EXHIBIT 99.1

Published on October 3, 2019

Exhibit 99.1

Cantor Fitzgerald Global Healthcare Conference October 2019

2 Forward Looking Statements This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27A of the Securities Act and Section 21E of the Exchange Act about Apollo Medical Holdings, Inc. and its subsidiaries and variab le interest entities (the “Company” or “ApolloMed”). Forward - looking statements include any statements about the Company's business, financi al condition, operating results, plans, objectives, expectations and intentions, and any projections of earnings, revenue or oth er financial items, such as the Company's projected capitation and future liquidity, and may be identified by the use of forward - looking term s such as “anticipate,” “could,” “can,” “may,” “might,” “potential,” “predict,” “should,” “estimate,” “expect,” “project,” “believe,” “ pla n,” “envision,” “intend,” “continue,” “target,” “seek,” “will,” “would,” and the negative of such terms, other variations on such te rms or other similar or comparable words, phrases or terminology. Forward - looking statements reflect current views with respect to future eve nts and financial performance and therefore cannot be guaranteed. Such statements are based on the current expectations and certain a ssu mptions of the Company's management, and some or all of such expectations and assumptions may not materialize or may vary significant ly from actual results. Actual results may also vary materially from forward - looking statements due to risks, uncertainties and other fa ctors, known and unknown, including the risk factors described from time to time in the Company's reports to the U.S. Securities and Excha nge Commission (the “SEC”), including without limitation the risk factors discussed in the Company's Annual Report on Form 10 - K filed with the SEC on March 18, 2019 and subsequent 10 - Q filings. Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed or imp lie d in any forward - looking statements, you should not place undue reliance on any such forward - looking statements. Further, any forward - loo king statement speaks only as of the date of this presentation and, unless legally required, the Company does not undertake any ob lig ation to update any forward - looking statement, as a result of new information, future events or otherwise. This presentation does not con stitute an offer to sell or buy securities, and no offer or sale will be made in any state or jurisdiction in which such offer or sale w oul d be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

3 ApolloMed Team Kenneth Sim, M.D. Executive Chairman Co - Chief Executive Officer Thomas S. Lam, M.D, M.P.H. Co - Chief Executive Officer President Eric Chin Chief Financial Officer

4 Investment Highlights Patient - centric, physician - led organization focused on outcomes - based medical care Multiple growth avenues in a large and growing market driven by the shift to value - based care Primary care and specialist physician networks that create market alignment and care management opportunities Proprietary care management and technology capabilities to facilitate integrated care for population health management Track record of strong financial performance through cost - effective, outcomes - based care in risk - bearing model Clinically experienced management team with deep understanding of managing physicians

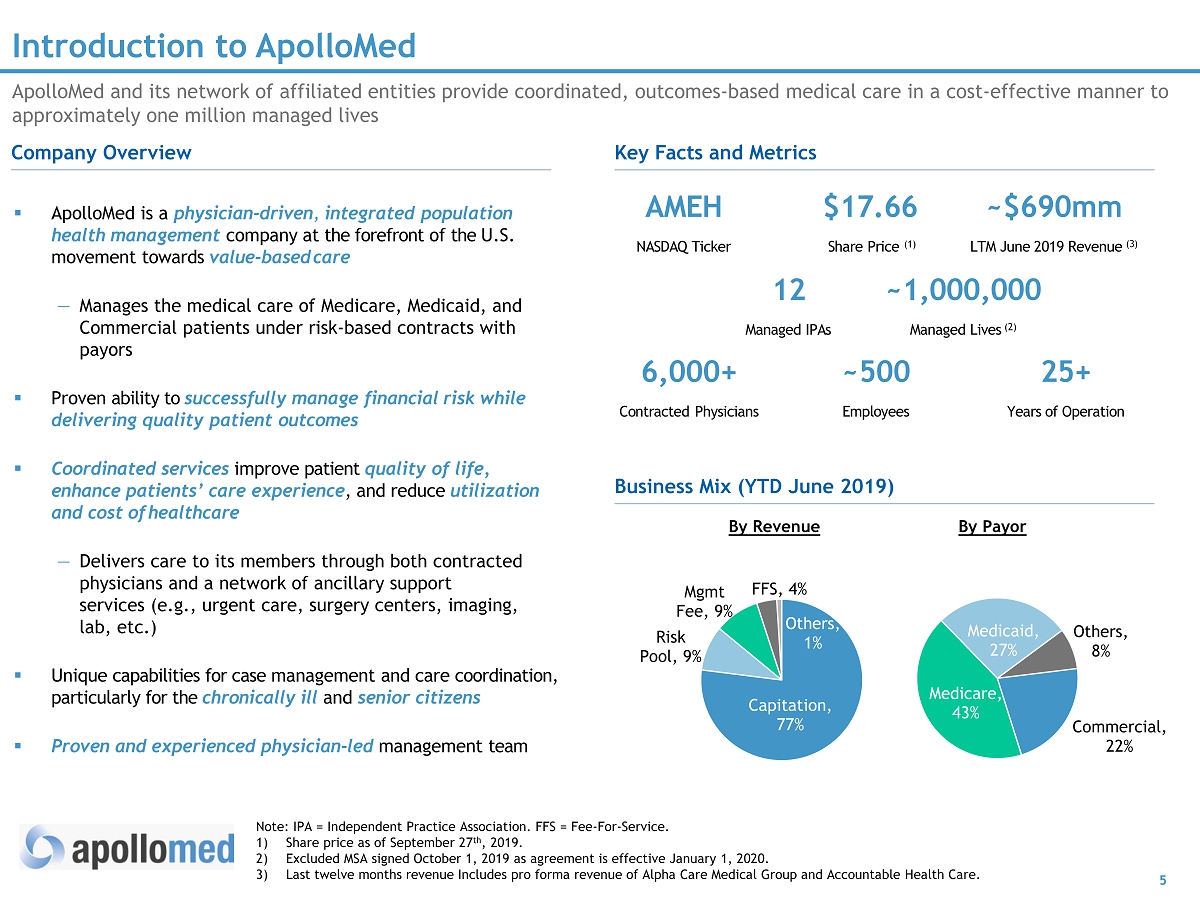

5 Introduction to ApolloMed Note: IPA = Independent Practice Association. FFS = Fee - For - Service. 1) Share price as of September 27 th , 2019 . 2) Excluded MSA signed October 1, 2019 as agreement is effective January 1, 2020. 3) Last twelve months revenue Includes pro forma revenue of Alpha Care Medical Group and Accountable Health Care. ApolloMed and its network of affiliated entities provide coordinated, outcomes - based medical care in a cost - effective manner to approximately one million managed lives ▪ ApolloMed is a physician - driven , integrated population health management company at the forefront of the U.S. movement towards value - based care — Manages the medical care of Medicare, Medicaid, and Commercial patients under risk - based contracts with payors ▪ Proven ability to successfully manage financial risk while delivering quality patient outcomes ▪ Coordinated services improve patient quality of life, enhance patients’ c a re experience , and reduce utilization and cost of healthcare — Delivers care to its members through both contracted physicians and a network of ancillary support services (e.g., urgent care, surgery centers, imaging , lab, etc .) ▪ Unique capabilities for case management and care coordination , particularly for the chronically ill and senior citizens ▪ Proven and experienced p hysician - led managemen t team Key Facts and Metrics AM E H N AS D A Q Tic ke r $ 1 7 . 66 S h a r e P r ic e ( 1 ) ~ 1,000 , 00 0 Ma n a ge d L iv e s (2) 12 Ma n a ge d I P A s ~ 500 E m p lo yee s 6 , 000 + C o nt r ac te d P hy s icia n s Business Mix (YTD June 2019) 25+ Years of Operation ~$690mm LTM June 2019 Revenue (3) By Revenue By Payor Company Overview Commercial , 22% Medicare , 43% Medicaid , 27% Others , 8% Capitation , 77% Risk Pool , 9% Mgmt Fee , 9% FFS , 4% Others , 1%

