EXHIBIT 99.2

Published on March 14, 2025

|

March 2025 Fourth Quarter & Full Year 2024 Earnings Supplement |

|

2 Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements include any statements about the Company's business, financial condition, operating results, plans, objectives, expectations and intentions, expansion plans, estimates of our total addressable market, our ability to successfully complete and realize the benefits of anticipated acquisitions, integration of acquired companies and any projections of earnings, revenue, EBITDA, Adjusted EBITDA or other financial items, such as the Company's projected capitation and future liquidity, and may be identified by the use of forward-looking terms such as “anticipate,” “could,” “can,” “may,” “might,” “potential,” “predict,” “should,” “estimate,” “expect,” “project,” “believe,” “plan,” “envision,” “intend,” “continue,” “target,” “seek,” “will,” “would,” and the negative of such terms, other variations on such terms or other similar or comparable words, phrases or terminology. Forward-looking statements reflect current views with respect to future events and financial performance and therefore cannot be guaranteed. Such statements are based on the current expectations and certain assumptions of the Company’s management, and some or all of such expectations and assumptions may not materialize or may vary significantly from actual results. Actual results may also vary materially from forward-looking statements due to risks, uncertainties and other factors, known and unknown, including the risk factors described from time to time in the Company’s reports to the U.S. Securities and Exchange Commission (the “SEC”), including without limitation the risk factors discussed in the Company’s last Annual Report on Form 10-K and any subsequent quarterly reports on Form 10-Q filed with the SEC. Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed or implied in any forward-looking statements, you should not place undue reliance on any such forward-looking statements. Any forward-looking statements speak only as of the date of this presentation and, unless legally required, the Company does not undertake any obligation to update any forward-looking statement, as a result of new information, future events or otherwise. This presentation may contain statistics and other data that in some cases has been obtained from or compiled from information made available by third-party service providers. The Company makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of such information. Use of Non-GAAP Financial Measures This presentation contains the non-GAAP financial measures EBITDA and Adjusted EBITDA, of which the most directly comparable financial measure presented in accordance with U.S. generally accepted accounting principles (“GAAP”) is net income. These measures are not in accordance with, or alternatives to, GAAP, and may be calculated differently from similar non-GAAP financial measures used by other companies. The Company uses Adjusted EBITDA as a supplemental performance measure of our operations, for financial and operational decision-making, and as a supplemental means of evaluating period-to-period comparisons on a consistent basis. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation, and amortization, excluding income or loss from equity method investments, non-recurring and non-cash transactions, stock-based compensation, and APC excluded assets costs. Beginning in the third quarter ended September 30, 2022, the Company has revised the calculation for Adjusted EBITDA to exclude provider bonus payments and losses from recently acquired IPAs, which it believes to be more reflective of its business. The Company believes the presentation of these non-GAAP financial measures provides investors with relevant and useful information, as it allows investors to evaluate the operating performance of the business activities without having to account for differences recognized because of non-core or non-recurring financial information. When GAAP financial measures are viewed in conjunction with non-GAAP financial measures, investors are provided with a more meaningful understanding of the Company’s ongoing operating performance. In addition, these non-GAAP financial measures are among those indicators the Company uses as a basis for evaluating operational performance, allocating resources, and planning and forecasting future periods. Non-GAAP financial measures are not intended to be considered in isolation, or as a substitute for, GAAP financial measures. Other companies may calculate both EBITDA and Adjusted EBITDA differently, limiting the usefulness of these measures for comparative purposes. To the extent this Presentation contains historical or future non-GAAP financial measures, the Company has provided corresponding GAAP financial measures for comparative purposes. The reconciliation between certain GAAP and non-GAAP measures is provided in the Appendix. The Company has not provided a quantitative reconciliation of applicable non-GAAP measures, such as the projected adjusted EBITDA and adjusted EBITDA margin in 2024 and in future years for planned acquisitions, to the most comparable GAAP measure, such as net income, on a forward-looking basis within this presentation because the Company is unable, without unreasonable efforts, to provide reconciling information with respect to certain line items that cannot be calculated. These items, which could materially affect the computation of forward-looking GAAP net income, are inherently uncertain and depend on various factors, some of which are outside of the Company’s control. |

|

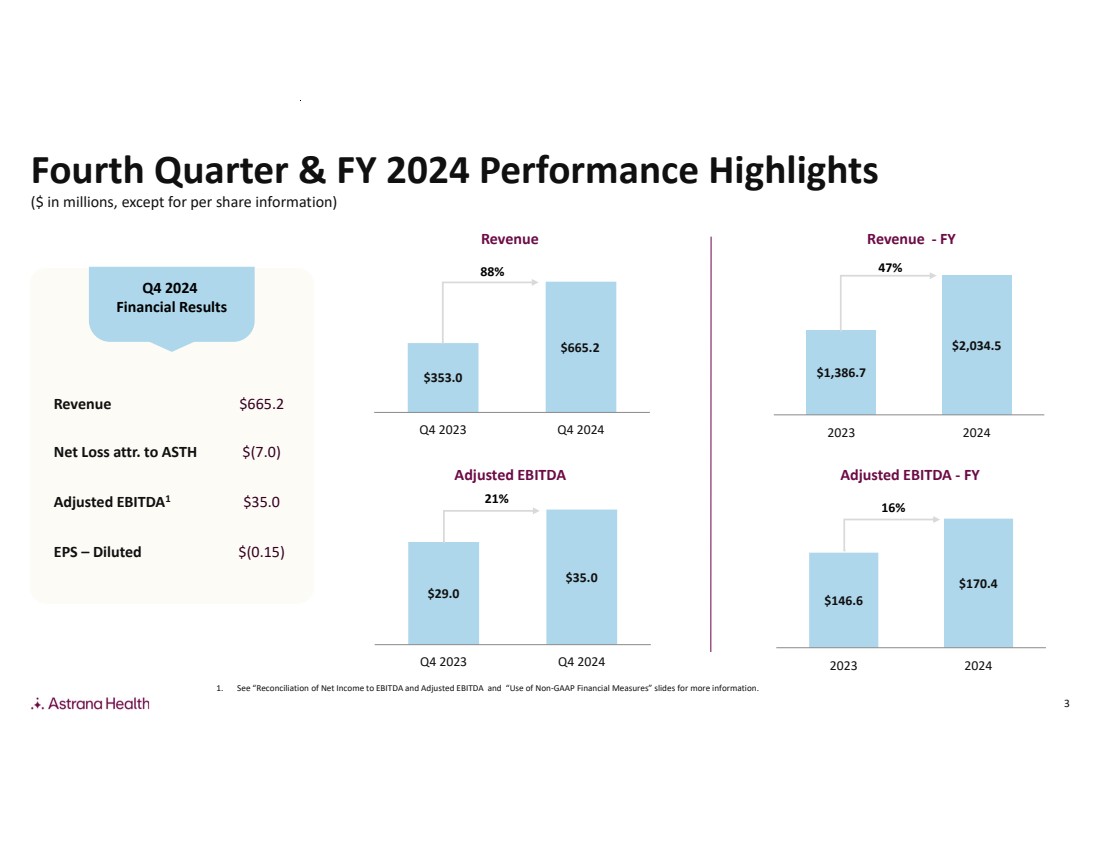

3 $353.0 $665.2 Q4 2023 Q4 2024 $1,386.7 $2,034.5 2023 2024 $29.0 $35.0 Q4 2023 Q4 2024 Q4 2024 Financial Results Revenue $665.2 Net Loss attr. to ASTH $(7.0) Adjusted EBITDA $35.0 1 EPS – Diluted $(0.15) 1. See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA and “Use of Non-GAAP Financial Measures” slides for more information. Revenue Adjusted EBITDA 88% 21% Fourth Quarter & FY 2024 Performance Highlights ($ in millions, except for per share information) $146.6 $170.4 2023 2024 Adjusted EBITDA - FY 16% Revenue - FY 47% |

