EXHIBIT 99.1

Published on January 12, 2026

| Investor Presentation January 2026 |

| 2 Forward Looking Statements This presentation contains forward -looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward - looking statements include any statements about the Company's business, financial condition, operating results, plans, object ive s, expectations and intentions, expansion plans, estimates of our total addressable market, our ability to successfully complete and realize the benefits of anticipated acquisitions , integration of acquired companies and any projections of earnings, revenue, EBITDA, Adjusted EBITDA or other financial items, such as the Company's projected capitation and future liquidity, and may be identified by the use of forward -looking terms such as “anticipate,” “could,” “can,” “may,” “might,” “potential,” “predict,” “should,” “estimate,” “expect,” “project,” “believe,” “plan,” “envision,” “intend,” “continue,” “target,” “seek,” “will,” “wo uld ,” and the negative of such terms, other variations on such terms or other similar or comparable words, phrases or terminology. Forward -looking statements reflect current views with respect to future events and fin ancial performance and therefore cannot be guaranteed. Such statements are based on the current expectations and certain assumptions of the Company’s management, and some or all of such expectations and assumptions may not materialize or may vary significantly from actual results. Actual results may also vary materially from forward -looking statements due to risks, uncertainties and other factors, known and unknown, including the risk factors described from time to time in the Company’s reports to the U.S. Securities and Exchange Commission (the “SEC”), including without limitation the risk factors d isc ussed in the Company's last Annual Report on Form 10 -K, and subsequent Quarterly Reports on Form 10 -Q. Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed or imp lied in any forward -looking statements, you should not place undue reliance on any such forward -looking statements. Any forward -looking statements speak only as of the date of this presentation and, unless legal ly required, the Company does not undertake any obligation to update any forward -looking statement, as a result of new information, future events or otherwise. This presentation may contain statistics and other data that in some cases has been obtained from or compiled from informatio n made available by third -party service providers. The Company makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of such informat ion. Use of Non -GAAP Financial Measures This presentation contains the non -GAAP financial measures EBITDA and Adjusted EBITDA, of which the most directly comparable fin ancial measure presented in accordance with U.S. generally accepted accounting principles (“GAAP”) is net income. These measures are not in accordance with, or alternatives to, GAAP, and may be ca lculated differently from similar non -GAAP financial measures used by other companies. The Company uses Adjusted EBITDA as a supplemental performance measure of our operations, for financial and operat ional decision -making, and as a supplemental means of evaluating period -to-period comparisons on a consistent basis. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation, and am ortization, excluding income or loss from equity method investments, non - recurring and non -cash transactions, stock -based compensation, and APC excluded assets costs. Beginning in the third quarter end ed September 30, 2022, the Company has revised the calculation for Adjusted EBITDA to exclude provider bonus payments and losses from recently acquired IPAs, which it believes to be more reflective of its business. The Company believes the presentation of these non -GAAP financial measures provides investors with relevant and useful informati on, as it allows investors to evaluate the operating performance of the business activities without having to account for differences recognized because of non -core or non -recurring financial informat ion. When GAAP financial measures are viewed in conjunction with non -GAAP financial measures, investors are provided with a more meaningful understanding of the Company’s ongoing operating performanc e. In addition, these non -GAAP financial measures are among those indicators the Company uses as a basis for evaluating operational performance, allocating resources, and planning and forecasting future pe riods. Non -GAAP financial measures are not intended to be considered in isolation, or as a substitute for, GAAP financial measures. Other companies may calculate both EBITDA and Adjusted EBITDA dif fer ently, limiting the usefulness of these measures for comparative purposes. To the extent this Presentation contains historical or future non -GAAP financial measures, the Company has provided corresponding G AAP financial measures for comparative purposes, except as otherwise noted below. The reconciliation between certain GAAP and non -GAAP measures is provided in the Appendix. The Company has not provided a quantitative reconciliation of applicable non -GAAP measures, such as the projected adjusted EBITD A in 2025 and for future years, to the most comparable GAAP measure, such as net income, on a forward -looking basis within this presentation because the Company is unable, without unreasonable efforts, to provide reconciling information with respect to certain line items that cannot be calculated. These items, which could materially affect the computation of forward -looking GAAP net income, are inherently unc ertain and depend on various factors, some of which are outside of the Company’s control. |

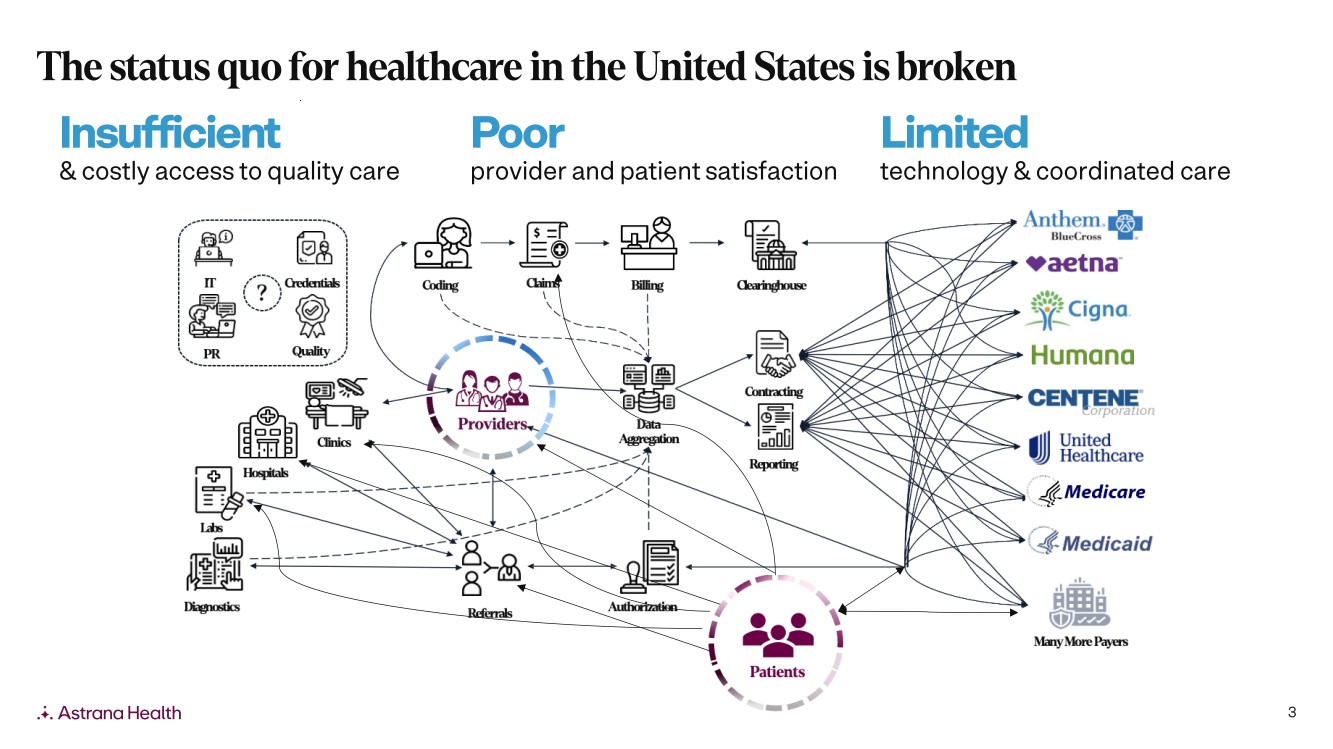

| 3 Poor provider and patient satisfaction Insufficient & costly access to quality care Limited technology & coordinated care The status quo for healthcare in the United States is broken |

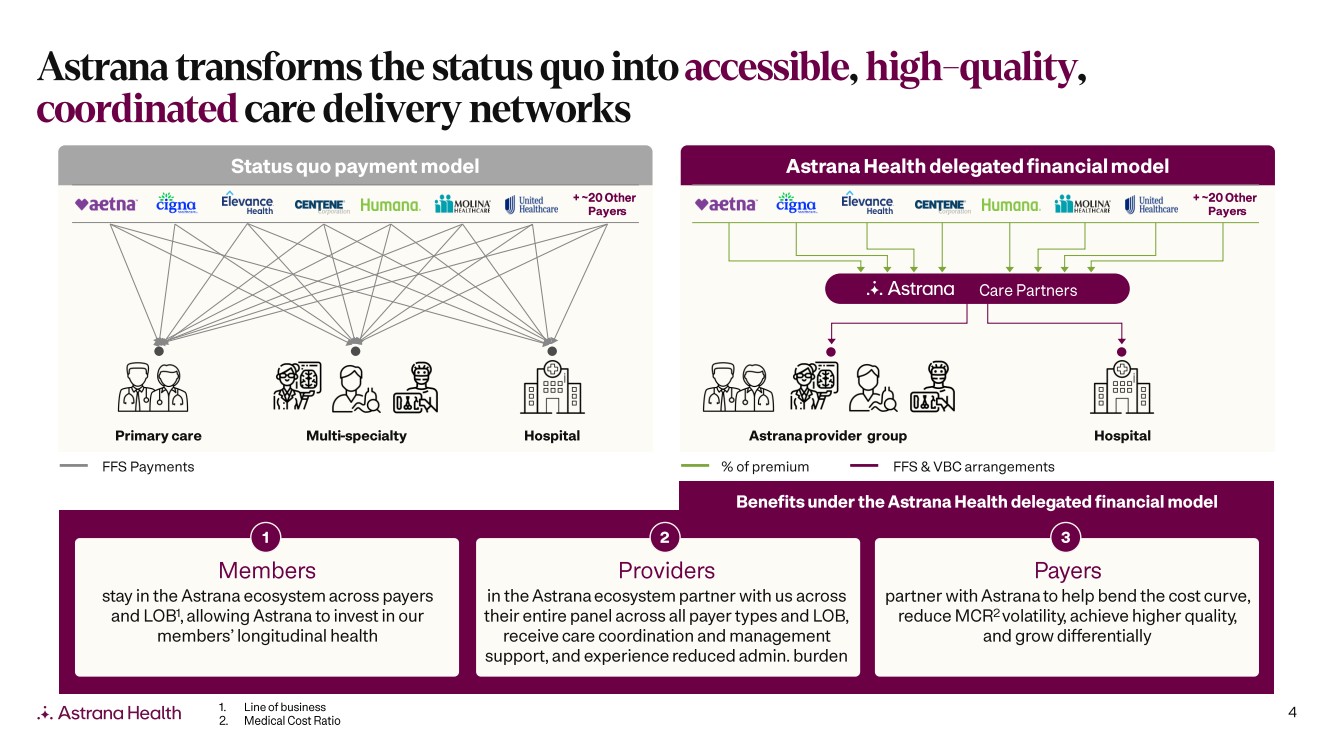

| 4 Astrana transforms the status quo into accessible, high - quality , coordinated care delivery networks Status quo payment model Astrana Health delegated financial model Primary care Multi -specialty Hospital Members stay in the Astrana ecosystem across payers and LOB 1 , allowing Astrana to invest in our members’ longitudinal health Providers in the Astrana ecosystem partner with us across their entire panel across all payer types and LOB, receive care coordination and management support, and experience reduced admin. burden Payers partner with Astrana to help bend the cost curve, reduce MCR 2 volatility, achieve higher quality, and grow differentially Astrana provider group Hospital Care Partners + ~20 Other Payer s FFS Payments % of premium FFS & VBC arrangements + ~20 Other Payer s 1 2 3 Benefits under the Astrana Health delegated financial model 1. Line of business 2. Medical Cost Ratio |

