EX-99.1

Published on March 13, 2023

Apollo Medical Holdings March 2023 Powered by Technology. Built by Doctors. For Patients.

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements include any statements about the Company's business, financial condition, operating results, plans, objectives, expectations and intentions, expansion plans, integration of acquired companies and any projections of earnings, revenue, EBITDA, Adjusted EBITDA or other financial items, such as the Company's projected capitation and future liquidity, and may be identified by the use of forward-looking terms such as “anticipate,” “could,” “can,” “may,” “might,” “potential,” “predict,” “should,” “estimate,” “expect,” “project,” “believe,” “plan,” “envision,” “intend,” “continue,” “target,” “seek,” “will,” “would,” and the negative of such terms, other variations on such terms or other similar or comparable words, phrases or terminology. Forward-looking statements reflect current views with respect to future events and financial performance and therefore cannot be guaranteed. Such statements are based on the current expectations and certain assumptions of the Company's management, and some or all of such expectations and assumptions may not materialize or may vary significantly from actual results. Actual results may also vary materially from forward-looking statements due to risks, uncertainties and other factors, known and unknown, including the risk factors described from time to time in the Company’s reports to the U.S. Securities and Exchange Commission (the “SEC”), including without limitation the risk factors discussed in the Company's Annual Report on Form 10-K for the year ended December 31, 2022, and subsequent Quarterly Reports on Form 10-Q. Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed or implied in any forward-looking statements, you should not place undue reliance on any such forward-looking statements. Any forward-looking statements speak only as of the date of this presentation and, unless legally required, the Company does not undertake any obligation to update any forward-looking statement, as a result of new information, future events or otherwise. Forward-looking statements 2

$140M TTM Adj. EBITDA1 1.3M Patients Managed in VBC Contracts2 $1.14B TTM Revenue1 >4.2X Gross Savings vs. Median ACO 2017-20213 (1) For more information, see “Reconciliation of TTM and 12 Months Net Income to EBITDA and Adjusted EBITDA” and “Use of Non-GAAP Financial Measures“ slides for more information (2) As of December 2022. This figure excludes patients that are purely Fee-for-Service. (3) Gross savings defined as total benchmark expenditures less total aligned beneficiary expenditures ApolloMed is a physician-centric, tech-powered, value-based healthcare platform accelerating the transition towards a future where all can get access to high quality healthcare

(1) Medicare Advantage, Managed Medicaid, Commercial, ACA Exchange, and Medicare FFS (2) ApolloMed 2019 to 2023E revenue and adj. EBITDA growth, using midpoint of 2023 guidance for both metrics. Please refer to the “2022 Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA” and “Use of Non-GAAP Financial Measures” slides for more information. 4 1. 2. 3. 5. 6. 4. Accelerating high quality, value-based care across all patient populations1 Strong growth with 4-year CAGR2 for revenue of 26% and for adj. EBITDA of 27% Scalable approach that empowers entrepreneurial providers to deliver value-based care and industry-leading outcomes Purpose-built technology platform leveraging 25+ years of real-world clinical data Profitable, highly replicable unit economics TAM of $2T, growing across all populations and geographies ApolloMed investment highlights

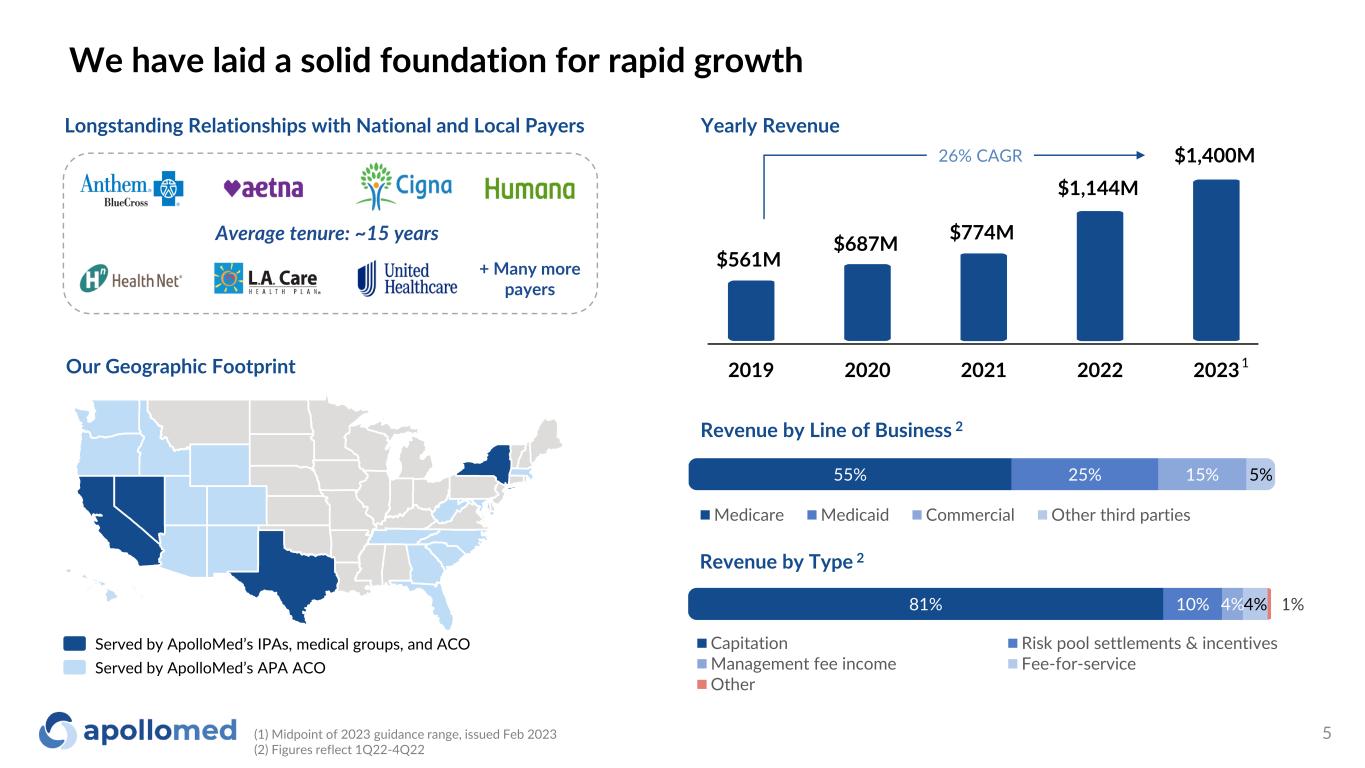

55% 25% 15% 5% Medicare Medicaid Commercial Other third parties Our Geographic Footprint Longstanding Relationships with National and Local Payers + Many more payers Served by ApolloMed’s IPAs, medical groups, and ACO Served by ApolloMed’s APA ACO 2019 2020 2021 2022 2023 Yearly Revenue 1 Average tenure: ~15 years 81% 10% 4%4% 1% Capitation Risk pool settlements & incentives Management fee income Fee-for-service Other Revenue by Line of Business 2 Revenue by Type 2 $561M $687M $774M $1,400M26% CAGR (1) Midpoint of 2023 guidance range, issued Feb 2023 (2) Figures reflect 1Q22-4Q22 5 We have laid a solid foundation for rapid growth $1,144M

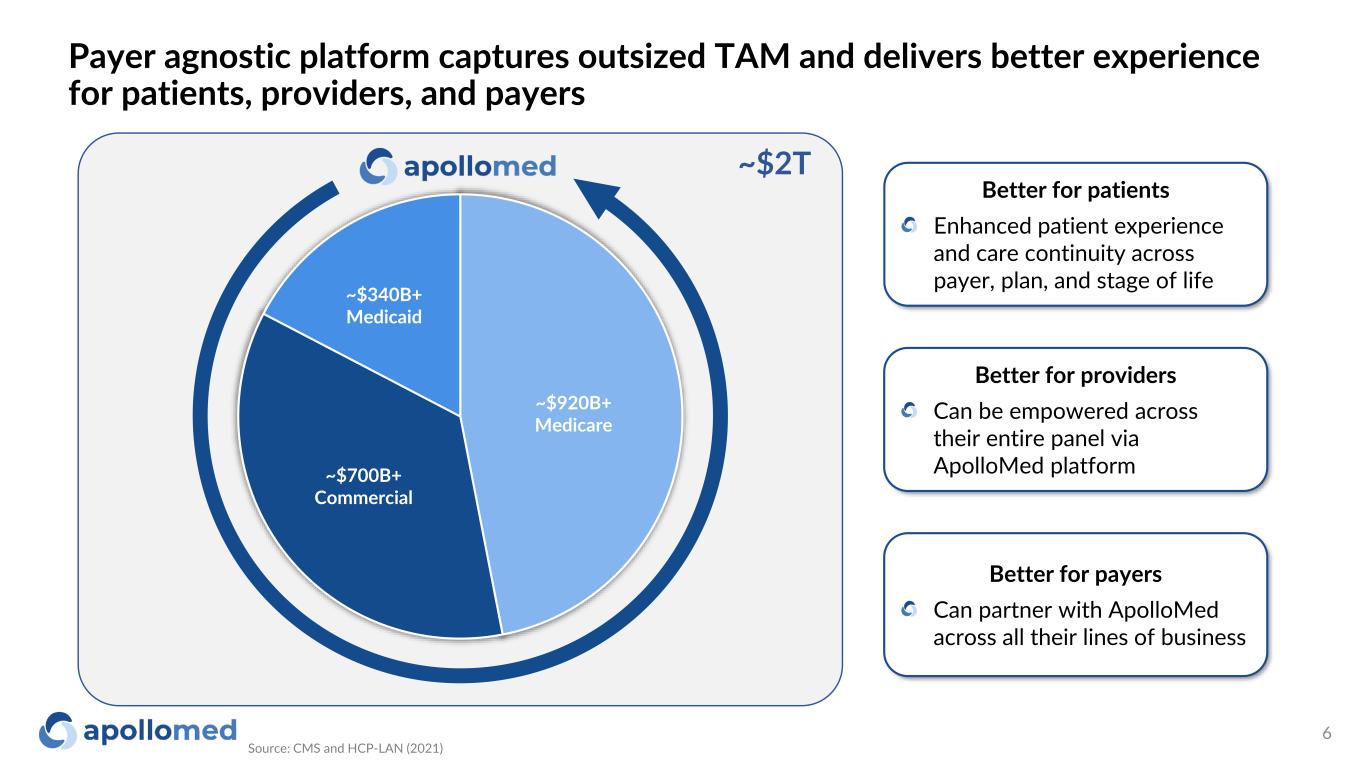

Payer agnostic platform captures outsized TAM and delivers better experience for patients, providers, and payers Source: CMS and HCP-LAN (2021) 6 Better for patients Enhanced patient experience and care continuity across payer, plan, and stage of life Better for providers Can be empowered across their entire panel via ApolloMed platform Better for payers Can partner with ApolloMed across all their lines of business ~$340B+ Medicaid ~$700B+ Commercial ~$920B+ Medicare ~$2T

