EX-99.2

Published on February 23, 2023

1 Powered by Technology. Built by Doctors. For Patients. Apollo Medical Holdings (NASDAQ: AMEH) Fourth Quarter and Year-End 2022 Earnings Call Supplement February 24, 2023

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements include any statements about the Company's business, financial condition, operating results, plans, objectives, expectations and intentions, expansion plans, integration of acquired companies and any projections of earnings, revenue, EBITDA, Adjusted EBITDA or other financial items, such as the Company's projected capitation and future liquidity, and may be identified by the use of forward-looking terms such as “anticipate,” “could,” “can,” “may,” “might,” “potential,” “predict,” “should,” “estimate,” “expect,” “project,” “believe,” “plan,” “envision,” “intend,” “continue,” “target,” “seek,” “will,” “would,” and the negative of such terms, other variations on such terms or other similar or comparable words, phrases or terminology. Forward-looking statements reflect current views with respect to future events and financial performance and therefore cannot be guaranteed. Such statements are based on the current expectations and certain assumptions of the Company’s management, and some or all of such expectations and assumptions may not materialize or may vary significantly from actual results. Actual results may also vary materially from forward-looking statements due to risks, uncertainties and other factors, known and unknown, including the risk factors described from time to time in the Company’s reports to the U.S. Securities and Exchange Commission (the “SEC”), including without limitation the risk factors discussed in the Company's Annual Report on Form 10-K for the year ended December 31, 2021, and subsequent Quarterly Reports on Form 10-Q. Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed or implied in any forward-looking statements, you should not place undue reliance on any such forward-looking statements. Any forward-looking statements speak only as of the date of this presentation and, unless legally required, the Company does not undertake any obligation to update any forward-looking statement, as a result of new information, future events or otherwise. 2www.apollomed.net

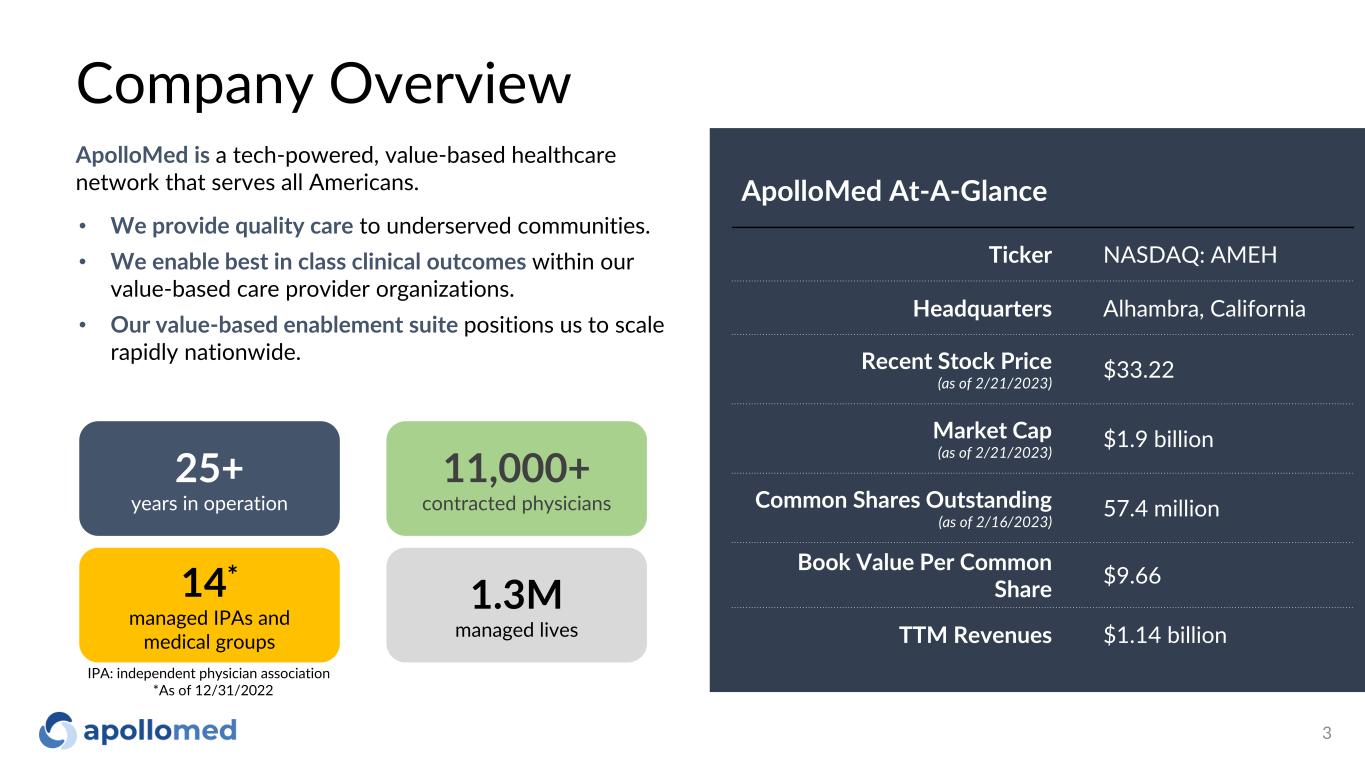

14* managed IPAs and medical groups 1.3M managed lives Company Overview 3 11,000+ contracted physicians 25+ years in operation ApolloMed is a tech-powered, value-based healthcare network that serves all Americans. • We provide quality care to underserved communities. • We enable best in class clinical outcomes within our value-based care provider organizations. • Our value-based enablement suite positions us to scale rapidly nationwide. ApolloMed At-A-Glance Ticker NASDAQ: AMEH Headquarters Alhambra, California Recent Stock Price (as of 2/21/2023) $33.22 Market Cap (as of 2/21/2023) $1.9 billion Common Shares Outstanding (as of 2/16/2023) 57.4 million Book Value Per Common Share $9.66 TTM Revenues $1.14 billion IPA: independent physician association *As of 12/31/2022

Strong YE 2022 financial results Q4/YE and Recent Highlights Expected to close in Q1 2023: • Entered into a definitive agreement to acquire 100% of For Your Benefit (“FYB”), as well as certain managed care assets Strategic transactions www.apollomed.net *See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA” and “Use of Non-GAAP Financial Measures” slides for more information. Please note that beginning the third quarter ended September 30, 2022, the Company has revised the calculation for Adjusted EBITDA to exclude addbacks related to provider bonus payments and losses from recently acquired IPAs, which it believes to be more reflective of its business. Revenue $1.1B 48% Net income attr. to AMEH $49.0M EPS – diluted $1.08 Adj. EBITDA* $140.0M 5% 4 • Orma Health • Jade Health Care Medical Group • All American Medical Group (“AAMG”) • Valley Oaks Medical Group (“VOMG”) Poised for growth with the closing of several strategic transactions in 2022:

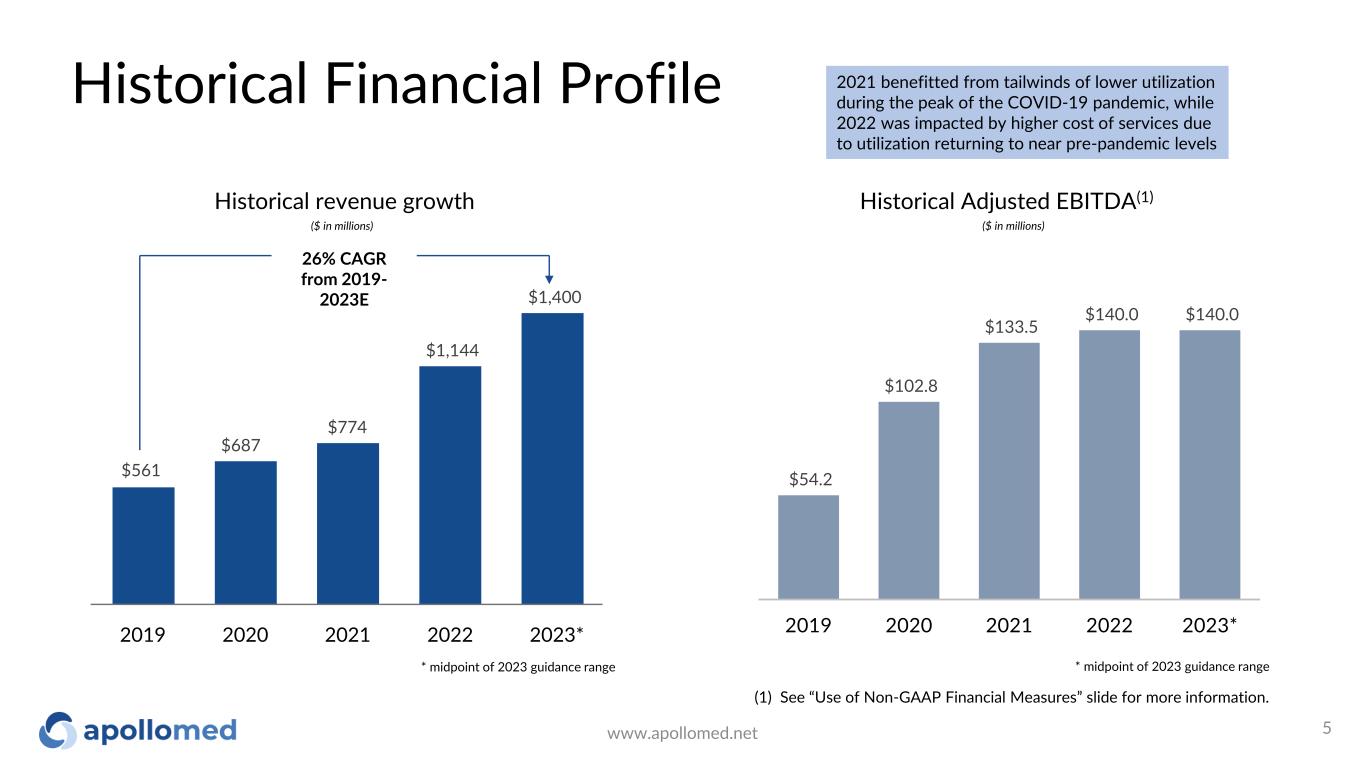

Historical Financial Profile www.apollomed.net $54.2 $102.8 $133.5 $140.0 $140.0 2019 2020 2021 2022 2023* $561 $687 $774 $1,144 $1,400 Historical revenue growth ($ in millions) * midpoint of 2023 guidance range ($ in millions) Historical Adjusted EBITDA(1) 2019 2020 2021 5 2022 2023* 2021 benefitted from tailwinds of lower utilization during the peak of the COVID-19 pandemic, while 2022 was impacted by higher cost of services due to utilization returning to near pre-pandemic levels * midpoint of 2023 guidance range (1) See “Use of Non-GAAP Financial Measures” slide for more information. 26% CAGR from 2019- 2023E