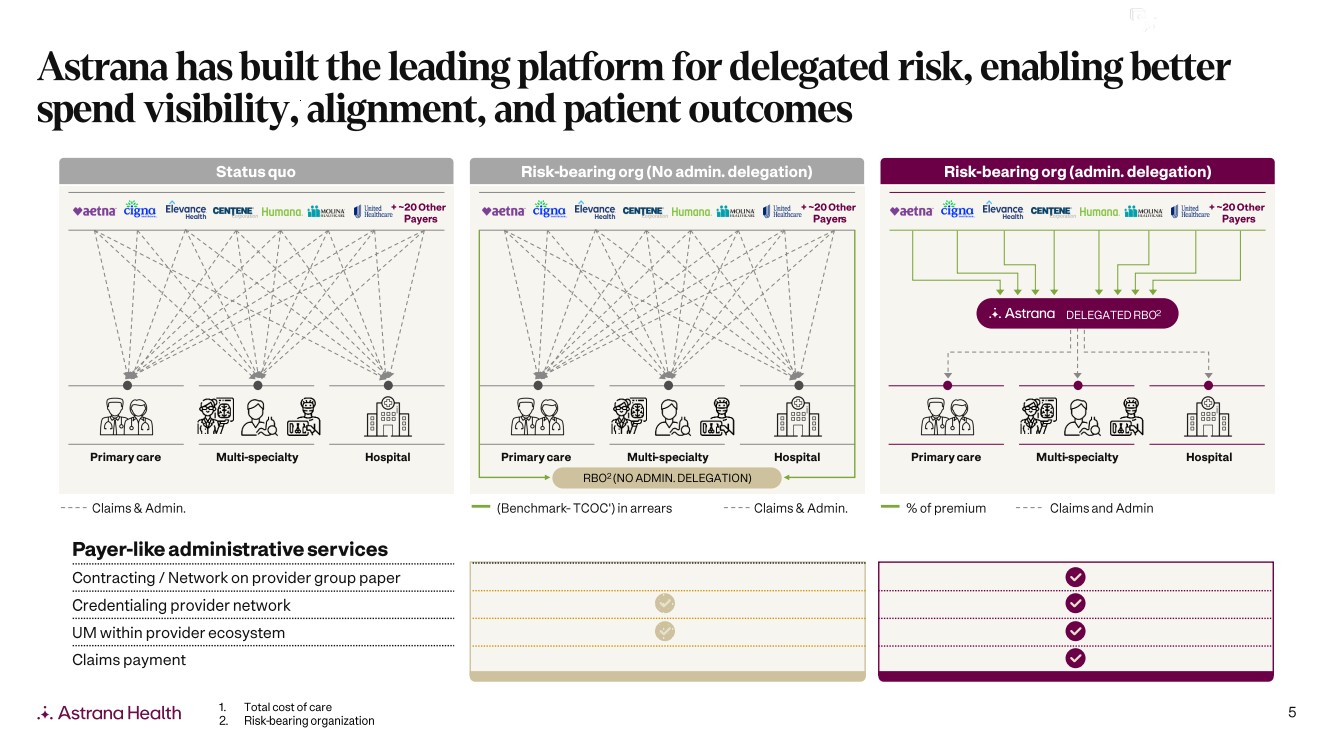

| 5 Astrana has built the leading platform for delegated risk, enabling better spend visibility, alignment, and patient outcomes Status quo Primary care Multi -specialty Hospital Claims & Admin. Risk -bearing org (admin. delegation) % of premium Claims and Admin Risk -bearing org (No admin. delegation) Primary care Multi -specialty Hospital Primary care Multi -specialty Hospital + ~20 Other Payer s + ~20 Other Payer s + ~20 Other Payer s (Benchmark - TCOC') in arrears Claims & Admin. RBO 2 (NO ADMIN. DELEGATION) DELEGATED RBO 2 Payer -like administrative services Contracting / Network on provider group paper Credentialing provider network UM within provider ecosystem Claims payment 1. Total cost of care 2. Risk -bearing organization |

| 6 From our start in one market, we’ve scaled across new markets nationwide We continue to grow into new markets through the Astrana Care Model, delivering coordinated, high - quality care 159 159 159 15 11 215 11 15 215 612 612 ENTERPRISE HENDERSON LAS VEGAS NORTH LAS VEGAS PARADISE SPRING VALLEY Example Market: Astrana in Southern Nevada 1 1. Providers shown are affiliate and/or employed providers Primary care Specialists Hospitals Employed Risk -bearing organization Example Network: Astrana in San Gabriel Valley 1 Primary care Specialists Hospitals Employed Risk -bearing organization SAN MARINO SOUTH SAN GABRIEL 60 60 60 134 10 710 PASADENA SOUTH PASADENA ALHAMBRA MONTEREY PARK |

| 7 2019 2020 2021 2022 2023 2024 2025 # of Markets 3 3 4 6 6 11 16 Astrana now serves sixteen markets across the country Note: Colored states represent those with more than 5,000 members |

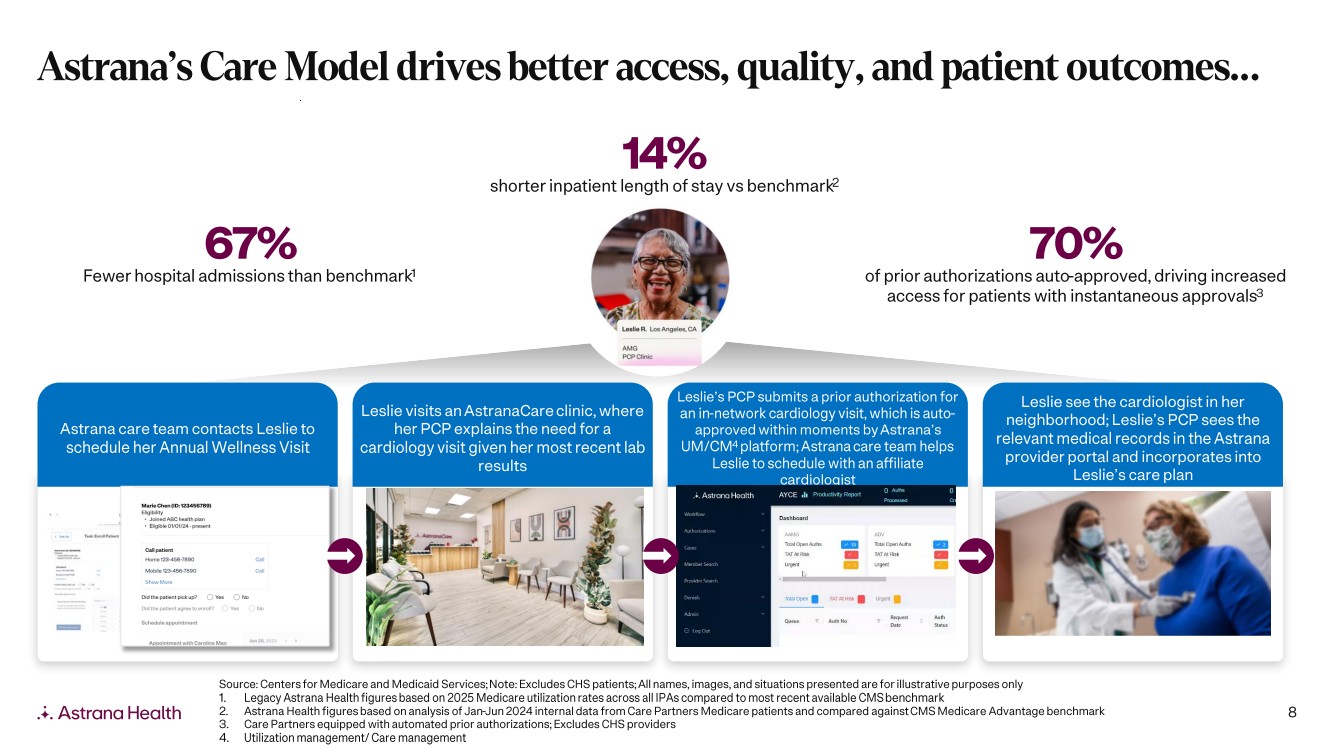

| 8 Astrana’s Care Model drives better access, quality, and patient outcomes… Astrana care team contacts Leslie to schedule her Annual Wellness Visit Leslie visits an AstranaCare clinic, where her PCP explains the need for a cardiology visit given her most recent lab results Leslie’s PCP submits a prior authorization for an in -network cardiology visit, which is auto - approved within moments by Astrana’s UM/CM 4 platform; Astrana care team helps Leslie to schedule with an affiliate cardiologist Leslie see the cardiologist in her neighborhood; Leslie’s PCP sees the relevant medical records in the Astrana provider portal and incorporates into Leslie’s care plan Source: Centers for Medicare and Medicaid Services; Note: Excludes CHS patients; All names, images, and situations presented are for illustrative purposes only 1. Legacy Astrana Health figures based on 2025 Medicare utilization rates across all IPAs compared to most recent available CMS ben chmark 2. Astrana Health figures based on analysis of Jan -Jun 2024 internal data from Care Partners Medicare patients and compared against CMS Medicare Advantage benchmark 3. Care Partners equipped with automated prior authorizations; Excludes CHS providers 4. Utilization management/ Care management 14% shorter inpatient length of stay vs benchmark 2 67% Fewer hospital admissions than benchmark 1 70% of prior authorizations auto -approved, driving increased access for patients with instantaneous approvals 3 |

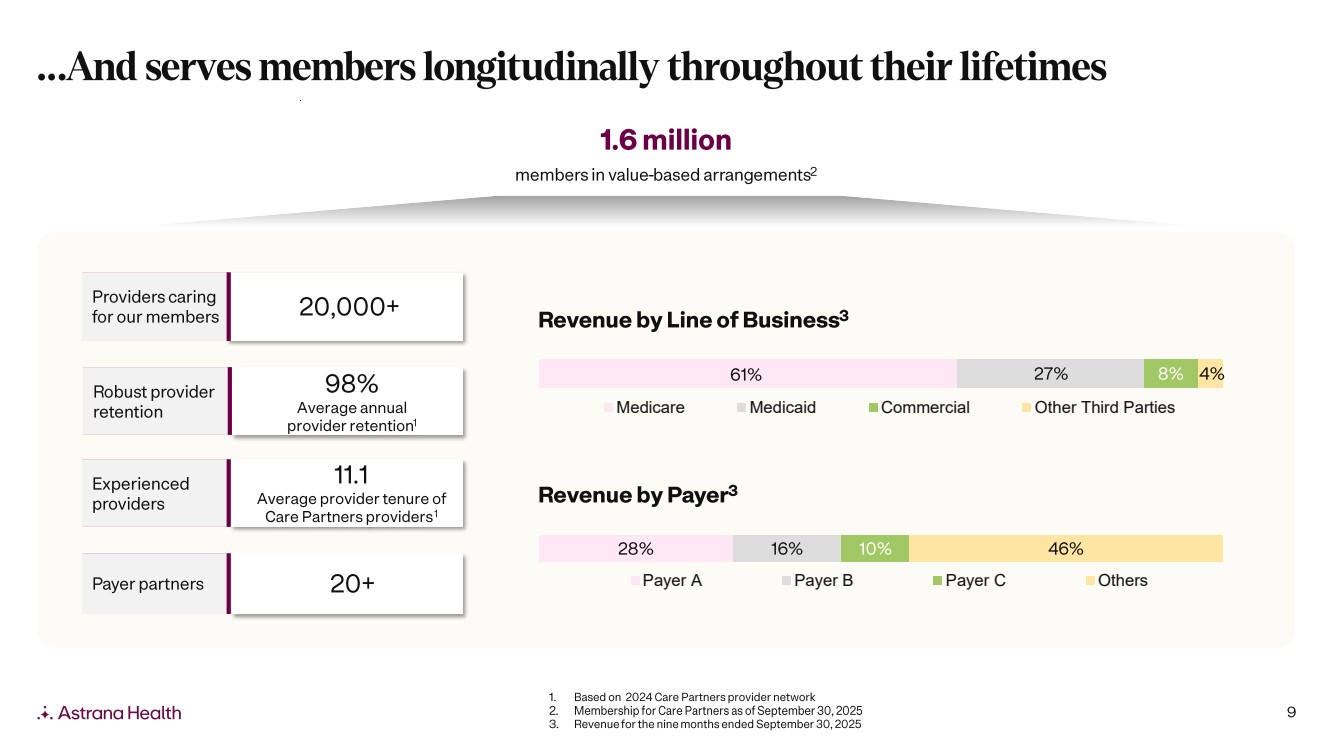

| 9 …And serves members longitudinally throughout their lifetimes 1.6 million members in value -based arrangements 2 20,000+ Providers caring for our members 98% Average annual provider retention 1 Experienced providers 11.1 Average provider tenure of Care Partners providers 1 Payer partners 1. Based on 2024 Care Partners provider network 2. Membership for Care Partners as of September 30, 2025 3. Revenue for the nine months ended September 30, 2025 20+ Robust provider retention Revenue by Payer 3 28% 16% 10% 46% Payer A Payer B Payer C Others 27% 8% Medicare Medicaid Commercial Other Third Parties Revenue by Line of Business 3 61% 4% |