|

4 Growth FY 2024 Highlights and Recent Updates Risk Progression Increasing alignment through total cost of care responsibility in value-based arrangements 73% of total capitation revenue came from full risk by the end of 2024 33% of Care Partners members in full risk arrangements Outcomes and Cost Achieving superior patient outcomes while managing cost Approx. three quarters of our senior members received an annual wellness visit YoY improvement in gap closure rates and STAR ratings across key quality metrics including blood pressure control and hemoglobin A1C 5.3% blended utilization trend across all lines of business Operating Leverage Driving operating leverage across our business through our Care Enablement suite Began a Care Enablement partnership with Provider HealthLink, a provider network in Georgia serving approximately 10,000 Medicare Advantage members; onboarding expected to be complete in first half of 2025 Continuing investments made in automation and AI expected to yield at least $10 million in annual operating efficiencies by early 2026 Growth Sustainably growing membership to bring better care to more Americans 55% membership growth in our Care Partners segment Organically entered new markets in central California, Arizona, and Hawaii Closed Collaborative Health Systems acquisition; integration to be substantially completed by April 2025 Announced intended Prospect Health acquisition; pro-forma footprint spans 13 states |

|

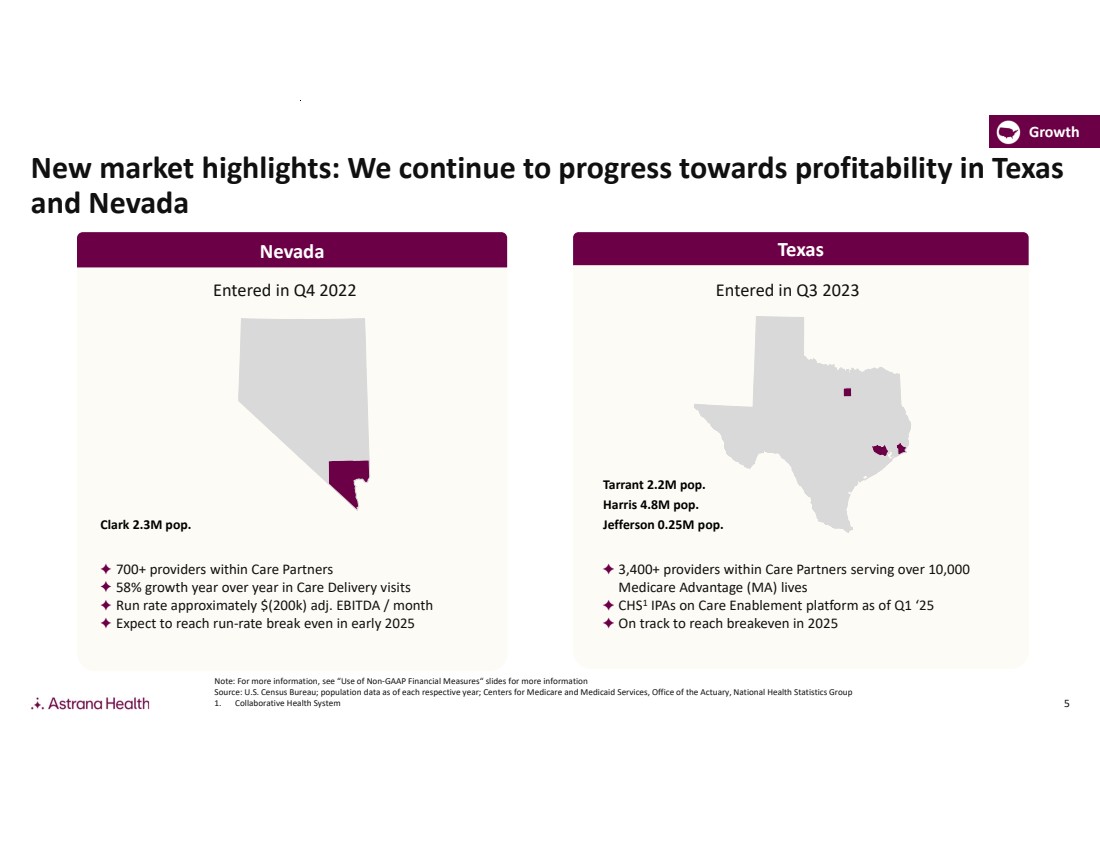

5 Note: For more information, see “Use of Non-GAAP Financial Measures“ slides for more information Source: U.S. Census Bureau; population data as of each respective year; Centers for Medicare and Medicaid Services, Office of the Actuary, National Health Statistics Group 1. Collaborative Health System Growth New market highlights: We continue to progress towards profitability in Texas and Nevada Nevada Texas 700+ providers within Care Partners 58% growth year over year in Care Delivery visits Run rate approximately $(200k) adj. EBITDA / month Expect to reach run-rate break even in early 2025 Clark 2.3M pop. 3,400+ providers within Care Partners serving over 10,000 Medicare Advantage (MA) lives CHS1 IPAs on Care Enablement platform as of Q1 ‘25 On track to reach breakeven in 2025 Tarrant 2.2M pop. Harris 4.8M pop. Jefferson 0.25M pop. Entered in Q4 2022 Entered in Q3 2023 |

|

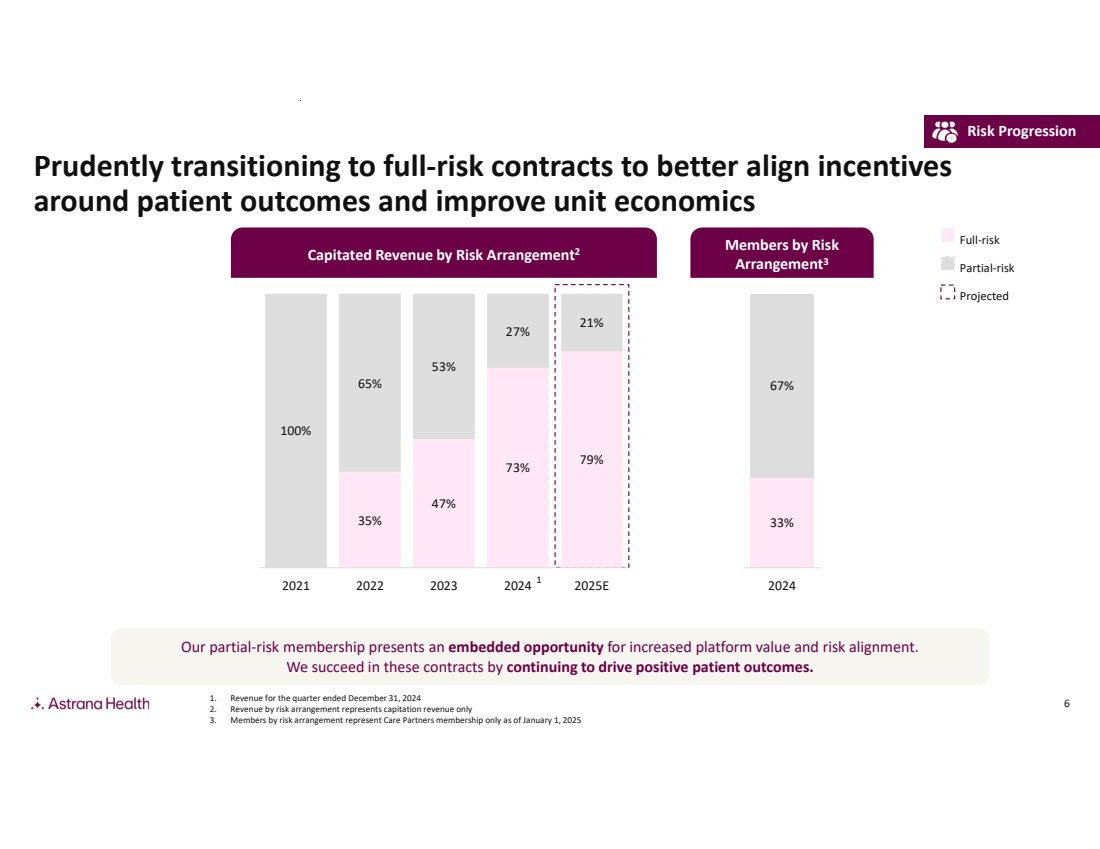

6 Prudently transitioning to full-risk contracts to better align incentives around patient outcomes and improve unit economics Projected Full-risk Partial-risk 1. Revenue for the quarter ended December 31, 2024 2. Revenue by risk arrangement represents capitation revenue only 3. Members by risk arrangement represent Care Partners membership only as of January 1, 2025 Members by Risk Arrangement3 35% 47% 73% 79% 100% 65% 53% 27% 21% 2021 2022 2023 2024 2025E 33% 67% 2024 Capitated Revenue by Risk Arrangement2 Our partial-risk membership presents an embedded opportunity for increased platform value and risk alignment. We succeed in these contracts by continuing to drive positive patient outcomes. Risk Progression 1 |