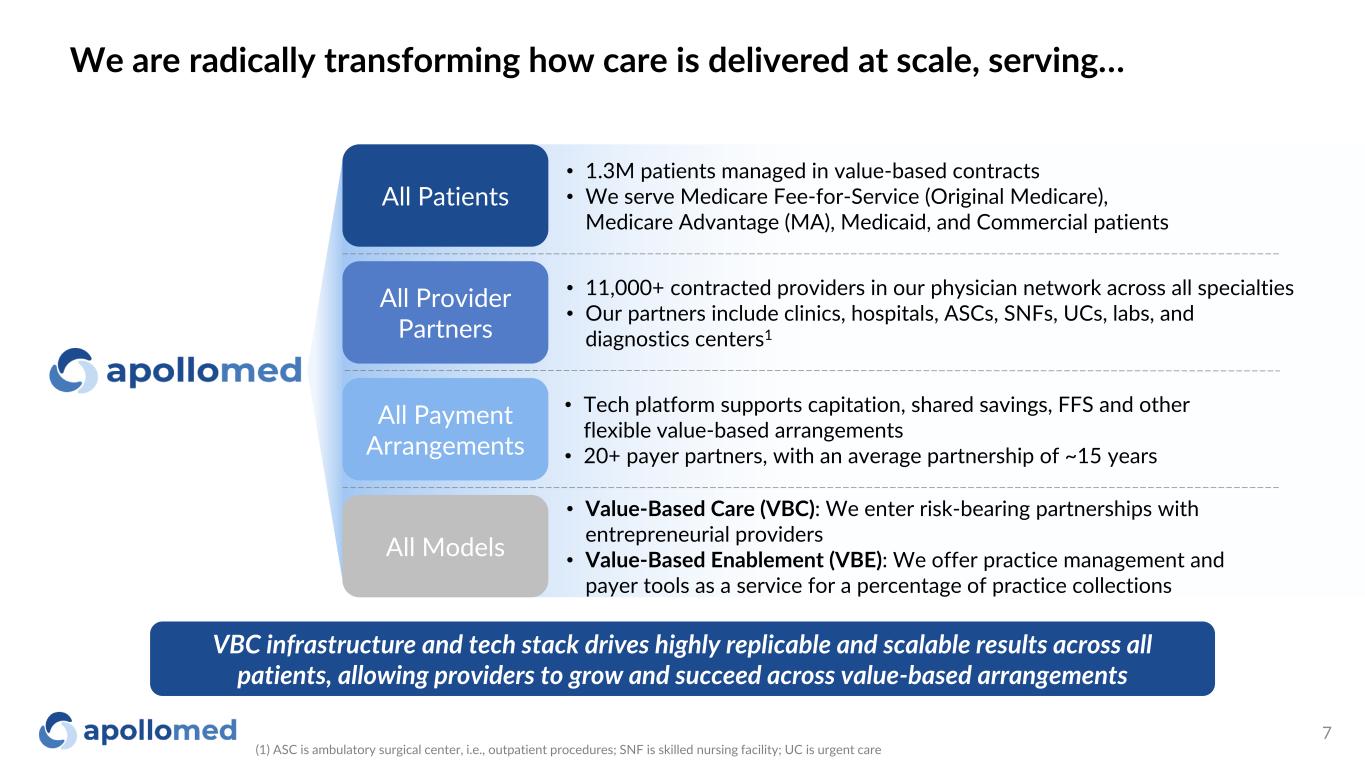

VBC infrastructure and tech stack drives highly replicable and scalable results across all patients, allowing providers to grow and succeed across value-based arrangements • 1.3M patients managed in value-based contracts • We serve Medicare Fee-for-Service (Original Medicare), Medicare Advantage (MA), Medicaid, and Commercial patients All Provider Partners • 11,000+ contracted providers in our physician network across all specialties • Our partners include clinics, hospitals, ASCs, SNFs, UCs, labs, and diagnostics centers1 All Payment Arrangements • Tech platform supports capitation, shared savings, FFS and other flexible value-based arrangements • 20+ payer partners, with an average partnership of ~15 years • Value-Based Care (VBC): We enter risk-bearing partnerships with entrepreneurial providers • Value-Based Enablement (VBE): We offer practice management and payer tools as a service for a percentage of practice collections We are radically transforming how care is delivered at scale, serving… (1) ASC is ambulatory surgical center, i.e., outpatient procedures; SNF is skilled nursing facility; UC is urgent care 7 All Models All Patients

Industry Overview and ApolloMed Value Proposition

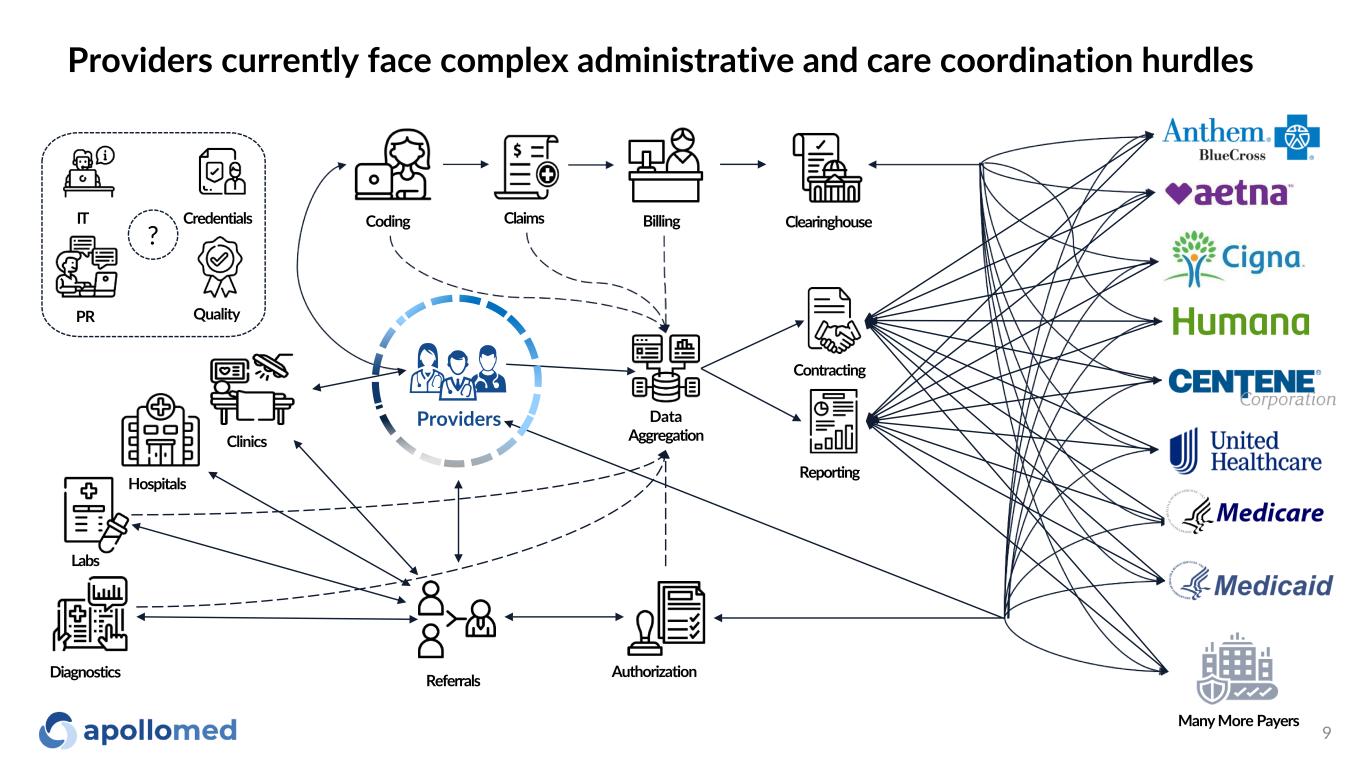

Providers currently face complex administrative and care coordination hurdles Reporting Contracting Claims Data Aggregation BillingCoding Hospitals Clinics Referrals Authorization ClearinghouseIT Credentials Quality Providers PR Labs Many More Payers Diagnostics ? 9

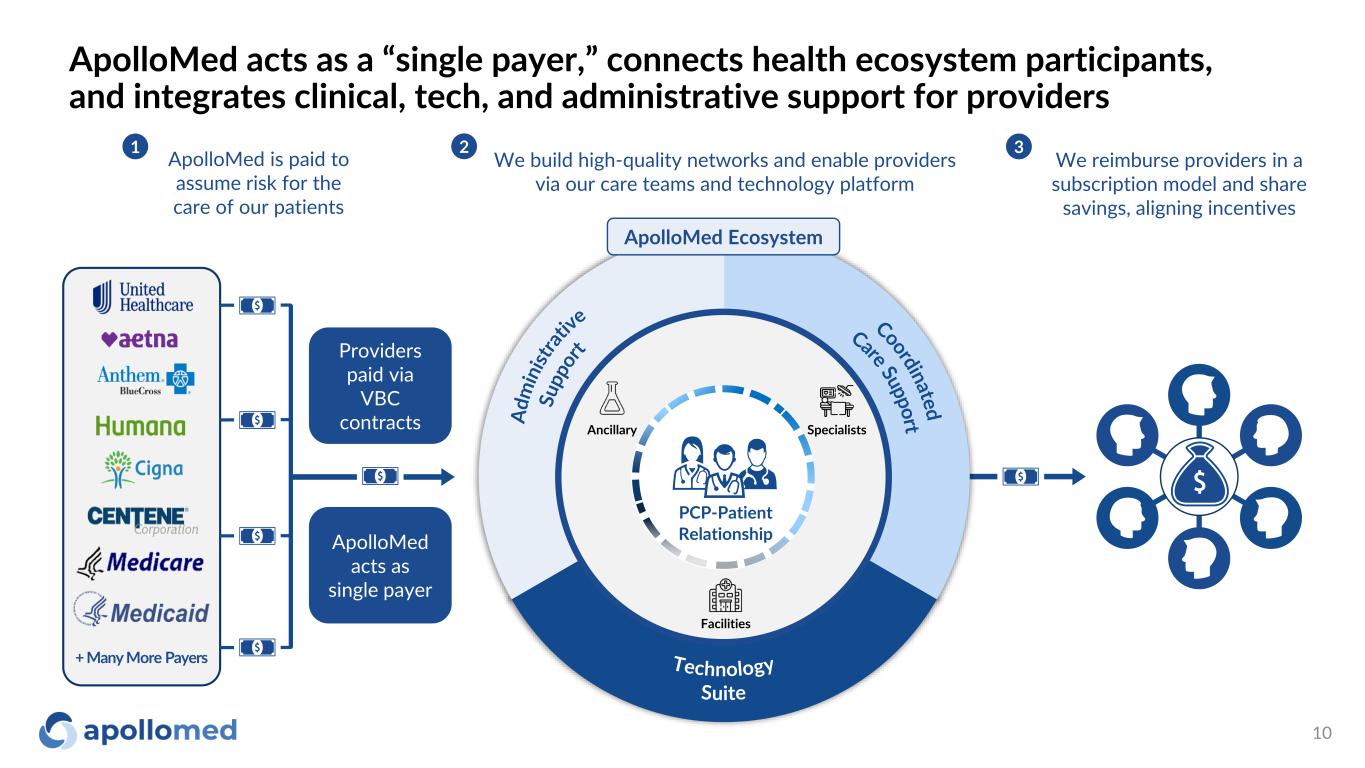

ApolloMed acts as a “single payer,” connects health ecosystem participants, and integrates clinical, tech, and administrative support for providers 10 ApolloMed is paid to assume risk for the care of our patients 1 We reimburse providers in a subscription model and share savings, aligning incentives 3 We build high-quality networks and enable providers via our care teams and technology platform 2 PCP-Patient Relationship Specialists Facilities Ancillary ApolloMed Ecosystem ApolloMed acts as single payer Providers paid via VBC contracts + Many More Payers

