Care Partner segment by end of 2023 while continuing to leverage our Care Enablement platform • Advantage Health Network acquisition into Care Partners while continuing to be on our Care Enablement platform • Acquisition of Ardmore Medical Clinic into our Care Delivery segment • Associated Hispanic Partners will be onboarded onto Care Enablement platform by Q1 2024 • Wider Circle – Enhanced Care Management joint venture provides comprehensive patient - centered care for Medicaid members with complex needs Care Enablement Care Delivery Care Partners

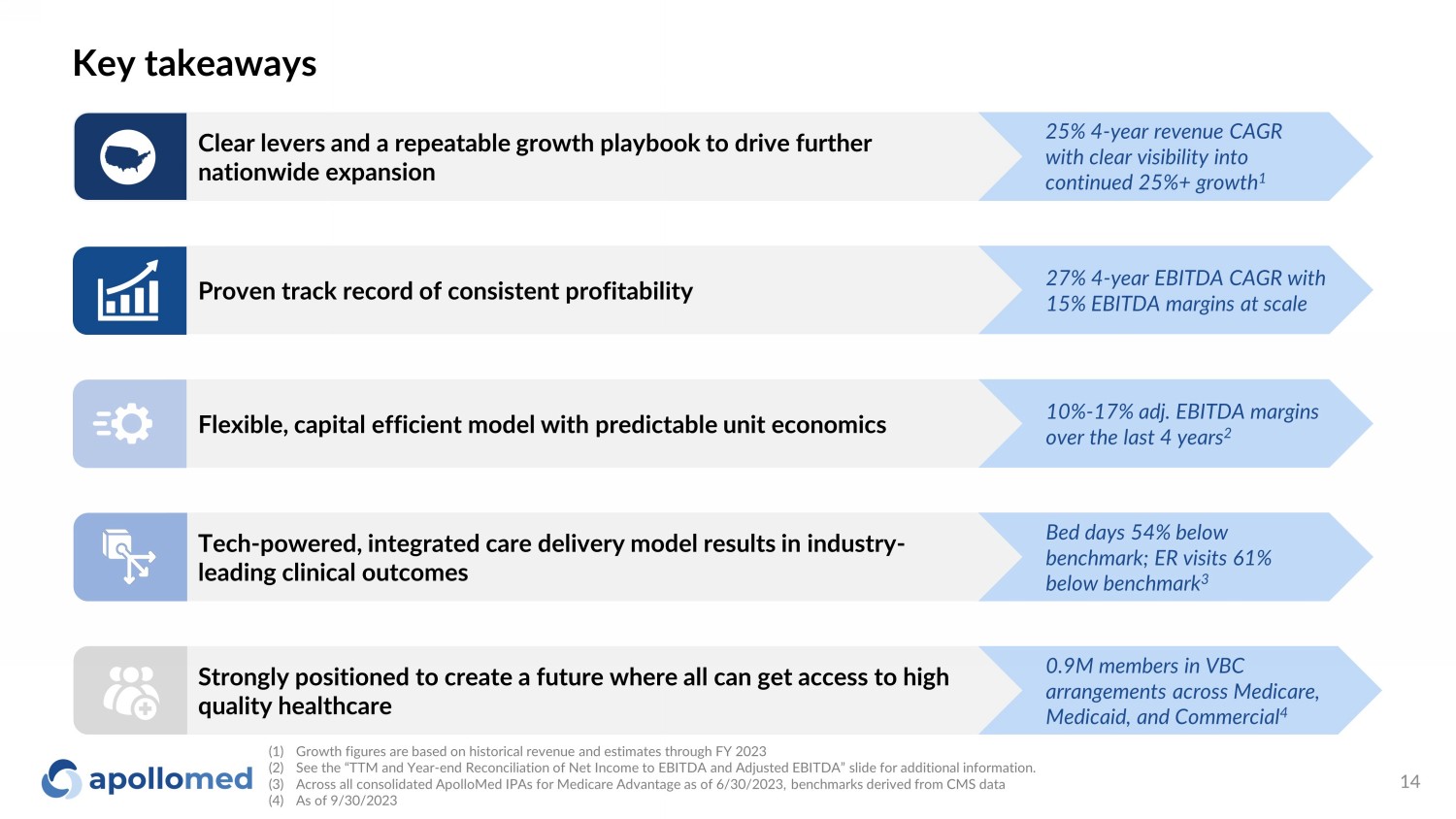

10% - 17% adj. EBITDA margins over the last 4 years 2 Bed days 54% below benchmark; ER visits 61% below benchmark 3 0.9M members in VBC arrangements across Medicare, Medicaid, and Commercial 4 27% 4 - year EBITDA CAGR with 15% EBITDA margins at scale Key takeaways Strongly positioned to create a future where all can get access to high quality healthcare Proven track record of consistent profitability Tech - powered, integrated care delivery model results in industry - leading clinical outcomes Flexible, capital efficient model with predictable unit economics Clear levers and a repeatable growth playbook to drive further nationwide expansion (1) Growth figures are based on historical revenue and estimates through FY 2023 (2) See the “TTM and Year - end Reconciliation of Net Income to EBITDA and Adjusted EBITDA” slide for additional information. (3) Across all consolidated ApolloMed IPAs for Medicare Advantage as of 6/30/2023, benchmarks derived from CMS data (4) As of 9/30/2023 25% 4 - year revenue CAGR with clear visibility into continued 25%+ growth 1 14