|

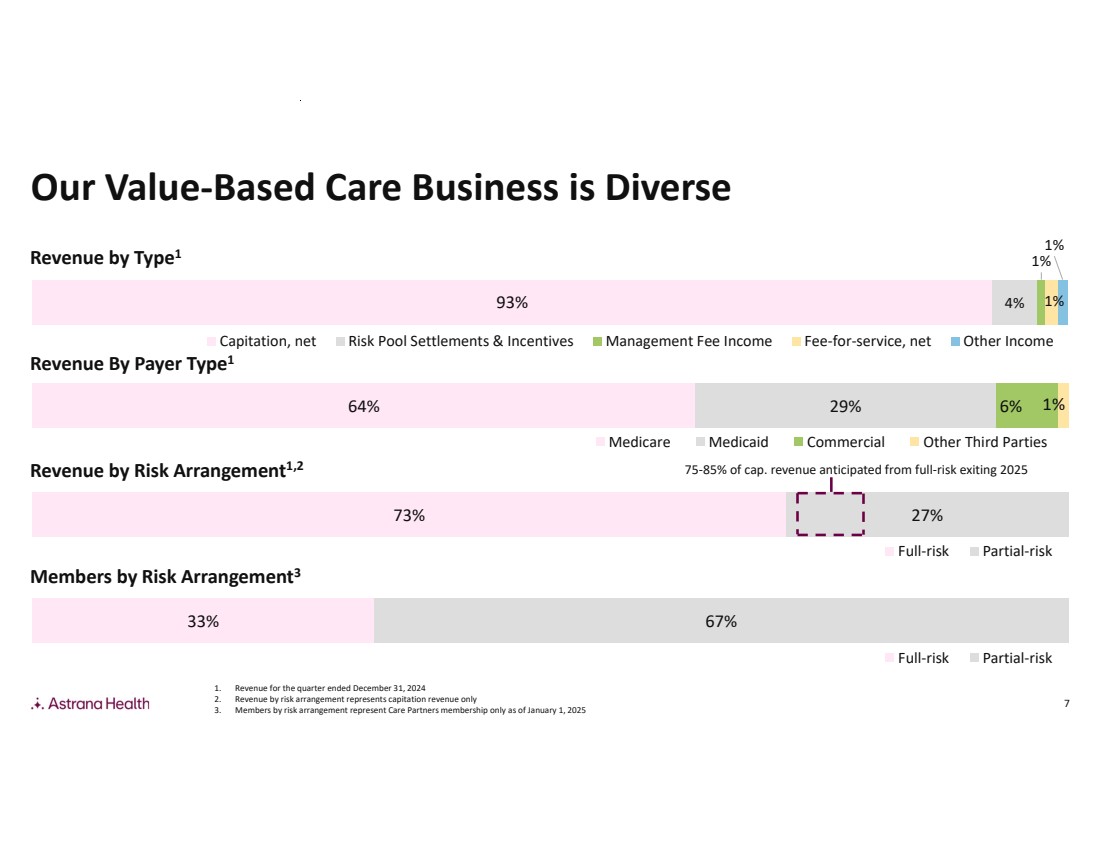

7 93% 4% 1% 1% 1% Capitation, net Risk Pool Settlements & Incentives Management Fee Income Fee-for-service, net Other Income Revenue by Type1 1. Revenue for the quarter ended December 31, 2024 2. Revenue by risk arrangement represents capitation revenue only 3. Members by risk arrangement represent Care Partners membership only as of January 1, 2025 64% 29% 6% 1% Medicare Medicaid Commercial Other Third Parties Revenue By Payer Type1 73% 27% Full-risk Partial-risk Revenue by Risk Arrangement1,2 33% 67% Full-risk Partial-risk Members by Risk Arrangement3 75-85% of cap. revenue anticipated from full-risk exiting 2025 Our Value-Based Care Business is Diverse |

|

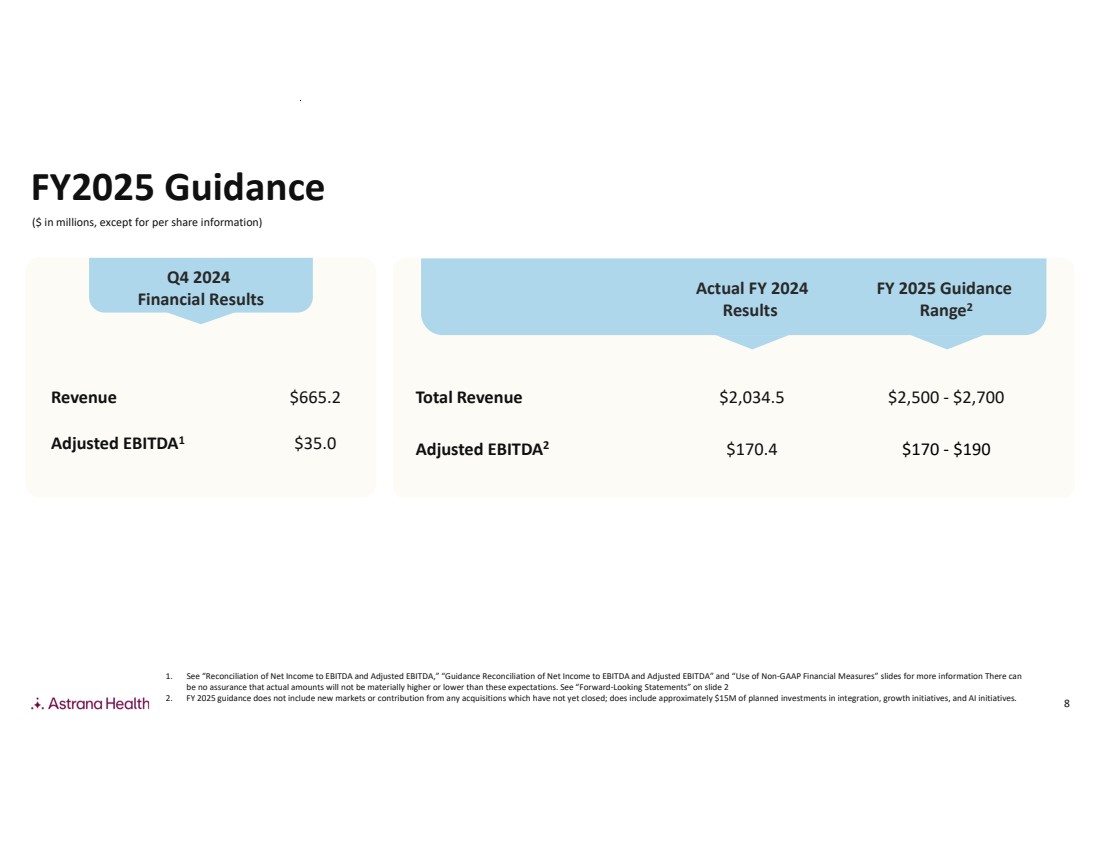

8 Q4 2024 Financial Results 1. See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA,” “Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA” and “Use of Non-GAAP Financial Measures” slides for more information There can be no assurance that actual amounts will not be materially higher or lower than these expectations. See “Forward-Looking Statements” on slide 2 2. FY 2025 guidance does not include new markets or contribution from any acquisitions which have not yet closed; does include approximately $15M of planned investments in integration, growth initiatives, and AI initiatives. ($ in millions, except for per share information) FY 2025 Guidance Range2 Actual FY 2024 Results Total Revenue $2,034.5 $2,500 - $2,700 Adjusted EBITDA $170.4 $170 - $190 2 Revenue $665.2 Adjusted EBITDA $35.0 1 FY2025 Guidance |