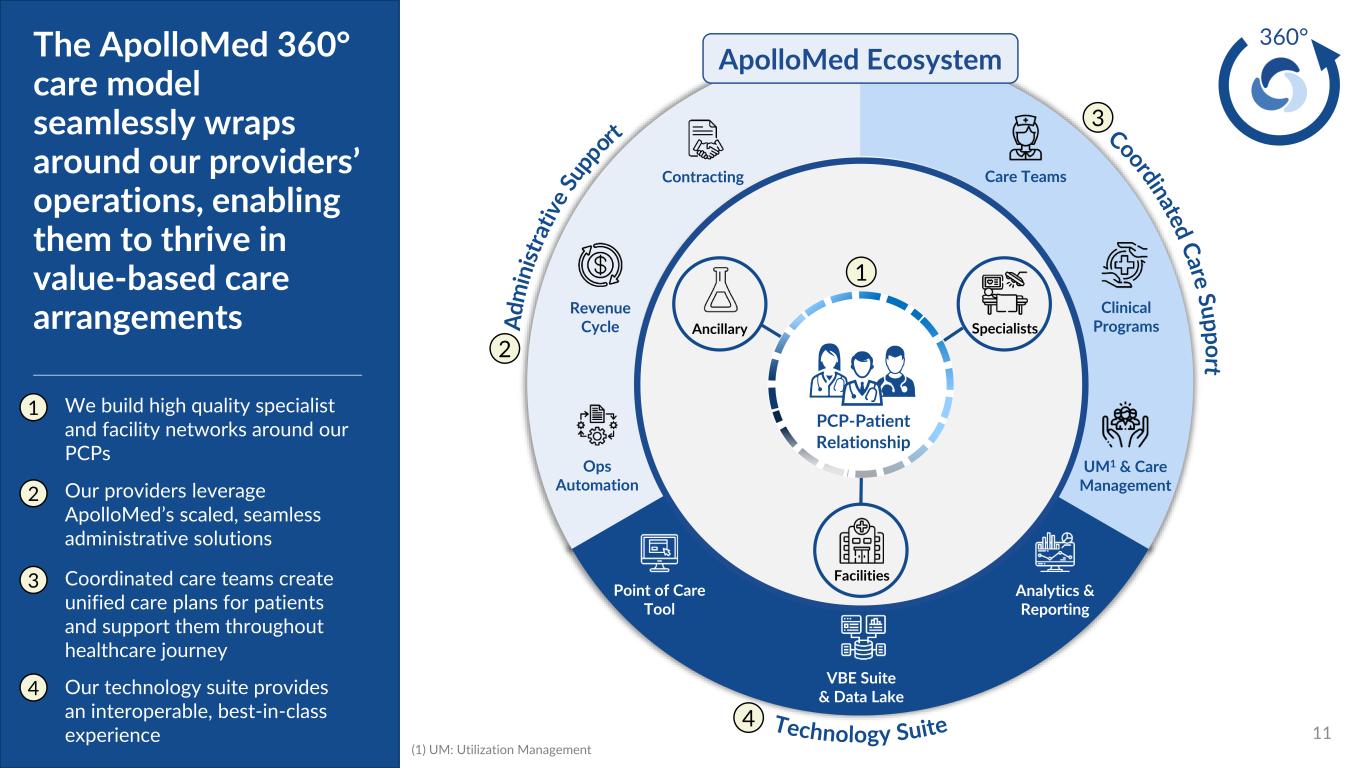

11 The ApolloMed 360° care model seamlessly wraps around our providers’ operations, enabling them to thrive in value-based care arrangements 360° SpecialistsAncillary ApolloMed Ecosystem PCP-Patient Relationship Facilities Clinical Programs UM1 & Care Management Point of Care Tool Revenue Cycle Contracting Ops Automation VBE Suite & Data Lake Analytics & Reporting We build high quality specialist and facility networks around our PCPs Care Teams 1 2 3 4 (1) UM: Utilization Management 1 2 3 4 Our providers leverage ApolloMed’s scaled, seamless administrative solutions Coordinated care teams create unified care plans for patients and support them throughout healthcare journey Our technology suite provides an interoperable, best-in-class experience

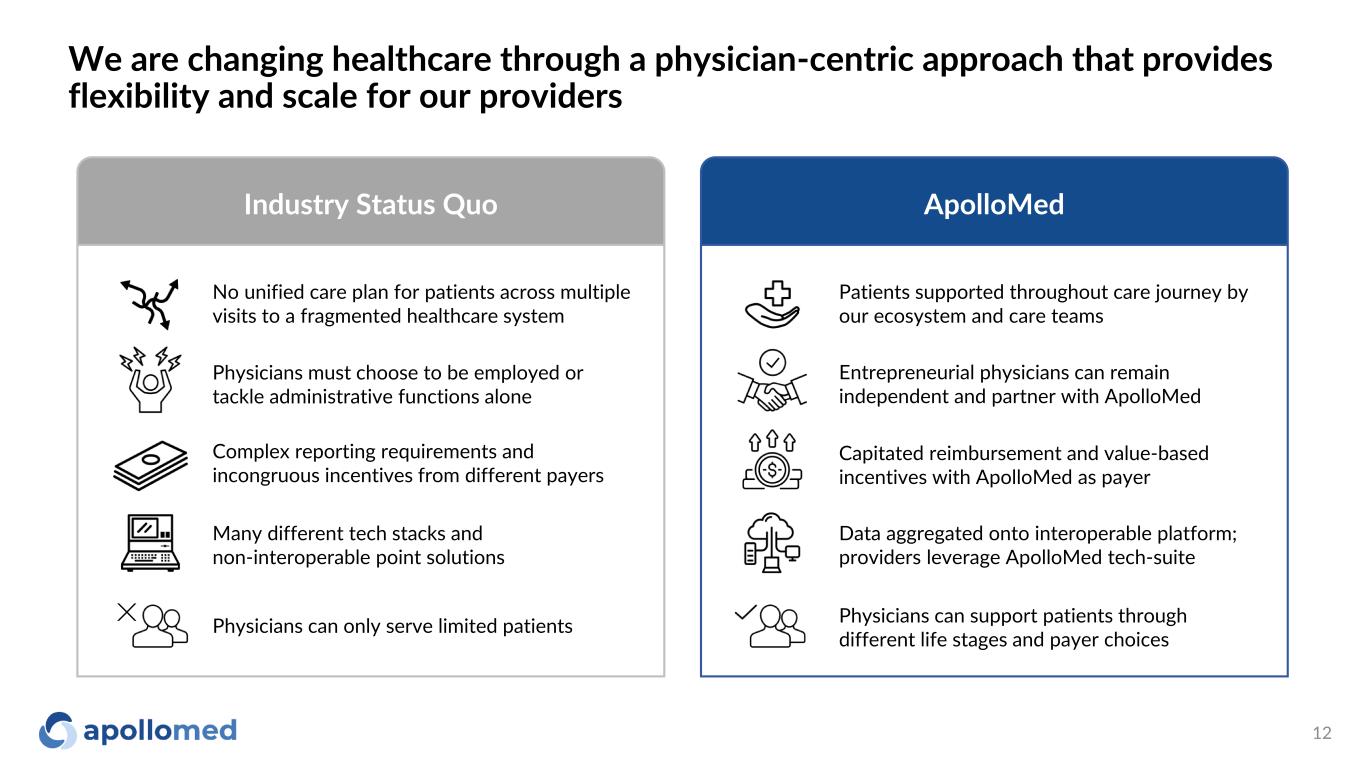

We are changing healthcare through a physician-centric approach that provides flexibility and scale for our providers Industry Status Quo ApolloMed Patients supported throughout care journey by our ecosystem and care teams Entrepreneurial physicians can remain independent and partner with ApolloMed Capitated reimbursement and value-based incentives with ApolloMed as payer Data aggregated onto interoperable platform; providers leverage ApolloMed tech-suite Physicians can support patients through different life stages and payer choices No unified care plan for patients across multiple visits to a fragmented healthcare system Physicians must choose to be employed or tackle administrative functions alone Complex reporting requirements and incongruous incentives from different payers Many different tech stacks and non-interoperable point solutions Physicians can only serve limited patients 12

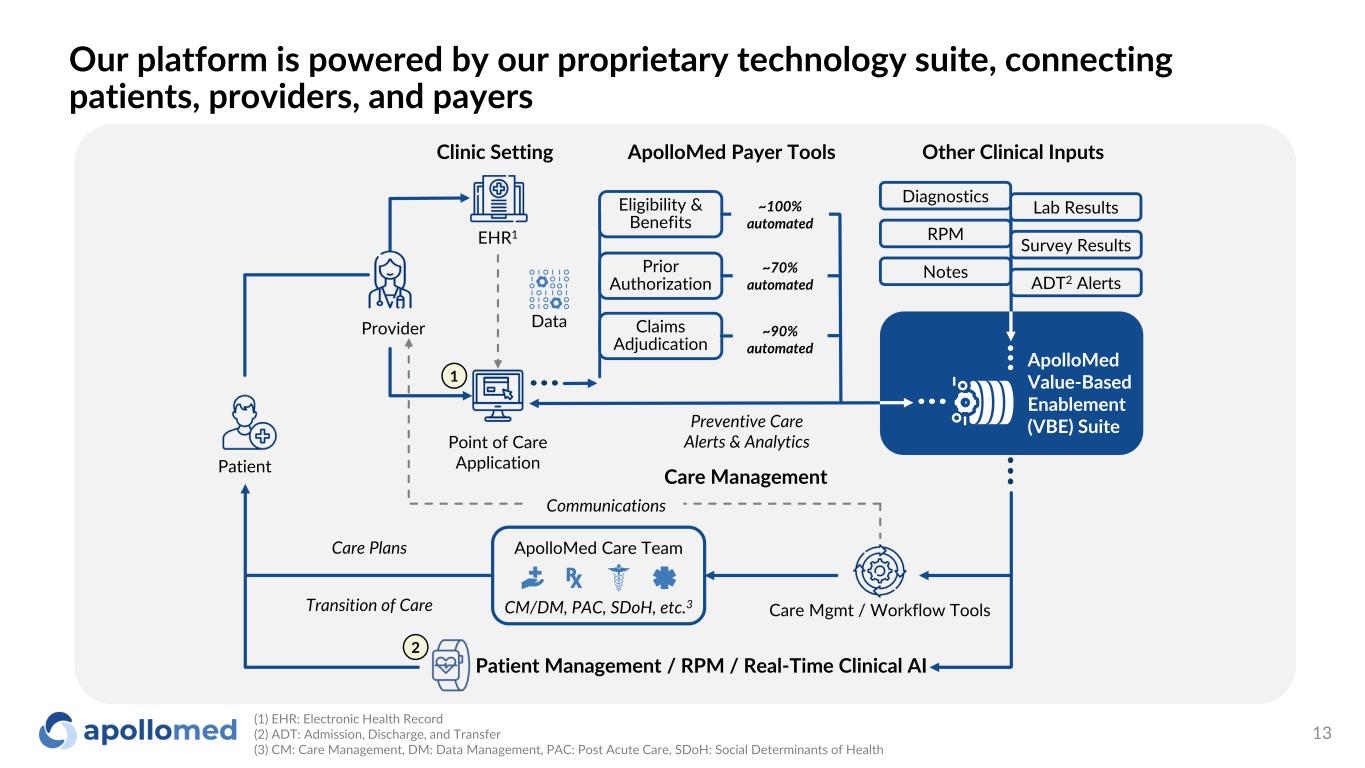

Our platform is powered by our proprietary technology suite, connecting patients, providers, and payers Provider Point of Care Application EHR1 Data Patient Care Management ApolloMed Care Team CM/DM, PAC, SDoH, etc.3 Communications Patient Management / RPM / Real-Time Clinical AI Care Mgmt / Workflow Tools Eligibility & Benefits Claims Adjudication Prior Authorization ApolloMed Payer Tools Other Clinical InputsClinic Setting ~100% automated ~70% automated ~90% automated ApolloMed Value-Based Enablement (VBE) Suite Care Plans Transition of Care Preventive Care Alerts & Analytics Notes ADT2 Alerts Diagnostics Lab Results RPM Survey Results 2 1 (1) EHR: Electronic Health Record (2) ADT: Admission, Discharge, and Transfer (3) CM: Care Management, DM: Data Management, PAC: Post Acute Care, SDoH: Social Determinants of Health 13