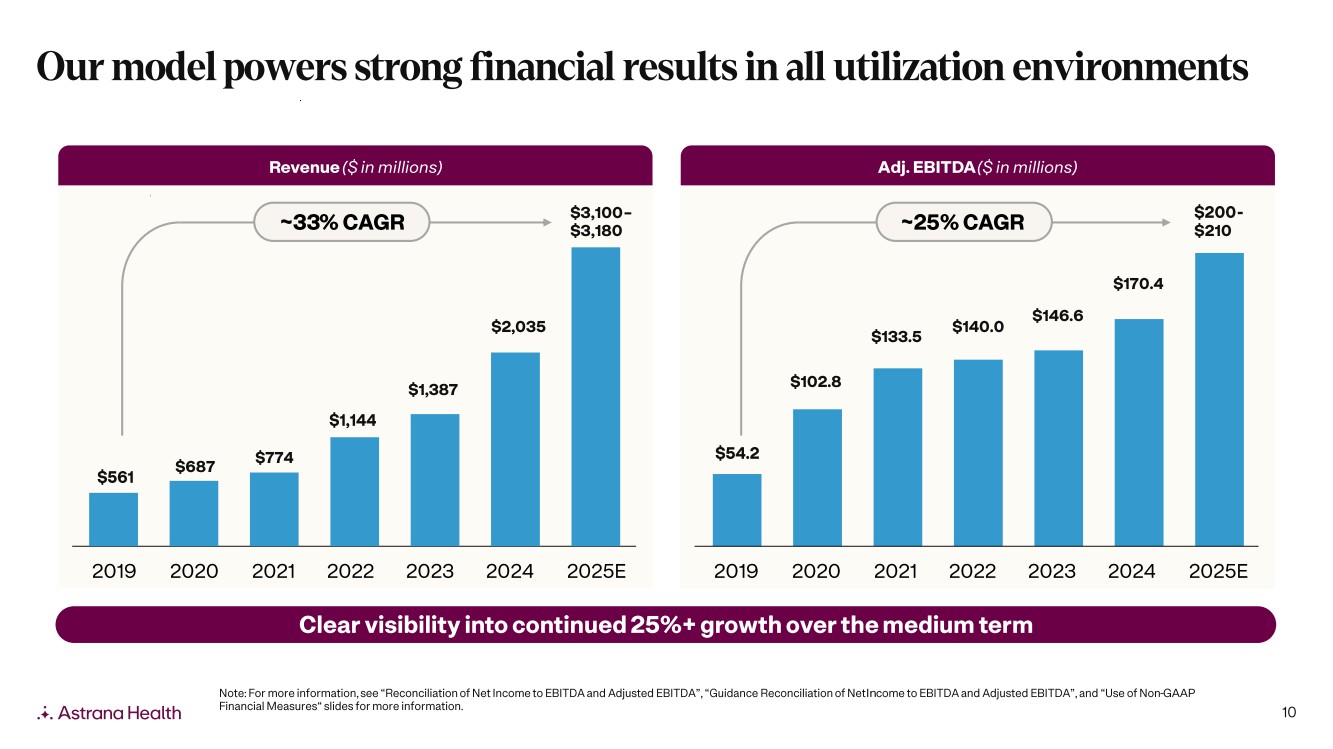

| 10 $54.2 $102.8 $133.5 $140.0 $146.6 $170.4 Our model powers strong financial results in all utilization environments Revenue ($ in millions) Adj. EBITDA ($ in millions) ~25% CAGR Clear visibility into continued 25%+ growth over the medium term $561 $687 $774 $1,144 $1,387 $2,035 $3,100 – $3,180 2019 2020 2021 2022 2023 2024 2025E ~33 % CAGR $200 - $210 2019 2020 2021 2022 2023 2024 2025E Note: For more information, see “Reconciliation of Net Income to EBITDA and Adjusted EBITDA”, “Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA”, and “Use of Non -GAAP Financial Measures“ slides for more information. |

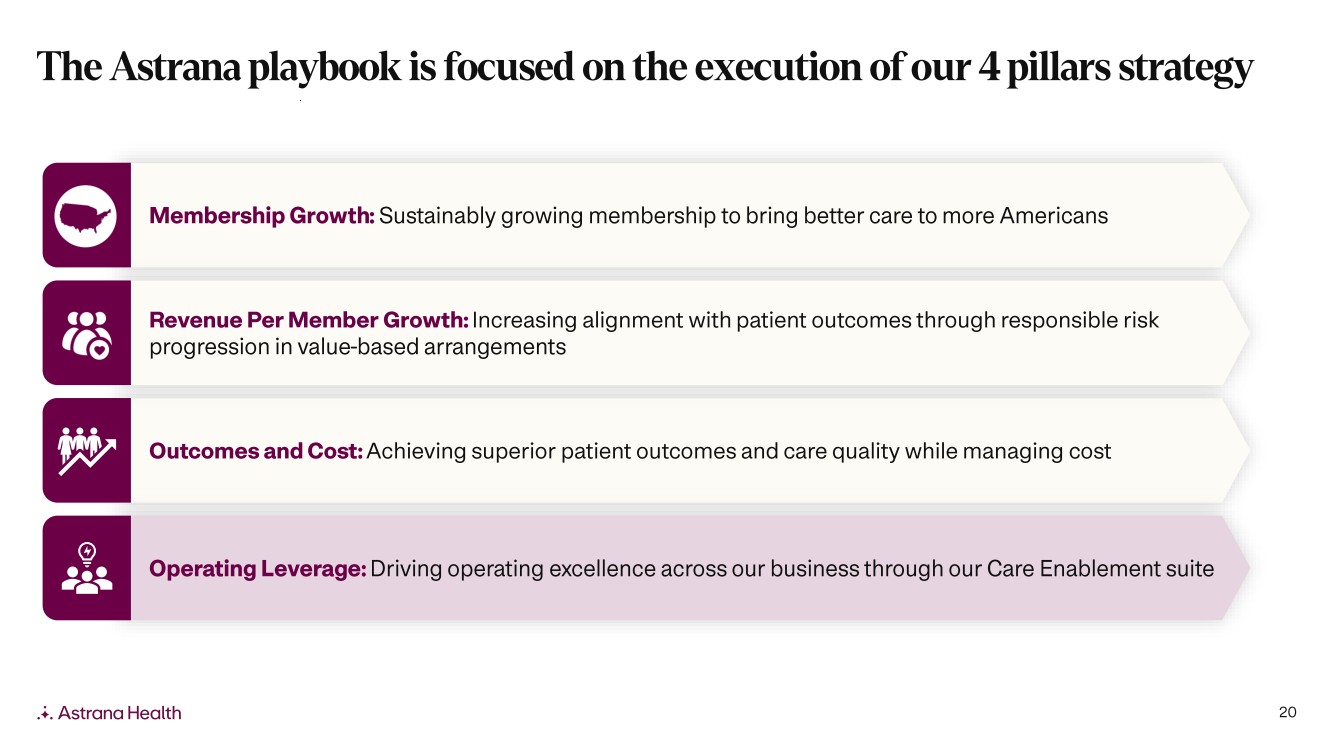

| 11 Outcomes and Cost: Achieving superior patient outcomes and care quality while managing cost Membership Growth : Sustainably growing membership to bring better care to more Americans Revenue Per Member Growth : Increasing alignment with patient outcomes through responsible risk progression in value -based arrangements Operating Leverage: Driving operating excellence across our business through our Care Enablement suite The Astrana playbook is focused on the execution of our 4 pillars strategy |

| 12 Outcomes and Cost: Achieving superior patient outcomes and care quality while managing cost Membership Growth : Sustainably growing membership to bring better care to more Americans Revenue Per Member Growth : Increasing alignment with patient outcomes through responsible risk progression in value -based arrangements Operating Leverage: Driving operating excellence across our business through our Care Enablement suite The Astrana playbook is focused on the execution of our 4 pillars strategy |