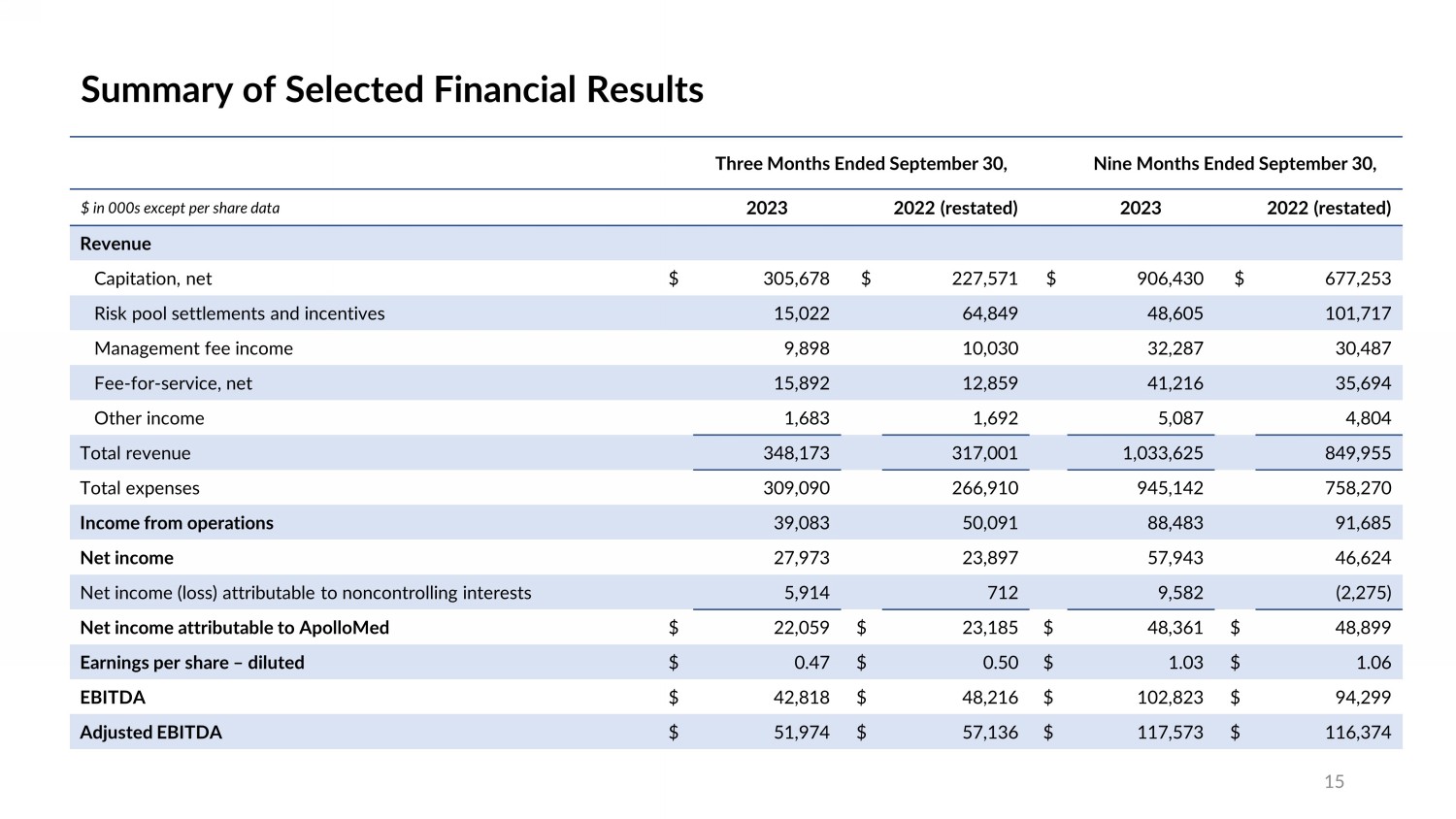

Summary of Selected Financial Results 15 Three Months Ended September 30, Nine Months Ended September 30, $ in 000s except per share data 2023 2022 (restated) 2023 2022 (restated) Revenue Capitation, net $ 305,678 $ 227,571 $ 906,430 $ 677,253 Risk pool settlements and incentives 15,022 64,849 48,605 101,717 Management fee income 9,898 10,030 32,287 30,487 Fee - for - service, net 15,892 12,859 41,216 35,694 Other income 1,683 1,692 5,087 4,804 Total revenue 348,173 317,001 1,033,625 849,955 Total expenses 309,090 266,910 945,142 758,270 Income from operations 39,083 50,091 88,483 91,685 Net income 27,973 23,897 57,943 46,624 Net income (loss) attributable to noncontrolling interests 5,914 712 9,582 (2,275) Net income attributable to ApolloMed $ 22,059 $ 23,185 $ 48,361 $ 48,899 Earnings per share – diluted $ 0.47 $ 0.50 $ 1.03 $ 1.06 EBITDA $ 42,818 $ 48,216 $ 102,823 $ 94,299 Adjusted EBITDA $ 51,974 $ 57,136 $ 117,573 $ 116,374

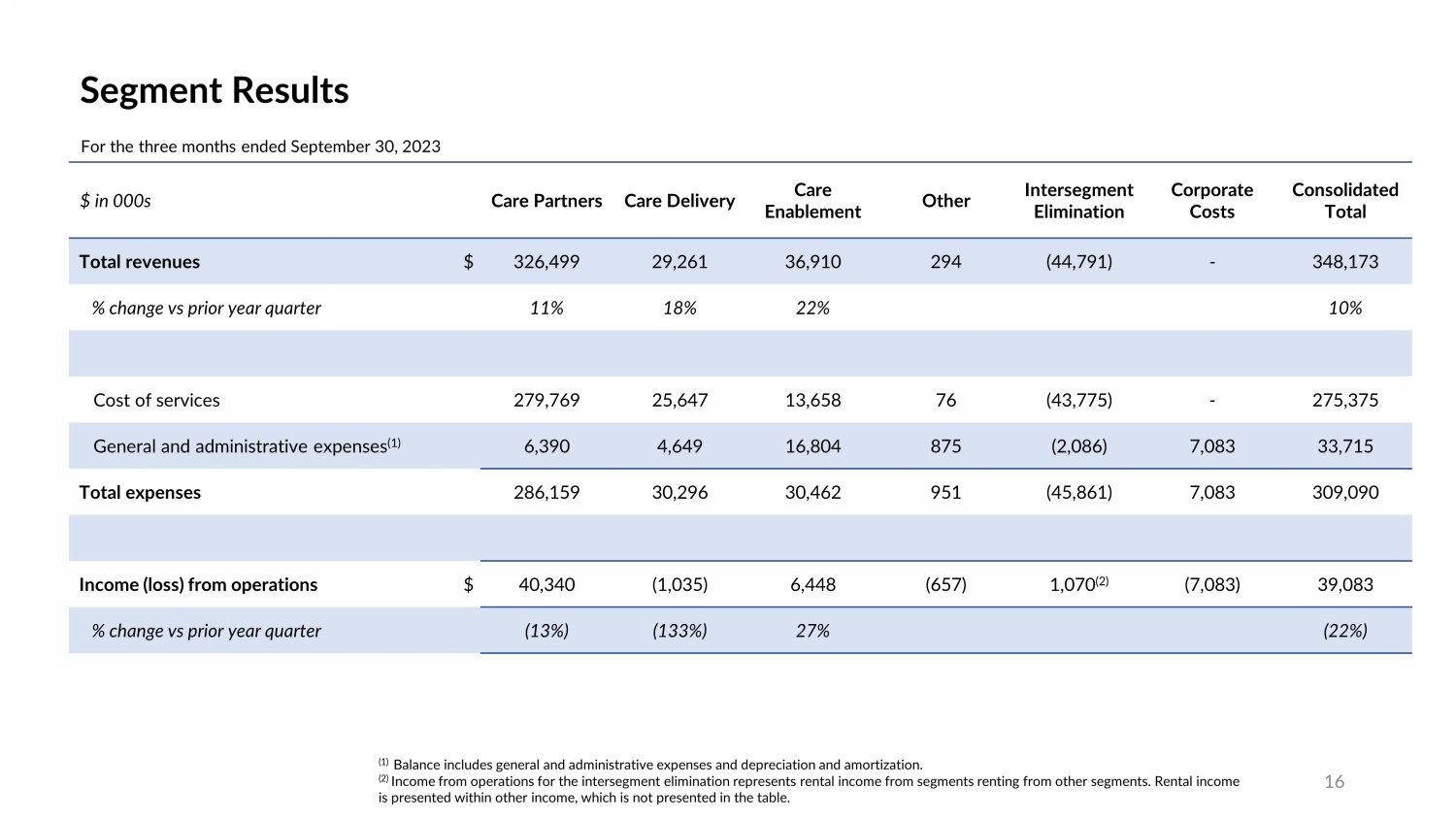

Segment Results 16 $ in 000s Care Partners Care Delivery Care Enablement Other Intersegment Elimination Corporate Costs Consolidated Total Total revenues $ 326,499 29,261 36,910 294 (44,791) - 348,173 % change vs prior year quarter 11% 18% 22% 10% Cost of services 279,769 25,647 13,658 76 (43,775) - 275,375 General and administrative expenses (1) 6,390 4,649 16,804 875 (2,086 ) 7,083 33,715 Total expenses 286,159 30,296 30,462 951 (45,861) 7,083 309,090 Income (loss) from operations $ 40,340 (1,035) 6,448 (657) 1,070 (2) (7,083) 39,083 % change vs prior year quarter (13%) (133%) 27% (22%) For the three months ended September 30, 2023 (1) Balance includes general and administrative expenses and depreciation and amortization . (2) Income from operations for the intersegment elimination represents rental income from segments renting from other segments. R ent al income is presented within other income, which is not presented in the table.