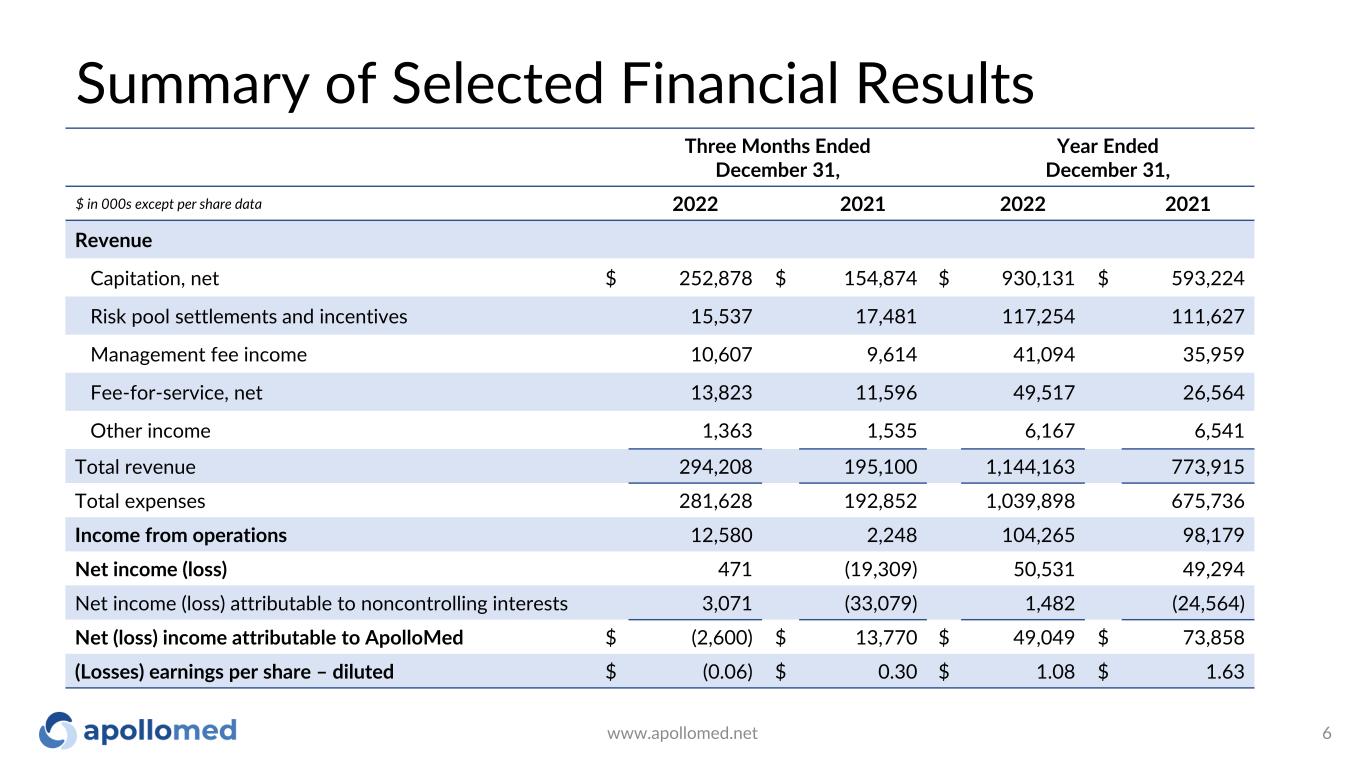

Summary of Selected Financial Results www.apollomed.net 6 Three Months Ended December 31, Year Ended December 31, $ in 000s except per share data 2022 2021 2022 2021 Revenue Capitation, net $ 252,878 $ 154,874 $ 930,131 $ 593,224 Risk pool settlements and incentives 15,537 17,481 117,254 111,627 Management fee income 10,607 9,614 41,094 35,959 Fee-for-service, net 13,823 11,596 49,517 26,564 Other income 1,363 1,535 6,167 6,541 Total revenue 294,208 195,100 1,144,163 773,915 Total expenses 281,628 192,852 1,039,898 675,736 Income from operations 12,580 2,248 104,265 98,179 Net income (loss) 471 (19,309) 50,531 49,294 Net income (loss) attributable to noncontrolling interests 3,071 (33,079) 1,482 (24,564) Net (loss) income attributable to ApolloMed $ (2,600) $ 13,770 $ 49,049 $ 73,858 (Losses) earnings per share – diluted $ (0.06) $ 0.30 $ 1.08 $ 1.63

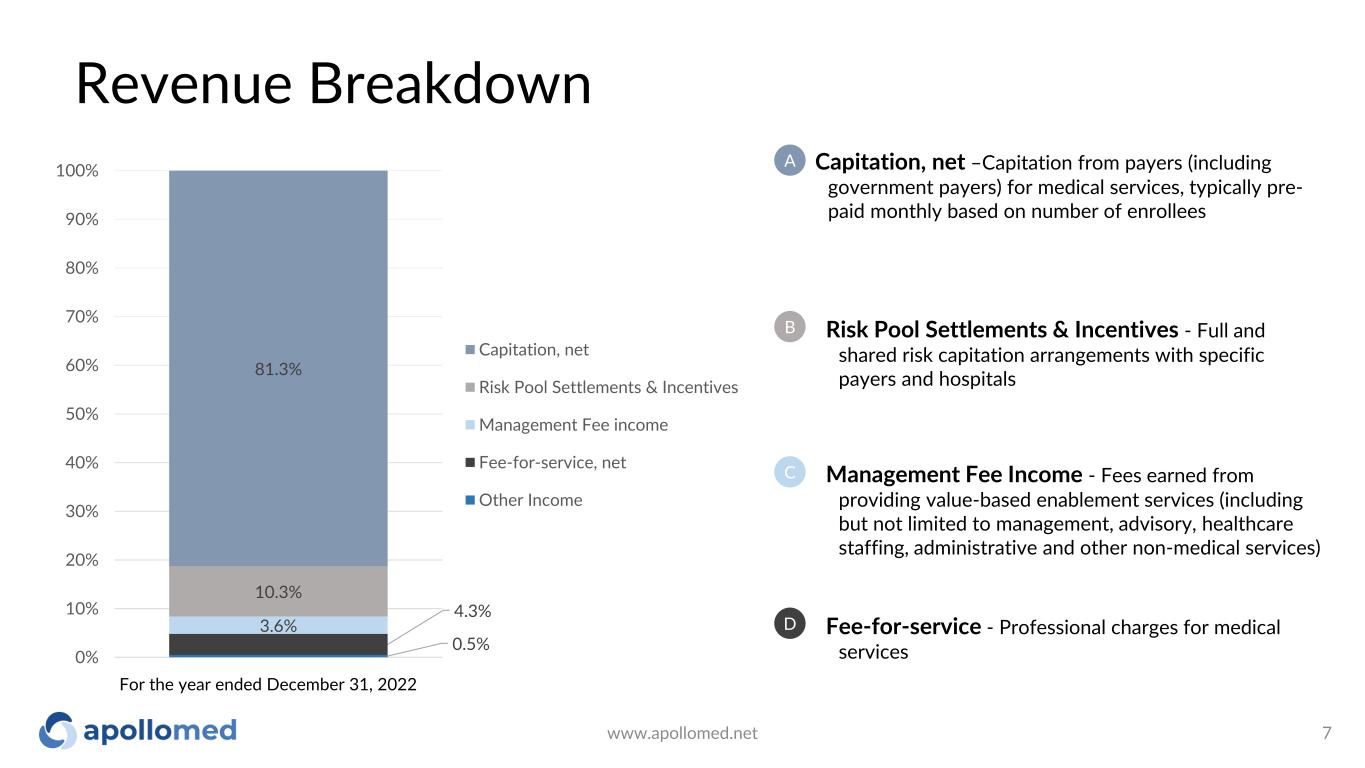

Capitation, net –Capitation from payers (including government payers) for medical services, typically pre- paid monthly based on number of enrollees 0.5% 4.3% 3.6% 10.3% 81.3% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Capitation, net Risk Pool Settlements & Incentives Management Fee income Fee-for-service, net Other Income Revenue Breakdown 7 A B C D www.apollomed.net For the year ended December 31, 2022 Risk Pool Settlements & Incentives - Full and shared risk capitation arrangements with specific payers and hospitals Management Fee Income - Fees earned from providing value-based enablement services (including but not limited to management, advisory, healthcare staffing, administrative and other non-medical services) Fee-for-service - Professional charges for medical services