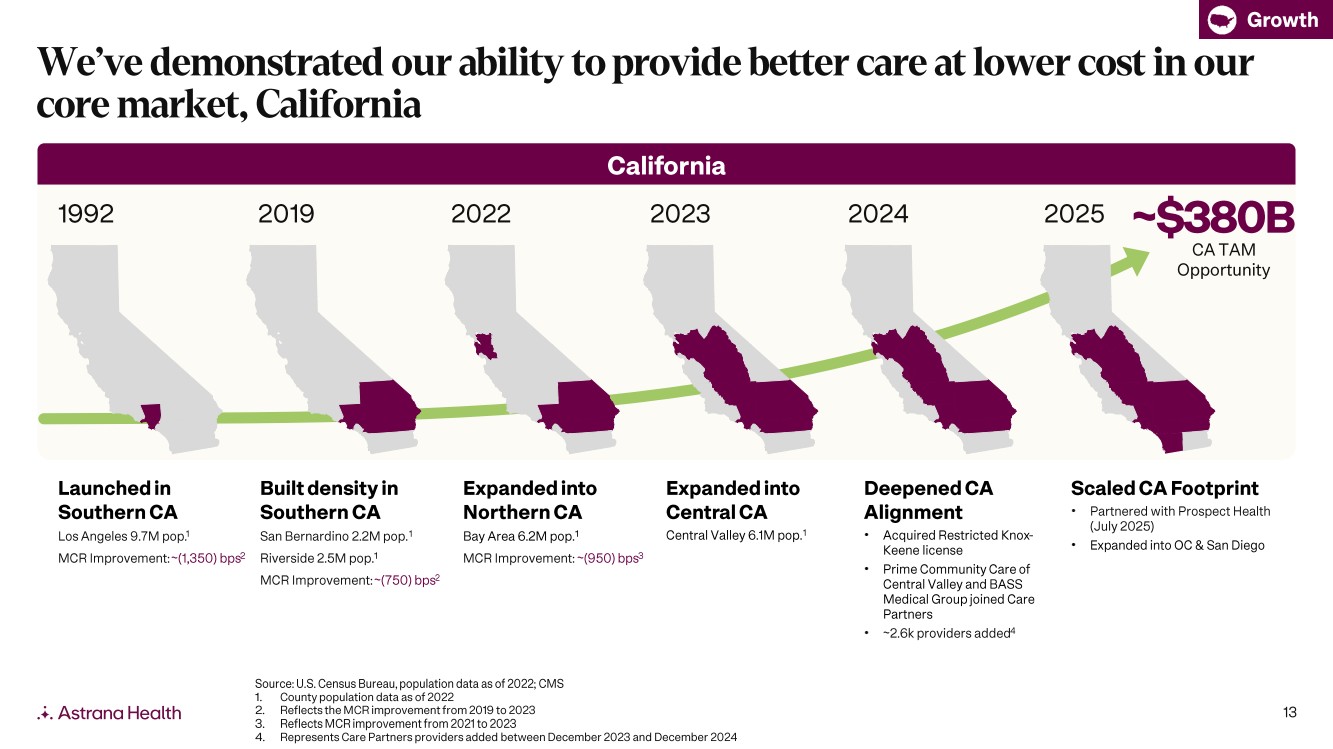

| 13 California 1992 2019 2022 2023 Built density in Southern CA San Bernardino 2.2M pop. 1 Riverside 2.5M pop. 1 MCR Improvement: ~(750) bps 2 Expanded into Northern CA Bay Area 6.2M pop. 1 MCR Improvement: ~(950) bps 3 Expanded into Central CA Central Valley 6.1M pop. 1 Launched in Southern CA Los Angeles 9.7M pop. 1 MCR Improvement: ~(1,350) bps 2 Source: U.S. Census Bureau, population data as of 2022; CMS 1. County population data as of 2022 2. Reflects the MCR improvement from 2019 to 2023 3. Reflects MCR improvement from 2021 to 2023 4. Represents Care Partners providers added between December 2023 and December 2024 2024 Deepened CA Alignment • Acquired Restricted Knox - Keene license • Prime Community Care of Central Valley and BASS Medical Group joined Care Partners • ~2.6k providers added 4 We’ve demonstrated our ability to provide better care at lower cost in our core market, California Growth ~$380B CA TAM Opportunity 2025 Scaled CA Footprint • Partnered with Prospect Health (July 2025) • Expanded into OC & San Diego |

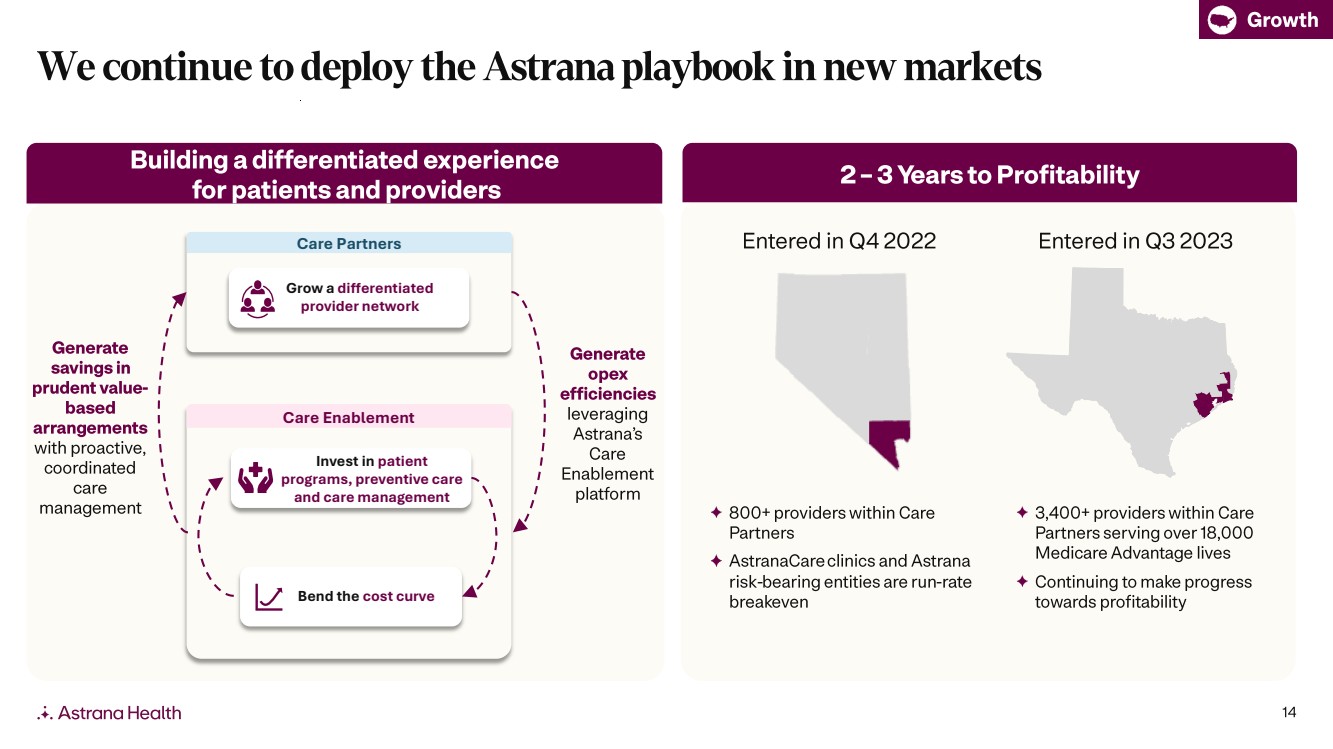

| 14 2 – 3 Years to Profitability 800+ providers within Care Partners AstranaCare clinics and Astrana risk -bearing entities are run -rate breakeven 3,400+ providers within Care Partners serving over 18,000 Medicare Advantage lives Continuing to make progress towards profitability Entered in Q4 2022 Entered in Q3 2023 Growth Building a differentiated experience for patients and providers We continue to deploy the Astrana playbook in new markets Grow a differentiated provider network Bend the cost curve Invest in patient programs, preventive care and care management Care Enablement Care Partners Generate savings in prudent value - based arrangements with proactive, coordinated care management Generate opex efficiencies leveraging Astrana’s Care Enablement platform |

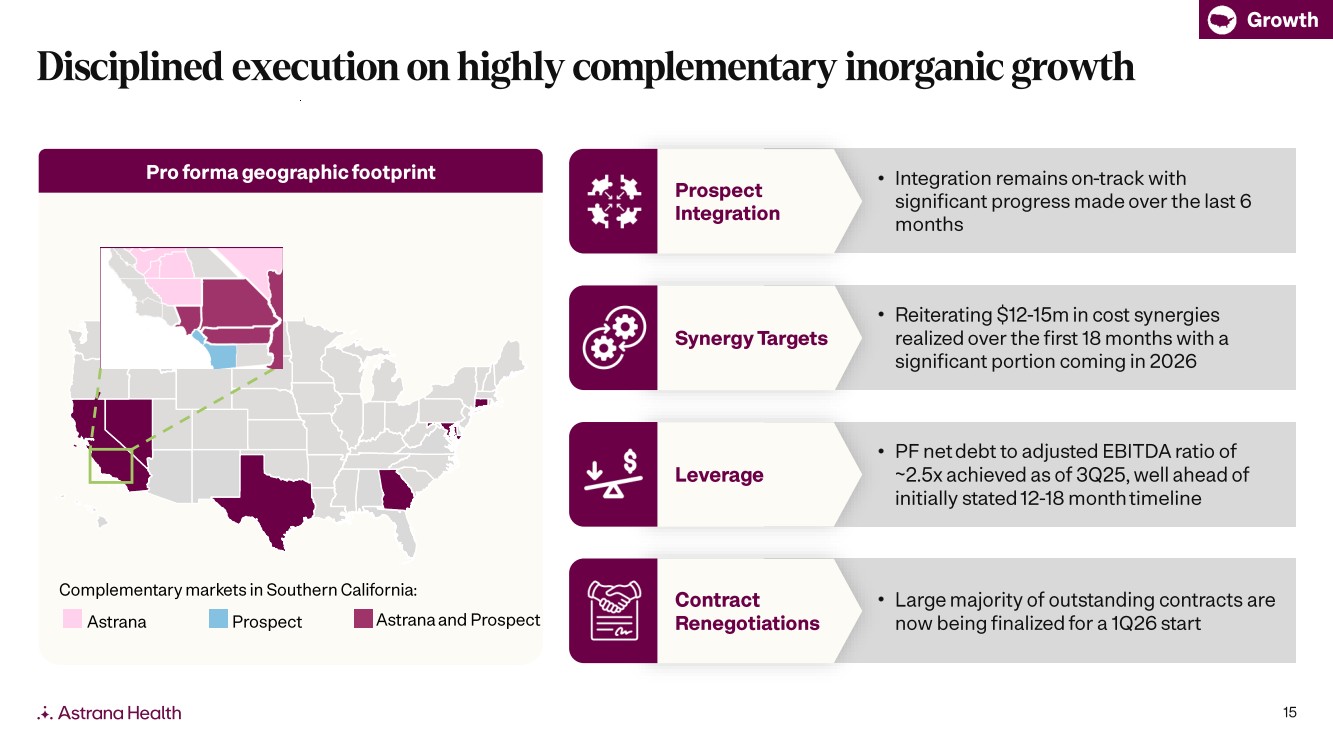

| 15 • Integration remains on -track with significant progress made over the last 6 months Pro forma geographic footprint Astrana Prospect Astrana and Prospect Complementary markets in Southern California: Growth Disciplined execution on highly complementary inorganic growth • PF net debt to adjusted EBITDA ratio of ~2.5x achieved as of 3Q25, well ahead of initially stated 12-18 month timeline Leverage Prospect Integration • Reiterating $12 -15m in cost synergies realized over the first 18 months with a significant portion coming in 2026 Synergy Targets • Large majority of outstanding contracts are now being finalized for a 1Q26 start Contract Renegotiations |

| 16 Outcomes and Cost: Achieving superior patient outcomes and care quality while managing cost Membership Growth : Sustainably growing membership to bring better care to more Americans Revenue Per Member Growth : Increasing alignment with patient outcomes through responsible risk progression in value -based arrangements Operating Leverage: Driving operating excellence across our business through our Care Enablement suite The Astrana playbook is focused on the execution of our 4 pillars strategy |