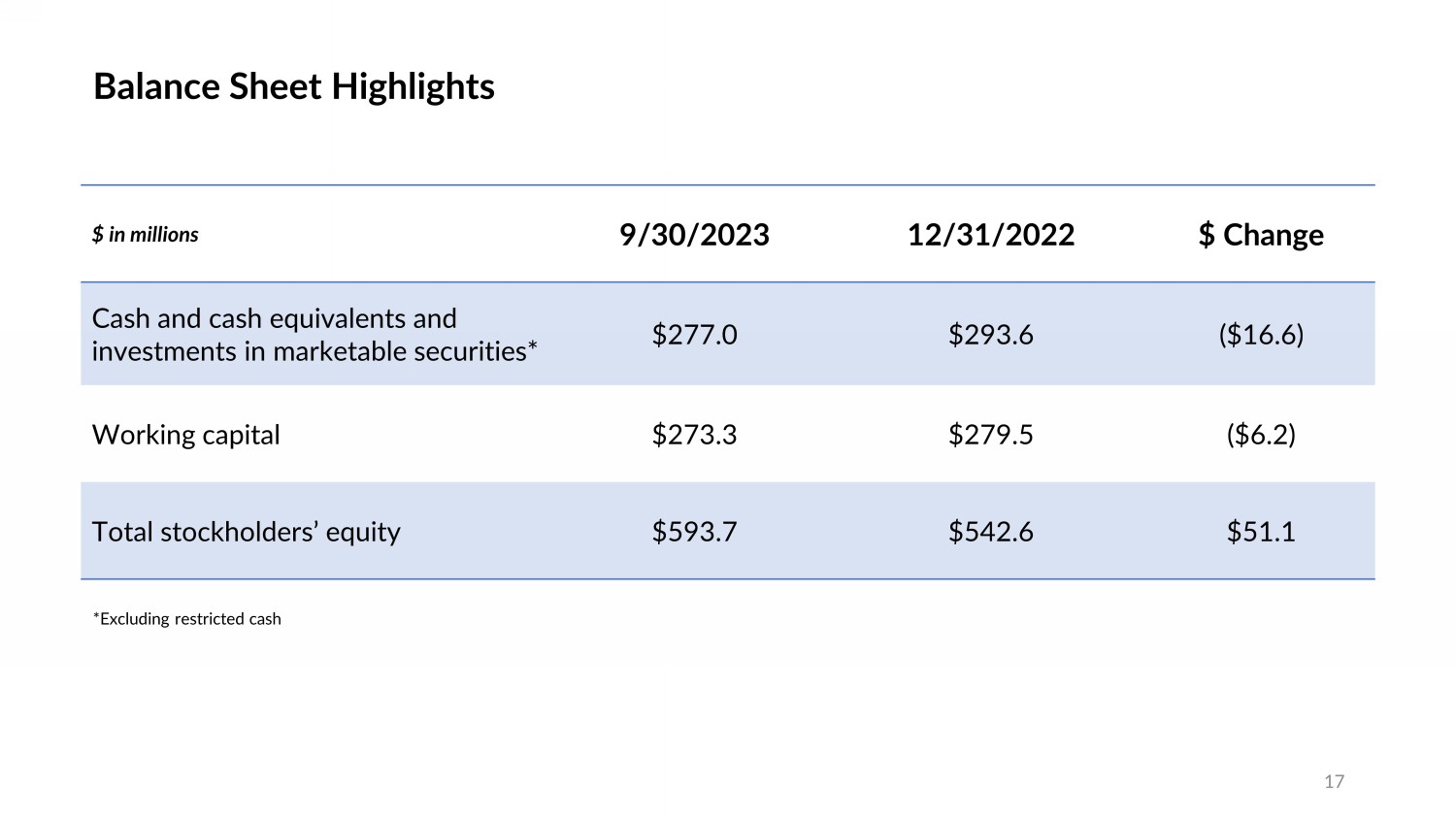

Balance Sheet Highlights 17 $ in millions 9/30/2023 12/31/2022 $ Change Cash and cash equivalents and investments in marketable securities* $277.0 $293.6 ($16.6) Working capital $273.3 $279.5 ($6.2) Total stockholders’ equity $593.7 $542.6 $51.1 *Excluding restricted cash

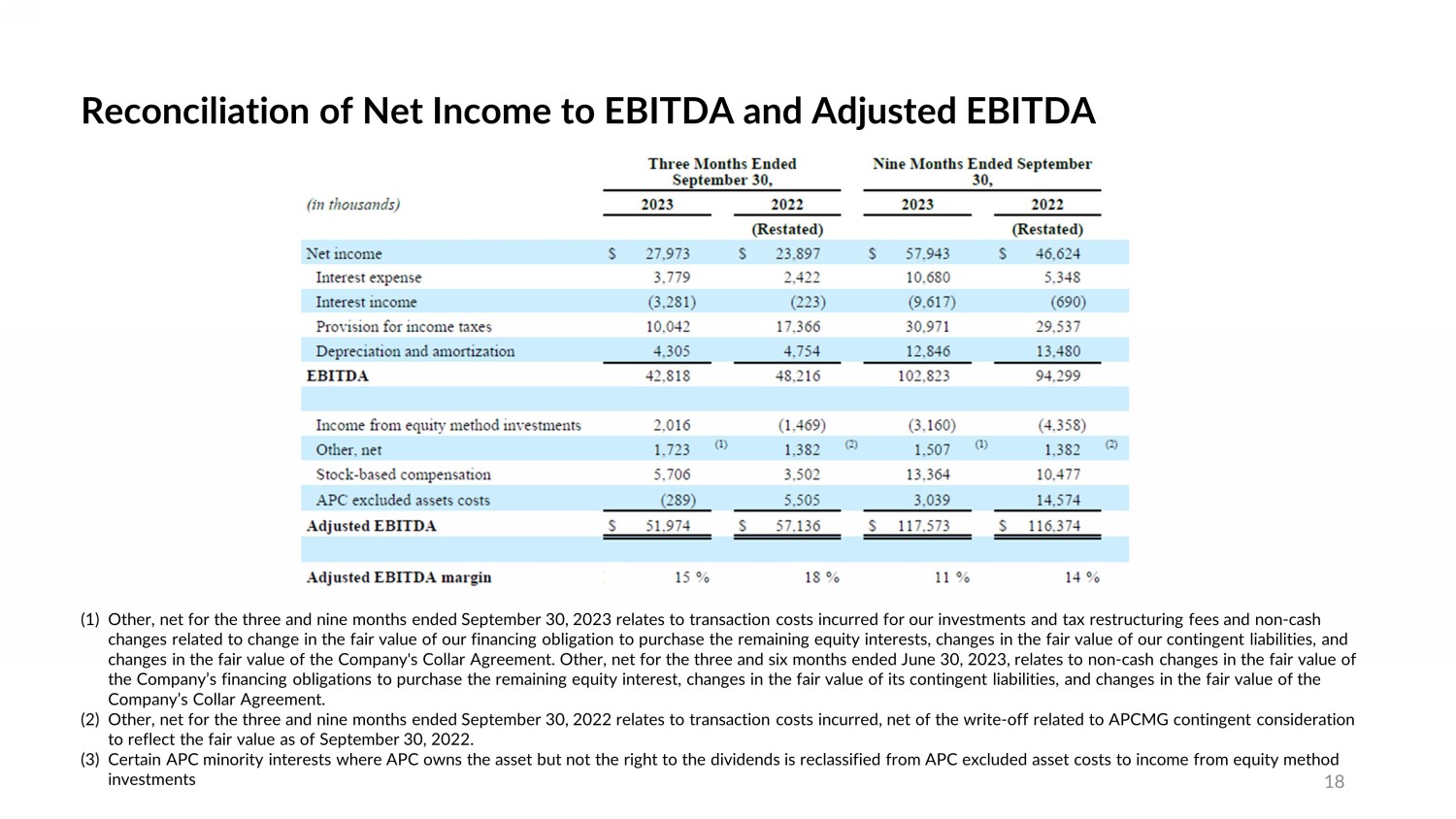

Reconciliation of Net Income to EBITDA and Adjusted EBITDA 18 (1) Other, net for the three and nine months ended September 30, 2023 relates to transaction costs incurred for our investments and tax restructuring fees and non - cash changes related to change in the fair value of our financing obligation to purchase the remaining equity interests, changes i n t he fair value of our contingent liabilities, and changes in the fair value of the Company's Collar Agreement. Other, net for the three and six months ended June 30, 2023, rel ate s to non - cash changes in the fair value of the Company’s financing obligations to purchase the remaining equity interest, changes in the fair value of its contingent li abi lities, and changes in the fair value of the Company’s Collar Agreement. (2) Other, net for the three and nine months ended September 30, 2022 relates to transaction costs incurred, net of the write - off re lated to APCMG contingent consideration to reflect the fair value as of September 30, 2022. (3) Certain APC minority interests where APC owns the asset but not the right to the dividends is reclassified from APC excluded ass et costs to income from equity method investments