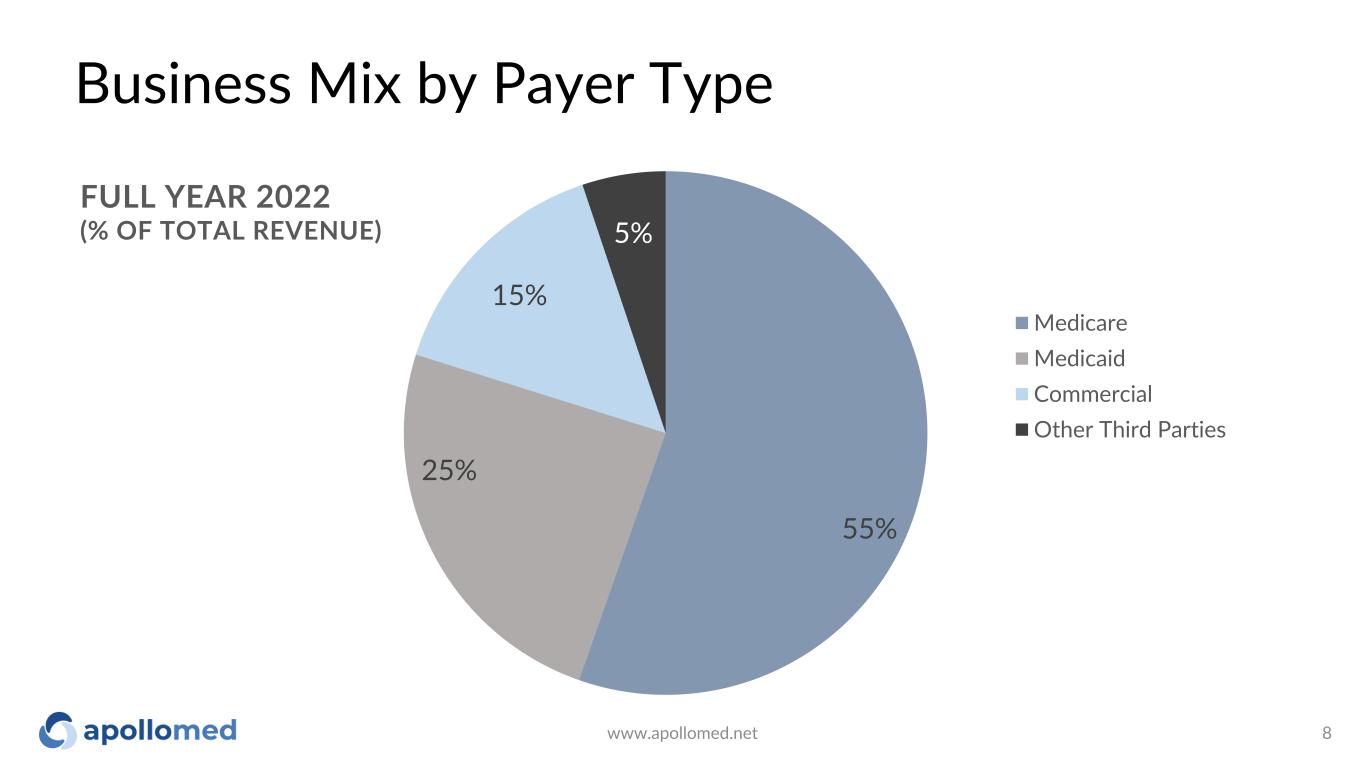

55% 25% 15% 5% FULL YEAR 2022 (% OF TOTAL REVENUE) Medicare Medicaid Commercial Other Third Parties Business Mix by Payer Type 8www.apollomed.net

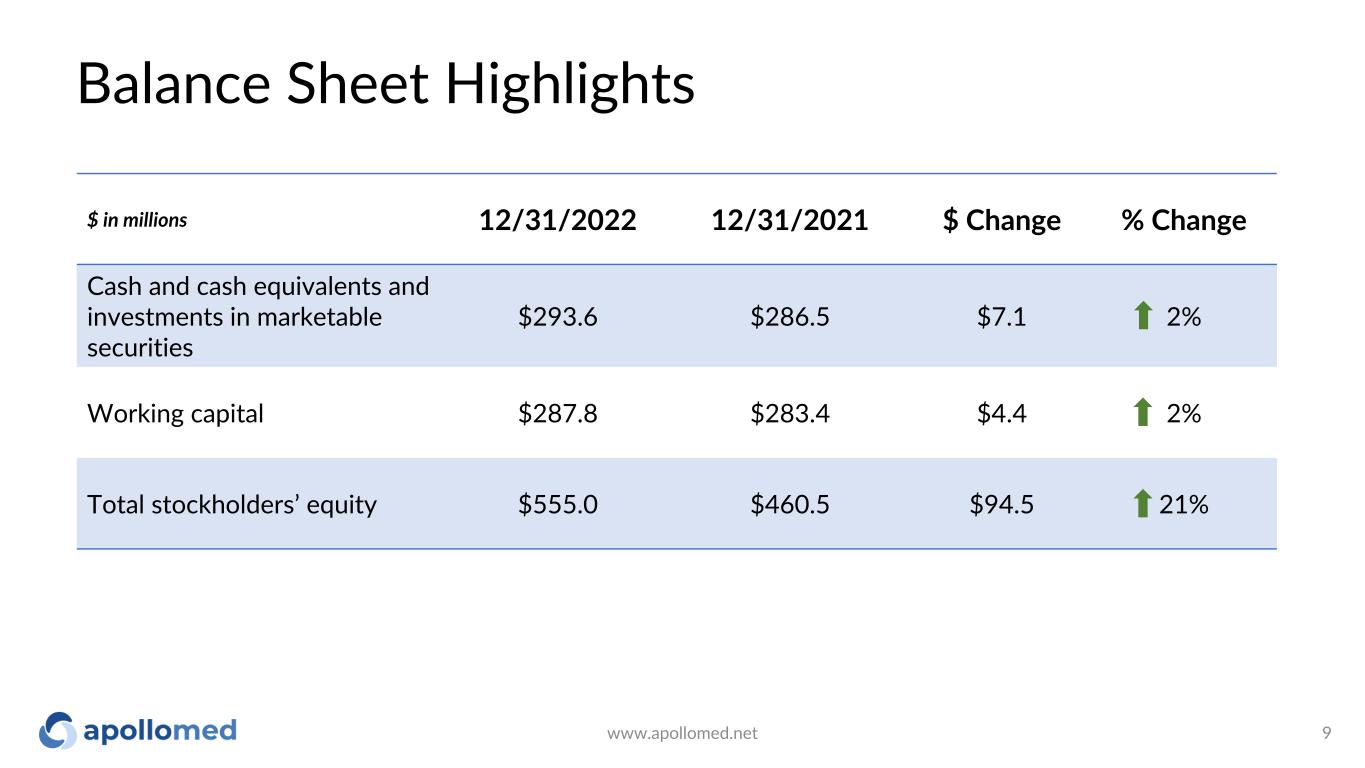

Balance Sheet Highlights 9 $ in millions 12/31/2022 12/31/2021 $ Change % Change Cash and cash equivalents and investments in marketable securities $293.6 $286.5 $7.1 2% Working capital $287.8 $283.4 $4.4 2% Total stockholders’ equity $555.0 $460.5 $94.5 21% www.apollomed.net