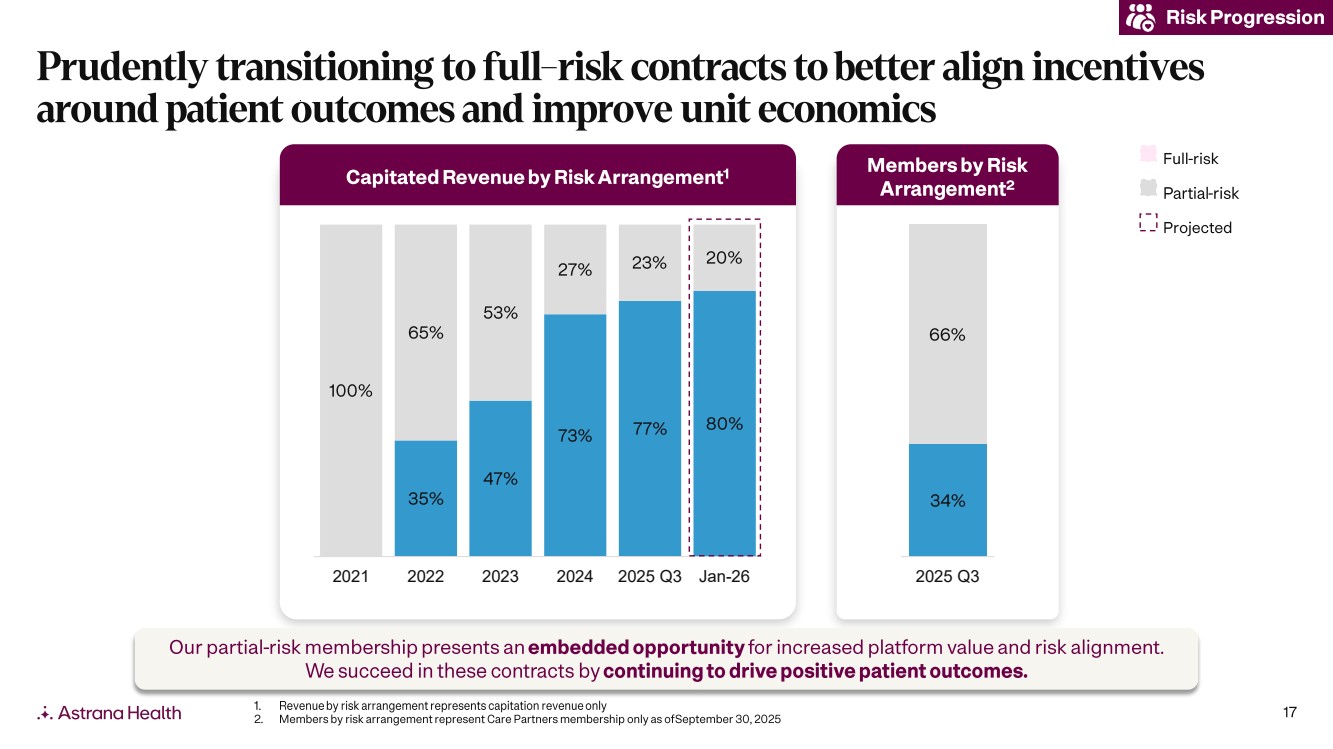

| 17 Risk Progression Prudently transitioning to full -risk contracts to better align incentives around patient outcomes and improve unit economics Projected Full -risk P artial -risk Members by Risk Arrangement 2 35% 47% 73% 77% 80% 100% 65% 53% 27% 23% 20% 2021 2022 2023 2024 2025 Q3 Jan-26 34% 66% 2025 Q3 Capitated Revenue by Risk Arrangement 1 Our partial -risk membership presents an embedded opportunity for increased platform value and risk alignment. We succeed in these contracts by continuing to drive positive patient outcomes. 1. Revenue by risk arrangement represents capitation revenue only 2. Members by risk arrangement represent Care Partners membership only as of September 30, 2025 |

| 18 Outcomes and Cost: Achieving superior patient outcomes and care quality while managing cost Membership Growth : Sustainably growing membership to bring better care to more Americans Revenue Per Member Growth : Increasing alignment with patient outcomes through responsible risk progression in value -based arrangements Operating Leverage: Driving operating excellence across our business through our Care Enablement suite The Astrana playbook is focused on the execution of our 4 pillars strategy |

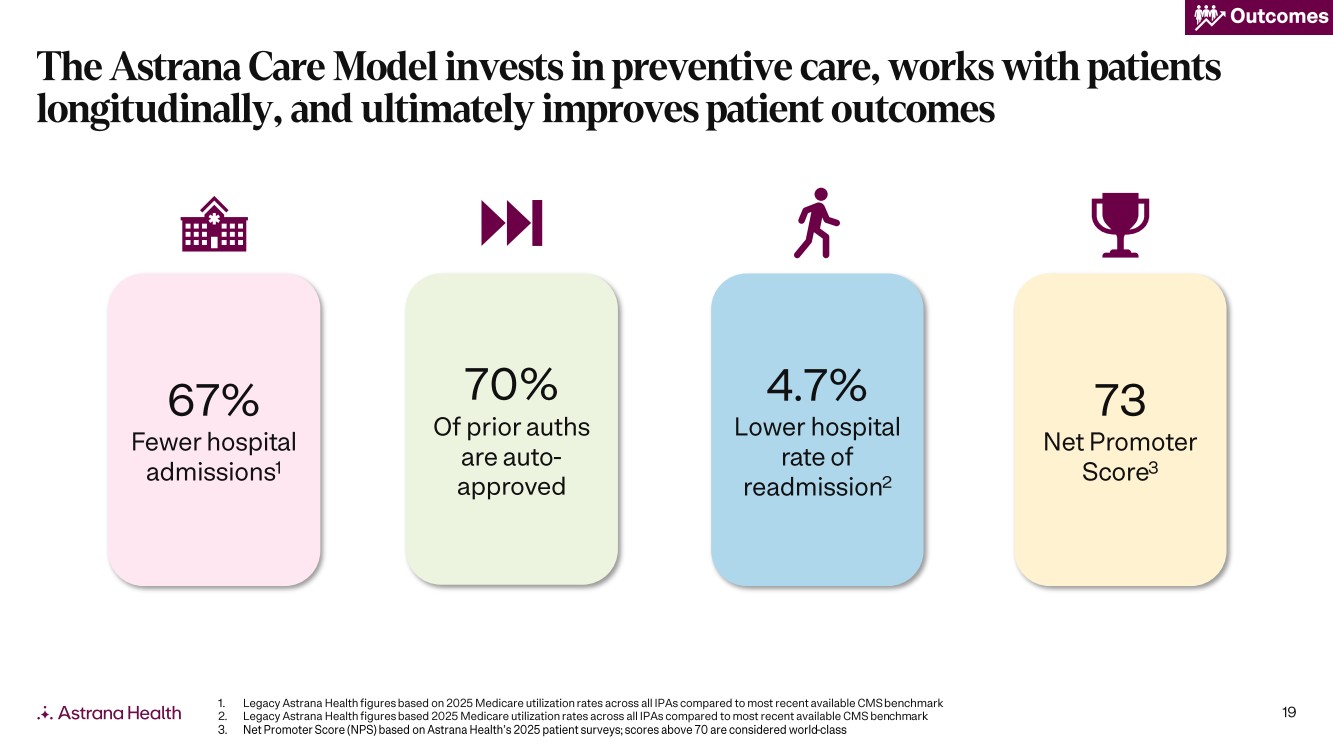

| 19 73 Net Promoter Score 3 4.7% Lower hospital rate of readmission 2 67% Fewer hospital admissions 1 70% Of prior auths are auto - approved Outcomes 1. Legacy Astrana Health figures based on 2025 Medicare utilization rates across all IPAs compared to most recent available CMS ben chmark 2. Legacy Astrana Health figures based 2025 Medicare utilization rates across all IPAs compared to most recent available CMS ben chm ark 3. Net Promoter Score (NPS) based on Astrana Health’s 2025 patient surveys; scores above 70 are considered world -class The Astrana Care Model invests in preventive care, works with patients longitudinally, and ultimately improves patient outcomes |

| 20 Outcomes and Cost: Achieving superior patient outcomes and care quality while managing cost Membership Growth : Sustainably growing membership to bring better care to more Americans Revenue Per Member Growth : Increasing alignment with patient outcomes through responsible risk progression in value -based arrangements Operating Leverage: Driving operating excellence across our business through our Care Enablement suite The Astrana playbook is focused on the execution of our 4 pillars strategy |

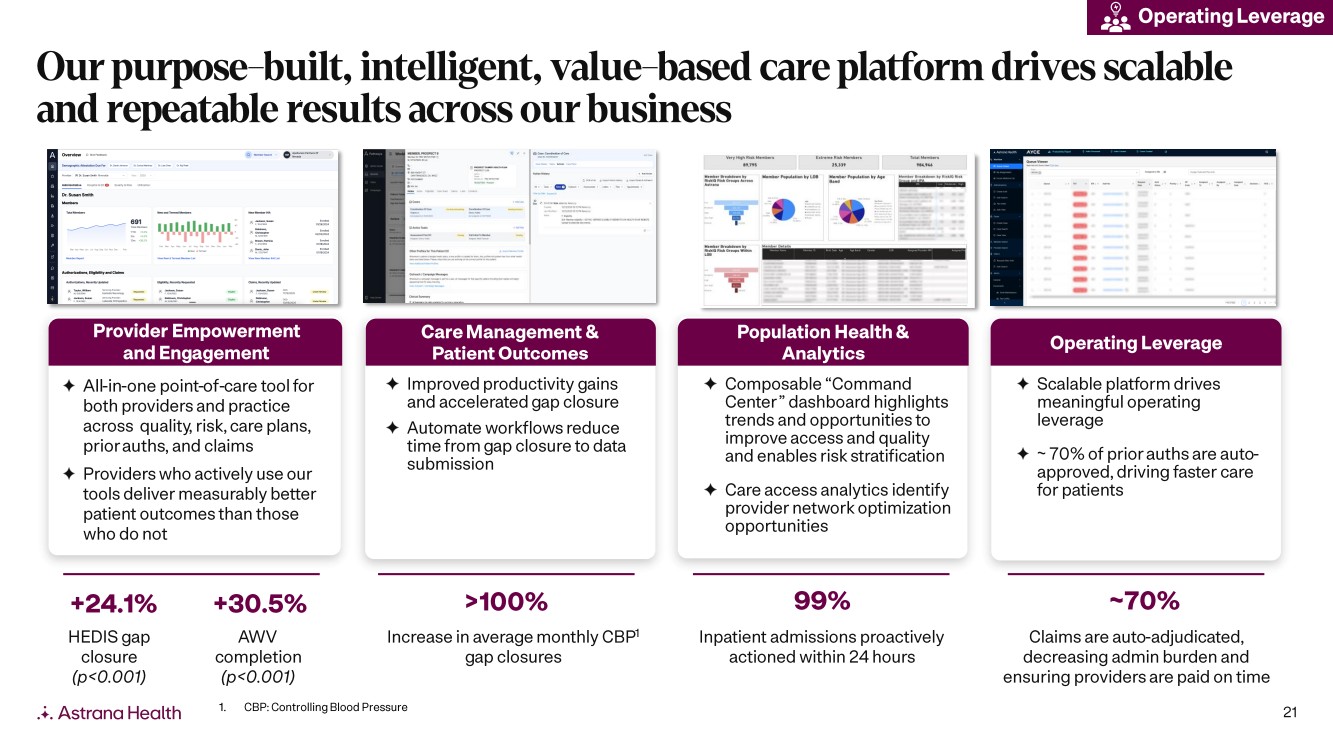

| 21 Provider Empowerment and Engagement All-in-one point -of-care tool for both providers and practice across quality, risk, care plans, prior auths , and claims Providers who actively use our tools deliver measurably better patient outcomes than those who do not Care Management & Patient Outcomes Improved productivity gains and accelerated gap closure Automate workflows reduce time from gap closure to data submission Population Health & Analytics Composable “Command Center” dashboard highlights trends and opportunities to improve access and quality and enables risk stratification Care access analytics identify provider network optimization opportunities Operating Leverage Scalable platform drives meaningful operating leverage ~ 70% of prior auths are auto - approved, driving faster care for patients Our purpose - built, intelligent, value - based care platform drives scalable and repeatable results across our business +24.1% >100% 99% ~70% HEDIS gap closure (p<0.001) Increase in average monthly CBP 1 gap closures Inpatient admissions proactively actioned within 24 hours Claims are auto -adjudicated, decreasing admin burden and ensuring providers are paid on time 1. CBP: Controlling Blood Pressure Operating Leverage +30.5% AWV completion (p<0.001) |