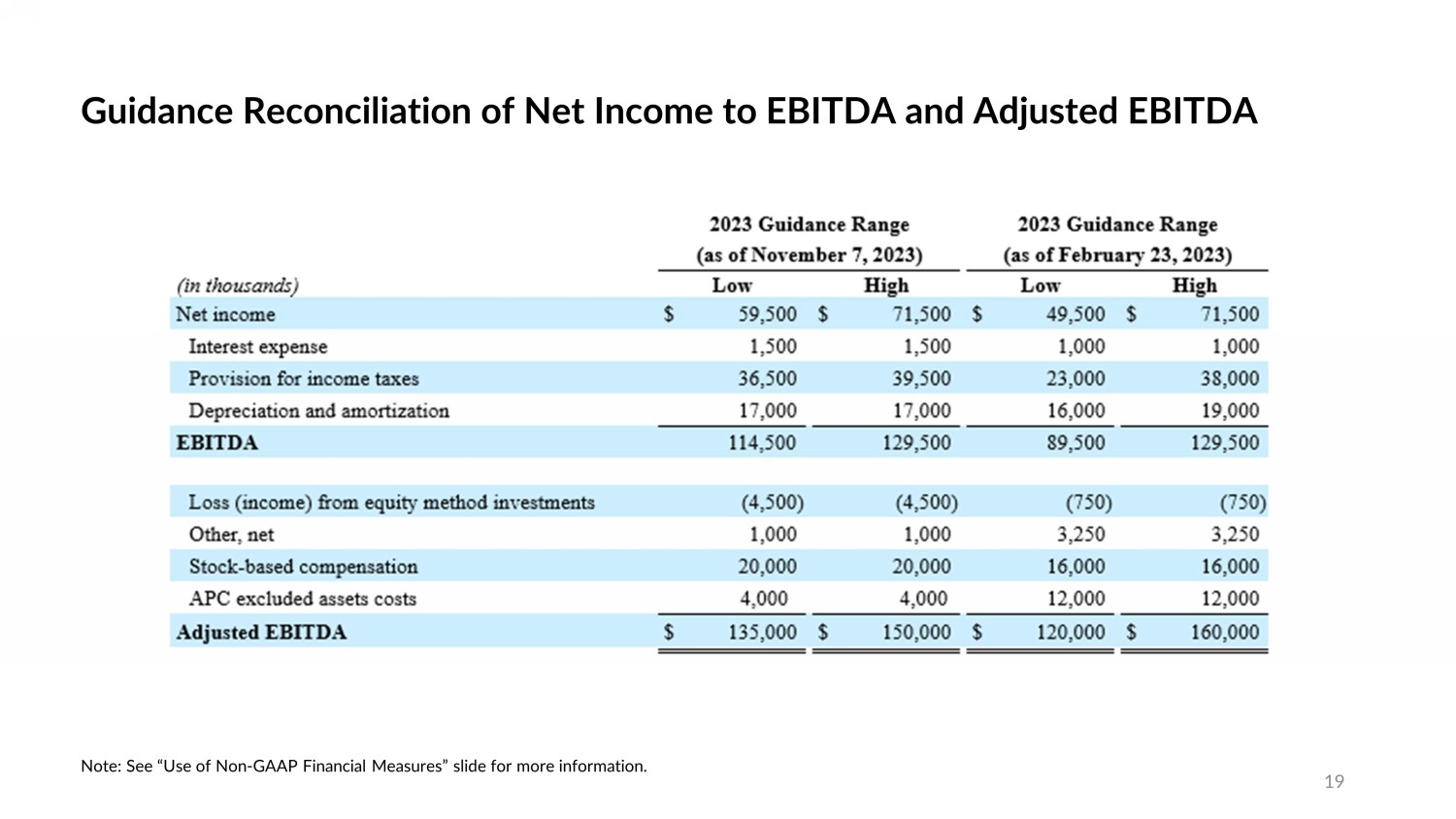

Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA 19 Note: See “Use of Non - GAAP Financial Measures” slide for more information.