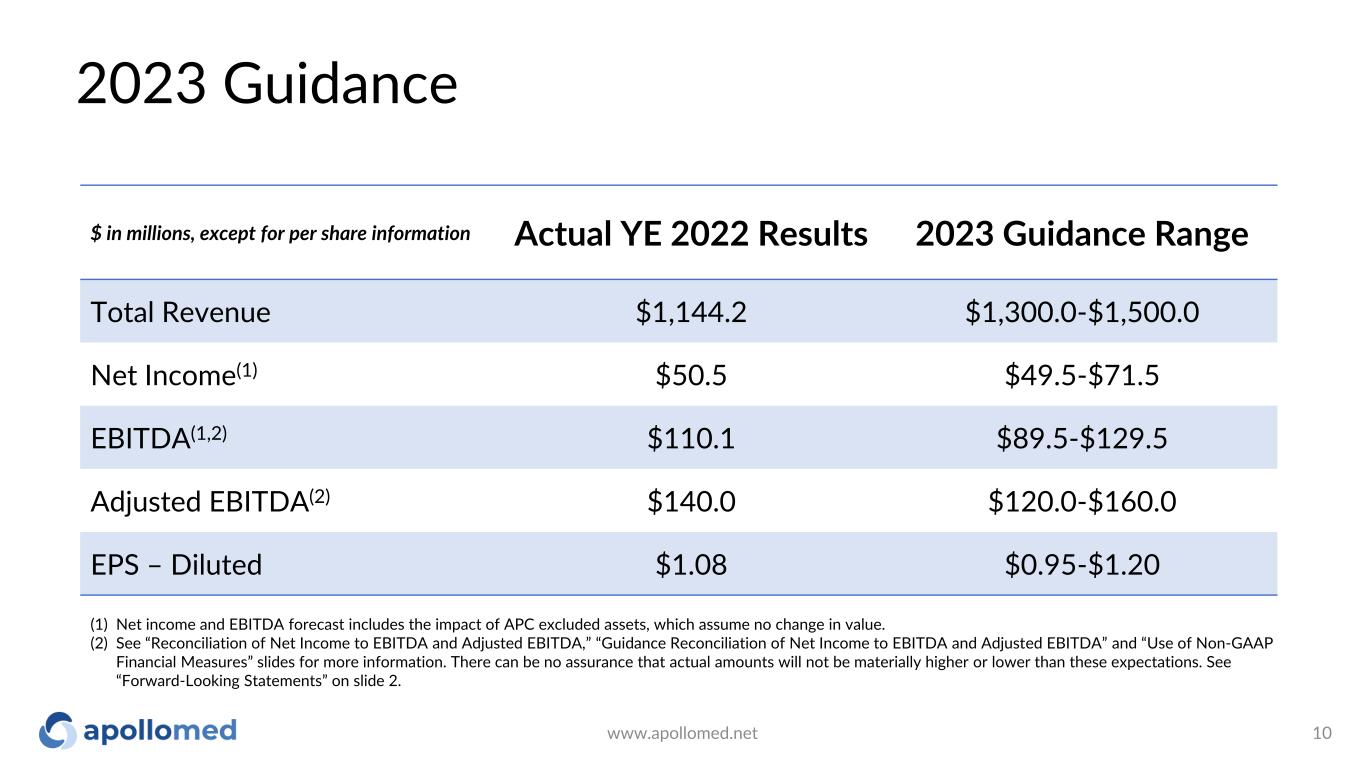

2023 Guidance 10www.apollomed.net $ in millions, except for per share information Actual YE 2022 Results 2023 Guidance Range Total Revenue $1,144.2 $1,300.0-$1,500.0 Net Income(1) $50.5 $49.5-$71.5 EBITDA(1,2) $110.1 $89.5-$129.5 Adjusted EBITDA(2) $140.0 $120.0-$160.0 EPS – Diluted $1.08 $0.95-$1.20 (1) Net income and EBITDA forecast includes the impact of APC excluded assets, which assume no change in value. (2) See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA,” “Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA” and “Use of Non-GAAP Financial Measures” slides for more information. There can be no assurance that actual amounts will not be materially higher or lower than these expectations. See “Forward-Looking Statements” on slide 2.

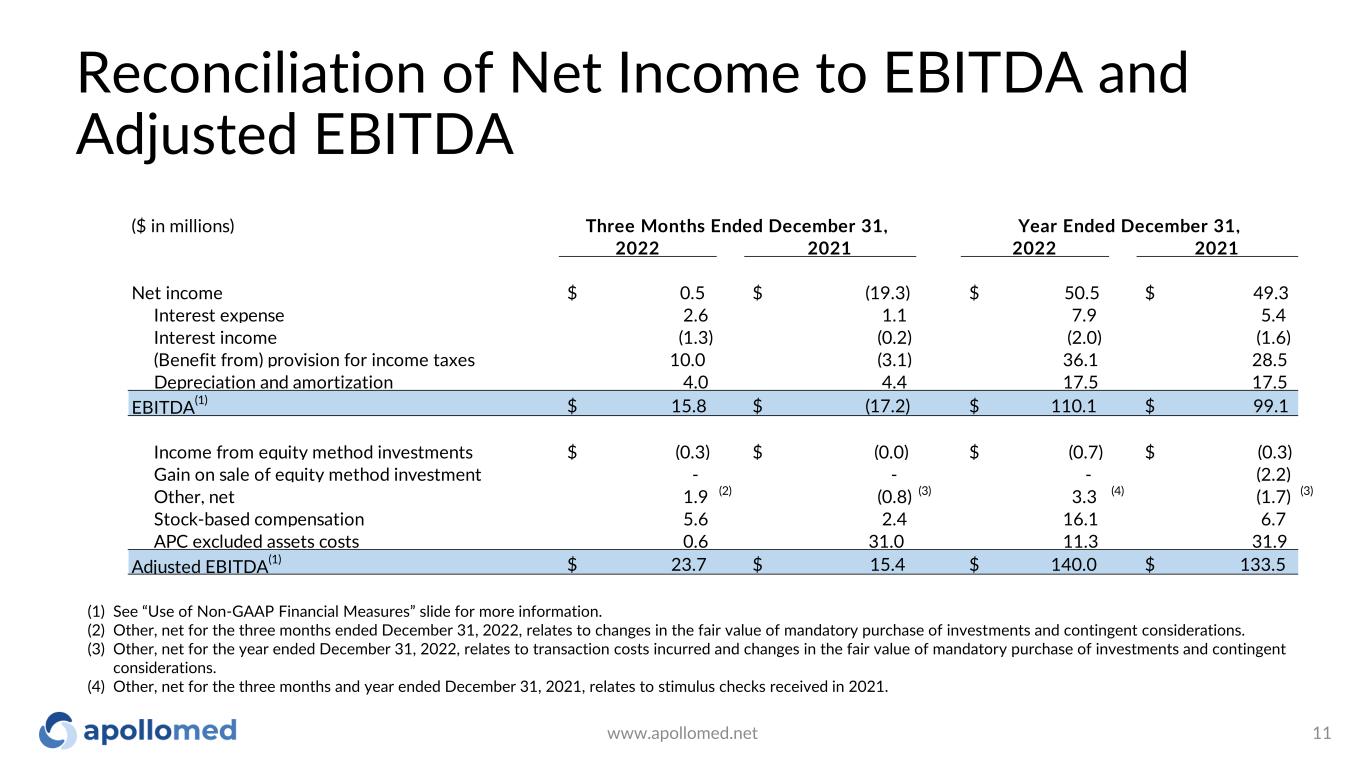

Reconciliation of Net Income to EBITDA and Adjusted EBITDA 11www.apollomed.net (1) See “Use of Non-GAAP Financial Measures” slide for more information. (2) Other, net for the three months ended December 31, 2022, relates to changes in the fair value of mandatory purchase of investments and contingent considerations. (3) Other, net for the year ended December 31, 2022, relates to transaction costs incurred and changes in the fair value of mandatory purchase of investments and contingent considerations. (4) Other, net for the three months and year ended December 31, 2021, relates to stimulus checks received in 2021. ($ in millions) 2022 2021 2022 2021 Net income $ 0.5 $ (19.3) $ 50.5 $ 49.3 Interest expense 2.6 1.1 7.9 5.4 Interest income (1.3) (0.2) (2.0) (1.6) (Benefit from) provision for income taxes 10.0 (3.1) 36.1 28.5 Depreciation and amortization 4.0 4.4 17.5 17.5 EBITDA(1) $ 15.8 $ (17.2) $ 110.1 $ 99.1 Income from equity method investments $ (0.3) $ (0.0) $ (0.7) $ (0.3) Gain on sale of equity method investment - - - (2.2) Other, net 1.9 (2) (0.8) (3) 3.3 (4) (1.7) (3) Stock-based compensation 5.6 2.4 16.1 6.7 APC excluded assets costs 0.6 31.0 11.3 31.9 Adjusted EBITDA(1) $ 23.7 $ 15.4 $ 140.0 $ 133.5 Year Ended December 31, Three Months Ended December 31,