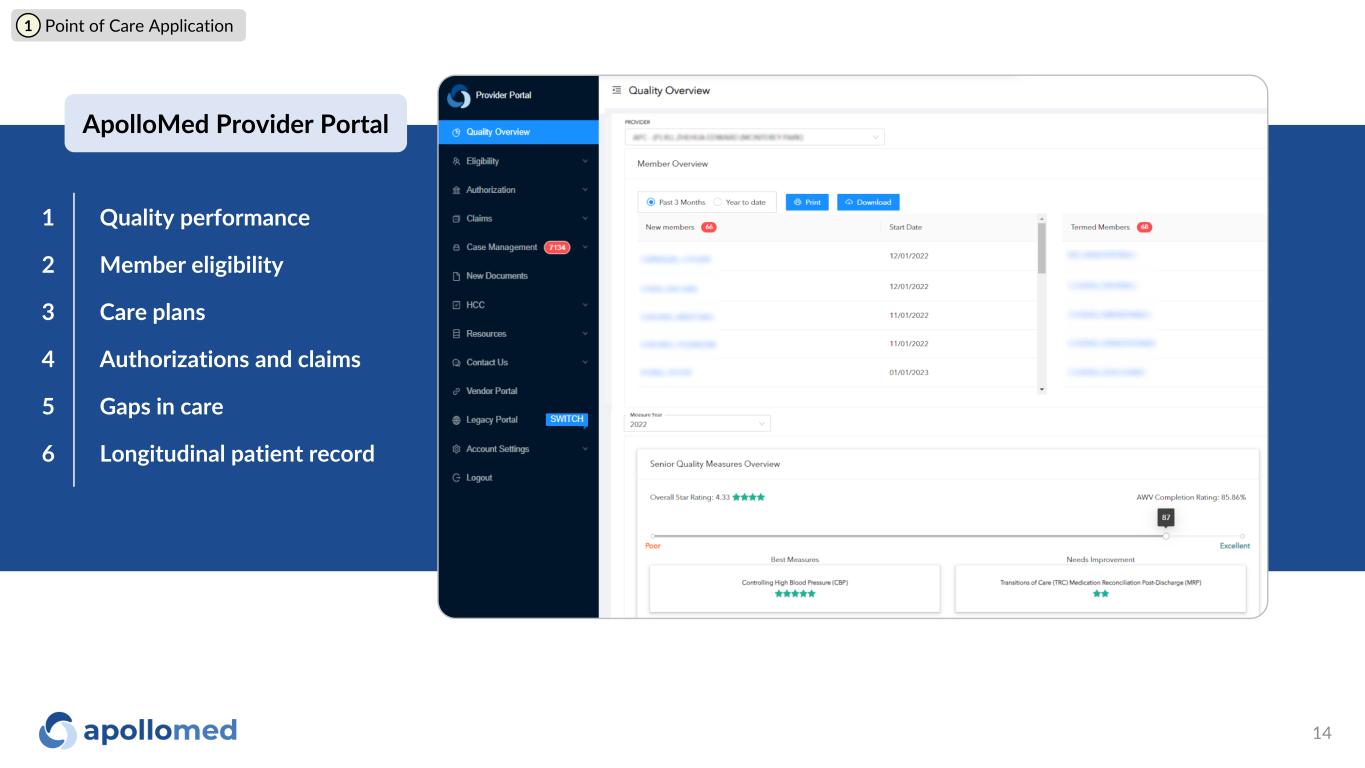

ApolloMed Provider Portal Quality performance Member eligibility Care plans Authorizations and claims Gaps in care Longitudinal patient record 1 2 3 4 5 6 1 Point of Care Application 14

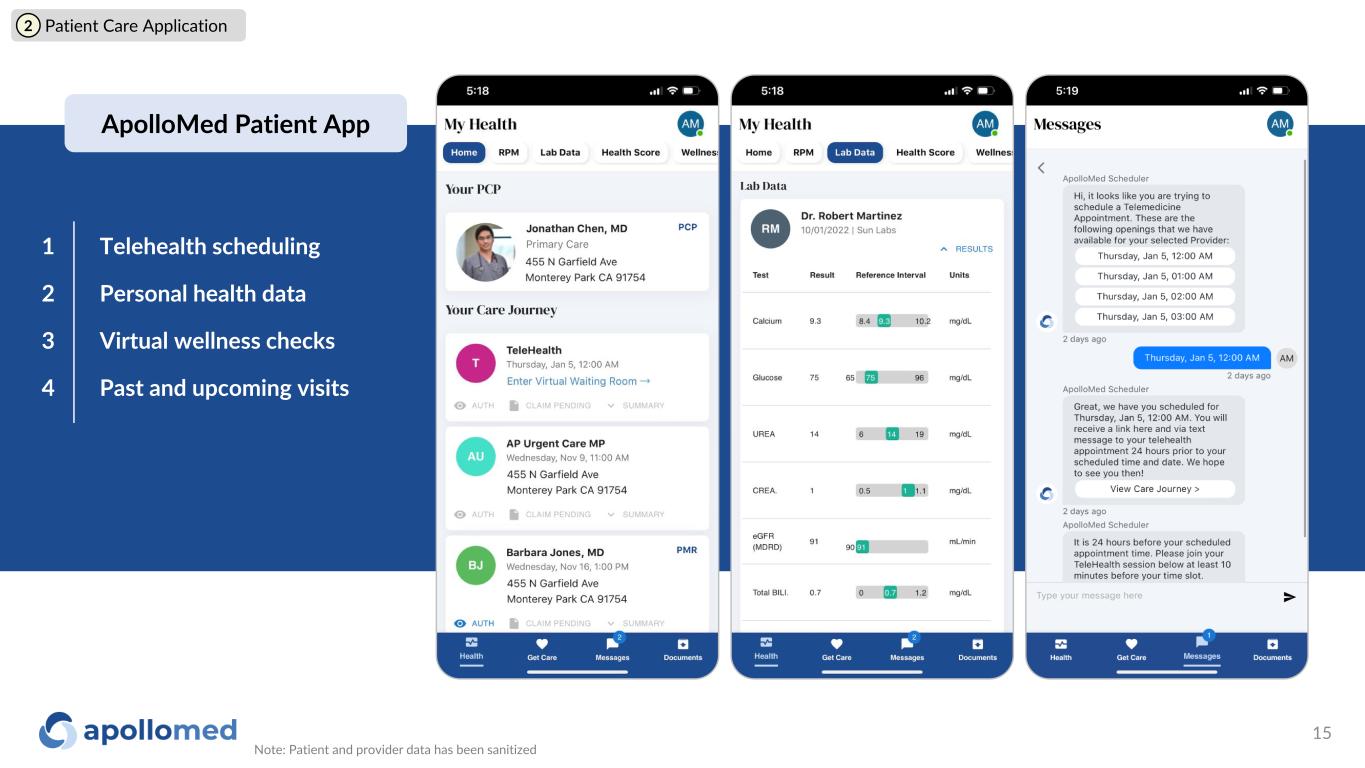

Telehealth scheduling Personal health data Virtual wellness checks Past and upcoming visits 1 2 3 4 2 Patient Care Application Note: Patient and provider data has been sanitized 15 ApolloMed Patient App

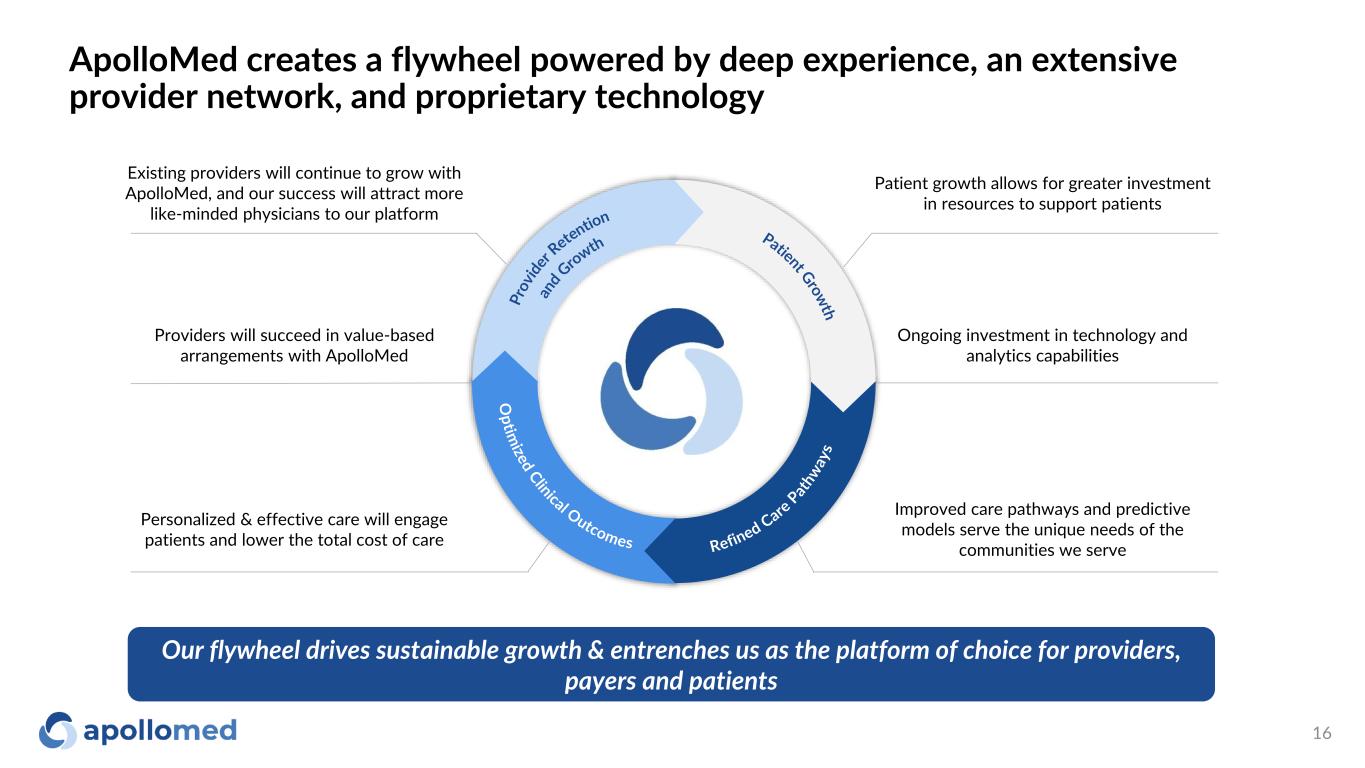

ApolloMed creates a flywheel powered by deep experience, an extensive provider network, and proprietary technology Providers will succeed in value-based arrangements with ApolloMed Personalized & effective care will engage patients and lower the total cost of care Improved care pathways and predictive models serve the unique needs of the communities we serve Ongoing investment in technology and analytics capabilities Patient growth allows for greater investment in resources to support patients Existing providers will continue to grow with ApolloMed, and our success will attract more like-minded physicians to our platform Our flywheel drives sustainable growth & entrenches us as the platform of choice for providers, payers and patients 16