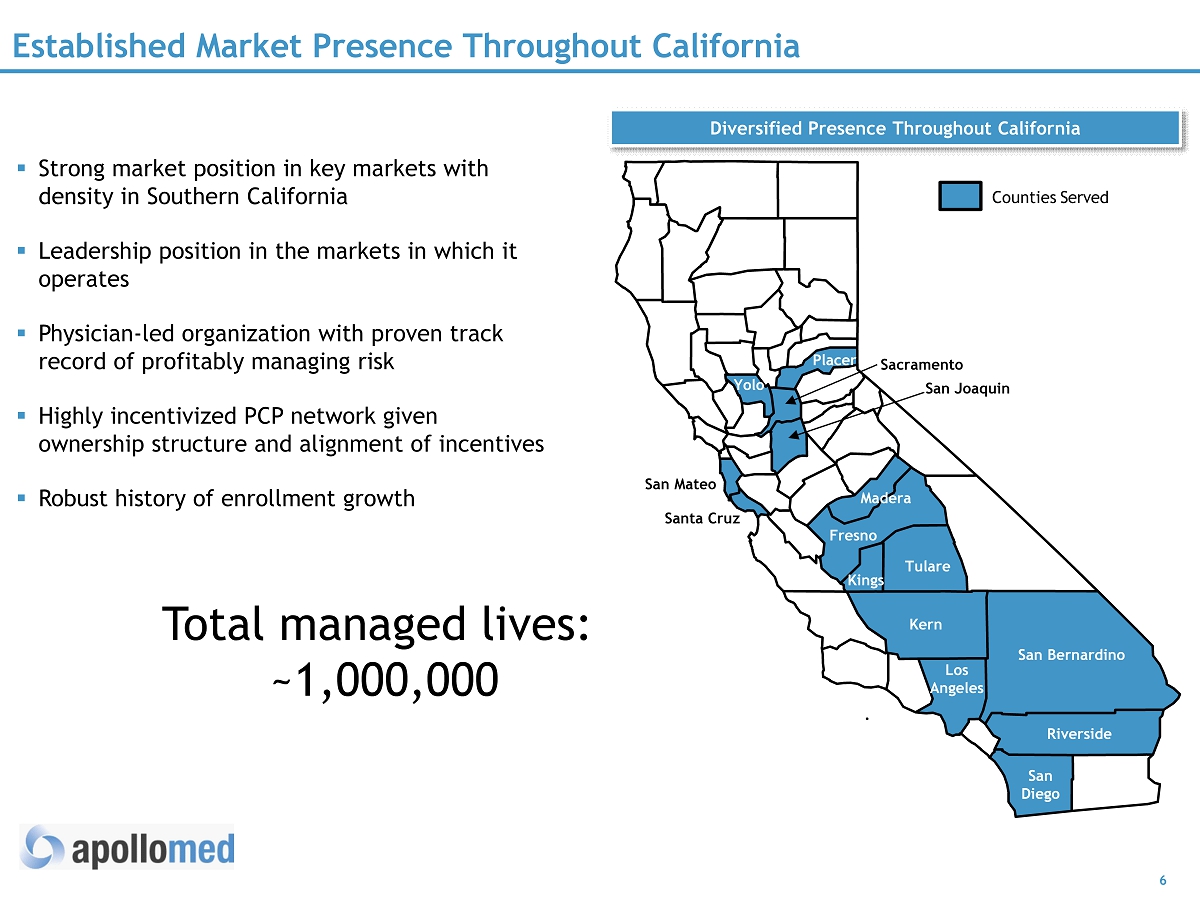

6 San Bernardino Riverside San Diego Los Angeles Kern Tulare Kings Fresno Madera Santa Cruz San Mateo Yolo Placer Sacramento San Joaquin Established Market Presence Throughout California Diversified Presence Throughout California Counties Served ▪ Strong market position in key markets with density in Southern California ▪ Leadership position in the markets in which it operates ▪ Physician - led organization with proven track record of profitably managing risk ▪ Highly incentivized PCP network given ownership structure and alignment of incentives ▪ Robust history of enrollment growth Total managed lives: ~ 1,000,000

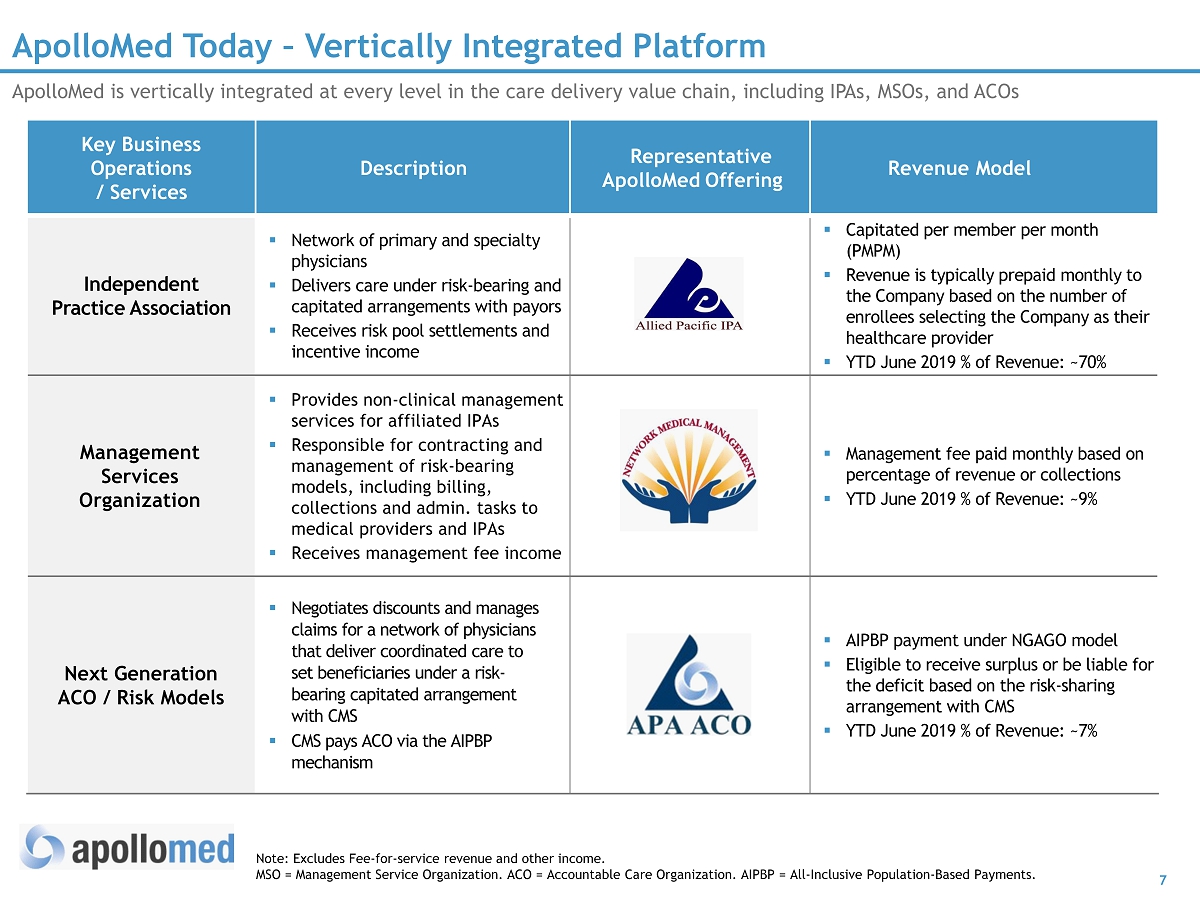

7 Key Business Operations / Services Description Representative ApolloMe d Offering Revenue Model Independent Practice Association ▪ Network of primary and specialty physicians ▪ Delivers care under risk - bearing and capitated arrangements with payors ▪ Receives risk pool settlements and incentive income ▪ Capitated per member per month (PMPM) ▪ Revenue is typically prepaid monthly to the Company based on the number of enrollees selecting the Company as their healthcare provider ▪ YTD June 2019 % of Revenue: ~70% Management Services Organization ▪ Provides non - clinical management services for affiliated IPAs ▪ Responsible for contracting and management of risk - bearing models, including billing, collections and admin. tasks to medical providers and IPAs ▪ Receives management fee income ▪ Management fee paid monthly based on percentage of revenue or collections ▪ YTD June 2019 % of Revenue: ~9% Next Generation ACO / Risk Models ▪ Negotiates discounts and manages claims for a network of physicians that deliver coordinated care to set beneficiaries under a risk - bearing capitated arrangement with CMS ▪ CMS pays ACO via the AIPBP mechanism ▪ AIPBP payment under NGAGO model ▪ Eligible to receive surplus or be liable for the deficit based on the risk - sharing arrangement with CMS ▪ YTD June 2019 % of Revenue: ~7% ApolloMed Today – Vertically Integrated Platform ApolloMed is vertically integrated at every level in the care delivery value chain, including IPAs , MSOs , and ACOs Note: Excludes Fee - for - service revenue and other income. MSO = Management Service Organization. ACO = Accountable Care Organization. AIPBP = All - Inclusive Population - Based Payments.