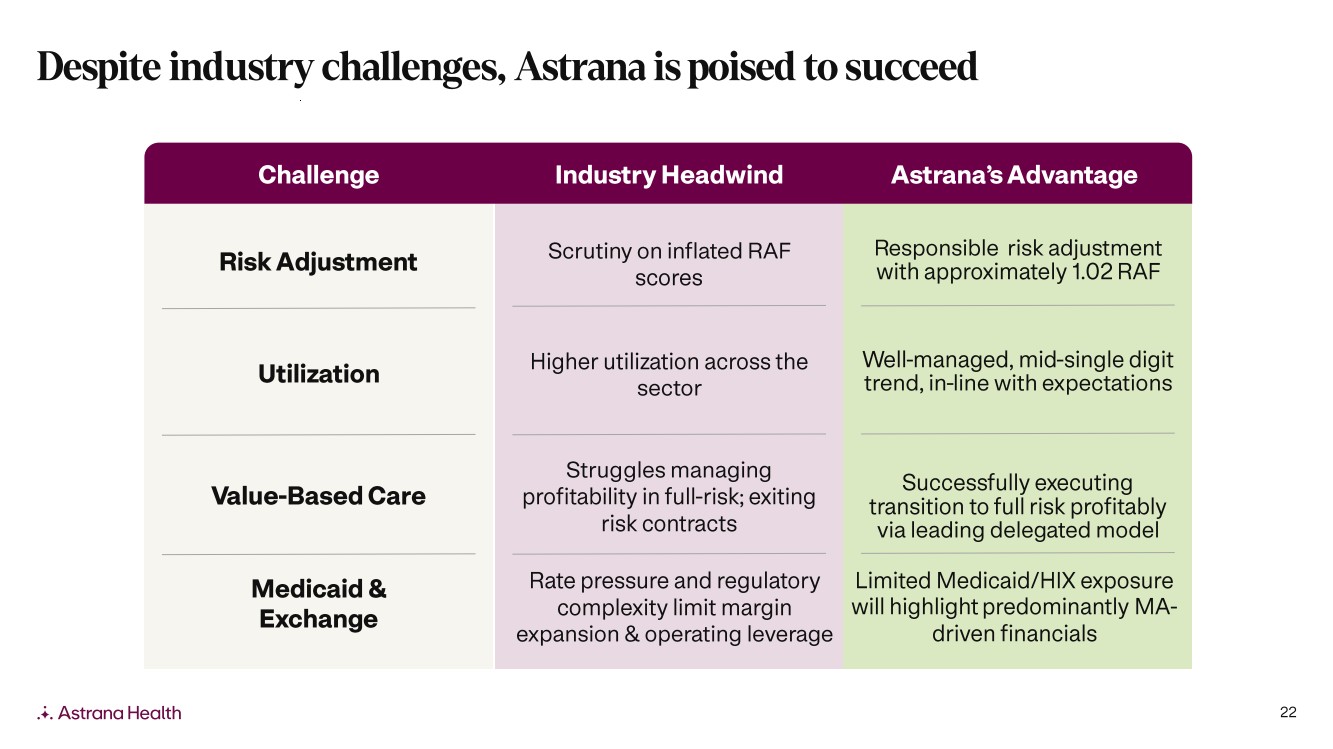

| 22 Challenge Industry Headwind Astrana’s Advantage Risk Adjustment Utilization Value -Based Care Scrutiny on inflated RAF scores Higher utilization across the sector Struggles managing profitability in full -risk; exiting risk contracts Responsible risk adjustment with approximately 1.02 RAF Well-managed, mid -single digit trend, in -line with expectations Successfully executing transition to full risk profitably via leading delegated model Medicaid & Exchange Rate pressure and regulatory complexity limit margin expansion & operating leverage Limited Medicaid/HIX exposure will highlight predominantly MA - driven financials Despite industry challenges, Astrana is poised to succeed |

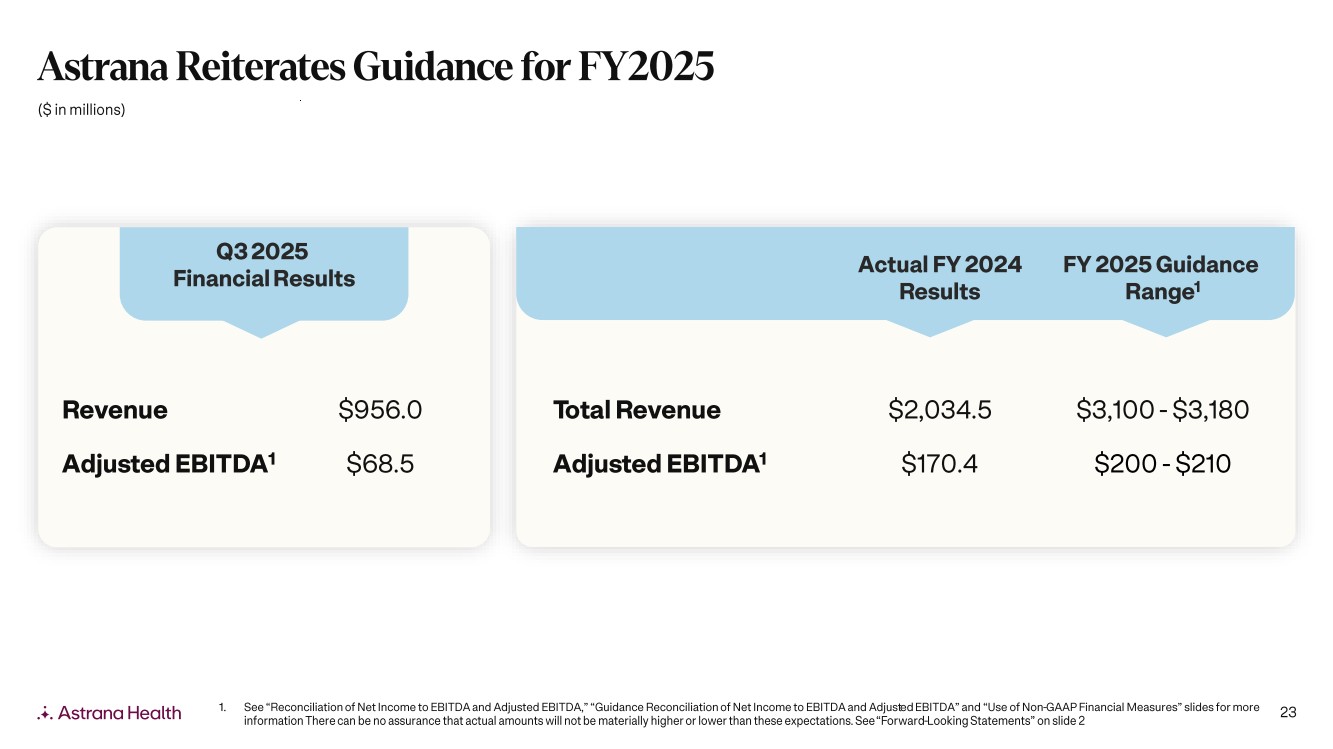

| 23 Q3 202 5 Financial Results 1. See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA,” “Guidance Reconciliation of Net Income to EBITDA and Adjust ed EBITDA” and “Use of Non -GAAP Financial Measures” slides for more information There can be no assurance that actual amounts will not be materially higher or lower than these expectations. See “Forward -Looking Statements” on slide 2 ($ in millions) Actual FY 2024 Results FY 2025 Guidance Range 1 Total Revenue $2,034.5 $3,100 - $3,180 Adjusted EBITDA 1 $170.4 $200 - $210 Revenue $956.0 Adjusted EBITDA 1 $68.5 Astrana Reiterates Guidance for FY2025 |

| 24 16 Markets ~1.6M VBC Members 20k+ Providers Membership Growth Outcomes and Cost Care Partners Care Delivery Care Enablement Operating Leverage Revenue Per Member Growth Building the premier, patient - centered healthcare platform for all |

| 25 Appendix |

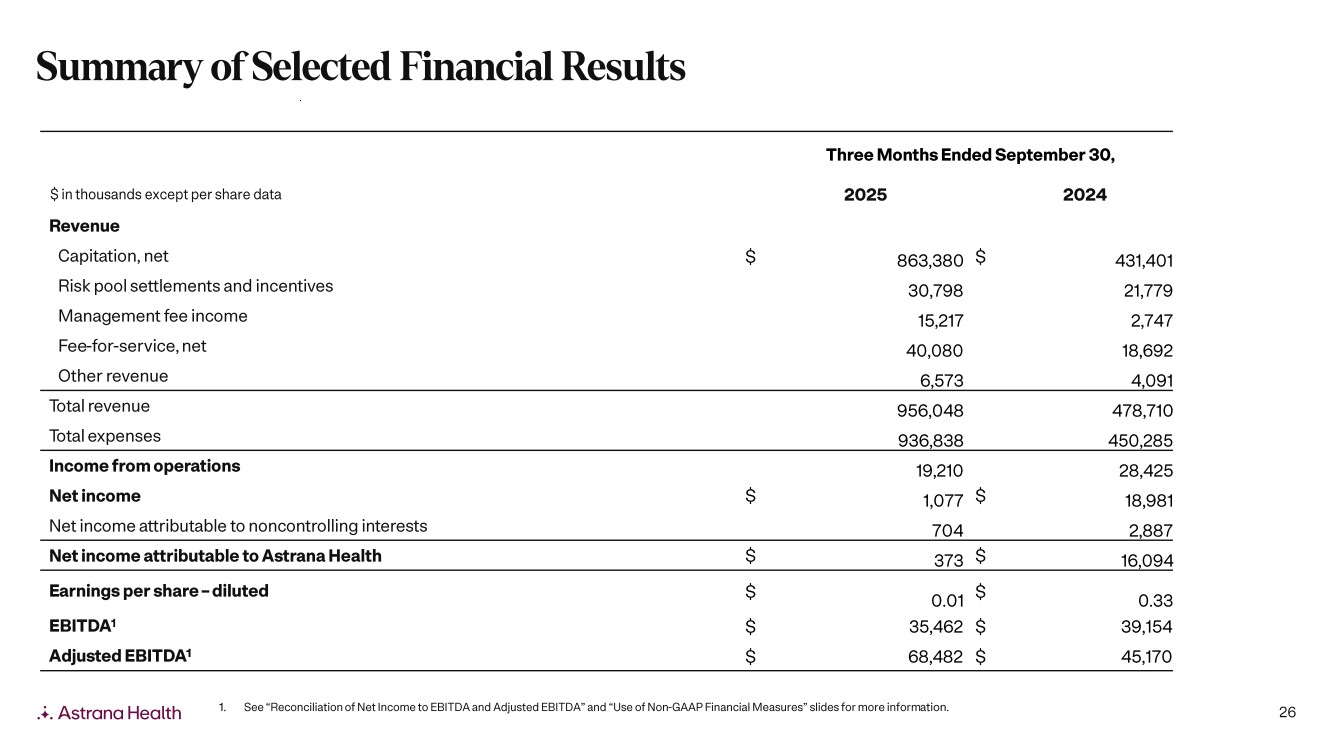

| 26 Three Months Ended September 30, $ in thousands except per share data 2025 2024 Revenue Capitation, net $ 863,380 $ 431,401 Risk pool settlements and incentives 30,798 21,779 Management fee income 15,217 2,747 Fee -for-service, net 40,080 18,692 Other revenue 6,573 4,091 Total revenue 956,048 478,710 Total expenses 936,838 450,285 Income from operations 19,210 28,425 Net income $ 1,077 $ 18,981 Net income attributable to noncontrolling interests 704 2,887 Net income attributable to Astrana Health $ 373 $ 16,094 Earnings per share – diluted $ 0.01 $ 0.33 EBITDA 1 $ 35,462 $ 39,154 Adjusted EBITDA 1 $ 68,482 $ 45,170 1. See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA” and “Use of Non -GAAP Financial Measures” slides for more inform ation. Summary of Selected Financial Results |