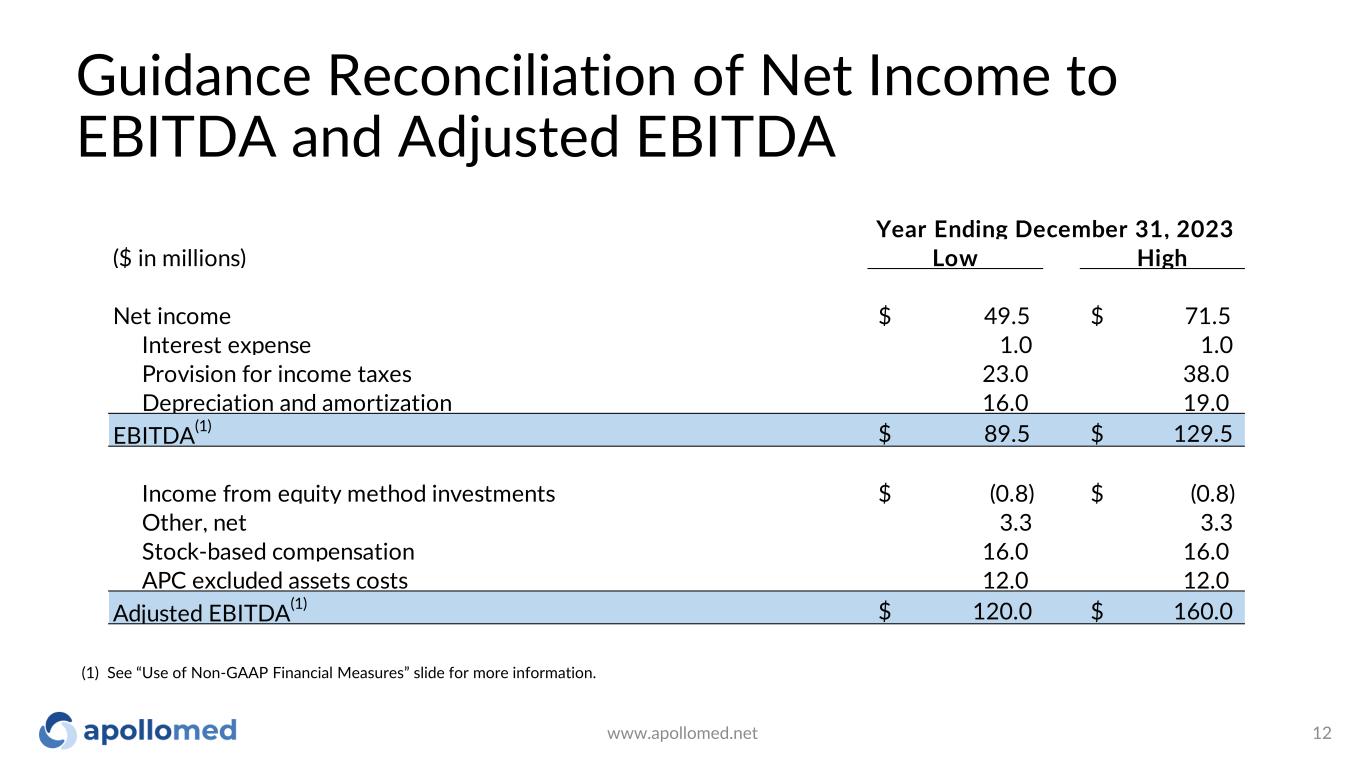

Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA 12www.apollomed.net (1) See “Use of Non-GAAP Financial Measures” slide for more information. ($ in millions) Low High Net income $ 49.5 $ 71.5 Interest expense 1.0 1.0 Provision for income taxes 23.0 38.0 Depreciation and amortization 16.0 19.0 EBITDA(1) $ 89.5 $ 129.5 Income from equity method investments $ (0.8) $ (0.8) Other, net 3.3 3.3 Stock-based compensation 16.0 16.0 APC excluded assets costs 12.0 12.0 Adjusted EBITDA(1) $ 120.0 $ 160.0 Year Ending December 31, 2023