Growth Strategy

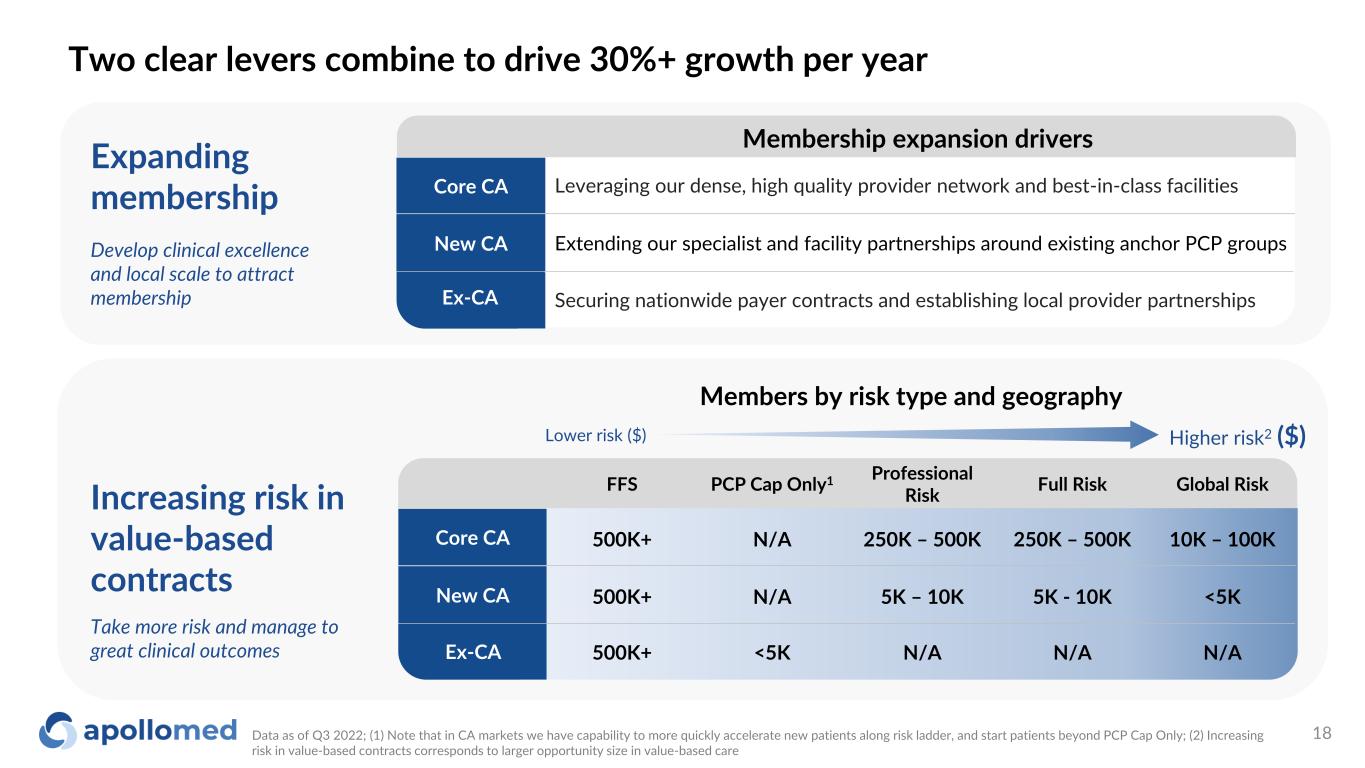

Two clear levers combine to drive 30%+ growth per year Data as of Q3 2022; (1) Note that in CA markets we have capability to more quickly accelerate new patients along risk ladder, and start patients beyond PCP Cap Only; (2) Increasing risk in value-based contracts corresponds to larger opportunity size in value-based care Lower risk ($) Higher risk2 ($) Members by risk type and geography Core CA New CA Ex-CA FFS PCP Cap Only1 Professional Risk Full Risk Global Risk 500K+ N/A 250K – 500K 250K – 500K 10K – 100K 500K+ N/A 5K – 10K 5K - 10K <5K 500K+ <5K N/A N/A N/A Increasing risk in value-based contracts Take more risk and manage to great clinical outcomes Expanding membership Develop clinical excellence and local scale to attract membership Core CA Securing nationwide payer contracts and establishing local provider partnershipsEx-CA Extending our specialist and facility partnerships around existing anchor PCP groups Leveraging our dense, high quality provider network and best-in-class facilities New CA Membership expansion drivers 18

Multi-faceted growth strategy across our markets Where we are today Growth strategy Recent developments Core CA New CA Ex-CA ✓ 7 counties across core CA geographies ✓ Extensive and long-standing provider network ✓ Entered two new states (NV, TX) ✓ Executing network development plans ✓ Operations and growth teams active ✓ Added 30k members in new CA counties ✓ Added 920 new providers • Move toward global risk with RKK1 • Leveraging MSO relationships and contracting new providers • Accretive tuck-ins • Expand payer partnerships • Deepen broker relationships • Establish specialist and hospital networks • Tuck-ins / selective M&A • Move toward global risk with RKK1 • Expand institutional and specialist partnerships • Growth with new and existing payers • Tuck-ins Opened multiple multi-specialty supercenters 20% growth2 in contracted providers YoY RECENT PROVIDER PARTNERSHIPS RECENT PROVIDER PARTNERSHIPS RECENTLY ADDED PAYER PARTNERS RECENTLY ADDED STATES NV TX Data as of December 2022; (1) RKK is a Restricted Knox-Keene license. The RKK License permits an Entity to enter into global risk arrangements with fully licensed health plans on a contract-by-contract basis. For more information on the impact of RKK, please refer to the “Path to Global Risk” section of the appendix; (2) For core CA region IPAs Dec 2021 – Dec 2022, which include Allied Pacific IPA, Accountable Health Care IPA, and Alpha Care Medical Group 19

Outcomes

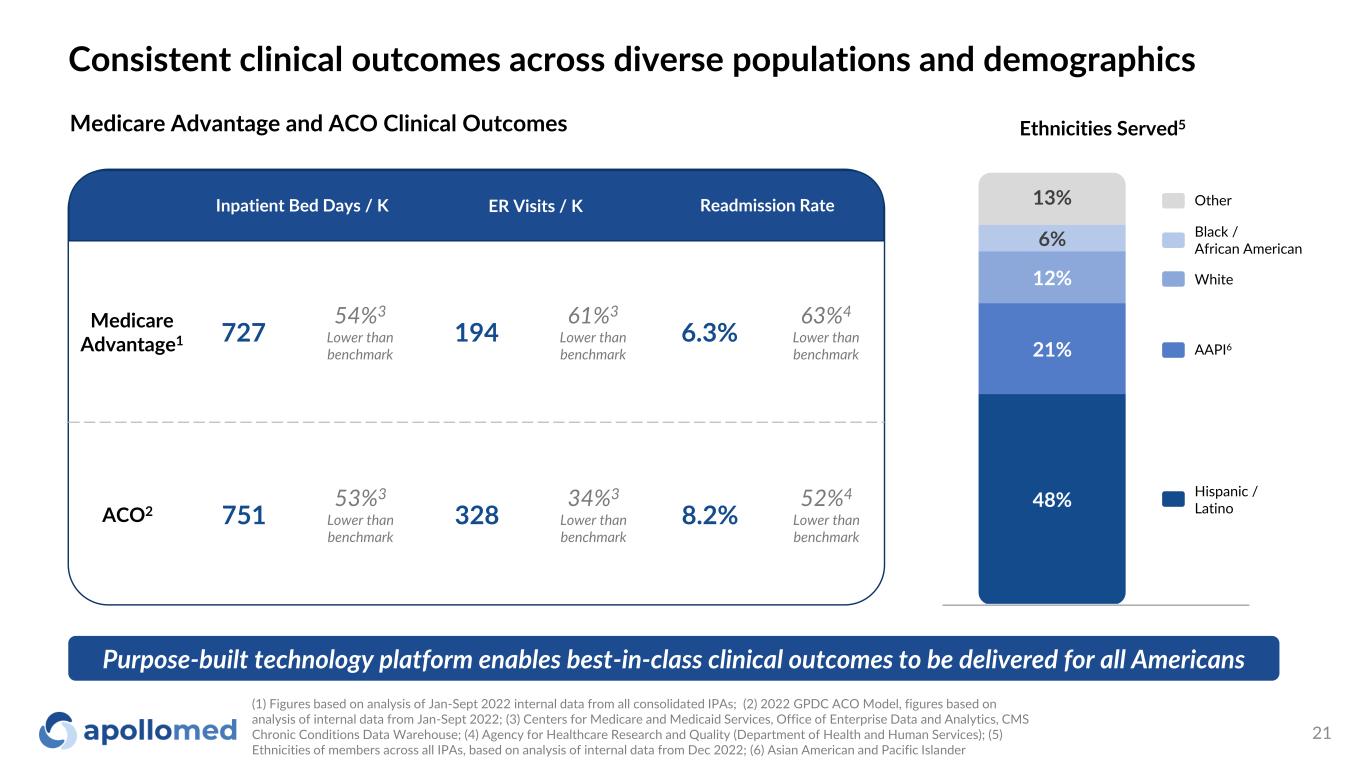

Consistent clinical outcomes across diverse populations and demographics Medicare Advantage and ACO Clinical Outcomes Purpose-built technology platform enables best-in-class clinical outcomes to be delivered for all Americans Ethnicities Served5 48% 21% 12% 6% 13% (1) Figures based on analysis of Jan-Sept 2022 internal data from all consolidated IPAs; (2) 2022 GPDC ACO Model, figures based on analysis of internal data from Jan-Sept 2022; (3) Centers for Medicare and Medicaid Services, Office of Enterprise Data and Analytics, CMS Chronic Conditions Data Warehouse; (4) Agency for Healthcare Research and Quality (Department of Health and Human Services); (5) Ethnicities of members across all IPAs, based on analysis of internal data from Dec 2022; (6) Asian American and Pacific Islander Hispanic / Latino AAPI6 White Black / African American Other Medicare Advantage1 727 54%3 Lower than benchmark 194 61%3 Lower than benchmark 6.3% 63%4 Lower than benchmark ACO2 751 53%3 Lower than benchmark 328 34%3 Lower than benchmark 8.2% 52%4 Lower than benchmark Inpatient Bed Days / K ER Visits / K Readmission Rate 21