|

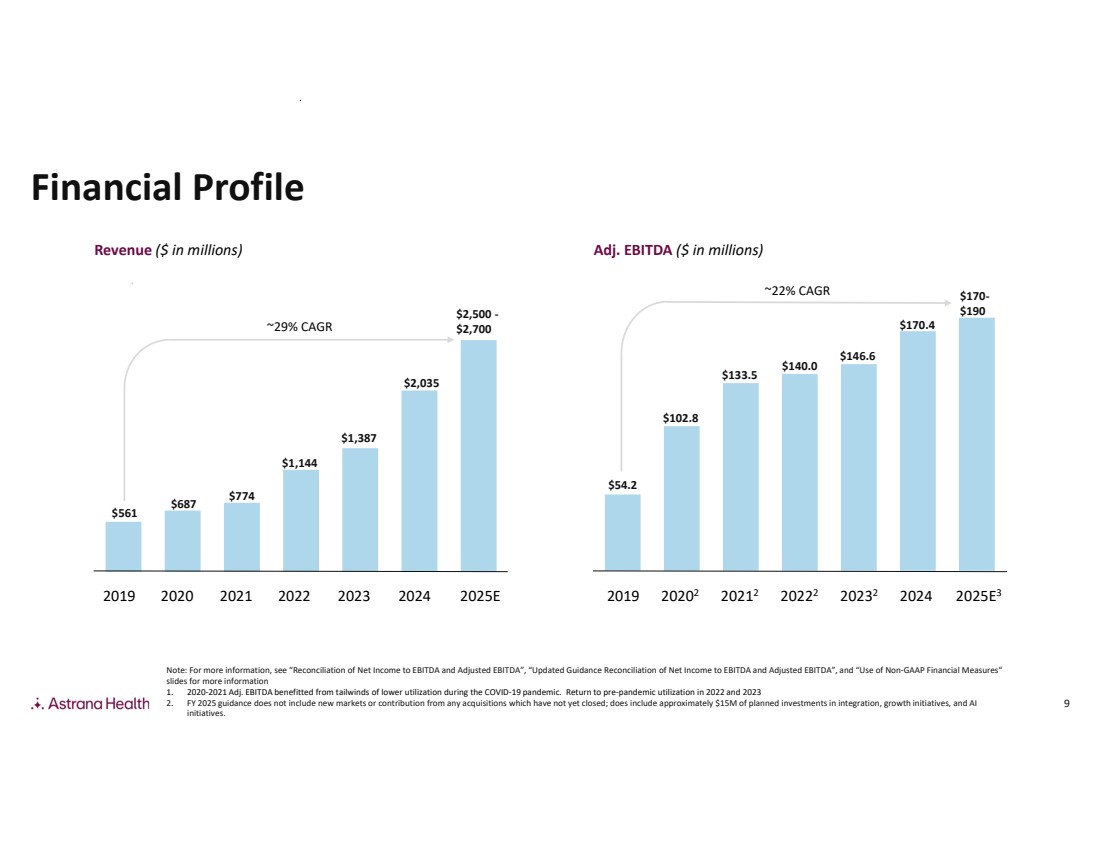

9 Note: For more information, see “Reconciliation of Net Income to EBITDA and Adjusted EBITDA”, “Updated Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA”, and “Use of Non-GAAP Financial Measures“ slides for more information 1. 2020-2021 Adj. EBITDA benefitted from tailwinds of lower utilization during the COVID-19 pandemic. Return to pre-pandemic utilization in 2022 and 2023 2. FY 2025 guidance does not include new markets or contribution from any acquisitions which have not yet closed; does include approximately $15M of planned investments in integration, growth initiatives, and AI initiatives. Revenue ($ in millions) Adj. EBITDA ($ in millions) $561 $687 $774 $1,144 $1,387 $2,035 2019 2020 2021 2022 2023 ~29% CAGR 2024 $54.2 $102.8 $133.5 $140.0 $146.6 $170.4 2019 20202 20212 20222 20232 2024 ~22% CAGR Financial Profile 2025E $2,500 - $2,700 $170- $190 2025E3 |

|

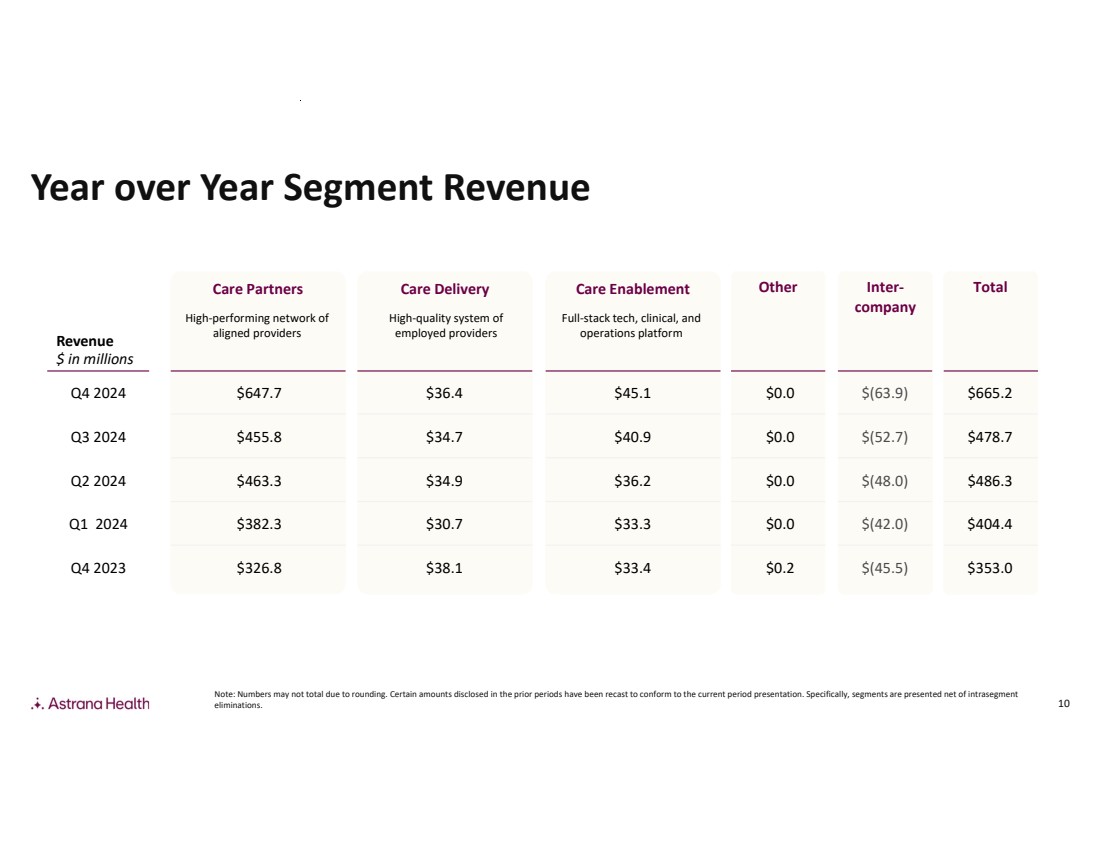

10 Year over Year Segment Revenue Revenue $ in millions Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Care Partners High-performing network of aligned providers $326.8 $382.3 $463.3 $455.8 $647.7 Care Delivery High-quality system of employed providers $38.1 $30.7 $34.9 $34.7 $36.4 Care Enablement Full-stack tech, clinical, and operations platform $33.4 $33.3 $36.2 $40.9 $45.1 Other $0.2 $0.0 $0.0 $0.0 $0.0 Inter-company $(45.5) $(42.0) $(48.0) $(52.7) $(63.9) Total $353.0 $404.4 $486.3 $478.7 $665.2 Note: Numbers may not total due to rounding. Certain amounts disclosed in the prior periods have been recast to conform to the current period presentation. Specifically, segments are presented net of intrasegment eliminations. |