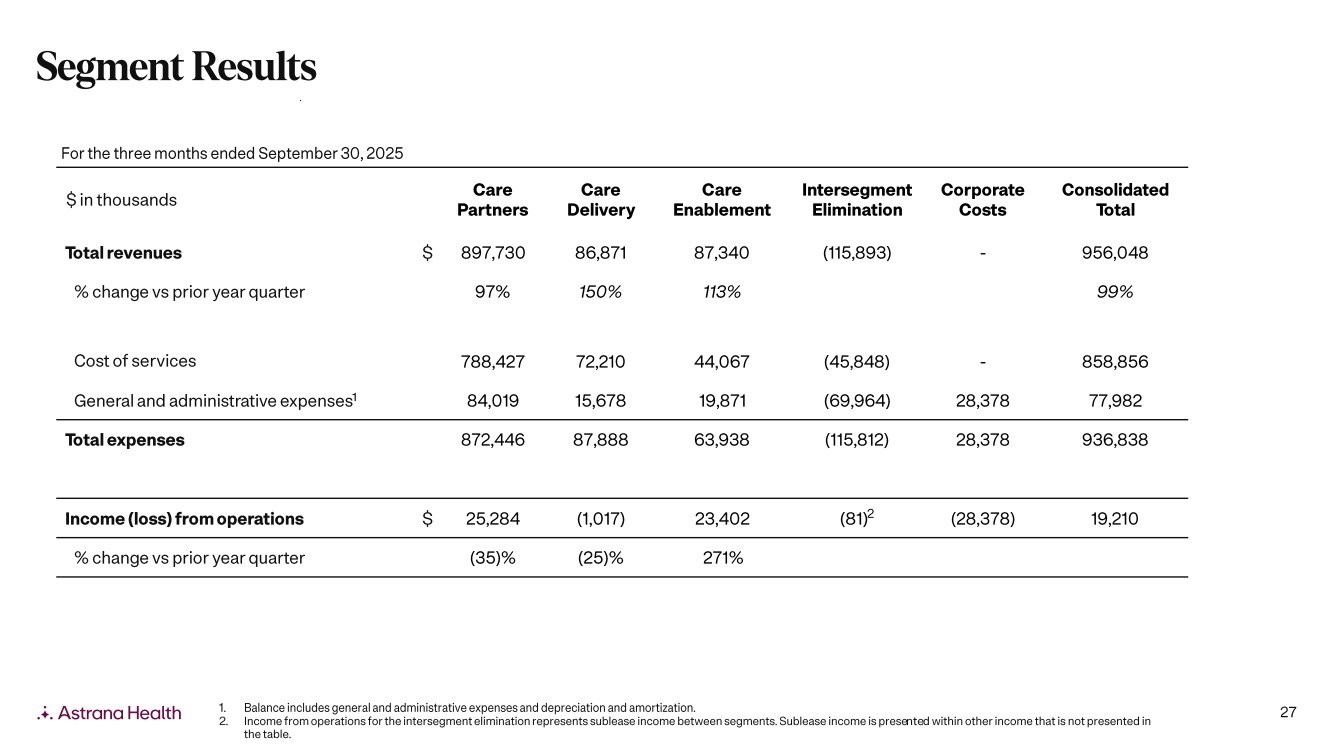

| 27 $ in thousands Care Partners Care Delivery Care Enablement Intersegment Elimination Corporate Costs Consolidated Total Total revenues $ 897,730 86,871 87,340 (115,893) - 956,048 % change vs prior year quarter 97% 150% 113% 99% Cost of services 788,427 72,210 44,067 (45,848) - 858,856 General and administrative expenses 1 84,019 15,678 19,871 (69,964) 28,378 77,982 Total expenses 872,446 87,888 63,938 (115,812) 28,378 936,838 Income (loss) from operations $ 25,284 (1,017) 23,402 (81)2 (28,378) 19,210 % change vs prior year quarter (35)% (25)% 271% For the three months ended September 30, 2025 1. Balance includes general and administrative expenses and depreciation and amortization. 2. Income from operations for the intersegment elimination represents sublease income between segments. Sublease income is prese nte d within other income that is not presented in the table. Segment Results |

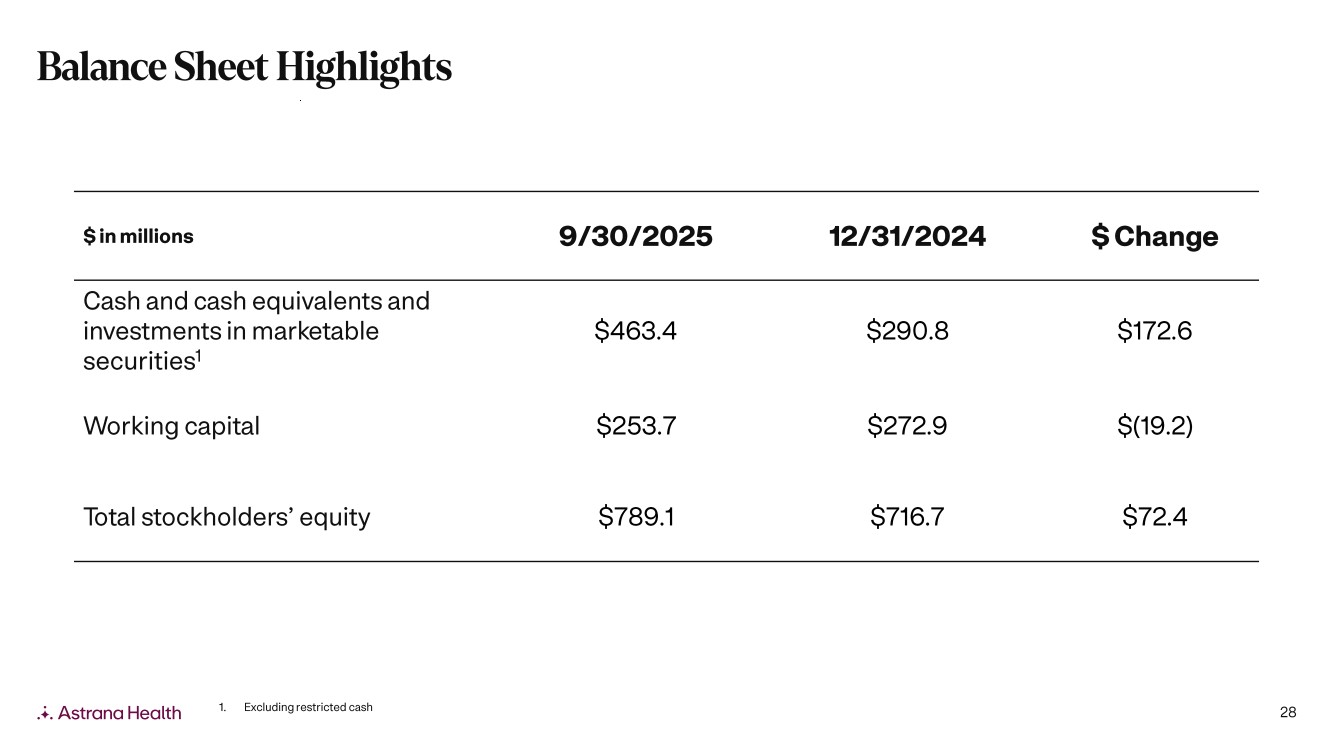

| 28 $ in millions 9/30/2025 12/31/2024 $ Change Cash and cash equivalents and investments in marketable securities 1 $463.4 $290.8 $172.6 Working capital $253.7 $272.9 $(19.2) Total stockholders’ equity $789.1 $716.7 $72.4 1. Excluding restricted cash Balance Sheet Highlights |

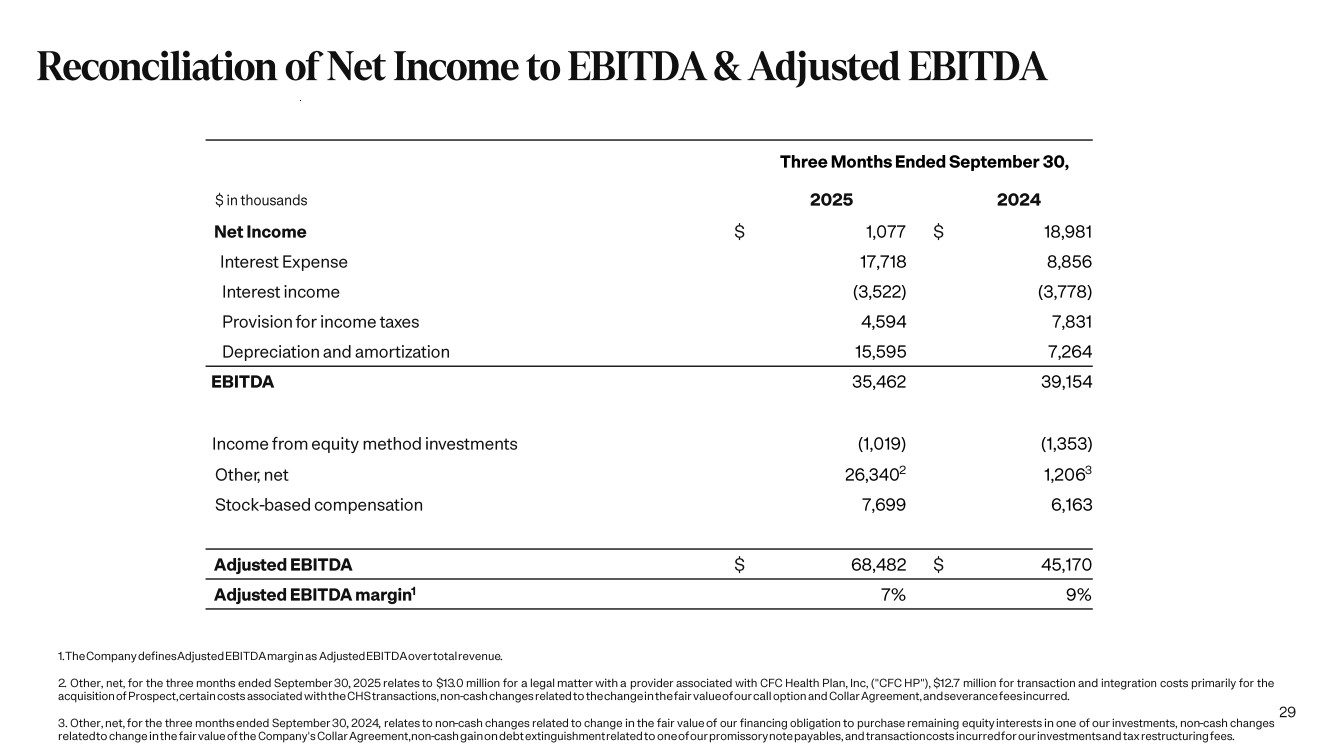

| 29 Three Months Ended September 30, $ in thousands 2025 2024 Net Income $ 1,077 $ 18,981 Interest Expense 17,718 8,856 Interest income (3,522) (3,778) Provision for income taxes 4,594 7,831 Depreciation and amortization 15,595 7,264 EBITDA 35,462 39,154 Income from equity method investments (1,019) (1,353) Other, net 26,340 2 1,206 3 Stock -based compensation 7,699 6,163 Adjusted EBITDA $ 68,482 $ 45,170 Adjusted EBITDA margin 1 7% 9% 1.The Company defines Adjusted EBITDA margin as Adjusted EBITDA over total revenue . 2. Other, net, for the three months ended September 30 , 2025 relates to $13.0 million for a legal matter with a provider associated with CFC Health Plan, Inc, ("CFC HP"), $12.7 million for transaction and integration costs primarily for the acquisition of Prospect, certain costs associated with the CHS transactions, non -cash changes related to the change in the fair value of our call option and Collar Agreement, and severance fees incurred . 3. Other, net, for the three months ended September 30 , 2024 , relates to non -cash changes related to change in the fair value of our financing obligation to purchase remaining equity interests in one of our investments, non -cash changes related to change in the fair value of the Company's Collar Agreement, non -cash gain on debt extinguishment related to one of our promissory note payables, and transaction costs incurred for our investments and tax restructuring fees . Reconciliation of Net Income to EBITDA & Adjusted EBITDA |