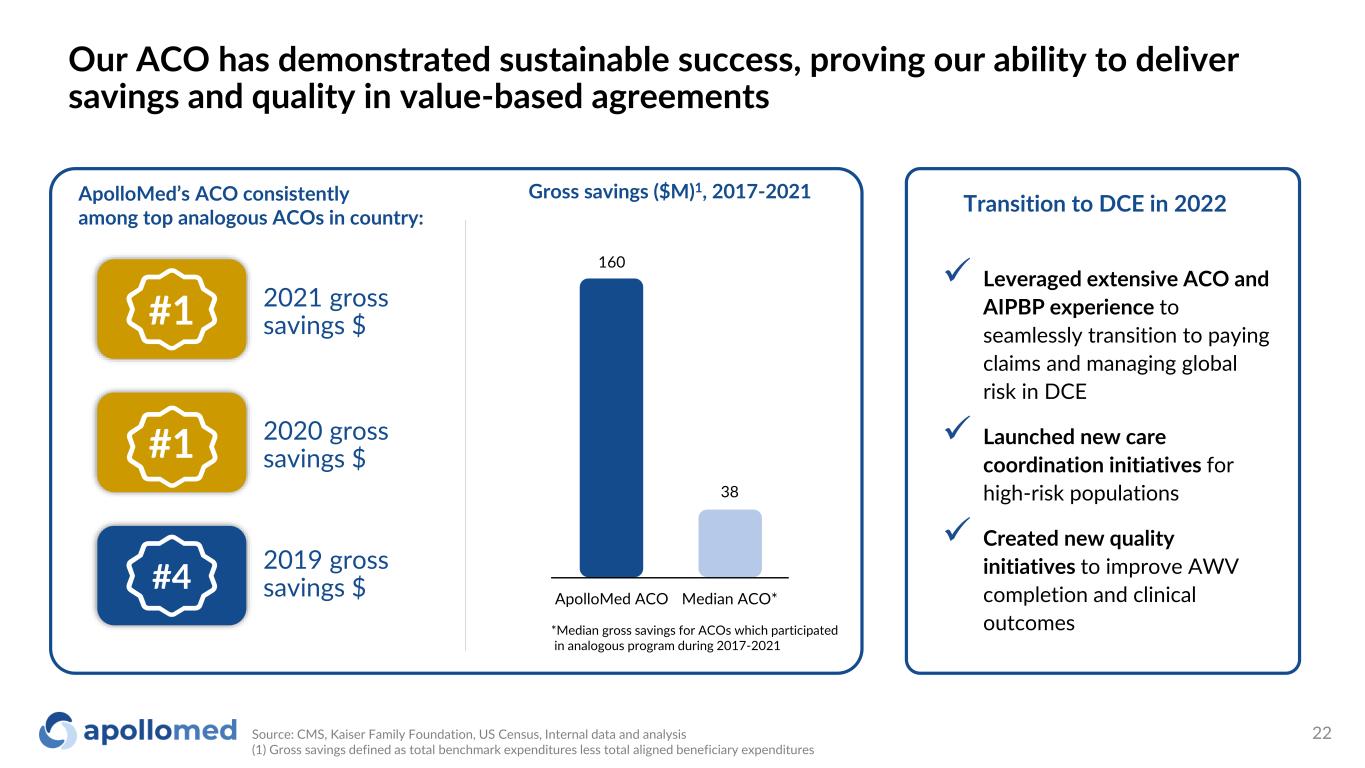

Our ACO has demonstrated sustainable success, proving our ability to deliver savings and quality in value-based agreements Source: CMS, Kaiser Family Foundation, US Census, Internal data and analysis (1) Gross savings defined as total benchmark expenditures less total aligned beneficiary expenditures ApolloMed’s ACO consistently among top analogous ACOs in country: Gross savings ($M)1, 2017-2021 *Median gross savings for ACOs which participated in analogous program during 2017-2021 160 38 ApolloMed ACO Median ACO* ✓ Leveraged extensive ACO and AIPBP experience to seamlessly transition to paying claims and managing global risk in DCE ✓ Launched new care coordination initiatives for high-risk populations ✓ Created new quality initiatives to improve AWV completion and clinical outcomes Transition to DCE in 2022 2020 gross savings $#1 2019 gross savings $#4 2021 gross savings $#1 22

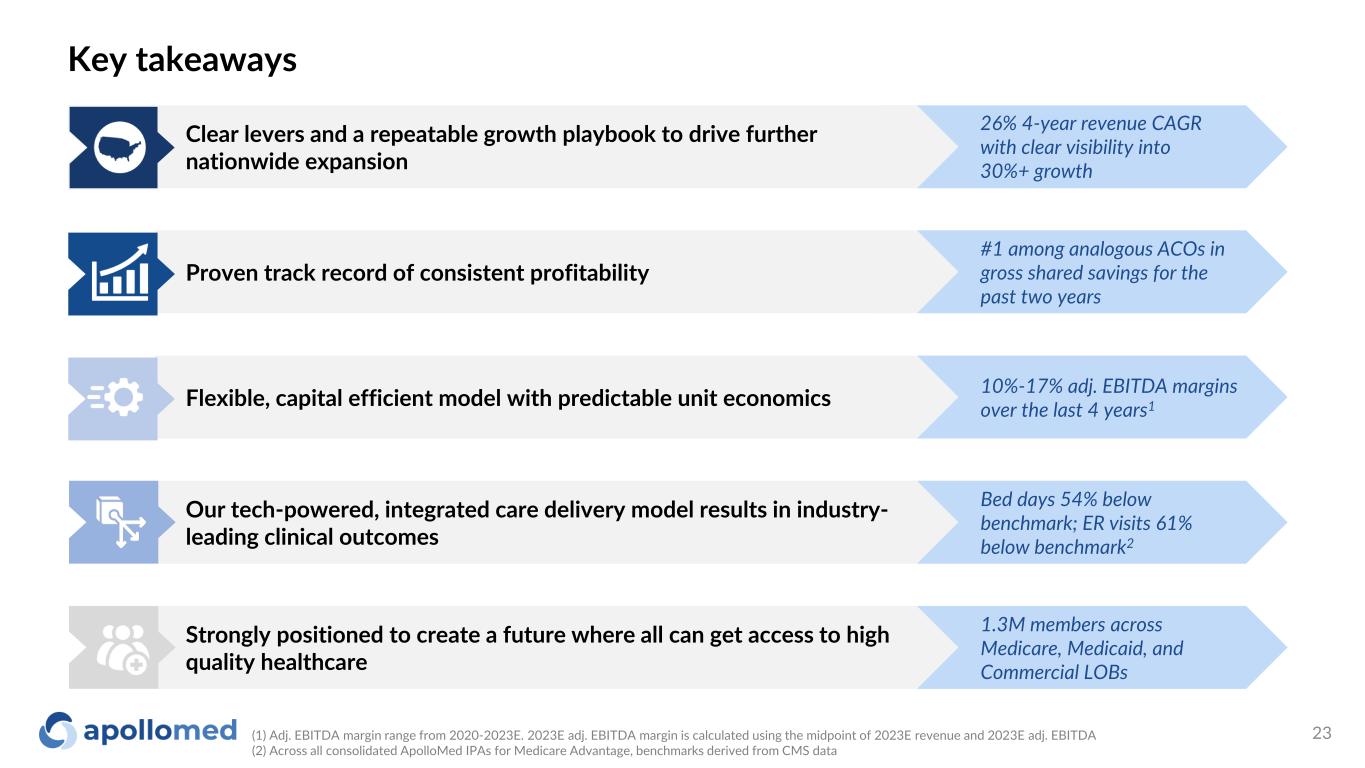

10%-17% adj. EBITDA margins over the last 4 years1 Bed days 54% below benchmark; ER visits 61% below benchmark2 1.3M members across Medicare, Medicaid, and Commercial LOBs #1 among analogous ACOs in gross shared savings for the past two years Key takeaways Strongly positioned to create a future where all can get access to high quality healthcare Proven track record of consistent profitability Our tech-powered, integrated care delivery model results in industry- leading clinical outcomes Flexible, capital efficient model with predictable unit economics Clear levers and a repeatable growth playbook to drive further nationwide expansion (1) Adj. EBITDA margin range from 2020-2023E. 2023E adj. EBITDA margin is calculated using the midpoint of 2023E revenue and 2023E adj. EBITDA (2) Across all consolidated ApolloMed IPAs for Medicare Advantage, benchmarks derived from CMS data 26% 4-year revenue CAGR with clear visibility into 30%+ growth 23

Appendix

Financial Data

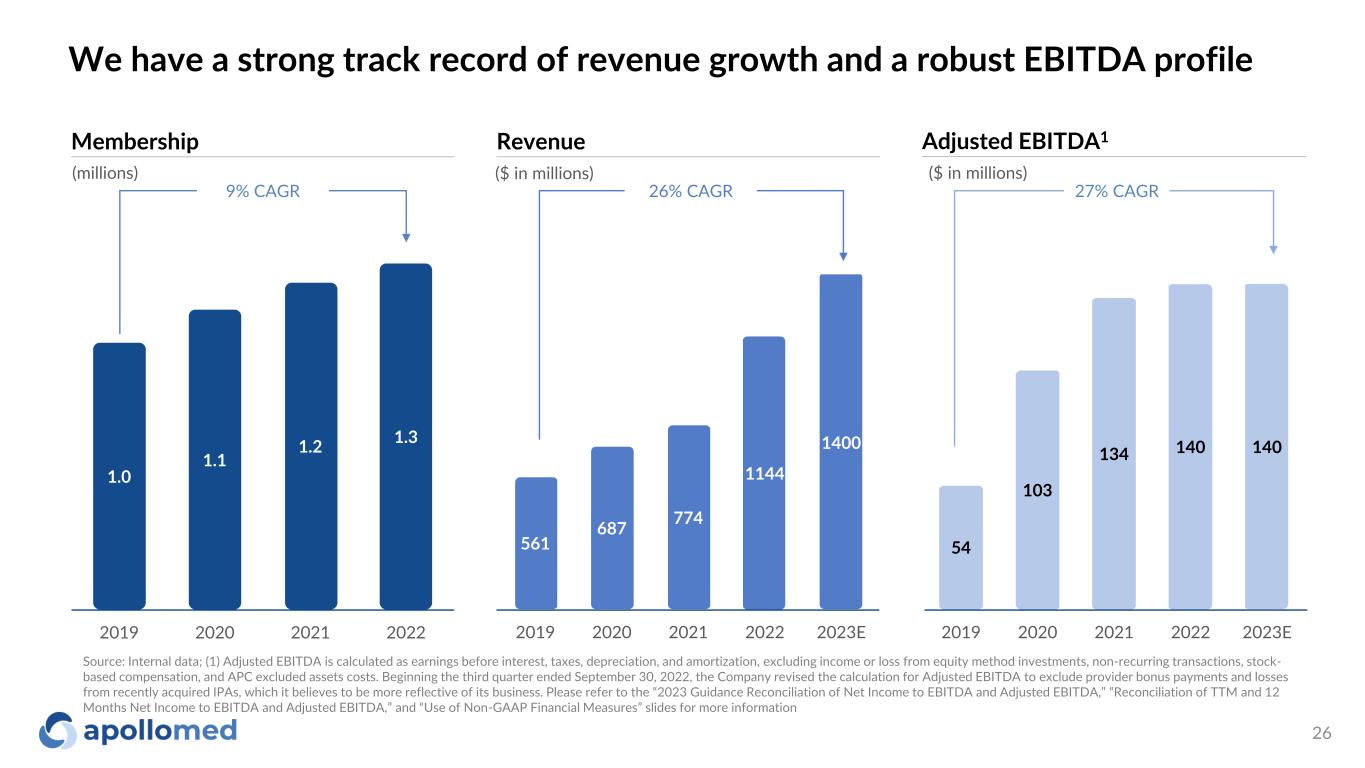

561 687 774 1144 1400 2019 2020 2021 2022 2023E We have a strong track record of revenue growth and a robust EBITDA profile ($ in millions) Revenue 26% CAGR ($ in millions) Adjusted EBITDA1 27% CAGR Source: Internal data; (1) Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation, and amortization, excluding income or loss from equity method investments, non-recurring transactions, stock- based compensation, and APC excluded assets costs. Beginning the third quarter ended September 30, 2022, the Company revised the calculation for Adjusted EBITDA to exclude provider bonus payments and losses from recently acquired IPAs, which it believes to be more reflective of its business. Please refer to the “2023 Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA,” “Reconciliation of TTM and 12 Months Net Income to EBITDA and Adjusted EBITDA,” and “Use of Non-GAAP Financial Measures” slides for more information 54 103 134 140 140 2019 2020 2021 2022 2023E Membership 9% CAGR 1.0 1.1 1.2 1.3 2019 2020 2021 2022 (millions) 26