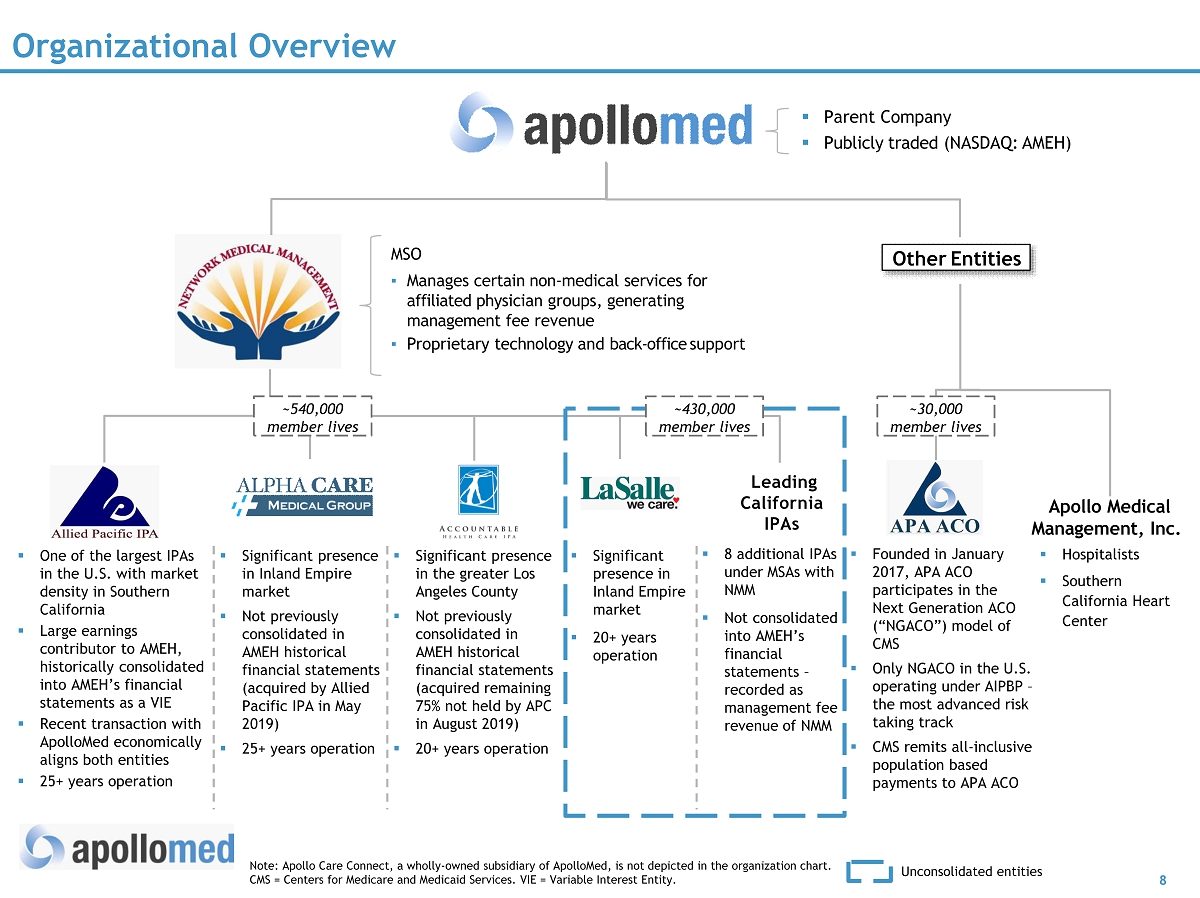

8 Note : Apollo Care Connect , a wholly - owned subsidiary of ApolloMed, is not depicted in the organization chart. CMS = Centers for Medicare and Medicaid Services. VIE = Variable Interest Entity . Organizational Overview Unconsolidated entities Other Entities ▪ One of the largest IPAs in the U.S. with market density in Southern California ▪ Large earnings contributor to AMEH, historically consolidated into AMEH’s financial statements as a VIE ▪ Recent transaction with ApolloMed economically aligns both entities ▪ 25 + years operation ▪ Significant presence in Inland Empire market ▪ Not previously consolidated in AMEH historical financial statements ( acquired by Allied Pacific IPA in May 2019) ▪ 25+ years operation Apollo Medical Management, Inc. ▪ Parent Company ▪ Publicly traded (NASDAQ: AMEH) ▪ Founded in January 2017, APA ACO participates in the Next Generation ACO (“ NGACO”) model of CMS ▪ Only NGACO in the U.S. operating under AIPBP – the most advanced risk taking track ▪ CMS remits all - inclusive population based payments to APA ACO ▪ Hospitalists ▪ Southern California Heart Center MSO ▪ Manages certain non - medical services for affiliated physician groups, generating management fee revenue ▪ Proprietary technology and back - office support ▪ 8 additional IPAs under MSAs with NMM ▪ Not consolidated into AMEH’s financial statements – recorded as management fee revenue of NMM Leading California IPAs ▪ Significant presence in the greater Los Angeles County ▪ Not previously consolidated in AMEH historical financial statements (acquired remaining 75% not held by APC in August 2019) ▪ 20+ years operation ▪ Significant presence in Inland Empire market ▪ 20+ years operation ~430,000 member lives ~540,000 member lives ~30,000 member lives

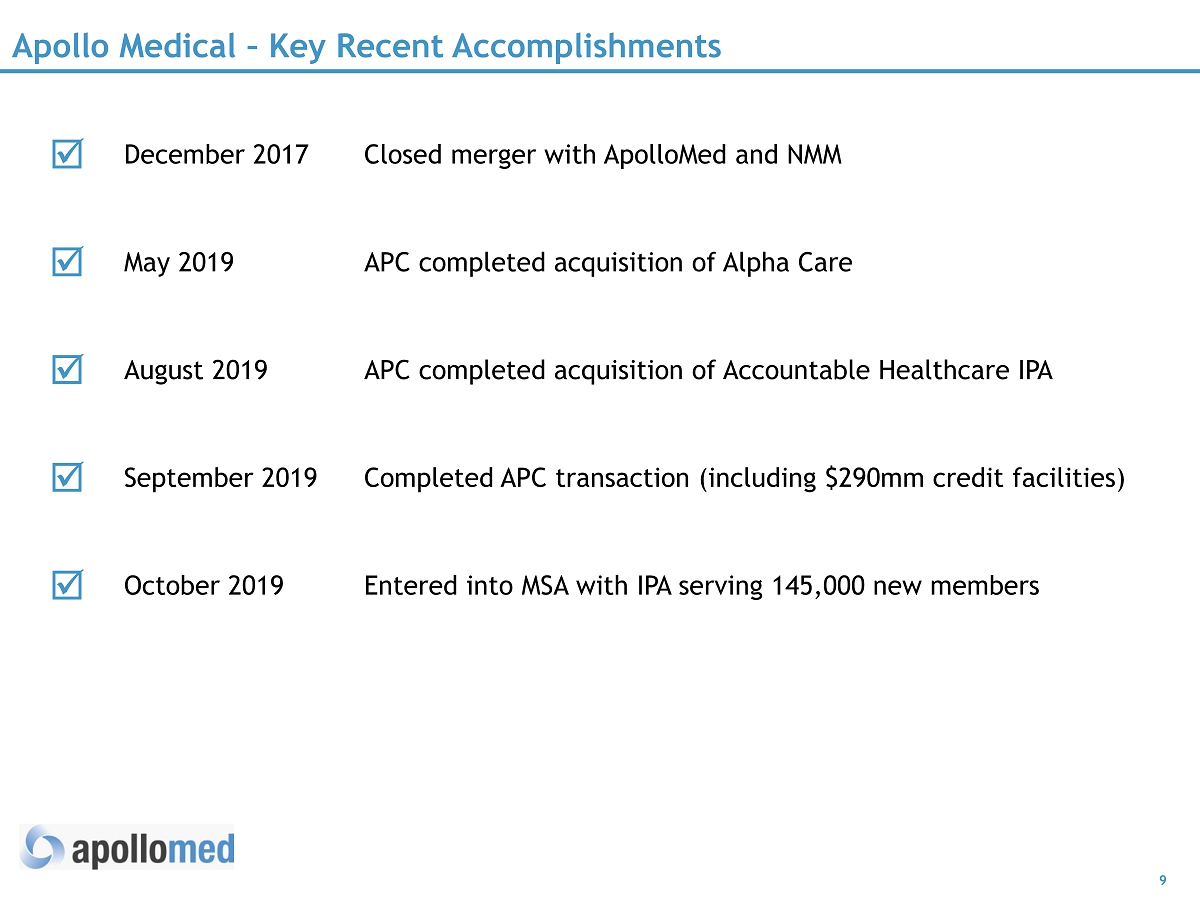

9 Apollo Medical – Key Recent Accomplishments December 2017 Closed merger with ApolloMed and NMM May 2019 APC completed acquisition of Alpha Care August 2019 APC completed acquisition of Accountable Healthcare IPA September 2019 Completed APC transaction (including $290mm credit facilities) October 2019 Entered into MSA with IPA serving 145,000 new members