|

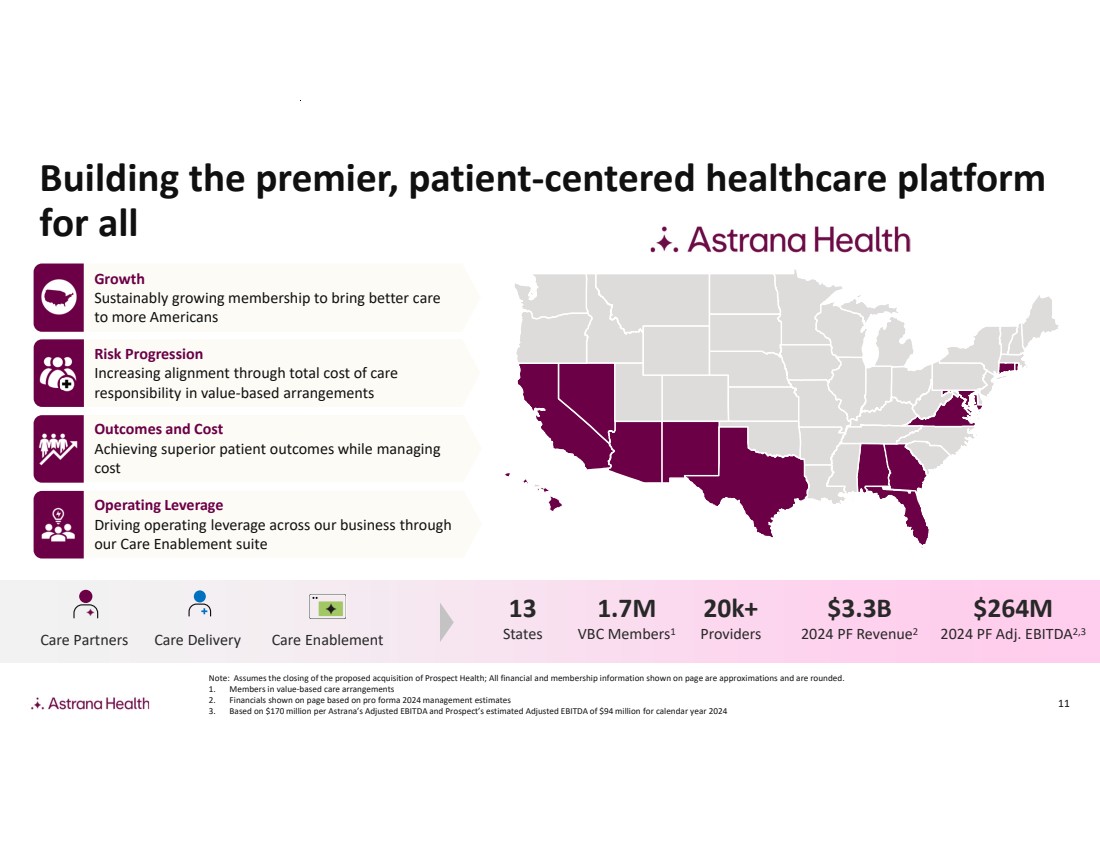

11 Building the premier, patient-centered healthcare platform for all Note: Assumes the closing of the proposed acquisition of Prospect Health; All financial and membership information shown on page are approximations and are rounded. 1. Members in value-based care arrangements 2. Financials shown on page based on pro forma 2024 management estimates 3. Based on $170 million per Astrana’s Adjusted EBITDA and Prospect’s estimated Adjusted EBITDA of $94 million for calendar year 2024 13 States 1.7M VBC Members1 $3.3B 2024 PF Revenue2 $264M 2024 PF Adj. EBITDA2,3 20k+ Providers Care Partners Care Delivery Care Enablement Outcomes and Cost Achieving superior patient outcomes while managing cost Growth Sustainably growing membership to bring better care to more Americans Risk Progression Increasing alignment through total cost of care responsibility in value-based arrangements Operating Leverage Driving operating leverage across our business through our Care Enablement suite Growth |

|

12 Selected Financial Results |

|

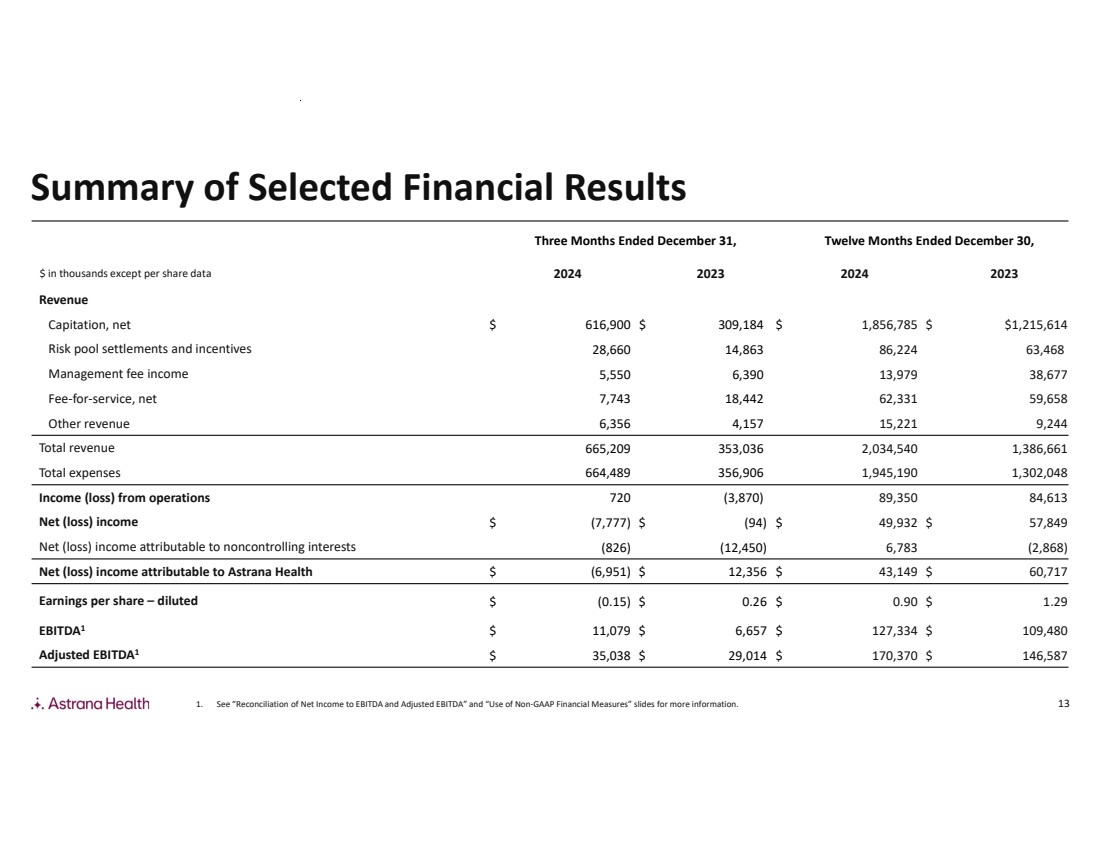

13 Three Months Ended December 31, Twelve Months Ended December 30, $ in thousands except per share data 2024 2023 2024 2023 Revenue Capitation, net $ 616,900 $ 309,184 $ 1,856,785 $ $1,215,614 Risk pool settlements and incentives 28,660 14,863 86,224 63,468 Management fee income 5,550 6,390 13,979 38,677 Fee-for-service, net 7,743 18,442 62,331 59,658 Other revenue 6,356 4,157 15,221 9,244 Total revenue 665,209 353,036 2,034,540 1,386,661 Total expenses 664,489 356,906 1,945,190 1,302,048 Income (loss) from operations 720 (3,870) 89,350 84,613 Net (loss) income $ (7,777) $ (94) $ 49,932 $ 57,849 Net (loss) income attributable to noncontrolling interests (826) (12,450) 6,783 (2,868) Net (loss) income attributable to Astrana Health $ (6,951) $ 12,356 $ 43,149 $ 60,717 Earnings per share – diluted $ (0.15) $ 0.26 $ 0.90 $ 1.29 EBITDA $ 11,079 $ 6,657 $ 127,334 $ 109,480 1 Adjusted EBITDA $ 35,038 $ 29,014 $ 170,370 $ 146,587 1 1. See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA” and “Use of Non-GAAP Financial Measures” slides for more information. Summary of Selected Financial Results |