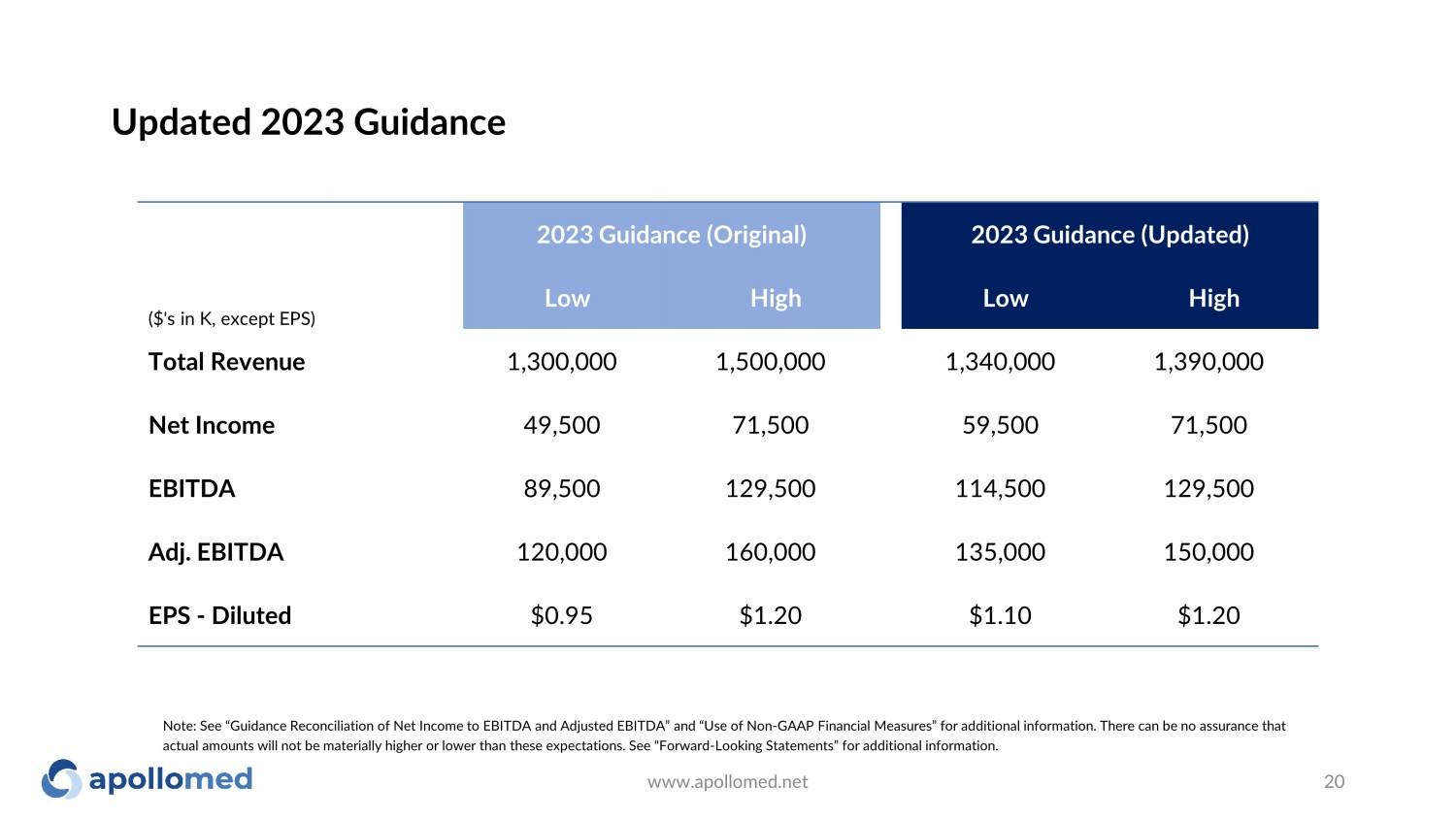

Updated 2023 Guidance www.apollomed.net 20 2023 Guidance (Original) 2023 Guidance (Updated) ($'s in K, except EPS) Low High Low High Total Revenue 1,300,000 1,500,000 1,340,000 1,390,000 Net Income 49,500 71,500 59,500 71,500 EBITDA 89,500 129,500 114,500 129,500 Adj. EBITDA 120,000 160,000 135,000 150,000 EPS - Diluted $0.95 $1.20 $1.10 $1.20 Note: See “Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA” and “Use of Non - GAAP Financial Measures” for add itional information. There can be no assurance that actual amounts will not be materially higher or lower than these expectations. See “Forward - Looking Statements” for additional i nformation.

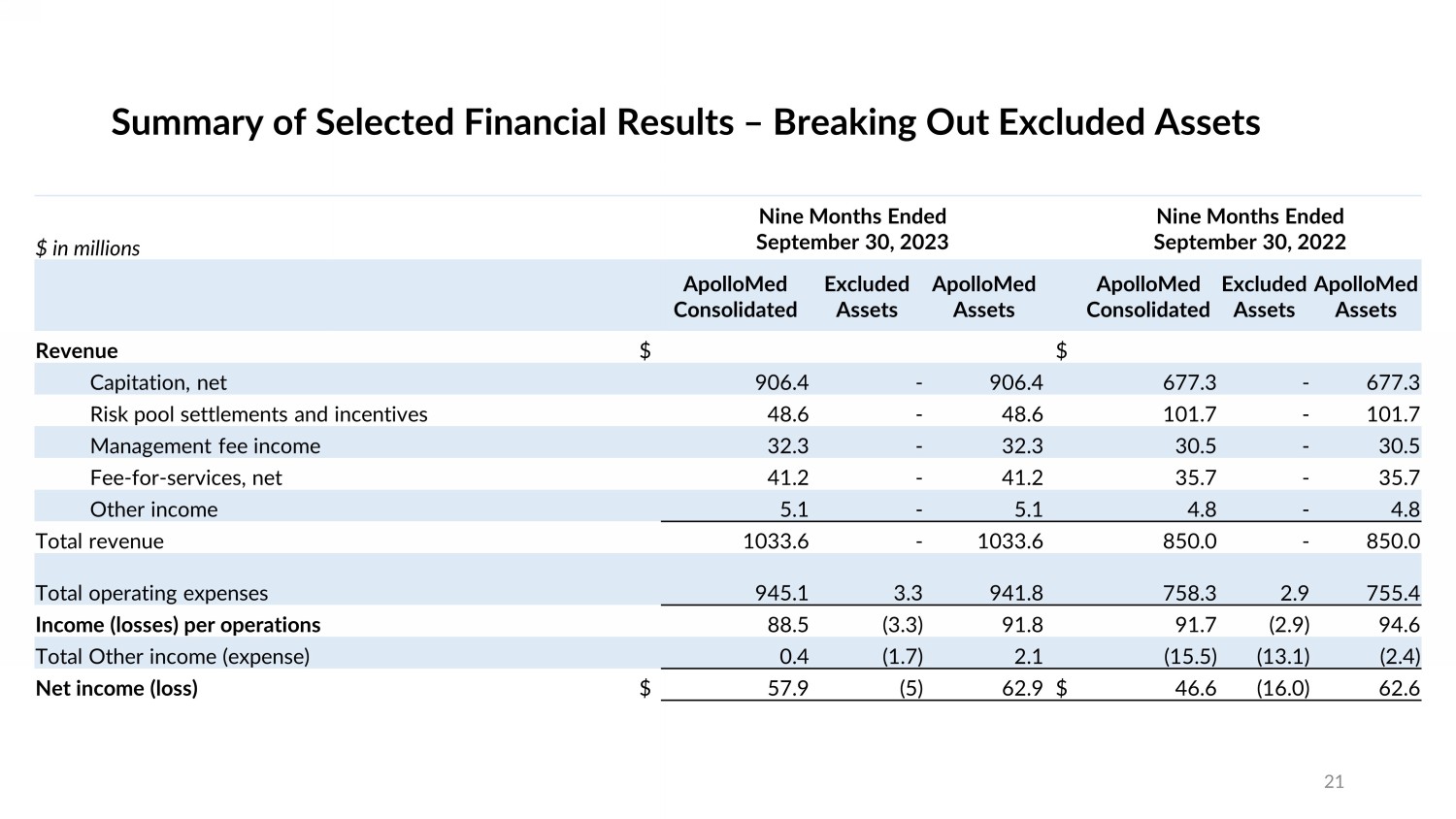

21 Summary of Selected Financial Results – Breaking Out Excluded Assets $ in millions Nine Months Ended September 30, 2023 Nine Months Ended September 30, 2022 ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Revenue $ $ Capitation, net 906.4 - 906.4 677.3 - 677.3 Risk pool settlements and incentives 48.6 - 48.6 101.7 - 101.7 Management fee income 32.3 - 32.3 30.5 - 30.5 Fee - for - services, net 41.2 - 41.2 35.7 - 35.7 Other income 5.1 - 5.1 4.8 - 4.8 Total revenue 1033.6 - 1033.6 850.0 - 850.0 Total operating expenses 945.1 3.3 941.8 758.3 2.9 755.4 Income (losses) per operations 88.5 (3.3) 91.8 91.7 (2.9) 94.6 Total Other income (expense) 0.4 (1.7) 2.1 (15.5) (13.1) (2.4) Net income (loss) $ 57.9 (5) 62.9 $ 46.6 (16.0) 62.6