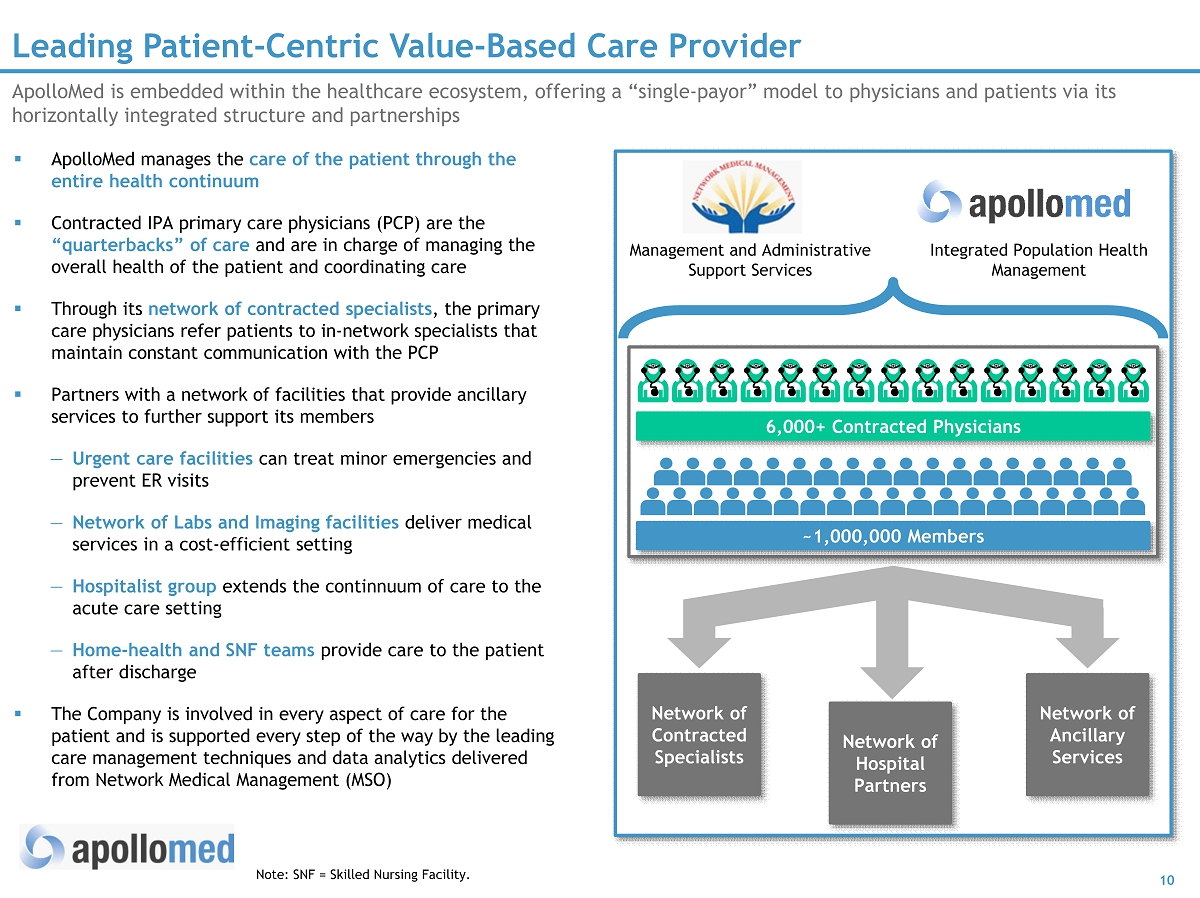

10 Leading Patient - Centric Value - Based Care Provider Note: SNF = Skilled Nursing Facility. ApolloMed is embedded within the healthcare ecosystem, offering a “ single - payor ” model to physicians and patients via its horizontally integrated structure and partnerships ▪ ApolloMed manages the care of the patient through the entire health continuum ▪ Contracted IPA primary care physicians (PCP) are the “quarterbacks” of care and are in charge of managing the overall health of the patient and coordinating care ▪ Through its network of contracted specialists , the primary care physicians refer patients to in - network specialists that maintain constant communication with the PCP ▪ Partners with a network of facilities that provide ancillary services to further support its members — Urgent care facilities can treat minor emergencies and prevent ER visits — Network of Labs and Imaging facilities deliver medical services in a cost - efficient setting — Hospitalist group extends the continnuum of care to the acute care setting — Home - health and SNF teams provide care to the patient after discharge ▪ The Company is involved in every aspect of care for the patient and is supported every step of the way by the leading care management techniques and data analytics delivered from Network Medical Management (MSO) Network of Contracted Specialists Network of Hospital Partners Network of Ancillary Services 6,000+ Contracted Physicians ~1,000,000 Members Management and Administrative Support Services Integrated Population Health Management

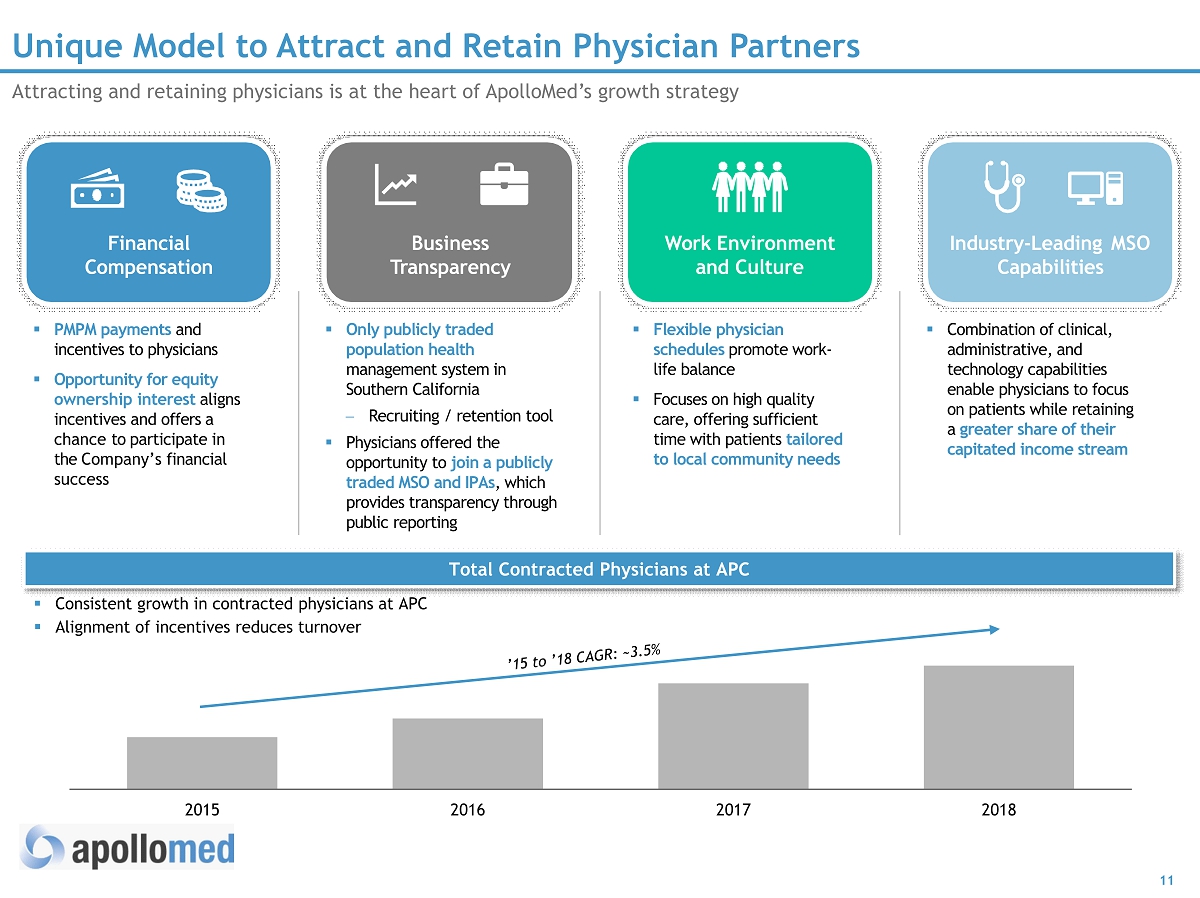

11 2015 2016 2017 2018 ▪ Combination of clinical, administrative, and technology capabilities enable physicians to focus on patients while retaining a greater share of their capitated income stream ▪ Flexible physician schedules promote work - life balance ▪ Focuses on high quality care, offering sufficient time with patients tailored to local community needs Unique Model to Attract and Retain Physician Partners Attracting and retaining physicians is at the heart of ApolloMed’s growth strategy Business Transparency Financial Compensation Work Environment and Culture Industry - Leading MSO Capabilities ▪ PMPM payments and incentives to physicians ▪ Opportunity for equity ownership interest aligns incentives and offers a chance to participate in the Company’s financial success Total Contracted Physicians at APC ▪ Only publicly traded population health management system in Southern California Recruiting / retention tool ▪ Physicians offered the opportunity to join a publicly traded MSO and IPAs , which provides transparency through public reporting ▪ Consistent growth in contracted physicians at APC ▪ Alignment of incentives reduces turnover

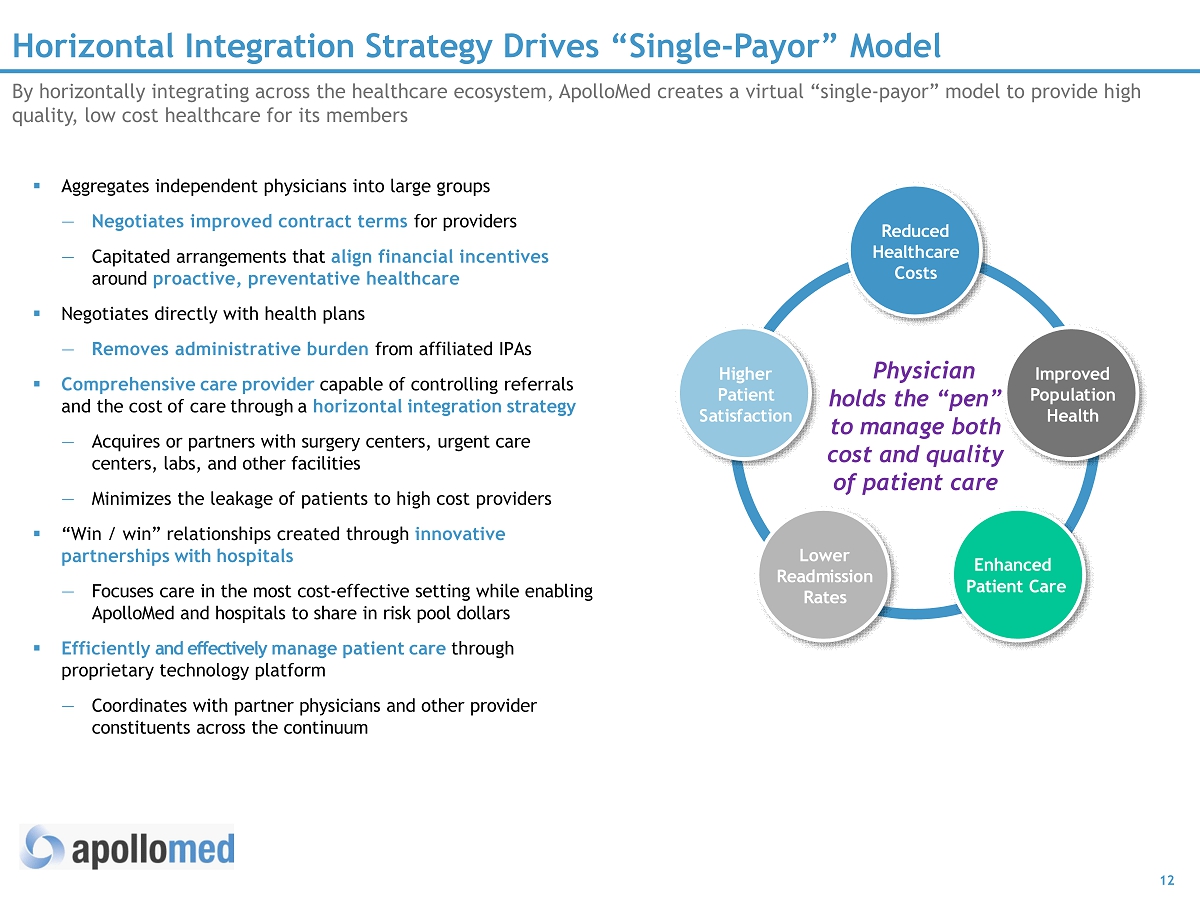

12 Horizontal Integration Strategy Drives “ Single - Payor ” Model By horizontally integrating across the healthcare ecosystem, ApolloMed creates a virtual “ single - payor ” model to provide high quality, low cost healthcare for its members Reduced H ea l t h ca r e Costs Improved P op u l a t i on Health Enhanced Patient Care Higher Patient S a t i s f ac t i on Lower R ea d m i ss i on Rates ▪ Aggregates independent physicians into large groups — Negotiates improved contract terms for providers — Capitated arrangements that align financial incentives around proactive, preventative healthcare ▪ N egotiates directly with health plans — Removes administrative burden from affiliated IPAs ▪ Comprehensive care provider capable of controlling referrals and the cost of care through a horizontal integration strategy — Acquires or partners with surgery centers, urgent care centers, labs, and other facilities — M inimizes the leakage of patients to high cost providers ▪ “Win / win” relationships created through innovative partnerships with hospitals — Focuses care in the most cost - effective setting while enabling ApolloMed and hospitals to share in risk pool dollars ▪ Efficiently and effectively manage patient care through proprietary technology platform — Coordinates with partner physicians and other provider constituents across the continuum Physician holds the “pen” to manage both cost and quality of patient care