|

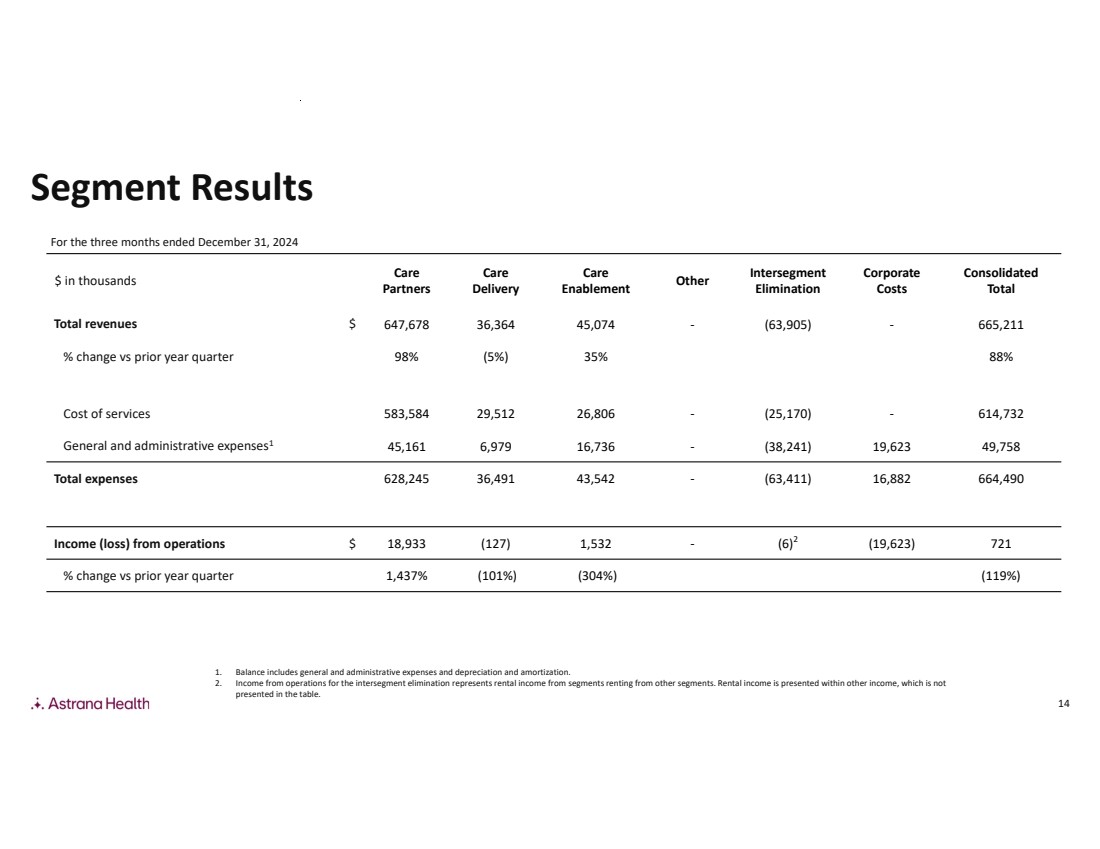

14 Consolidated Total Corporate Costs Intersegment Elimination Other Care Enablement Care Delivery Care Partners $ in thousands Total revenues $ 647,678 36,364 45,074 - (63,905) - 665,211 % change vs prior year quarter 98% (5%) 35% 88% Cost of services 583,584 29,512 26,806 - (25,170) - 614,732 General and administrative expenses 45,161 6,979 16,736 - (38,241) 19,623 49,758 1 Total expenses 628,245 36,491 43,542 - (63,411) 16,882 664,490 (6) (19,623) 721 2 Income (loss) from operations $ 18,933 (127) 1,532 - % change vs prior year quarter 1,437% (101%) (304%) (119%) For the three months ended December 31, 2024 1. Balance includes general and administrative expenses and depreciation and amortization. 2. Income from operations for the intersegment elimination represents rental income from segments renting from other segments. Rental income is presented within other income, which is not presented in the table. Segment Results |

|

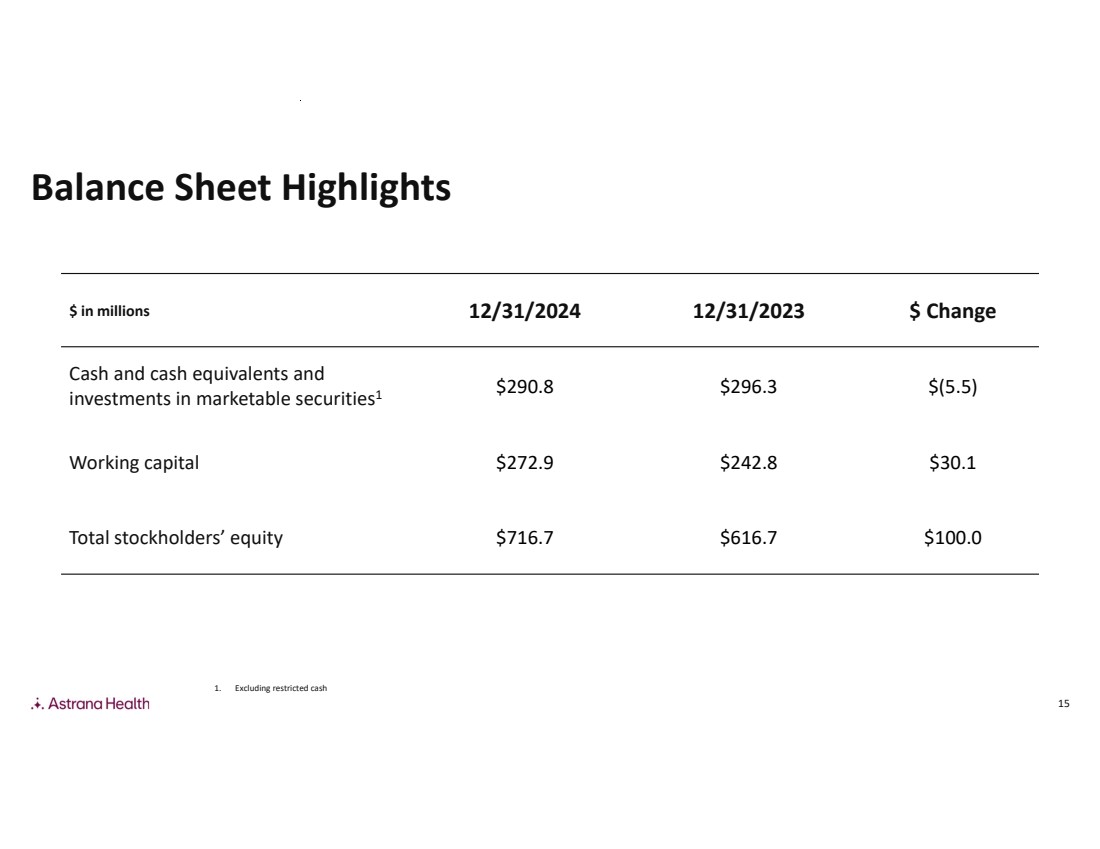

15 $ in millions 12/31/2024 12/31/2023 $ Change $290.8 $296.3 $(5.5) Cash and cash equivalents and investments in marketable securities1 Working capital $272.9 $242.8 $30.1 Total stockholders’ equity $716.7 $616.7 $100.0 1. Excluding restricted cash Balance Sheet Highlights |