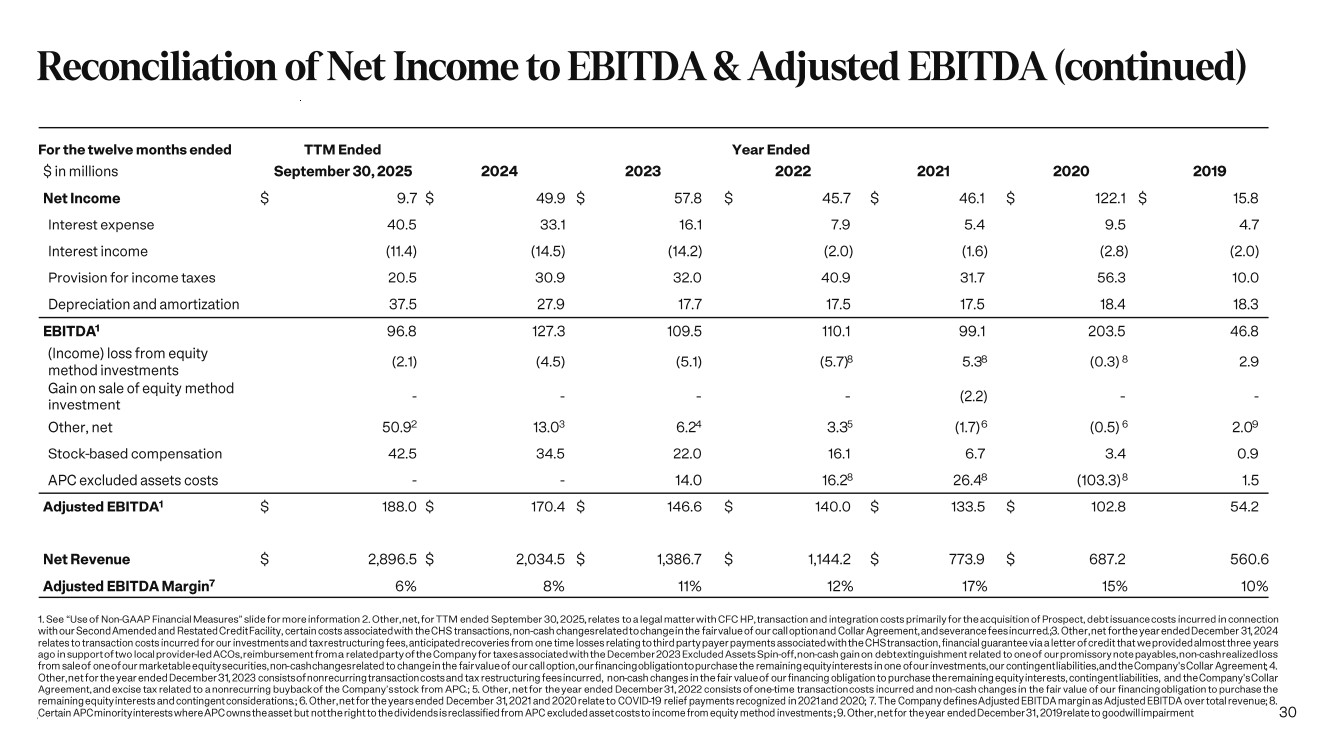

| 30 For the twelve months ended TTM Ended Year Ended $ in millions September 30, 2025 2024 2023 2022 2021 2020 2019 Net Income $ 9.7 $ 49.9 $ 57.8 $ 45.7 $ 46.1 $ 122.1 $ 15.8 Interest expense 40.5 33.1 16.1 7.9 5.4 9.5 4.7 Interest income (11.4) (14.5) (14.2) (2.0) (1.6) (2.8) (2.0) Provision for income taxes 20.5 30.9 32.0 40.9 31.7 56.3 10.0 Depreciation and amortization 37.5 27.9 17.7 17.5 17.5 18.4 18.3 EBITDA 1 96.8 127.3 109.5 110.1 99.1 203.5 46.8 (Income) loss from equity method investments (2.1) (4.5) (5.1) (5.7) 8 5.3 8 (0.3) 8 2.9 Gain on sale of equity method investment - - - - (2.2) - - Other, net 50.9 2 13.03 6.2 4 3.3 5 (1.7)6 (0.5) 6 2.0 9 Stock -based compensation 42.5 34.5 22.0 16.1 6.7 3.4 0.9 APC excluded assets costs - - 14.0 16.28 26.4 8 (103.3) 8 1.5 Adjusted EBITDA 1 $ 188.0 $ 170.4 $ 146.6 $ 140.0 $ 133.5 $ 102.8 54.2 Net Revenue $ 2,896.5 $ 2,034.5 $ 1,386.7 $ 1,144.2 $ 773.9 $ 687.2 560.6 Adjusted EBITDA Margin 7 6% 8% 11% 12% 17% 15% 10% 1. See “Use of Non -GAAP Financial Measures” slide for more information 2. Other, net, for TTM ended September 30 , 2025 , relates to a legal matter with CFC HP, transaction and integration costs primarily for the acquisition of Prospect, debt issuance costs incurred in connection with our Second Amended and Restated Credit Facility, certain costs associated with the CHS transactions, non -cash changes related to change in the fair value of our call option and Collar Agreement, and severance fees incurred .;3. Other, net for the year ended December 31, 2024 relates to transaction costs incurred for our investments and tax restructuring fees, anticipated recoveries from one time losses relating to third party payer payments associated with the CHS transaction, financial guarantee via a letter of credit that we provided almost three years ago in support of two local provider -led ACOs, reimbursement from a related party of the Company for taxes associated with the December 2023 Excluded Assets Spin -off, non -cash gain on debt extinguishment related to one of our promissory note payables, non -cash realized loss from sale of one of our marketable equity securities, non -cash changes related to change in the fair value of our call option, our financing obligation to purchase the remaining equity interests in one of our investments, our contingent liabilities, and the Company's Collar Agreement ; 4. Other, net for the year ended December 31, 2023 consists of nonrecurring transaction costs and tax restructuring fees incurred, non -cash changes in the fair value of our financing obligation to purchase the remaining equity interests, contingent liabilities, and the Company's Collar Agreement, and excise tax related to a nonrecurring buyback of the Company’s stock from APC .; 5. Other, net for the year ended December 31, 2022 consists of one -time transaction costs incurred and non -cash changes in the fair value of our financing obligation to purchase the remaining equity interests and contingent considerations .; 6. Other, net for the years ended December 31, 2021 and 2020 relate to COVID -19 relief payments recognized in 2021 and 2020 ; 7. The Company defines Adjusted EBITDA margin as Adjusted EBITDA over total revenue ; 8. Certain APC minority interests where APC owns the asset but not the right to the dividends is reclassified from APC excluded asset costs to income from equity method investments ; 9.Other, net for the year ended December 31, 2019 relate to goodwill impairment Reconciliation of Net Income to EBITDA & Adjusted EBITDA (continued) |

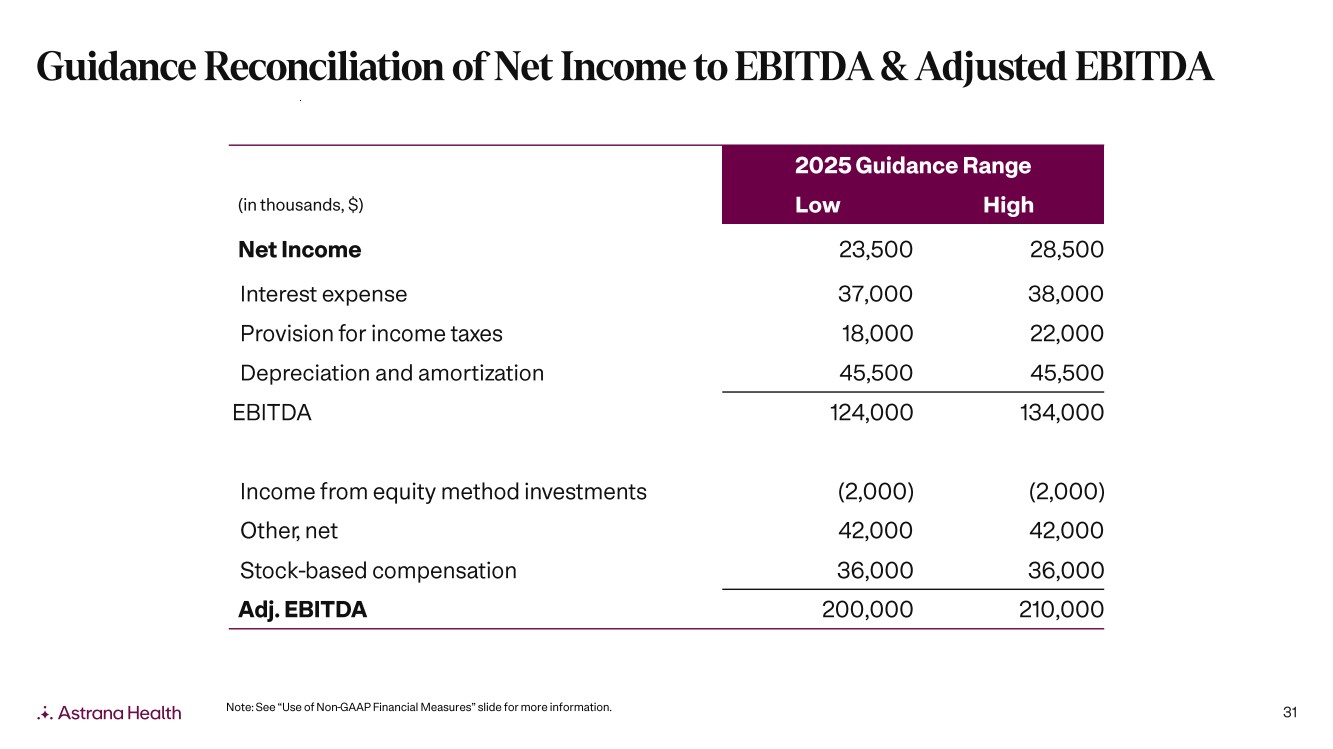

| 31 Note: See “Use of Non -GAAP Financial Measures” slide for more information. 2025 Guidance Range (in thousands, $) Low High Net Income 23,500 28,500 Interest expense 37,000 38,000 Provision for income taxes 18,000 22,000 Depreciation and amortization 45,500 45,500 EBITDA 124,000 134,000 Income from equity method investments (2,000) (2,000) Other, net 42,000 42,000 Stock -based compensation 36,000 36,000 Adj. EBITDA 200,000 210,000 Guidance Reconciliation of Net Income to EBITDA & Adjusted EBITDA |

| Investor Relations grant.hesser@astranahealth.com |