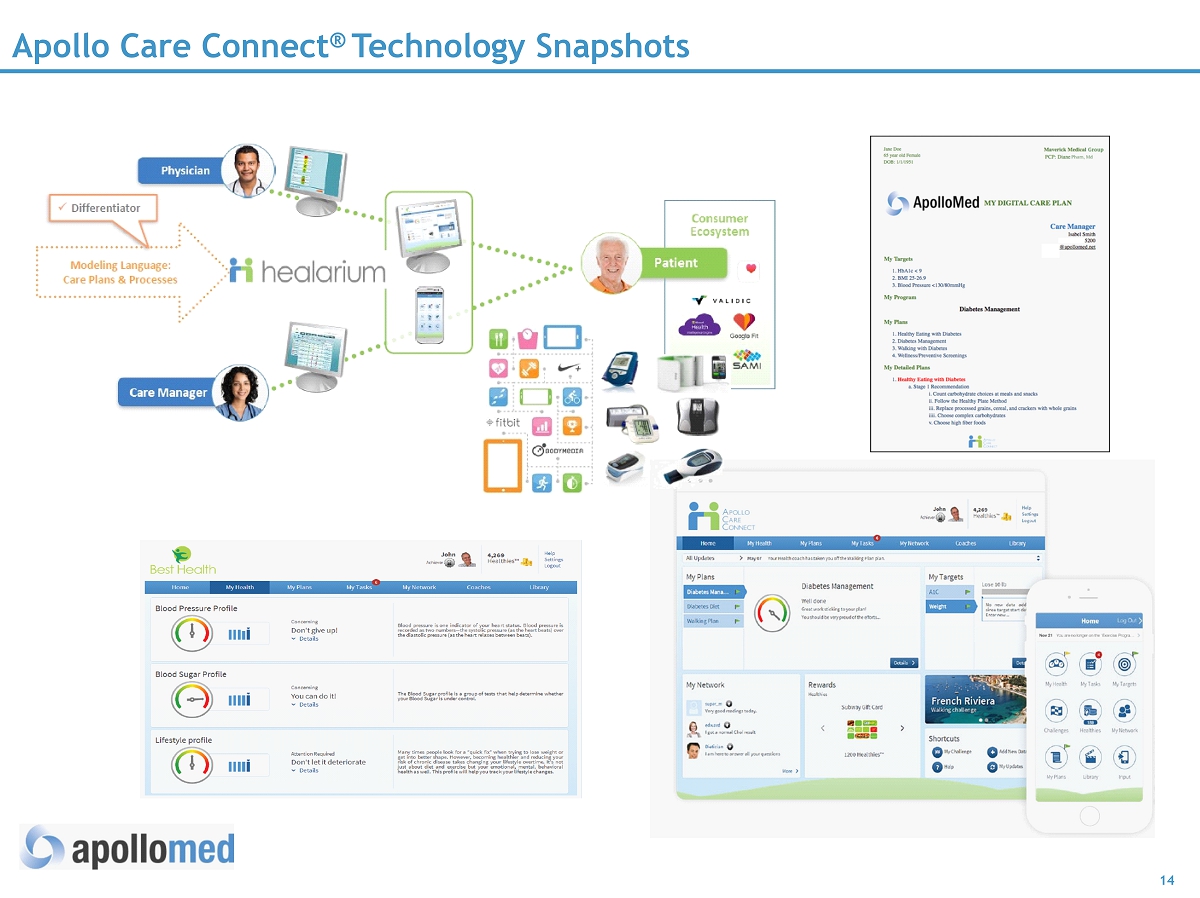

13 ApolloMed’s Technology Platform – Apollo Care Connect ® ▪ Emphasis on chronic care management and high - risk patient management ▪ Integrates with and captures clinical data from multiple EHRs, wearables and other tracking devices ▪ Flexible platform allows for easy integration with other internal and 3 rd party analytical tools ▪ Health risk assessments and surveys Population Health Management Patient Engagement ▪ Continuing investment in the next generation technology in preventative care ▪ Partnership with genetic company for preemptive testing Preventative Care Extensive and proprietary technology provides a competitive advantage around risk - based healthcare ▪ Robust mobile platform with Chat, SMS Text, Push Notifications, and Email capabilities ▪ Real - time communication between physicians/case managers and patients ▪ Interactive Personal Health Assistant with decision support, recommendations, and actionable tasks ▪ User - friendly Care Plan Wizard to easily create and modify care plans without additional coding Note: EHR = Electronic Health Record. Apollo Care Connect ® Offers Key Differentiation f rom a Pure Services - Centric Model

14 Apollo Care Connect ® Technology Snapshots

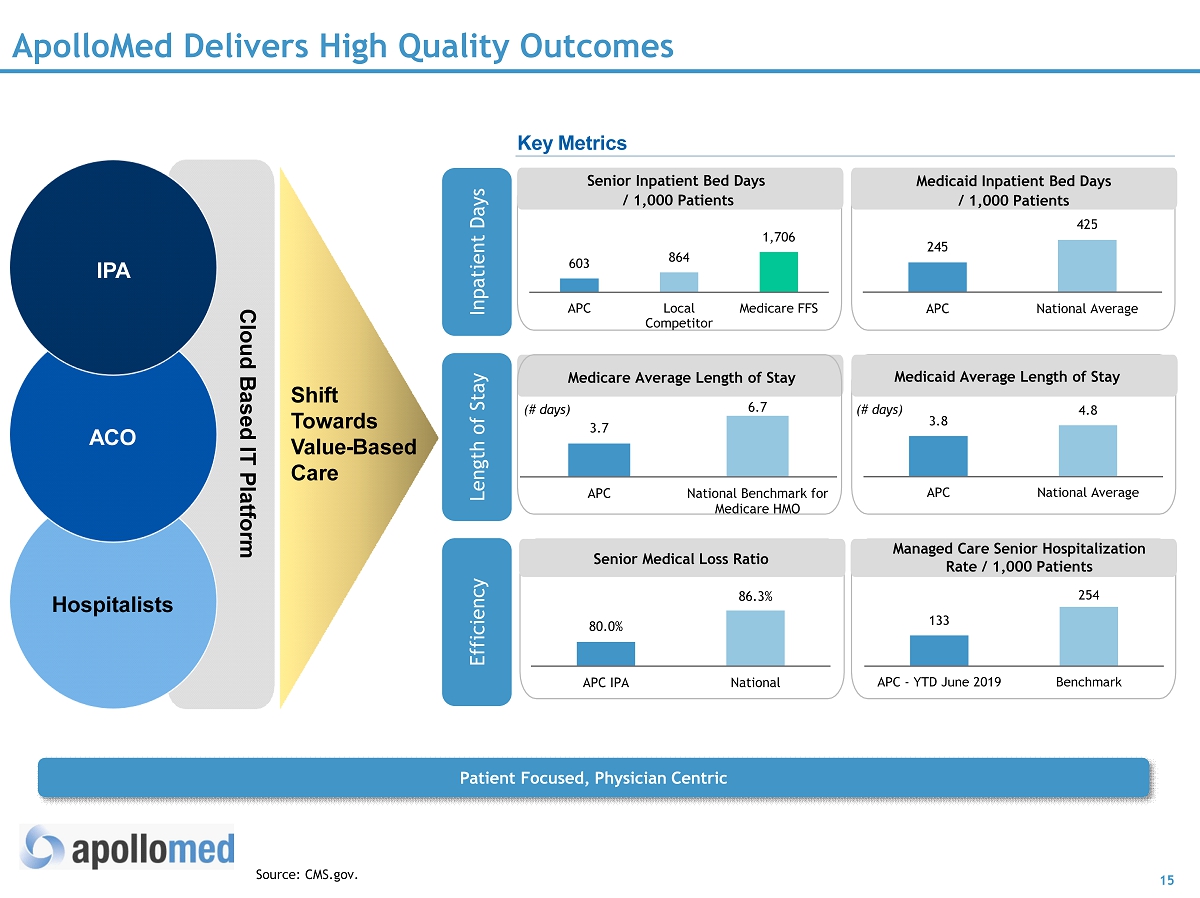

15 80.0% 86.3% APC IPA National ApolloMed Delivers High Quality Outcomes Cloud Based IT Platform Hospitalists A CO IPA Shift T owards Value - Based Care Key Metrics Patient Focused , Physician Centric Senior Inpatient Bed Days / 1,000 Patients 603 864 1,706 APC Local Competitor Medicare FFS * Senior Medical Loss Ratio 3.8 4.8 APC National Average 245 425 APC National Average Medicaid Inpatient Bed Days / 1,000 Patients 133 254 APC - YTD June 2019 Benchmark (# days) (# days) Source: CMS.gov. Managed Care Senior Hospitalization Rate / 1,000 Patients Medicaid Average Length of Stay Inpatient Days Length of Stay Efficiency 3.7 6.7 APC National Benchmark for Medicare HMO Medicare Average Length of Stay