|

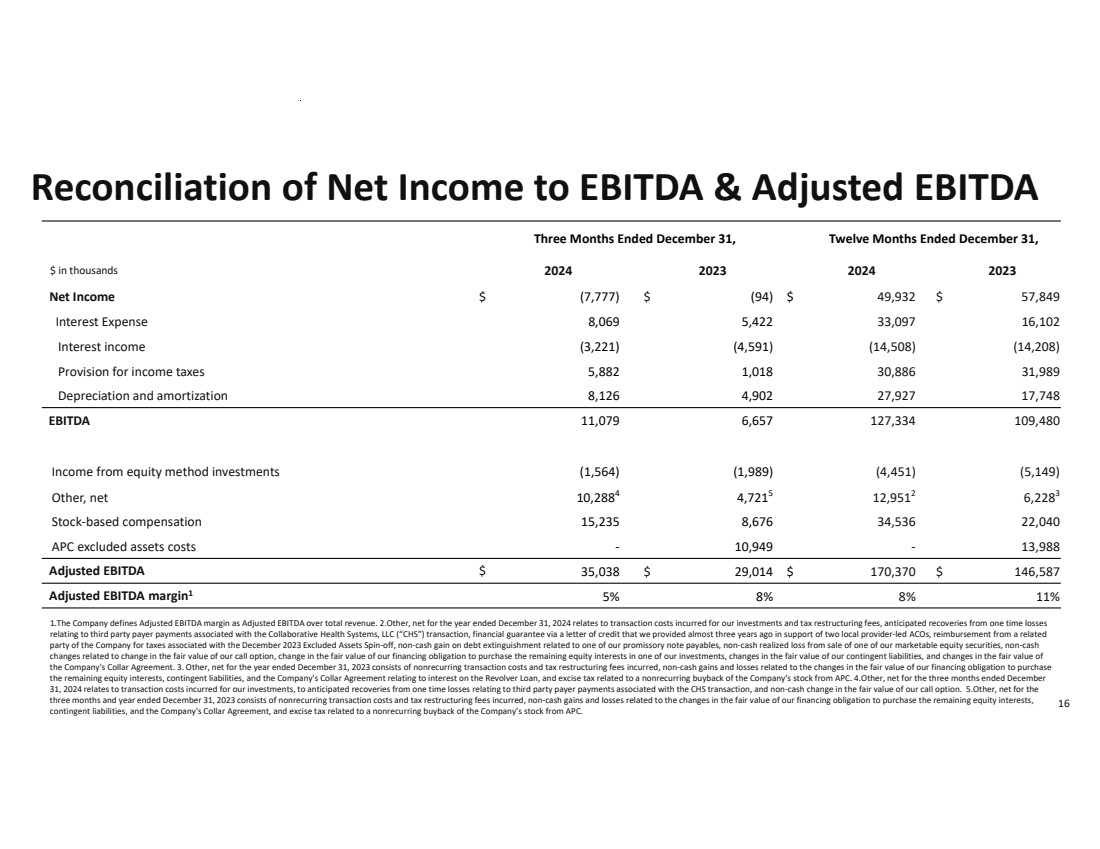

16 Three Months Ended December 31, Twelve Months Ended December 31, $ in thousands 2024 2023 2024 2023 Net Income $ (7,777) $ (94) $ 49,932 $ 57,849 Interest Expense 8,069 5,422 33,097 16,102 Interest income (3,221) (4,591) (14,508) (14,208) Provision for income taxes 5,882 1,018 30,886 31,989 Depreciation and amortization 8,126 4,902 27,927 17,748 EBITDA 11,079 6,657 127,334 109,480 Income from equity method investments (1,564) (1,989) (4,451) (5,149) 6,2283 12,9512 4,7215 10,2884 Other, net Stock-based compensation 15,235 8,676 34,536 22,040 APC excluded assets costs - 10,949 - 13,988 Adjusted EBITDA $ 35,038 $ 29,014 $ 170,370 $ 146,587 Adjusted EBITDA margin1 5% 8% 8% 11% 1.The Company defines Adjusted EBITDA margin as Adjusted EBITDA over total revenue. 2.Other, net for the year ended December 31, 2024 relates to transaction costs incurred for our investments and tax restructuring fees, anticipated recoveries from one time losses relating to third party payer payments associated with the Collaborative Health Systems, LLC (“CHS”) transaction, financial guarantee via a letter of credit that we provided almost three years ago in support of two local provider-led ACOs, reimbursement from a related party of the Company for taxes associated with the December 2023 Excluded Assets Spin-off, non-cash gain on debt extinguishment related to one of our promissory note payables, non-cash realized loss from sale of one of our marketable equity securities, non-cash changes related to change in the fair value of our call option, change in the fair value of our financing obligation to purchase the remaining equity interests in one of our investments, changes in the fair value of our contingent liabilities, and changes in the fair value of the Company's Collar Agreement. 3. Other, net for the year ended December 31, 2023 consists of nonrecurring transaction costs and tax restructuring fees incurred, non-cash gains and losses related to the changes in the fair value of our financing obligation to purchase the remaining equity interests, contingent liabilities, and the Company's Collar Agreement relating to interest on the Revolver Loan, and excise tax related to a nonrecurring buyback of the Company’s stock from APC. 4.Other, net for the three months ended December 31, 2024 relates to transaction costs incurred for our investments, to anticipated recoveries from one time losses relating to third party payer payments associated with the CHS transaction, and non-cash change in the fair value of our call option. 5.Other, net for the three months and year ended December 31, 2023 consists of nonrecurring transaction costs and tax restructuring fees incurred, non-cash gains and losses related to the changes in the fair value of our financing obligation to purchase the remaining equity interests, contingent liabilities, and the Company's Collar Agreement, and excise tax related to a nonrecurring buyback of the Company’s stock from APC. Reconciliation of Net Income to EBITDA & Adjusted EBITDA |