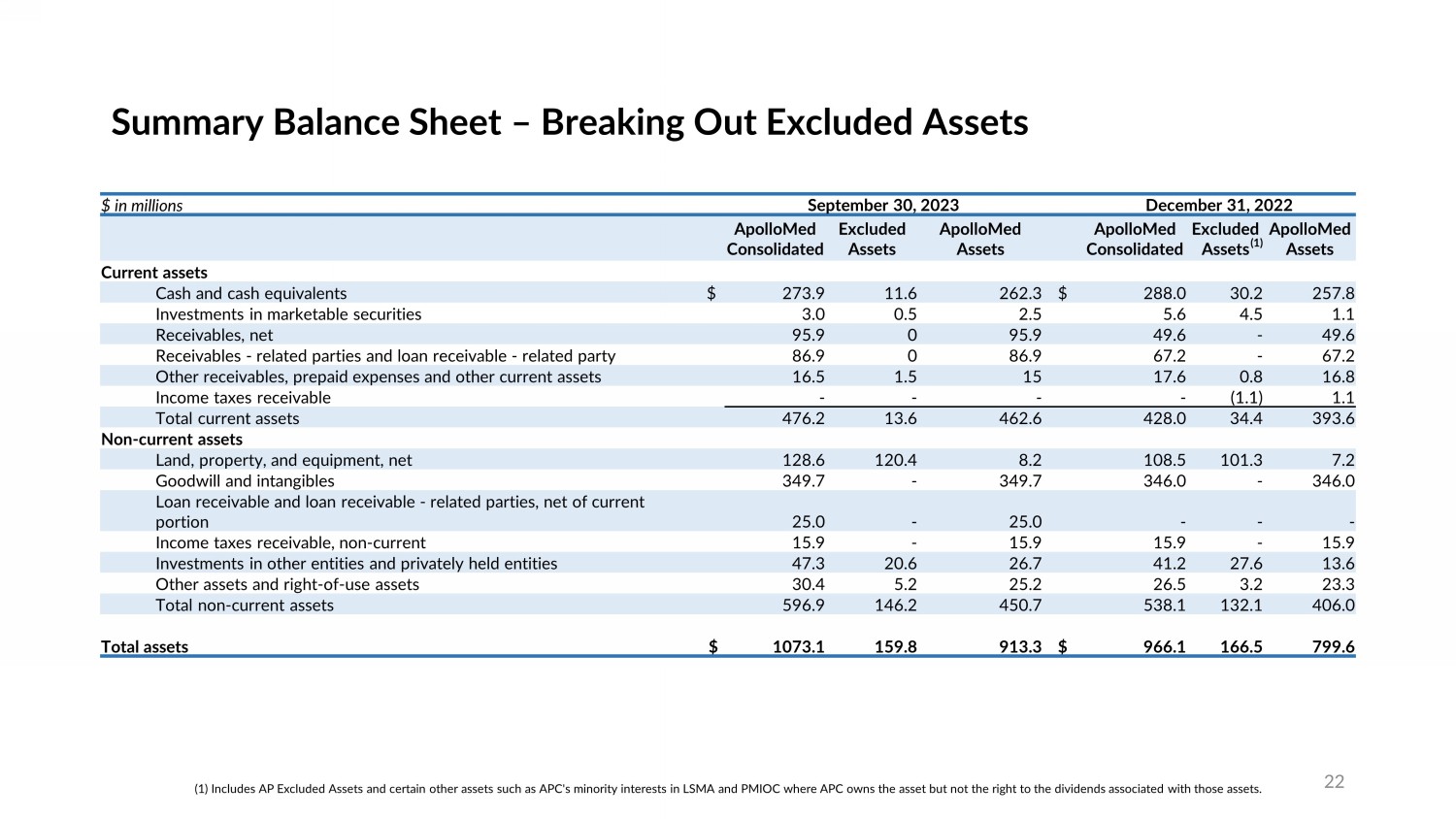

$ in millions September 30, 2023 December 31, 2022 ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Current assets Cash and cash equivalents $ 273.9 11.6 262.3 $ 288.0 30.2 257.8 Investments in marketable securities 3.0 0.5 2.5 5.6 4.5 1.1 Receivables, net 95.9 0 95.9 49.6 - 49.6 Receivables - related parties and loan receivable - related party 86.9 0 86.9 67.2 - 67.2 Other receivables, prepaid expenses and other current assets 16.5 1.5 15 17.6 0.8 16.8 Income taxes receivable - - - - (1.1) 1.1 Total current assets 476.2 13.6 462.6 428.0 34.4 393.6 Non - current assets Land, property, and equipment, net 128.6 120.4 8.2 108.5 101.3 7.2 Goodwill and intangibles 349.7 - 349.7 346.0 - 346.0 Loan receivable and loan receivable - related parties, net of current portion 25.0 - 25.0 - - - Income taxes receivable, non - current 15.9 - 15.9 15.9 - 15.9 Investments in other entities and privately held entities 47.3 20.6 26.7 41.2 27.6 13.6 Other assets and right - of - use assets 30.4 5.2 25.2 26.5 3.2 23.3 Total non - current assets 596.9 146.2 450.7 538.1 132.1 406.0 Total assets $ 1073.1 159.8 913.3 $ 966.1 166.5 799.6 22 Summary Balance Sheet – Breaking Out Excluded Assets (1) Includes AP Excluded Assets and certain other assets such as APC's minority interests in LSMA and PMIOC where APC owns th e a sset but not the right to the dividends associated with those assets. (1)