16 Experienced Management Team with a History of Success Name Title Year Joined Apollo Med Background Kenneth Sim, M.D. Executive Chairman and Co - CEO 2006 ▪ Also serves as Chairman of APC ▪ Holds bachelor’s degree from UCLA and M.D. from Loma Linda University School of Medicine and the Autonomous University of Guadalajara, Guadalajara, Mexico ▪ General surgeon Thomas S. Lam, M.D., M.P.H. Co - CEO and President 2005 ▪ Member of AMEH’s Board of Directors since 2016, CEO and CFO of APC since 2014 ▪ Previously CEO and board member of NMM ▪ Received medical training from New York Medical College and gastroenterology training from Georgetown University Eric Chin Chief Financial Officer 2018 ▪ Previously served as Chief Financial Officer of NMM, Controller / Head of Finance – Real Estate of Public Storage, Inc., Assistant Vice President of Financial Reporting at Alexandria REIT and Assurance Senior Manager at E&Y ▪ 17+ years of financial experience ▪ Holds a B.A. from UCLA and is a licensed CPA Hing Ang Chief Operating Officer 2007 ▪ Previously served as Senior Director of Operations of NMM ▪ Fellow of the Association of Chartered Certified Accountants in England and a licensed CPA Adrian Vazquez, M.D. Chief Medical Officer 2001 ▪ Previously served as President and Chairman of the Board of ApolloMed prior to the NMM merger and co - founder of ApolloMed Hospitalists ▪ Holds a B.S. and M.D. from UC Irvine ▪ Internal medicine specialist Albert Young, M.D. Chief Administrative Officer 2006 ▪ Holds an M.D. from West Virginia University School of Medicine and a Master’s in Public Health from UCLA; completed internal medicine residency and Fellowship in pulmonary medicine at USC Medical Center ▪ Pulmonology specialist Brandon Sim Chief Technology Officer 2019 ▪ Previously served as Quantitative Researcher at Citadel Securities and Chief Technology Officer at Theratech ▪ Holds a B.A. in Statistics and Physics and M.S. in Computer Science and Engineering from Harvard University In Addition to the Executive Management team, ApolloMed h as a Deep and Experienced Bench of Senior Managers

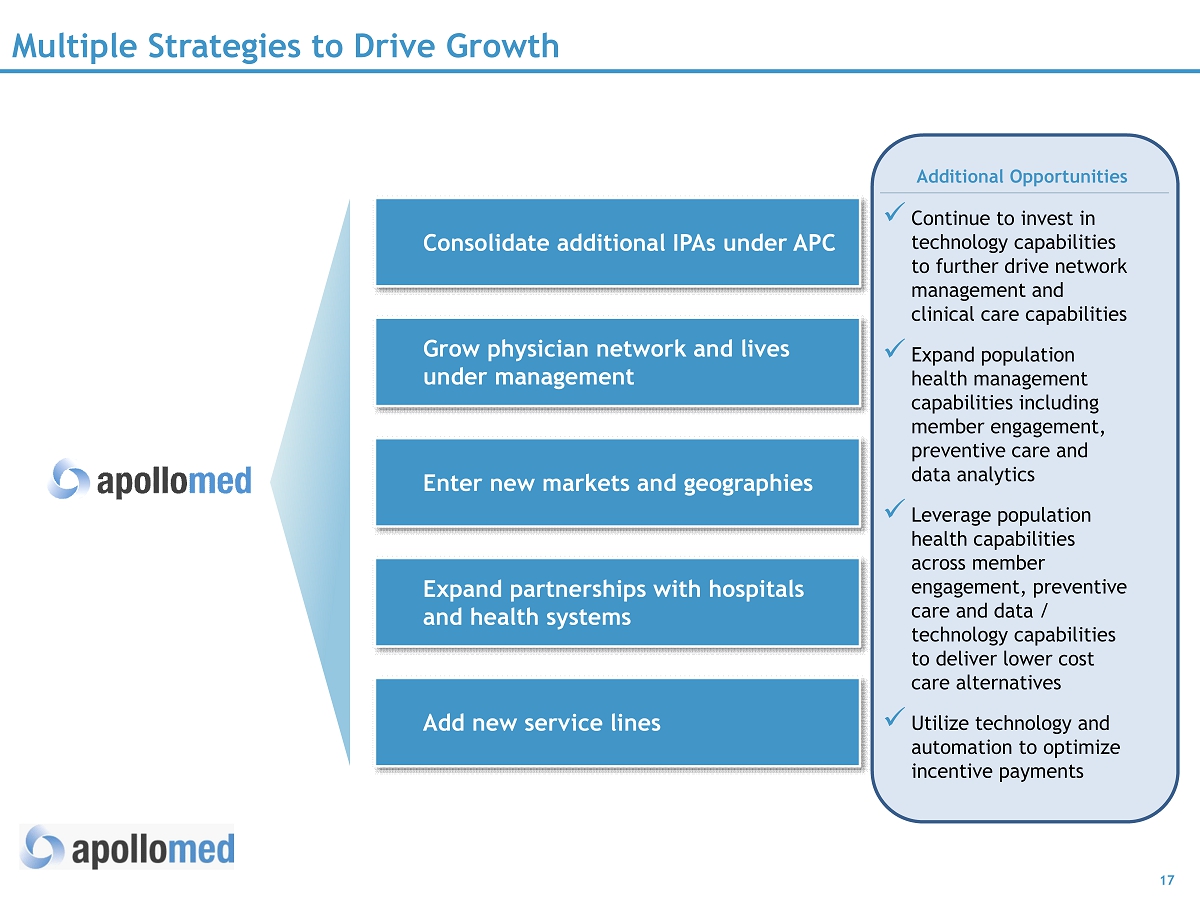

17 Multiple Strategies to Drive Growth x Continue to invest in technology capabilities to further drive network management and clinical care capabilities x Expand population health management capabilities including member engagement, preventive care and data analytics x Leverage population health capabilities across member engagement, preventive care and data / technology capabilities to deliver lower cost care alternatives x Utilize technology and automation to optimize incentive payments Additional Opportunities Grow physician network and lives under management Enter new markets and geographies Expand partnerships with hospitals and health systems Add new service lines Consolidate additional IPAs under APC

Financial Overview

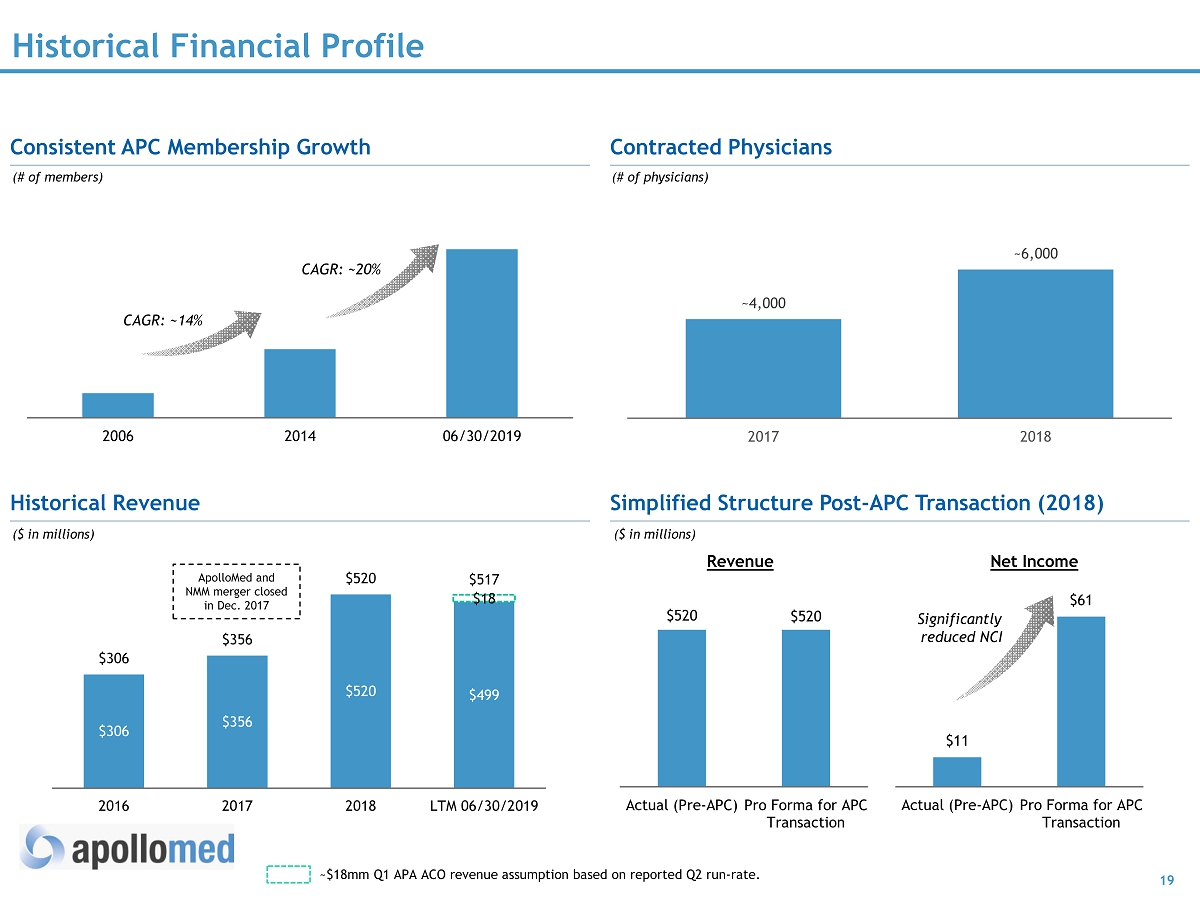

19 2006 2014 06/30/2019 Historical Financial Profile Simplified Structure Post - APC Transaction (2018) Historical Revenue Consistent APC Membership Growth Contracted Physicians $306 $356 $520 $499 $18 $306 $356 $520 $517 2016 2017 2018 LTM 06/30/2019 $11 $61 Actual (Pre-APC) Pro Forma for APC Transaction $520 $520 Actual (Pre-APC) Pro Forma for APC Transaction Significantly reduced NCI Revenue Net Income CAGR: ~14% CAGR: ~20% ApolloMed and NMM merger closed in Dec. 2017 ~$18mm Q1 APA ACO revenue assumption based on reported Q2 run - rate. (# of members) ($ in millions) ($ in millions) ~4,000 ~6,000 2017 2018 (# of physicians)