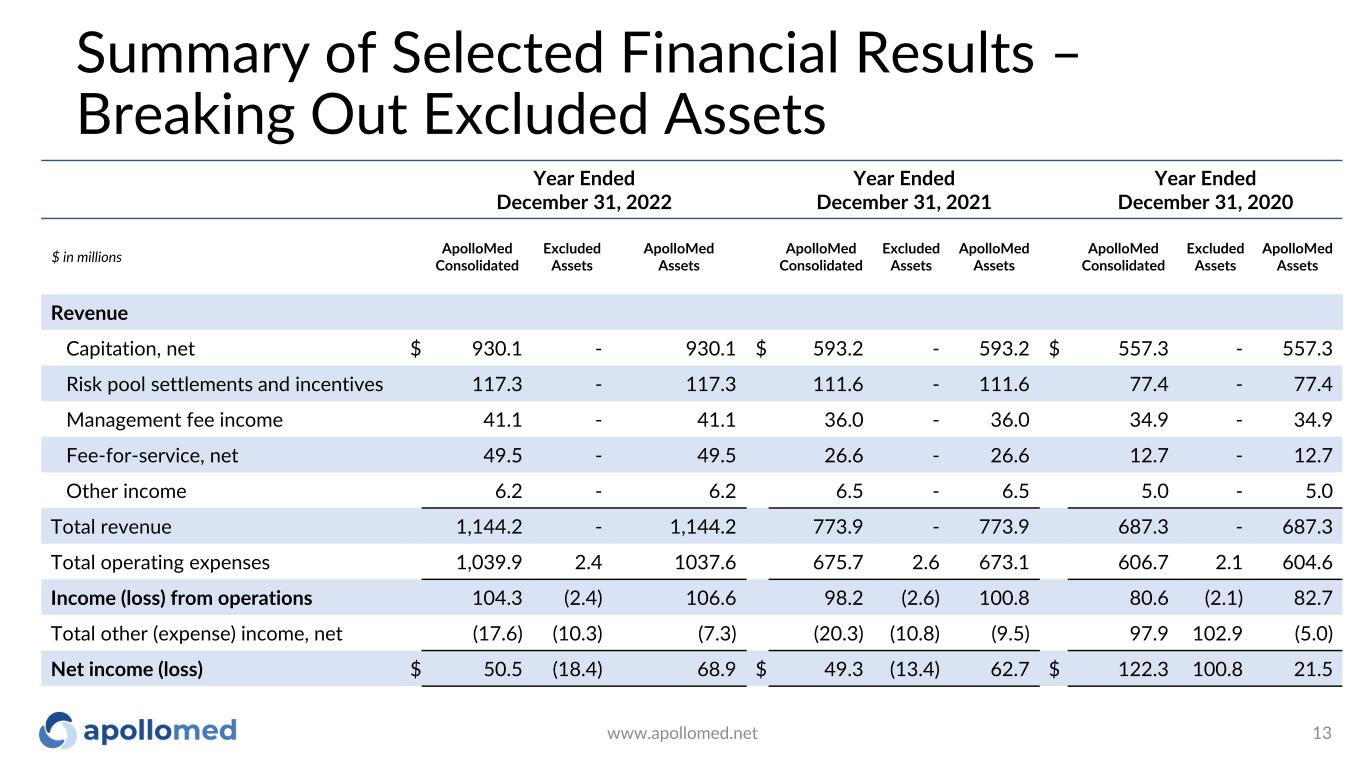

www.apollomed.net 13 Year Ended December 31, 2022 Year Ended December 31, 2021 Year Ended December 31, 2020 $ in millions ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Revenue Capitation, net $ 930.1 - 930.1 $ 593.2 - 593.2 $ 557.3 - 557.3 Risk pool settlements and incentives 117.3 - 117.3 111.6 - 111.6 77.4 - 77.4 Management fee income 41.1 - 41.1 36.0 - 36.0 34.9 - 34.9 Fee-for-service, net 49.5 - 49.5 26.6 - 26.6 12.7 - 12.7 Other income 6.2 - 6.2 6.5 - 6.5 5.0 - 5.0 Total revenue 1,144.2 - 1,144.2 773.9 - 773.9 687.3 - 687.3 Total operating expenses 1,039.9 2.4 1037.6 675.7 2.6 673.1 606.7 2.1 604.6 Income (loss) from operations 104.3 (2.4) 106.6 98.2 (2.6) 100.8 80.6 (2.1) 82.7 Total other (expense) income, net (17.6) (10.3) (7.3) (20.3) (10.8) (9.5) 97.9 102.9 (5.0) Net income (loss) $ 50.5 (18.4) 68.9 $ 49.3 (13.4) 62.7 $ 122.3 100.8 21.5 Summary of Selected Financial Results – Breaking Out Excluded Assets

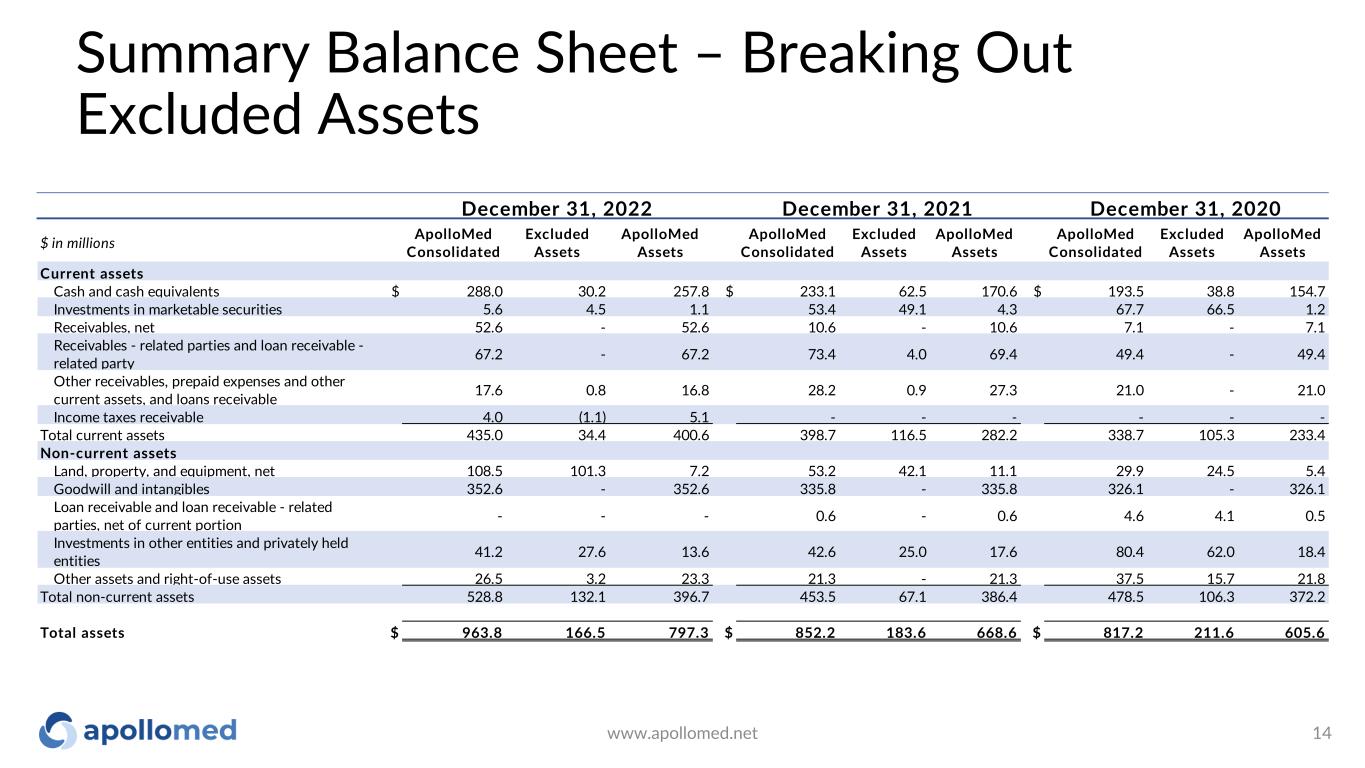

www.apollomed.net 14 Summary Balance Sheet – Breaking Out Excluded Assets $ in millions ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Current assets Cash and cash equivalents $ 288.0 30.2 257.8 $ 233.1 62.5 170.6 $ 193.5 38.8 154.7 Investments in marketable securities 5.6 4.5 1.1 53.4 49.1 4.3 67.7 66.5 1.2 Receivables, net 52.6 - 52.6 10.6 - 10.6 7.1 - 7.1 Receivables - related parties and loan receivable - related party 67.2 - 67.2 73.4 4.0 69.4 49.4 - 49.4 Other receivables, prepaid expenses and other current assets, and loans receivable 17.6 0.8 16.8 28.2 0.9 27.3 21.0 - 21.0 Income taxes receivable 4.0 (1.1) 5.1 - - - - - - Total current assets 435.0 34.4 400.6 398.7 116.5 282.2 338.7 105.3 233.4 Non-current assets Land, property, and equipment, net 108.5 101.3 7.2 53.2 42.1 11.1 29.9 24.5 5.4 Goodwill and intangibles 352.6 - 352.6 335.8 - 335.8 326.1 - 326.1 Loan receivable and loan receivable - related parties, net of current portion - - - 0.6 - 0.6 4.6 4.1 0.5 Investments in other entities and privately held entities 41.2 27.6 13.6 42.6 25.0 17.6 80.4 62.0 18.4 Other assets and right-of-use assets 26.5 3.2 23.3 21.3 - 21.3 37.5 15.7 21.8 Total non-current assets 528.8 132.1 396.7 453.5 67.1 386.4 478.5 106.3 372.2 Total assets $ 963.8 166.5 797.3 $ 852.2 183.6 668.6 $ 817.2 211.6 605.6 December 31, 2022 December 31, 2021 December 31, 2020