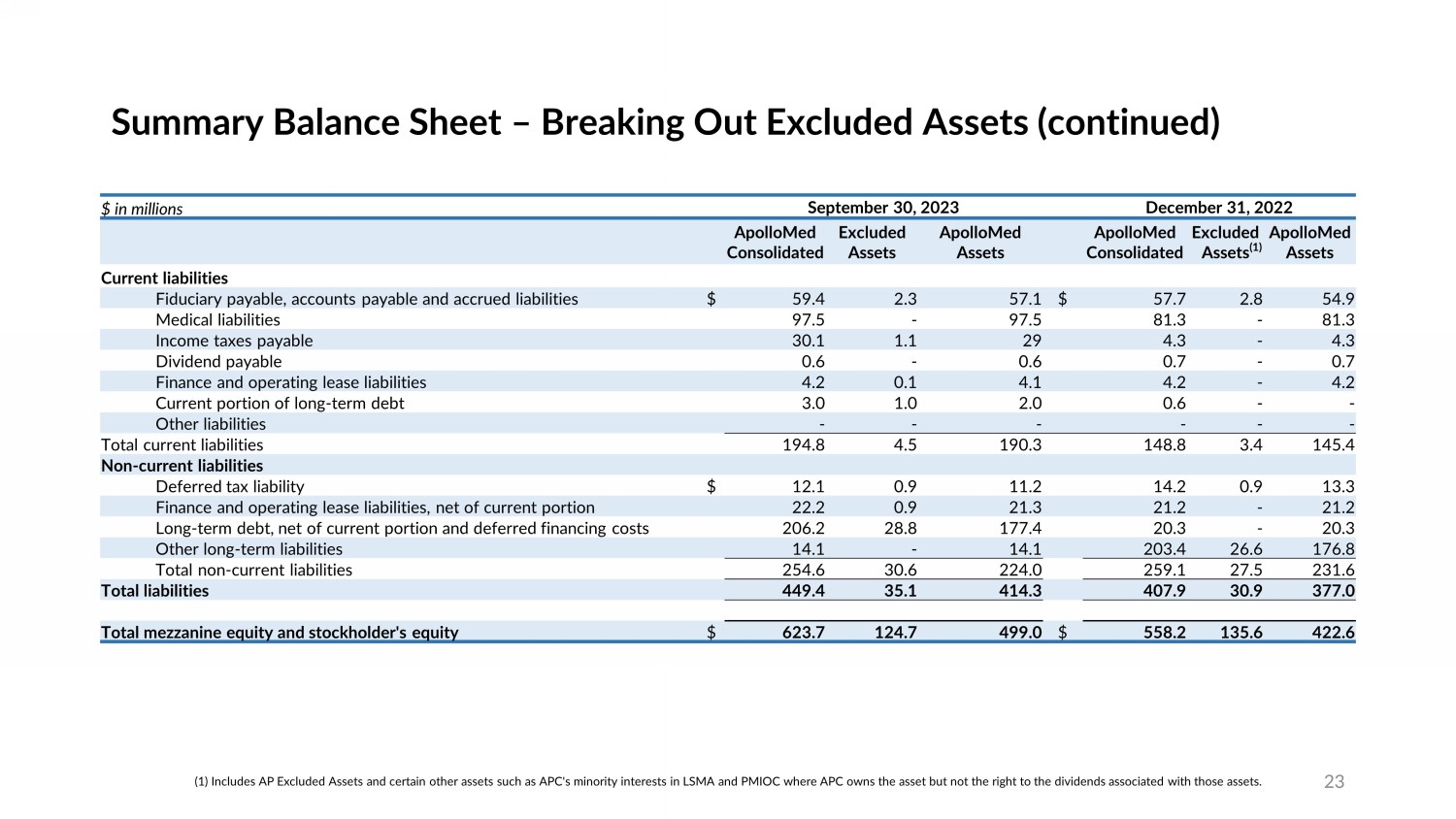

$ in millions September 30, 2023 December 31, 2022 ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Current liabilities Fiduciary payable, accounts payable and accrued liabilities $ 59.4 2.3 57.1 $ 57.7 2.8 54.9 Medical liabilities 97.5 - 97.5 81.3 - 81.3 Income taxes payable 30.1 1.1 29 4.3 - 4.3 Dividend payable 0.6 - 0.6 0.7 - 0.7 Finance and operating lease liabilities 4.2 0.1 4.1 4.2 - 4.2 Current portion of long - term debt 3.0 1.0 2.0 0.6 - - Other liabilities - - - - - - Total current liabilities 194.8 4.5 190.3 148.8 3.4 145.4 Non - current liabilities Deferred tax liability $ 12.1 0.9 11.2 14.2 0.9 13.3 Finance and operating lease liabilities, net of current portion 22.2 0.9 21.3 21.2 - 21.2 Long - term debt, net of current portion and deferred financing costs 206.2 28.8 177.4 20.3 - 20.3 Other long - term liabilities 14.1 - 14.1 203.4 26.6 176.8 Total non - current liabilities 254.6 30.6 224.0 259.1 27.5 231.6 Total liabilities 449.4 35.1 414.3 407.9 30.9 377.0 Total mezzanine equity and stockholder's equity $ 623.7 124.7 499.0 $ 558.2 135.6 422.6 23 Summary Balance Sheet – Breaking Out Excluded Assets (continued) (1) Includes AP Excluded Assets and certain other assets such as APC's minority interests in LSMA and PMIOC where APC owns th e a sset but not the right to the dividends associated with those assets. (1)

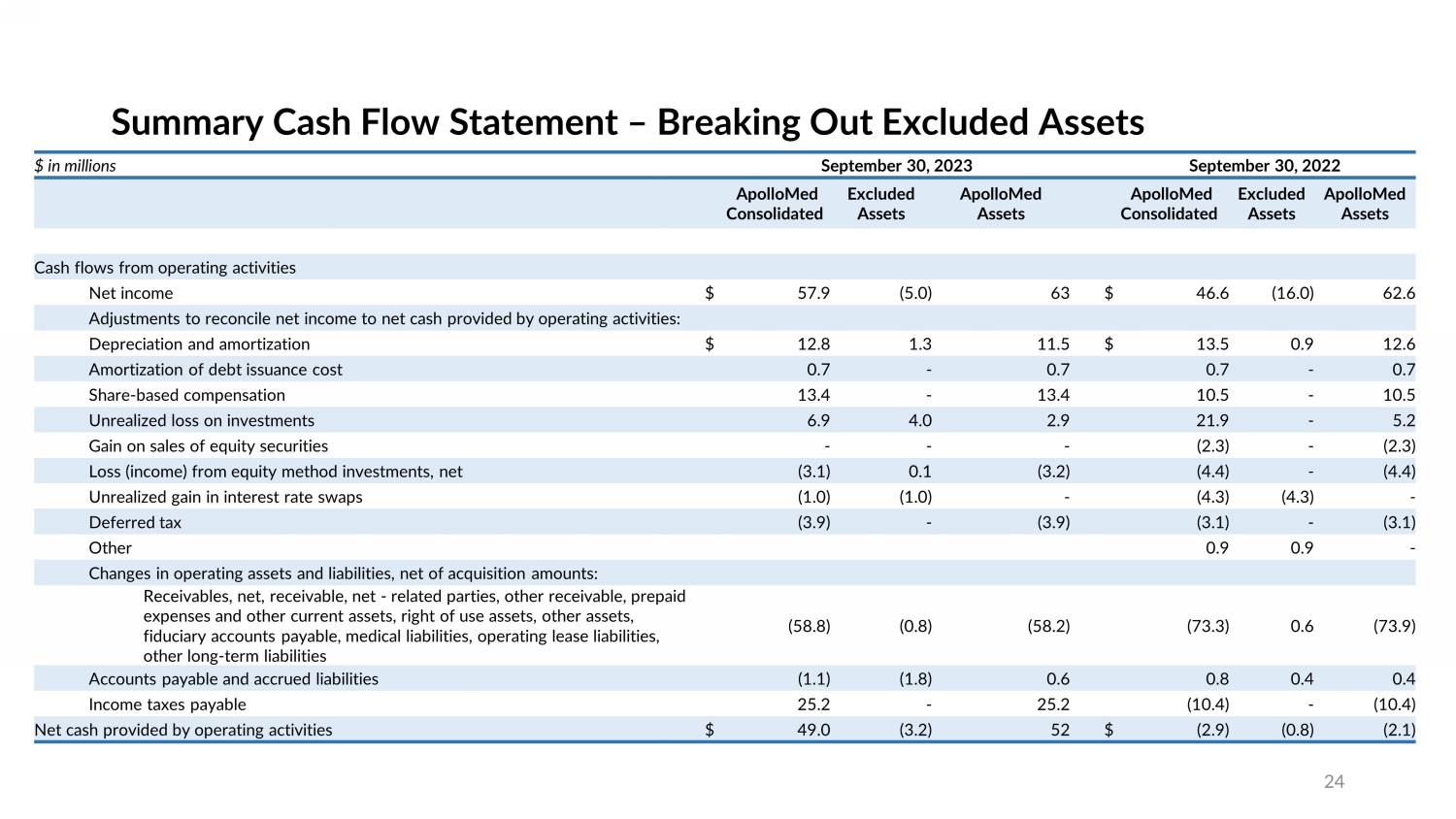

$ in millions September 30, 2023 September 30, 2022 ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Cash flows from operating activities Net income $ 57.9 (5.0) 63 $ 46.6 (16.0) 62.6 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization $ 12.8 1.3 11.5 $ 13.5 0.9 12.6 Amortization of debt issuance cost 0.7 - 0.7 0.7 - 0.7 Share - based compensation 13.4 - 13.4 10.5 - 10.5 Unrealized loss on investments 6.9 4.0 2.9 21.9 - 5.2 Gain on sales of equity securities - - - (2.3) - (2.3) Loss (income) from equity method investments, net (3.1) 0.1 (3.2) (4.4) - (4.4) Unrealized gain in interest rate swaps (1.0) (1.0) - (4.3) (4.3) - Deferred tax (3.9) - (3.9) (3.1) - (3.1) Other 0.9 0.9 - Changes in operating assets and liabilities, net of acquisition amounts: Receivables, net, receivable, net - related parties, other receivable, prepaid expenses and other current assets, right of use assets, other assets, fiduciary accounts payable, medical liabilities, operating lease liabilities, other long - term liabilities (58.8) (0.8) (58.2) (73.3) 0.6 (73.9) Accounts payable and accrued liabilities (1.1) (1.8) 0.6 0.8 0.4 0.4 Income taxes payable 25.2 - 25.2 (10.4) - (10.4) Net cash provided by operating activities $ 49.0 (3.2) 52 $ (2.9) (0.8) (2.1) Summary Cash Flow Statement – Breaking Out Excluded Assets 24