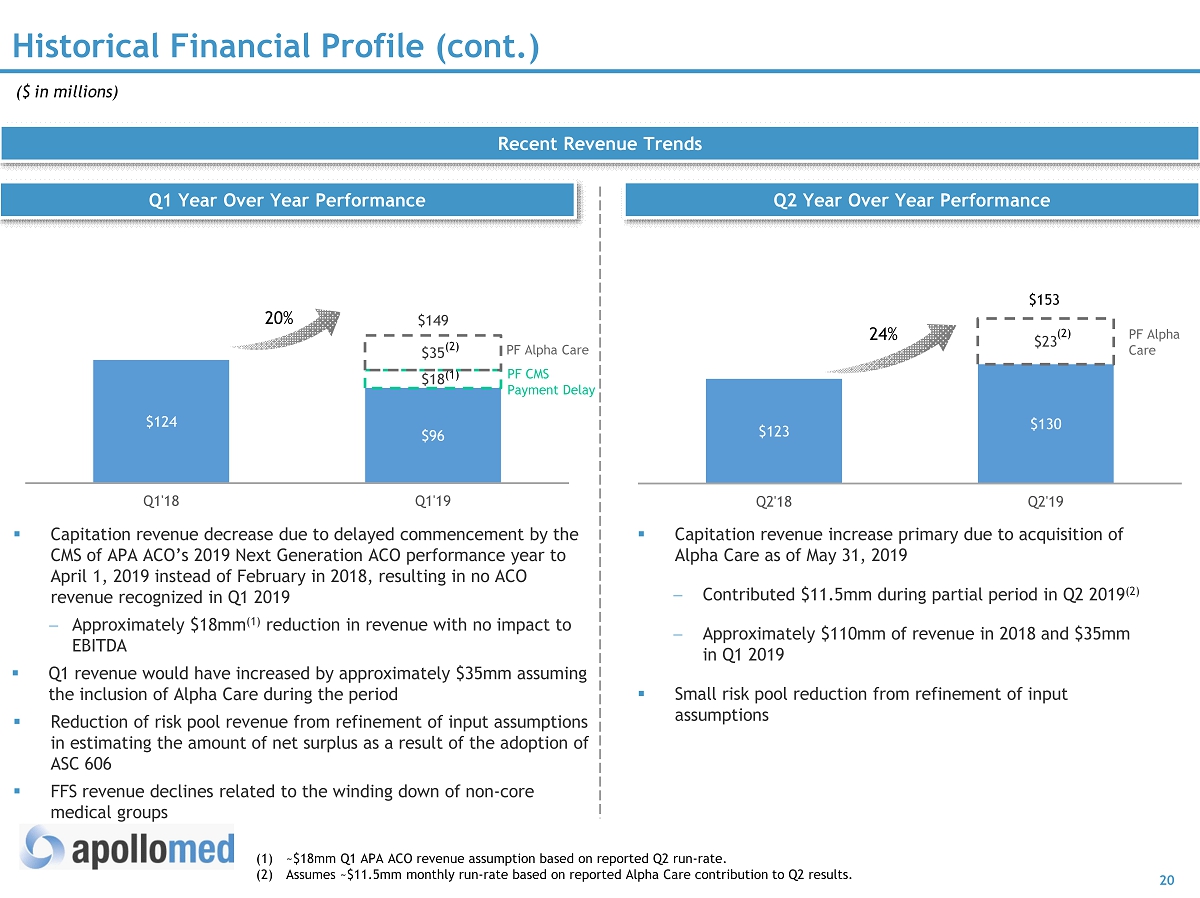

20 $124 $96 $18 $35 $149 Q1'18 Q1'19 Historical Financial Profile (cont.) ($ in millions) Recent Revenue Trends Q1 Year Over Year Performance Q2 Year Over Year Performance $123 $130 $23 Q2'18 Q2'19 $153 ▪ Capitation revenue decrease due to delayed commencement by the CMS of APA ACO’s 2019 Next Generation ACO performance year to April 1, 2019 instead of February in 2018, resulting in no ACO revenue recognized in Q1 2019 Approximately $18mm (1) reduction in revenue with no impact to EBITDA ▪ Q1 revenue would have increased by approximately $35mm assuming the inclusion of Alpha Care during the period ▪ Reduction of risk pool revenue from refinement of input assumptions in estimating the amount of net surplus as a result of the adoption of ASC 606 ▪ FFS revenue declines related to the winding down of non - core medical groups ▪ Capitation revenue increase primary due to acquisition of Alpha Care as of May 31, 2019 Contributed $11.5mm during partial period in Q2 2019 (2) Approximately $110mm of revenue in 2018 and $35mm in Q1 2019 ▪ Small risk pool reduction from refinement of input assumptions (1) ~$18mm Q1 APA ACO revenue assumption based on reported Q2 run - rate . (2) Assumes ~$11.5mm monthly run - rate based on reported Alpha Care contribution to Q2 results. PF Alpha Care PF CMS Payment Delay PF Alpha Care (2) (2) 20% 24% (1)

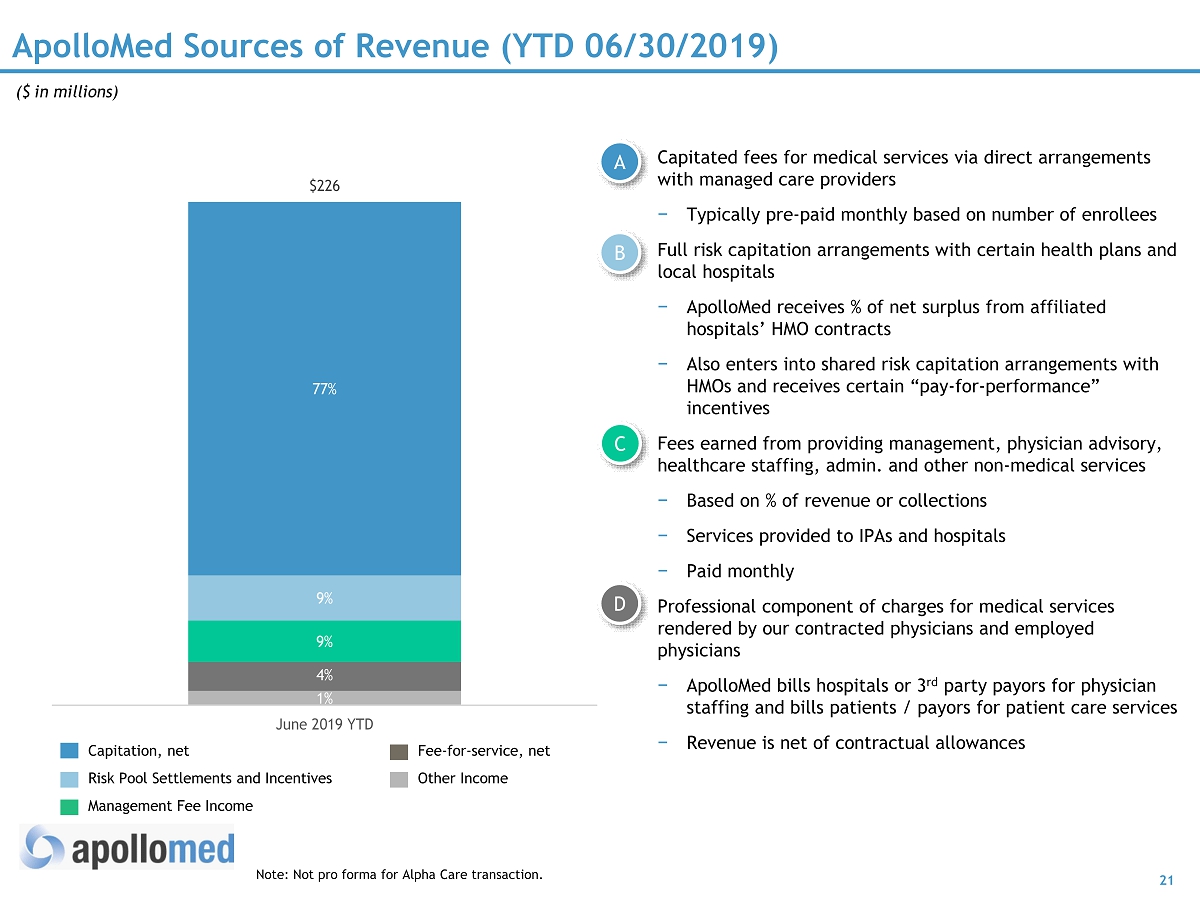

21 1% 4% 9% 9% 77% $226 June 2019 YTD Note: Not pro forma for Alpha Care transaction. ApolloMed Sources of Revenue (YTD 06/30/2019) ▪ Capitated fees for medical services via direct arrangements with managed care providers − Typically pre - paid monthly based on number of enrollees ▪ Full risk capitation arrangements with certain health plans and local hospitals − ApolloMed receives % of net surplus from affiliated hospitals’ HMO contracts − Also enters into shared risk capitation arrangements with HMOs and receives certain “pay - for - performance” incentives ▪ Fees earned from providing management, physician advisory, healthcare staffing, admin. and other non - medical services − Based on % of revenue or collections − Services provided to IPAs and hospitals − Paid monthly ▪ Professional component of charges for medical services rendered by our contracted physicians and employed physicians − ApolloMed bills hospitals or 3 rd party payors for physician staffing and bills patients / payors for patient care services − Revenue is net of contractual allowances A B C D ($ in millions) Capitation, net Risk Pool Settlements and Incentives Management Fee Income Fee - for - service, net Other Income