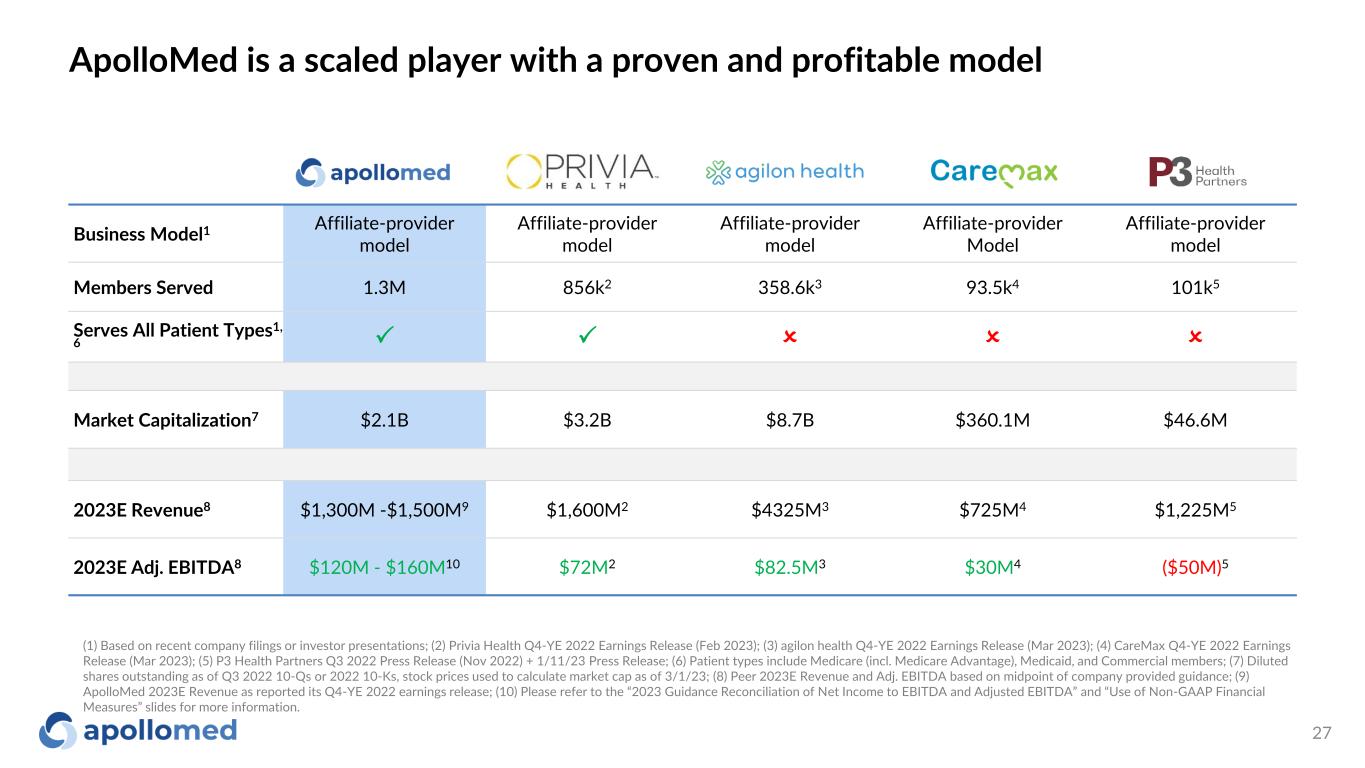

ApolloMed is a scaled player with a proven and profitable model Business Model1 Affiliate-provider model Affiliate-provider model Affiliate-provider model Affiliate-provider Model Affiliate-provider model Members Served 1.3M 856k2 358.6k3 93.5k4 101k5 Serves All Patient Types1, 6 P P O O O Market Capitalization7 $2.1B $3.2B $8.7B $360.1M $46.6M 2023E Revenue8 $1,300M -$1,500M9 $1,600M2 $4325M3 $725M4 $1,225M5 2023E Adj. EBITDA8 $120M - $160M10 $72M2 $82.5M3 $30M4 ($50M)5 (1) Based on recent company filings or investor presentations; (2) Privia Health Q4-YE 2022 Earnings Release (Feb 2023); (3) agilon health Q4-YE 2022 Earnings Release (Mar 2023); (4) CareMax Q4-YE 2022 Earnings Release (Mar 2023); (5) P3 Health Partners Q3 2022 Press Release (Nov 2022) + 1/11/23 Press Release; (6) Patient types include Medicare (incl. Medicare Advantage), Medicaid, and Commercial members; (7) Diluted shares outstanding as of Q3 2022 10-Qs or 2022 10-Ks, stock prices used to calculate market cap as of 3/1/23; (8) Peer 2023E Revenue and Adj. EBITDA based on midpoint of company provided guidance; (9) ApolloMed 2023E Revenue as reported its Q4-YE 2022 earnings release; (10) Please refer to the “2023 Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA” and “Use of Non-GAAP Financial Measures” slides for more information. 27

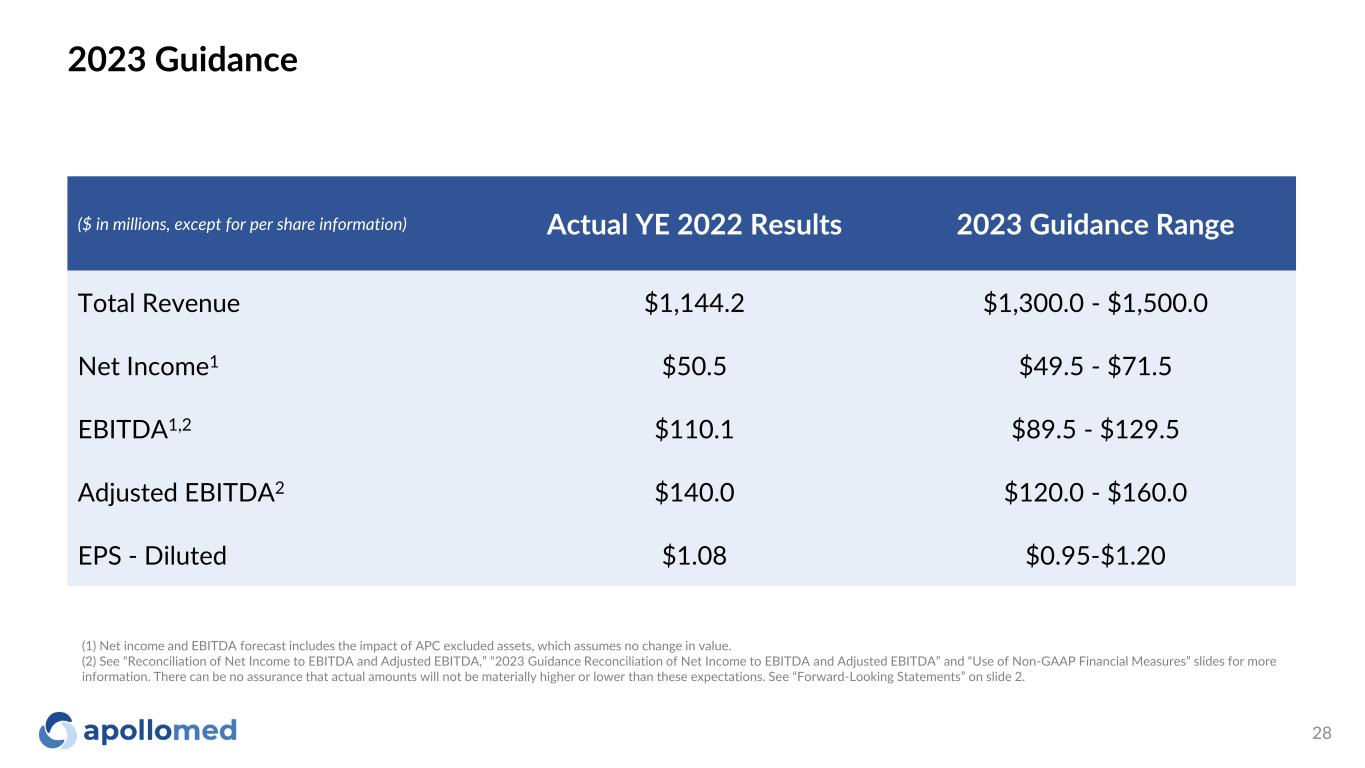

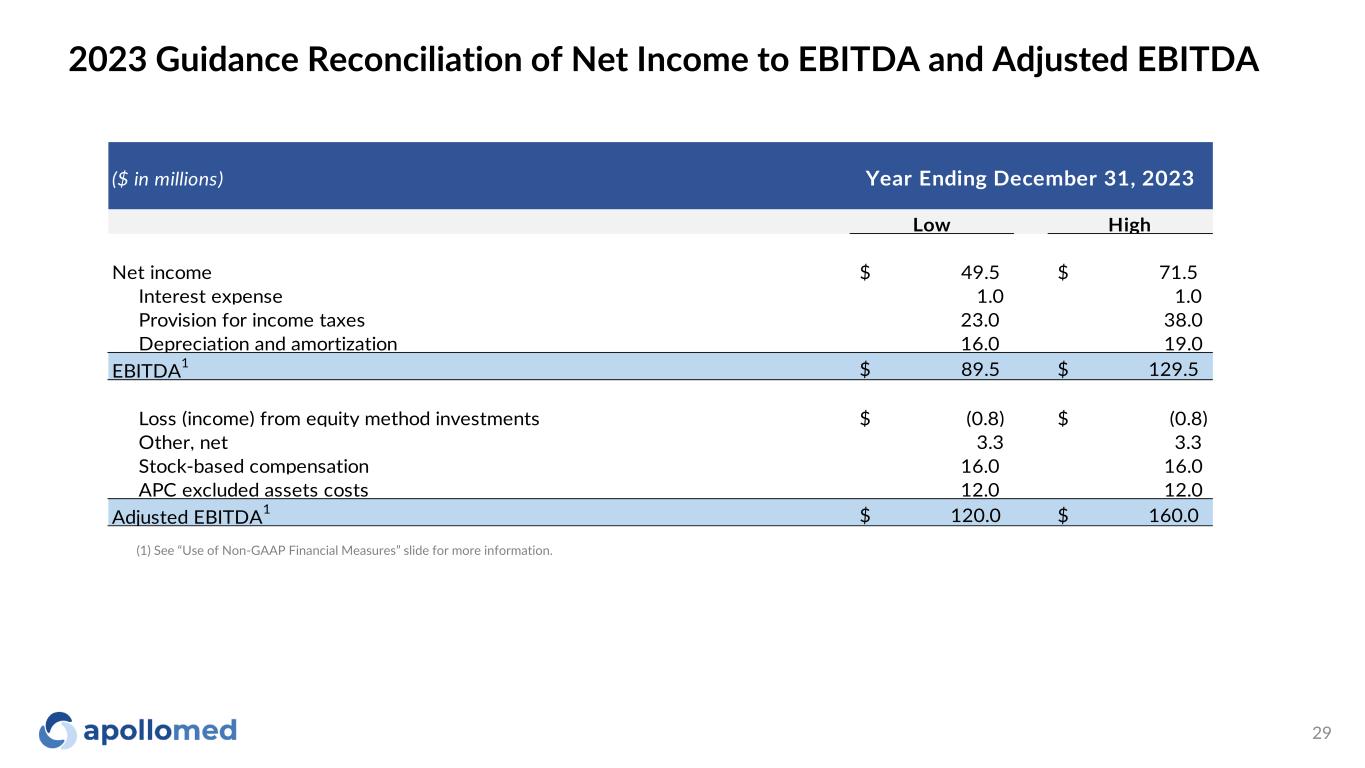

2023 Guidance ($ in millions, except for per share information) Actual YE 2022 Results 2023 Guidance Range Total Revenue $1,144.2 $1,300.0 - $1,500.0 Net Income1 $50.5 $49.5 - $71.5 EBITDA1,2 $110.1 $89.5 - $129.5 Adjusted EBITDA2 $140.0 $120.0 - $160.0 EPS - Diluted $1.08 $0.95-$1.20 (1) Net income and EBITDA forecast includes the impact of APC excluded assets, which assumes no change in value. (2) See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA,” “2023 Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA” and “Use of Non-GAAP Financial Measures” slides for more information. There can be no assurance that actual amounts will not be materially higher or lower than these expectations. See “Forward-Looking Statements” on slide 2. 28