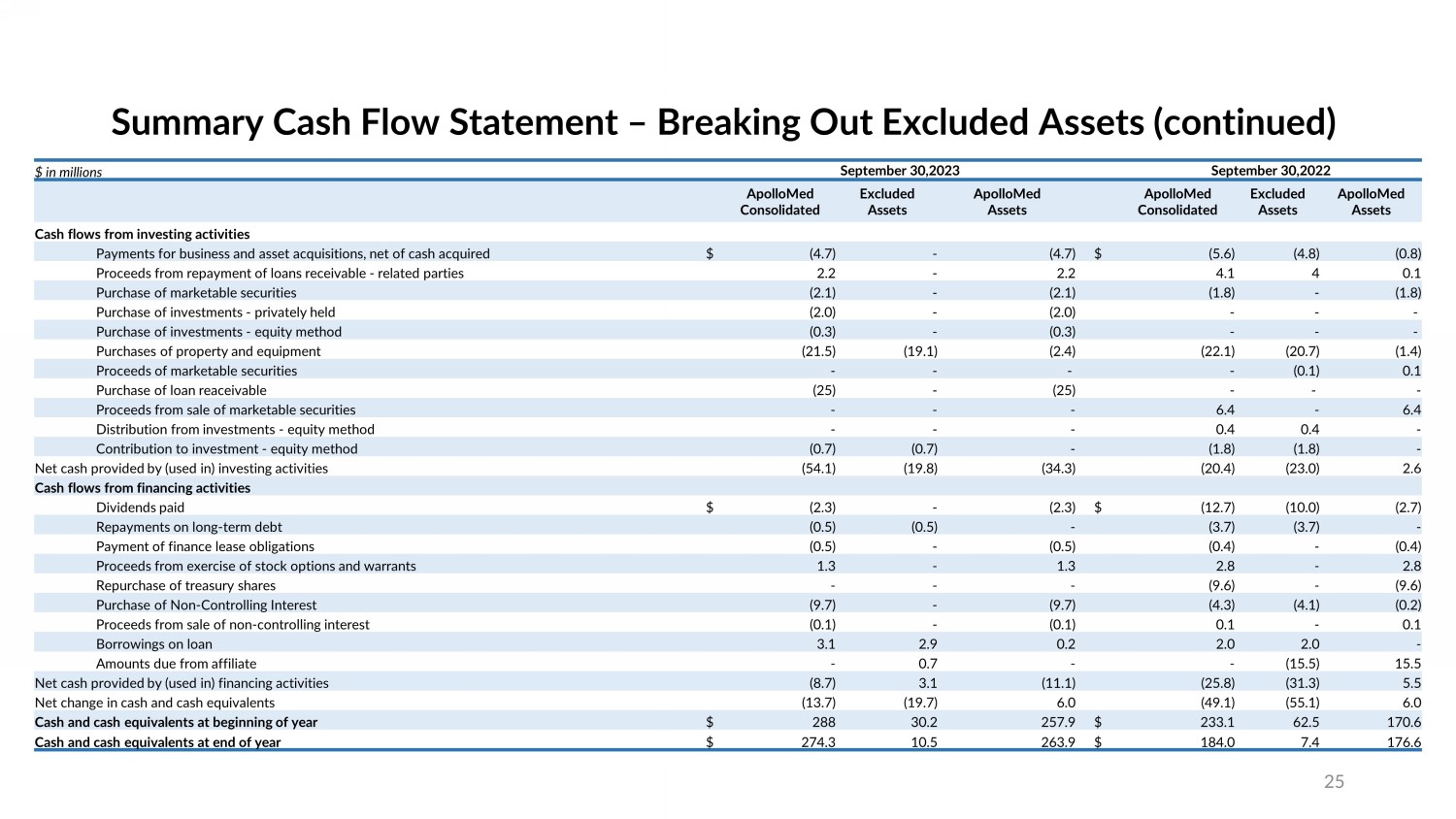

$ in millions September 30,2023 September 30,2022 ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Cash flows from investing activities Payments for business and asset acquisitions, net of cash acquired $ (4.7) - (4.7) $ (5.6) (4.8) (0.8) Proceeds from repayment of loans receivable - related parties 2.2 - 2.2 4.1 4 0.1 Purchase of marketable securities (2.1) - (2.1) (1.8) - (1.8) Purchase of investments - privately held (2.0) - (2.0) - - - Purchase of investments - equity method (0.3) - (0.3) - - - Purchases of property and equipment (21.5) (19.1) (2.4) (22.1) (20.7) (1.4) Proceeds of marketable securities - - - - (0.1) 0.1 Purchase of loan reaceivable (25) - (25) - - - Proceeds from sale of marketable securities - - - 6.4 - 6.4 Distribution from investments - equity method - - - 0.4 0.4 - Contribution to investment - equity method (0.7) (0.7) - (1.8) (1.8) - Net cash provided by (used in) investing activities (54.1) (19.8) (34.3) (20.4) (23.0) 2.6 Cash flows from financing activities Dividends paid $ (2.3) - (2.3) $ (12.7) (10.0) (2.7) Repayments on long - term debt (0.5) (0.5) - (3.7) (3.7) - Payment of finance lease obligations (0.5) - (0.5) (0.4) - (0.4) Proceeds from exercise of stock options and warrants 1.3 - 1.3 2.8 - 2.8 Repurchase of treasury shares - - - (9.6) - (9.6) Purchase of Non - Controlling Interest (9.7) - (9.7) (4.3) (4.1) (0.2) Proceeds from sale of non - controlling interest (0.1) - (0.1) 0.1 - 0.1 Borrowings on loan 3.1 2.9 0.2 2.0 2.0 - Amounts due from affiliate - 0.7 - - (15.5) 15.5 Net cash provided by (used in) financing activities (8.7) 3.1 (11.1) (25.8) (31.3) 5.5 Net change in cash and cash equivalents (13.7) (19.7) 6.0 (49.1) (55.1) 6.0 Cash and cash equivalents at beginning of year $ 288 30.2 257.9 $ 233.1 62.5 170.6 Cash and cash equivalents at end of year $ 274.3 10.5 263.9 $ 184.0 7.4 176.6 Summary Cash Flow Statement – Breaking Out Excluded Assets (continued) 25

Use of Non - GAAP Financial Measures This presentation contains the non - GAAP financial measures EBITDA and Adjusted EBITDA, of which the most directly comparable fin ancial measure presented in accordance with U.S. generally accepted accounting principles (“GAAP”) is net income. These measures are not in acc ordance with, or alternatives to GAAP, and may be different from other non - GAAP financial measures used by other companies. The Company uses Adju sted EBITDA as a supplemental performance measure of our operations, for financial and operational decision - making, and as a supplemental means o f evaluating period - to - period comparisons on a consistent basis. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation, and am ortization, excluding income or loss from equity method investments, non - recurring transactions, stock - based compensation, and APC excluded assets costs. Beg inning in the third quarter ended September 30, 2022, the Company has revised the calculation for Adjusted EBITDA to exclude provider bonus payme nts and losses from recently acquired IPAs, which it believes to be more reflective of its business. The Company believes the presentation of these non - GAAP financial measures provides investors with relevant and useful informati on, as it allows investors to evaluate the operating performance of the business activities without having to account for differences recogniz ed because of non - core or non - recurring financial information. When GAAP financial measures are viewed in conjunction with non - GAAP financial measures, in vestors are provided with a more meaningful understanding of the Company’s ongoing operating performance. In addition, these non - GAAP financial measu res are among those indicators the Company uses as a basis for evaluating operational performance, allocating resources, and planning and forecas tin g future periods. Non - GAAP financial measures are not intended to be considered in isolation, or as a substitute for, GAAP financial measures. Othe r c ompanies may calculate both EBITDA and Adjusted EBITDA differently, limiting the usefulness of these measures for comparative purposes. To the exten t t his release contains historical or future non - GAAP financial measures, the Company has provided corresponding GAAP financial measures for comparative purposes. The reconciliation between certain GAAP and non - GAAP measures is provided above. 26

For inquiries, please contact: ApolloMed Investor Relations Asher Dewhurst (626) 943 - 6491 investors@apollomed.net