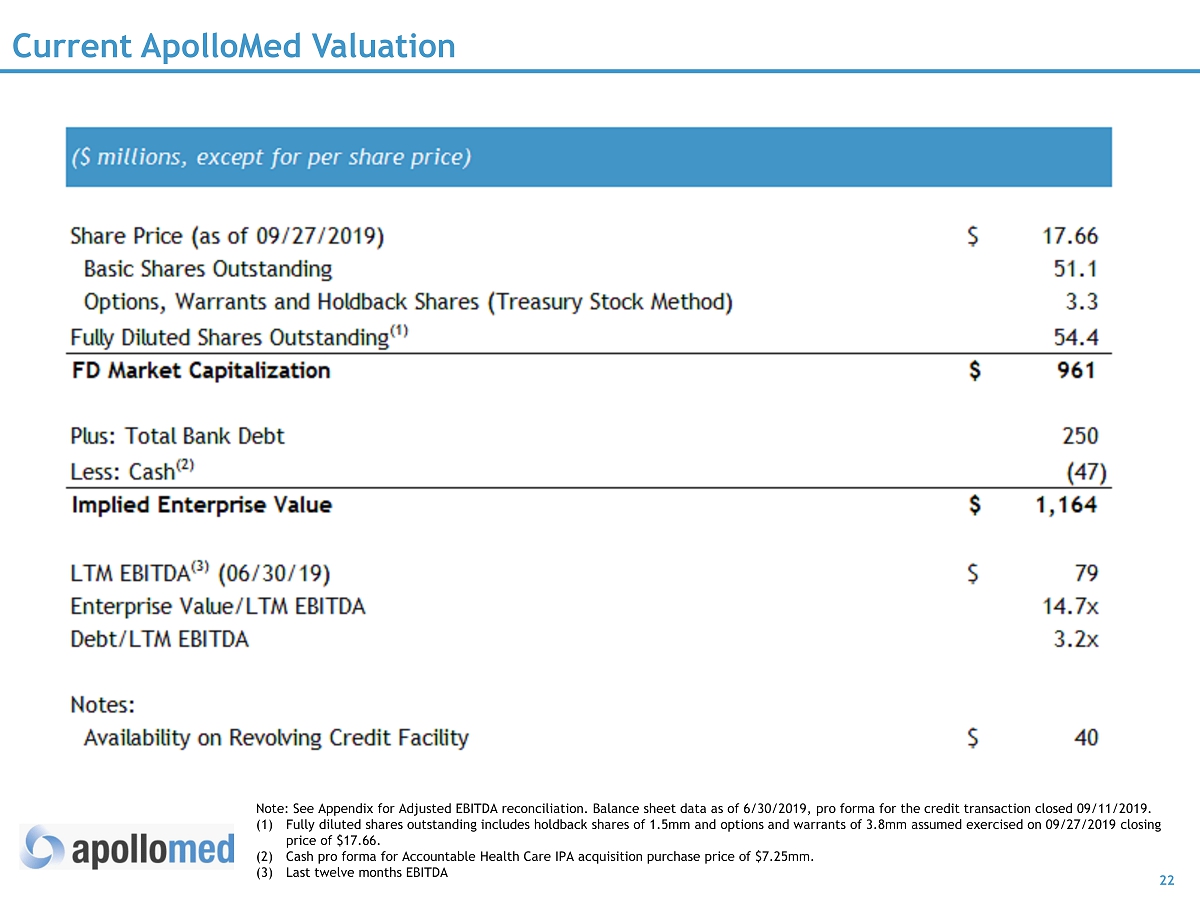

22 Current ApolloMed Valuation Note: See Appendix for Adjusted EBITDA reconciliation. Balance sheet data as of 6/30/2019, pro forma for the credit transacti on closed 09/11/2019. (1) Fully diluted shares outstanding includes holdback shares of 1.5mm and options and warrants of 3.8mm assumed exercised on 09/ 27/ 2019 closing price of $17.66. (2) Cash pro forma for Accountable Health Care IPA acquisition purchase price of $7.25mm. (3) Last twelve months EBITDA

23 Foundations of Shareholder Value Financial Parameters Key Business Attributes x Organic growth and acquisitions Revenue Growth x Ability to scale with future IPAs EBITDA Margin Expansion x Managed lives increased from ~800K to over 1mm Managed Lives Growth x Acquired two IPAs since May 2019 IPA Growth x 3.75:1.00 Maximum Leverage ▪ Leading platform focused on attractive markets ▪ Highly differentiated position − Networks of primary care and specialist physicians that create market alignment and care management − Track record of delivering high - quality, cost - effective outcomes in risk - bearing model − Clinically strong management team experienced in managing physician practices and risk - based organizations x Continuously assessing pipelines of potential IPA targets M&A

Appendix

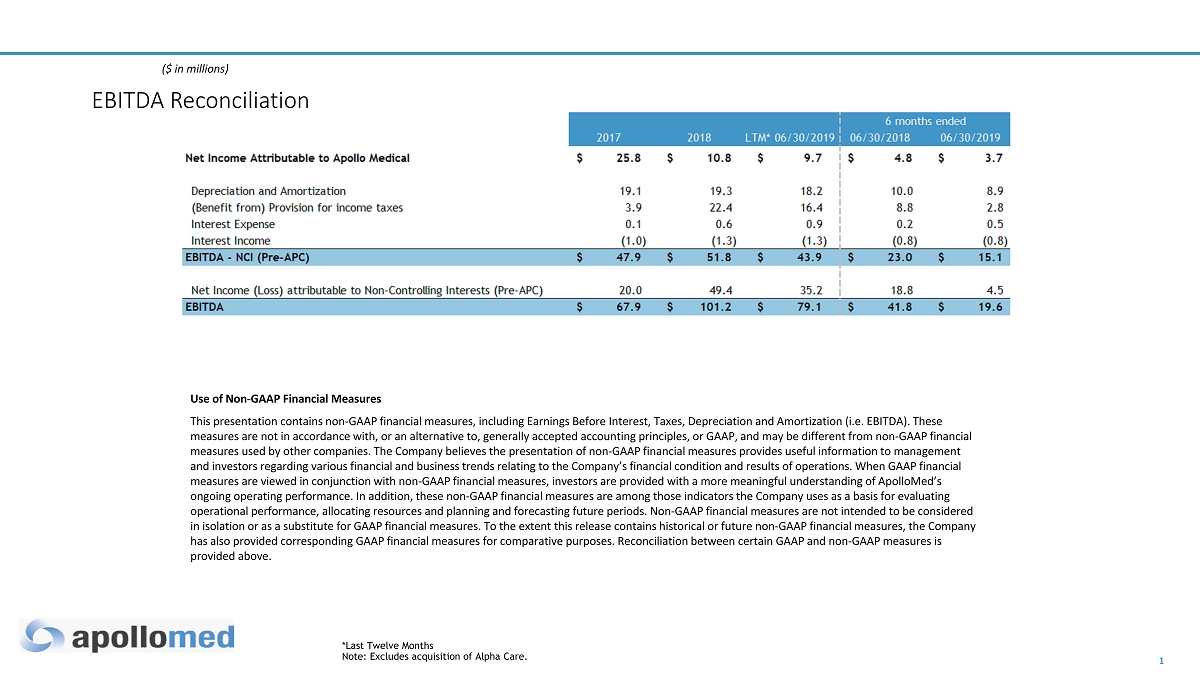

1 EBITDA Reconciliation ($ in millions) *Last Twelve Months Note: Excludes acquisition of Alpha Care. Use of Non - GAAP Financial Measures This presentation contains non - GAAP financial measures, including Earnings Before Interest, Taxes, Depreciation and Amortization (i.e. EBITDA). These measures are not in accordance with, or an alternative to, generally accepted accounting principles, or GAAP, and may be diff ere nt from non - GAAP financial measures used by other companies. The Company believes the presentation of non - GAAP financial measures provides useful informati on to management and investors regarding various financial and business trends relating to the Company’s financial condition and results of op era tions. When GAAP financial measures are viewed in conjunction with non - GAAP financial measures, investors are provided with a more meaningful understanding of ApolloMed’s ongoing operating performance. In addition, these non - GAAP financial measures are among those indicators the Company uses as a b asis for evaluating operational performance, allocating resources and planning and forecasting future periods. Non - GAAP financial measures are not i ntended to be considered in isolation or as a substitute for GAAP financial measures. To the extent this release contains historical or future non - GAAP f inancial measures, the Company has also provided corresponding GAAP financial measures for comparative purposes. Reconciliation between certain GAAP and non - GA AP measures is provided above.