|

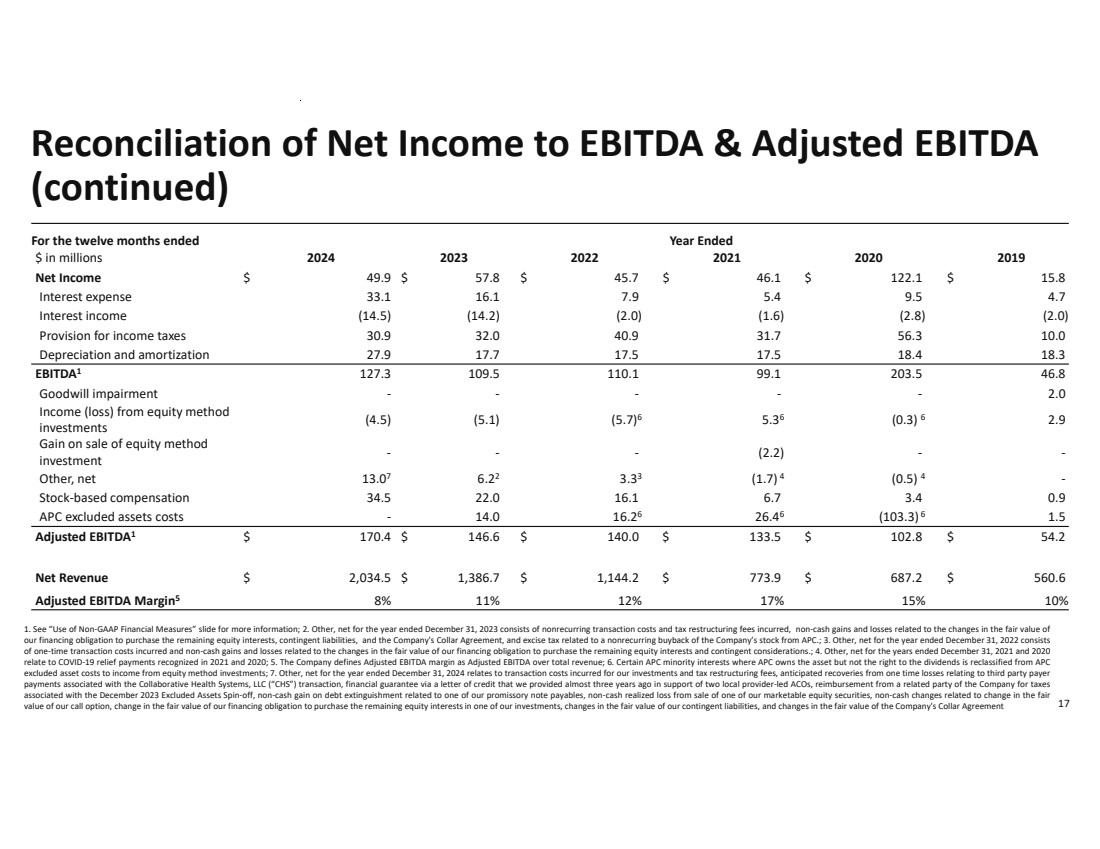

17 For the twelve months ended Year Ended $ in millions 2024 2023 2022 2021 2020 2019 Net Income $ 49.9 $ 57.8 $ 45.7 $ 46.1 $ 122.1 $ 15.8 Interest expense 33.1 16.1 7.9 5.4 9.5 4.7 Interest income (14.5) (14.2) (2.0) (1.6) (2.8) (2.0) Provision for income taxes 30.9 32.0 40.9 31.7 56.3 10.0 Depreciation and amortization 27.9 17.7 17.5 17.5 18.4 18.3 EBITDA 127.3 109.5 110.1 99.1 203.5 46.8 1 Goodwill impairment - - - - - 2.0 (0.3) 2.9 6 5.36 (5.7)6 (4.5) (5.1) Income (loss) from equity method investments - - - (2.2) - - Gain on sale of equity method investment (0.5) - 4 (1.7) 4 3.33 6.22 13.0 Other, net 7 Stock-based compensation 34.5 22.0 16.1 6.7 3.4 0.9 (103.3) 1.5 6 26.46 16.26 APC excluded assets costs - 14.0 Adjusted EBITDA $ 170.4 $ 146.6 $ 140.0 $ 133.5 $ 102.8 $ 54.2 1 Net Revenue $ 2,034.5 $ 1,386.7 $ 1,144.2 $ 773.9 $ 687.2 $ 560.6 Adjusted EBITDA Margin 8% 11% 12% 17% 15% 10% 5 1. See “Use of Non-GAAP Financial Measures” slide for more information; 2. Other, net for the year ended December 31, 2023 consists of nonrecurring transaction costs and tax restructuring fees incurred, non-cash gains and losses related to the changes in the fair value of our financing obligation to purchase the remaining equity interests, contingent liabilities, and the Company's Collar Agreement, and excise tax related to a nonrecurring buyback of the Company’s stock from APC.; 3. Other, net for the year ended December 31, 2022 consists of one-time transaction costs incurred and non-cash gains and losses related to the changes in the fair value of our financing obligation to purchase the remaining equity interests and contingent considerations.; 4. Other, net for the years ended December 31, 2021 and 2020 relate to COVID-19 relief payments recognized in 2021 and 2020; 5. The Company defines Adjusted EBITDA margin as Adjusted EBITDA over total revenue; 6. Certain APC minority interests where APC owns the asset but not the right to the dividends is reclassified from APC excluded asset costs to income from equity method investments; 7. Other, net for the year ended December 31, 2024 relates to transaction costs incurred for our investments and tax restructuring fees, anticipated recoveries from one time losses relating to third party payer payments associated with the Collaborative Health Systems, LLC (“CHS”) transaction, financial guarantee via a letter of credit that we provided almost three years ago in support of two local provider-led ACOs, reimbursement from a related party of the Company for taxes associated with the December 2023 Excluded Assets Spin-off, non-cash gain on debt extinguishment related to one of our promissory note payables, non-cash realized loss from sale of one of our marketable equity securities, non-cash changes related to change in the fair value of our call option, change in the fair value of our financing obligation to purchase the remaining equity interests in one of our investments, changes in the fair value of our contingent liabilities, and changes in the fair value of the Company's Collar Agreement Reconciliation of Net Income to EBITDA & Adjusted EBITDA (continued) |

|

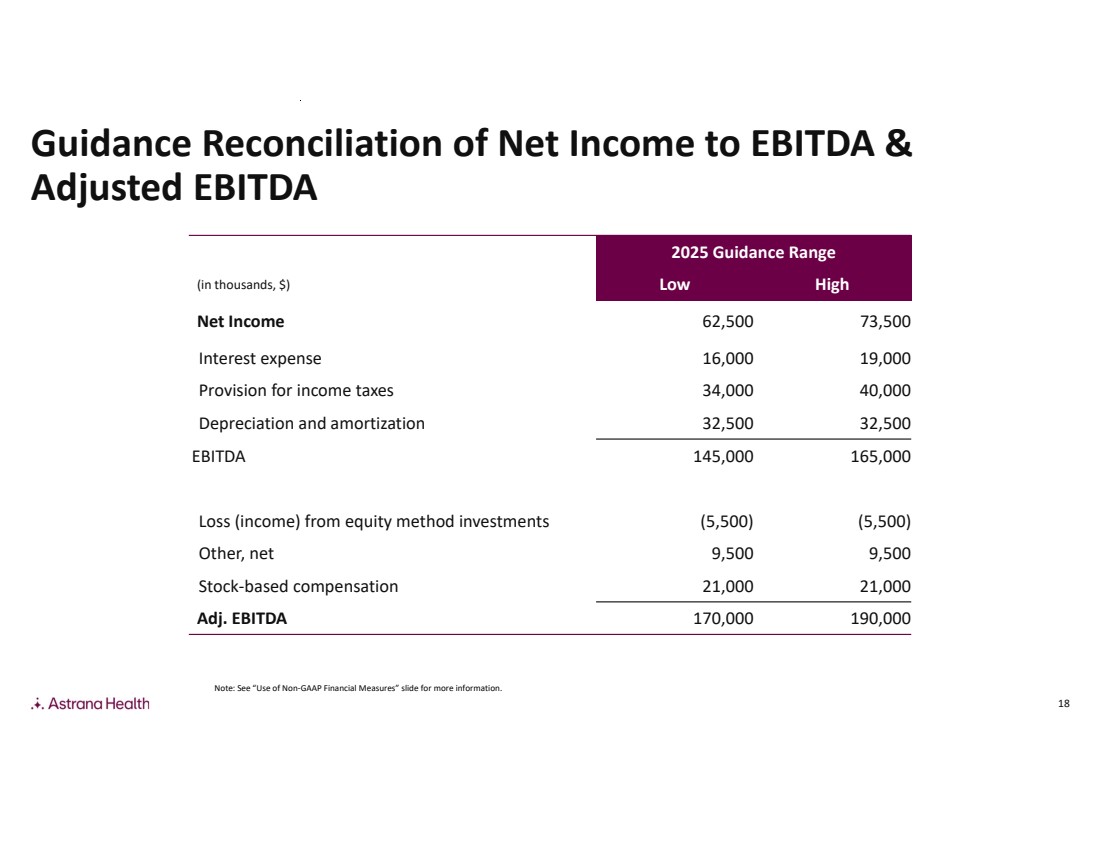

18 Note: See “Use of Non-GAAP Financial Measures” slide for more information. 2025 Guidance Range (in thousands, $) Low High Net Income 62,500 73,500 Interest expense 16,000 19,000 Provision for income taxes 34,000 40,000 Depreciation and amortization 32,500 32,500 EBITDA 145,000 165,000 Loss (income) from equity method investments (5,500) (5,500) Other, net 9,500 9,500 Stock-based compensation 21,000 21,000 Adj. EBITDA 170,000 190,000 Guidance Reconciliation of Net Income to EBITDA & Adjusted EBITDA |

|

Investor Relations Asher Dewhurst (626) 943-6491 investors@astranahealth.com |