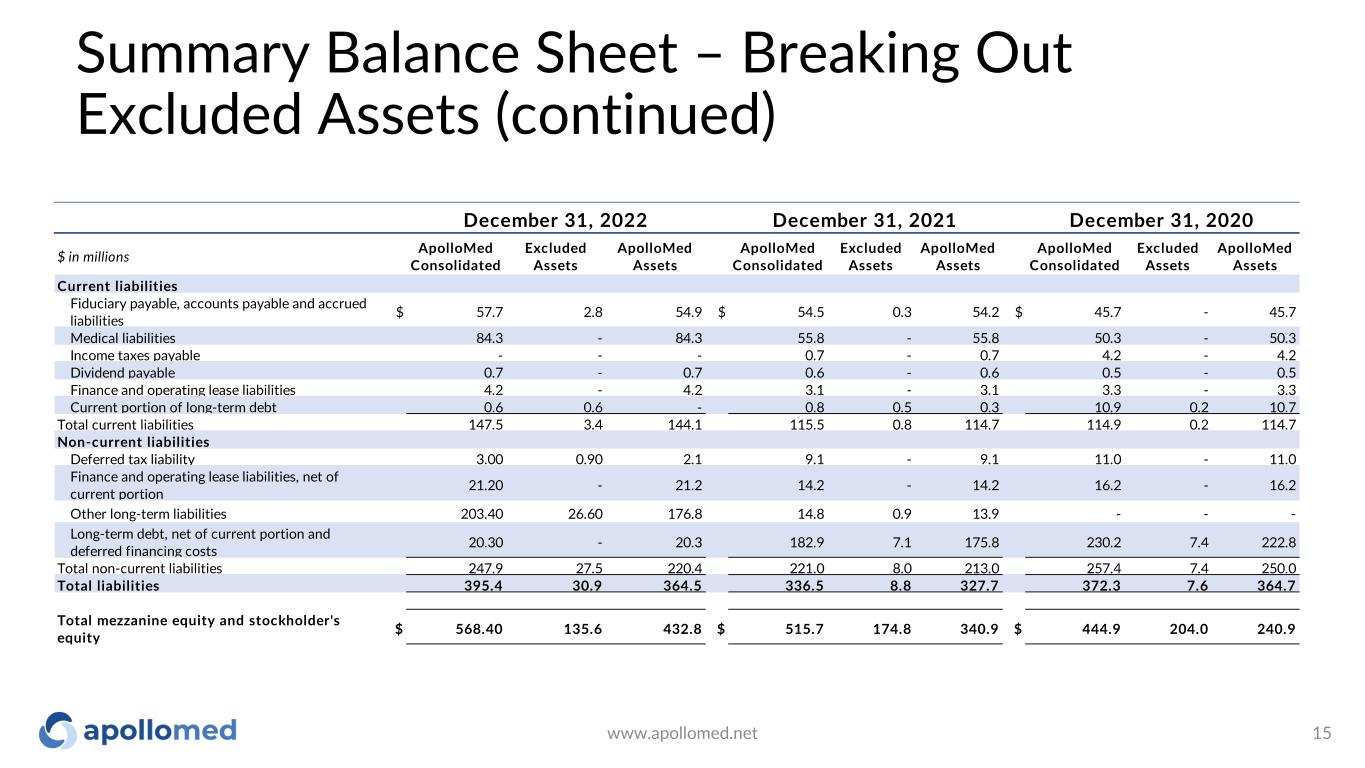

www.apollomed.net 15 Summary Balance Sheet – Breaking Out Excluded Assets (continued) $ in millions ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Current liabilities Fiduciary payable, accounts payable and accrued liabilities $ 57.7 2.8 54.9 $ 54.5 0.3 54.2 $ 45.7 - 45.7 Medical liabilities 84.3 - 84.3 55.8 - 55.8 50.3 - 50.3 Income taxes payable - - - 0.7 - 0.7 4.2 - 4.2 Dividend payable 0.7 - 0.7 0.6 - 0.6 0.5 - 0.5 Finance and operating lease liabilities 4.2 - 4.2 3.1 - 3.1 3.3 - 3.3 Current portion of long-term debt 0.6 0.6 - 0.8 0.5 0.3 10.9 0.2 10.7 Total current liabilities 147.5 3.4 144.1 115.5 0.8 114.7 114.9 0.2 114.7 Non-current liabilities Deferred tax liability 3.00 0.90 2.1 9.1 - 9.1 11.0 - 11.0 Finance and operating lease liabilities, net of current portion 21.20 - 21.2 14.2 - 14.2 16.2 - 16.2 Other long-term liabilities 203.40 26.60 176.8 14.8 0.9 13.9 - - - Long-term debt, net of current portion and deferred financing costs 20.30 - 20.3 182.9 7.1 175.8 230.2 7.4 222.8 Total non-current liabilities 247.9 27.5 220.4 221.0 8.0 213.0 257.4 7.4 250.0 Total liabilities 395.4 30.9 364.5 336.5 8.8 327.7 372.3 7.6 364.7 Total mezzanine equity and stockholder's equity $ 568.40 135.6 432.8 $ 515.7 174.8 340.9 $ 444.9 204.0 240.9 December 31, 2022 December 31, 2021 December 31, 2020

Use of Non-GAAP Financial Measures This presentation contains the non-GAAP financial measures EBITDA and Adjusted EBITDA, of which the most directly comparable financial measure presented in accordance with U.S. generally accepted accounting principles (“GAAP”) is net income. These measures are not in accordance with, or alternatives to GAAP, and may be different from other non-GAAP financial measures used by other companies. The Company uses Adjusted EBITDA as a supplemental performance measure of our operations, for financial and operational decision-making, and as a supplemental means of evaluating period-to- period comparisons on a consistent basis. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation, and amortization, excluding income or loss from equity method investments, non-recurring transactions, stock-based compensation, and APC excluded assets costs. Beginning in the third quarter ended September 30, 2022, the Company has revised the calculation for Adjusted EBITDA to exclude provider bonus payments and losses from recently acquired IPAs, which it believes to be more reflective of its business. The Company believes the presentation of these non-GAAP financial measures provides investors with relevant and useful information, as it allows investors to evaluate the operating performance of the business activities without having to account for differences recognized because of non-core or non-recurring financial information. When GAAP financial measures are viewed in conjunction with non-GAAP financial measures, investors are provided with a more meaningful understanding of the Company’s ongoing operating performance. In addition, these non-GAAP financial measures are among those indicators the Company uses as a basis for evaluating operational performance, allocating resources, and planning and forecasting future periods. Non- GAAP financial measures are not intended to be considered in isolation, or as a substitute for, GAAP financial measures. To the extent this release contains historical or future non-GAAP financial measures, the Company has provided corresponding GAAP financial measures for comparative purposes. The reconciliation between certain GAAP and non-GAAP measures is provided above. 16www.apollomed.net

17 For inquiries, please contact: ApolloMed Investor Relations (626) 943-6491 investors@apollomed.net Carolyne Sohn, The Equity Group (408) 538-4577 csohn@equityny.com