2023 Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA ($ in millions) Low High Net income $ 49.5 $ 71.5 Interest expense 1.0 1.0 Provision for income taxes 23.0 38.0 Depreciation and amortization 16.0 19.0 EBITDA1 $ 89.5 $ 129.5 Loss (income) from equity method investments $ (0.8) $ (0.8) Other, net 3.3 3.3 Stock-based compensation 16.0 16.0 APC excluded assets costs 12.0 12.0 Adjusted EBITDA1 $ 120.0 $ 160.0 Year Ending December 31, 2023 (1) See “Use of Non-GAAP Financial Measures” slide for more information. 29

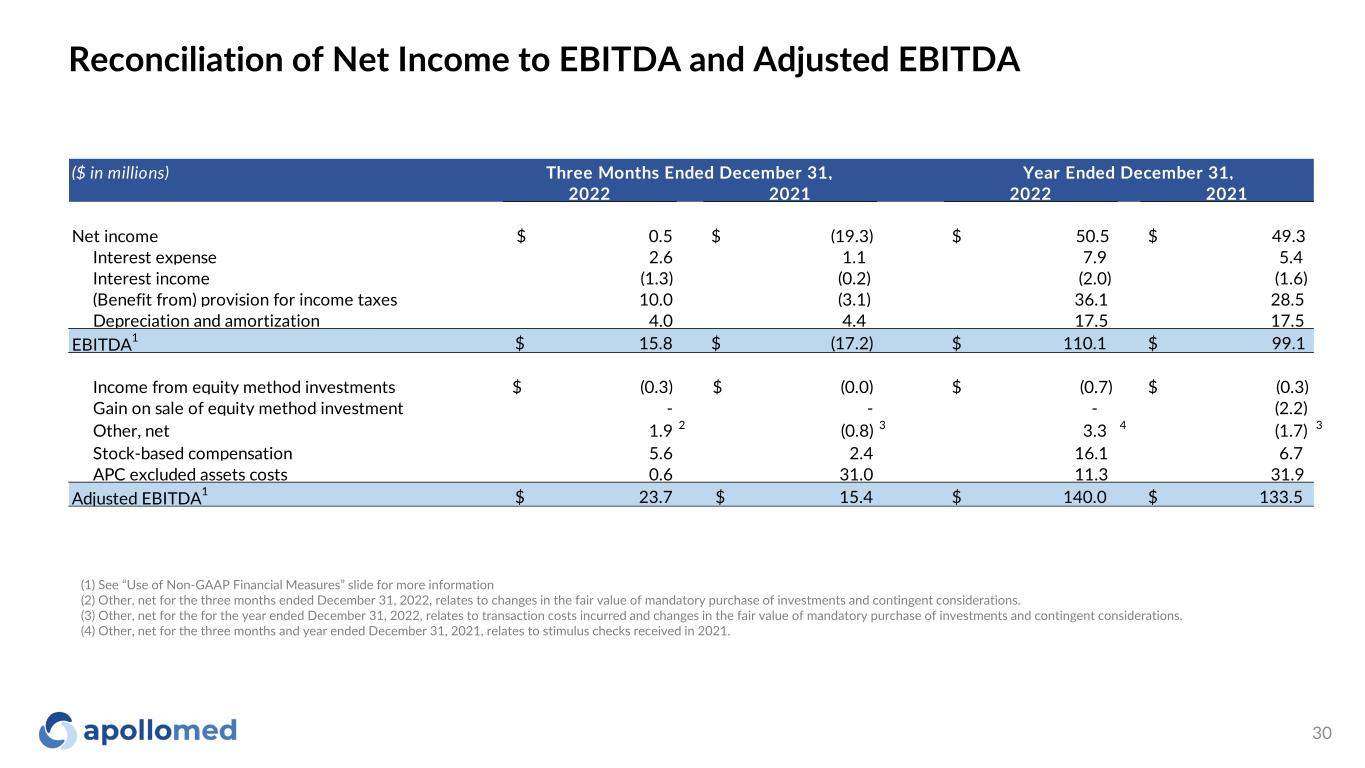

Reconciliation of Net Income to EBITDA and Adjusted EBITDA ($ in millions) 2022 2021 2022 2021 Net income $ 0.5 $ (19.3) $ 50.5 $ 49.3 Interest expense 2.6 1.1 7.9 5.4 Interest income (1.3) (0.2) (2.0) (1.6) (Benefit from) provision for income taxes 10.0 (3.1) 36.1 28.5 Depreciation and amortization 4.0 4.4 17.5 17.5 EBITDA1 $ 15.8 $ (17.2) $ 110.1 $ 99.1 Income from equity method investments $ (0.3) $ (0.0) $ (0.7) $ (0.3) Gain on sale of equity method investment - - - (2.2) Other, net 1.9 2 (0.8) 3 3.3 4 (1.7) 3 Stock-based compensation 5.6 2.4 16.1 6.7 APC excluded assets costs 0.6 31.0 11.3 31.9 Adjusted EBITDA1 $ 23.7 $ 15.4 $ 140.0 $ 133.5 Three Months Ended December 31, Year Ended December 31, (1) See “Use of Non-GAAP Financial Measures” slide for more information (2) Other, net for the three months ended December 31, 2022, relates to changes in the fair value of mandatory purchase of investments and contingent considerations. (3) Other, net for the for the year ended December 31, 2022, relates to transaction costs incurred and changes in the fair value of mandatory purchase of investments and contingent considerations. (4) Other, net for the three months and year ended December 31, 2021, relates to stimulus checks received in 2021. 30

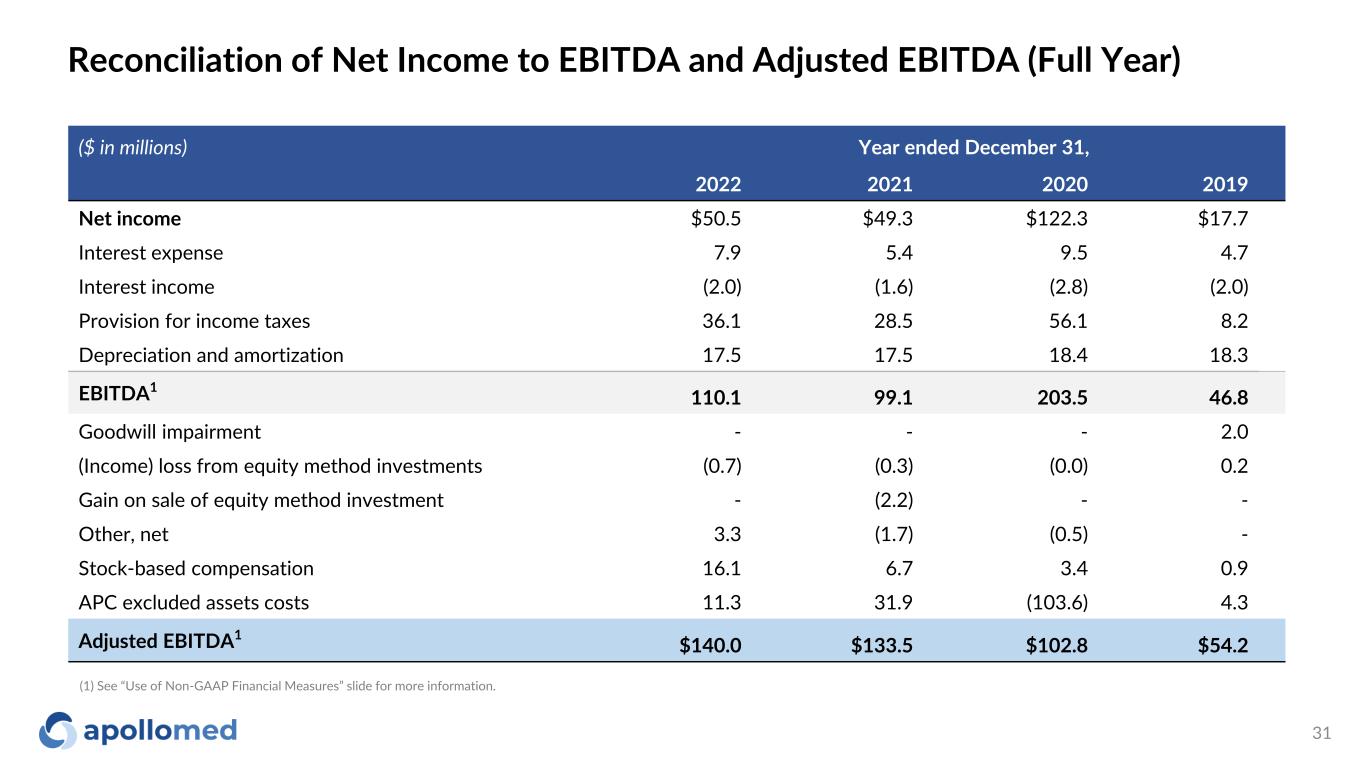

Reconciliation of Net Income to EBITDA and Adjusted EBITDA (Full Year) ($ in millions) Year ended December 31, 2022 2021 2020 2019 Net income $50.5 $49.3 $122.3 $17.7 Interest expense 7.9 5.4 9.5 4.7 Interest income (2.0) (1.6) (2.8) (2.0) Provision for income taxes 36.1 28.5 56.1 8.2 Depreciation and amortization 17.5 17.5 18.4 18.3 EBITDA1 110.1 99.1 203.5 46.8 Goodwill impairment - - - 2.0 (Income) loss from equity method investments (0.7) (0.3) (0.0) 0.2 Gain on sale of equity method investment - (2.2) - - Other, net 3.3 (1.7) (0.5) - Stock-based compensation 16.1 6.7 3.4 0.9 APC excluded assets costs 11.3 31.9 (103.6) 4.3 Adjusted EBITDA1 $140.0 $133.5 $102.8 $54.2 (1) See “Use of Non-GAAP Financial Measures” slide for more information. 31

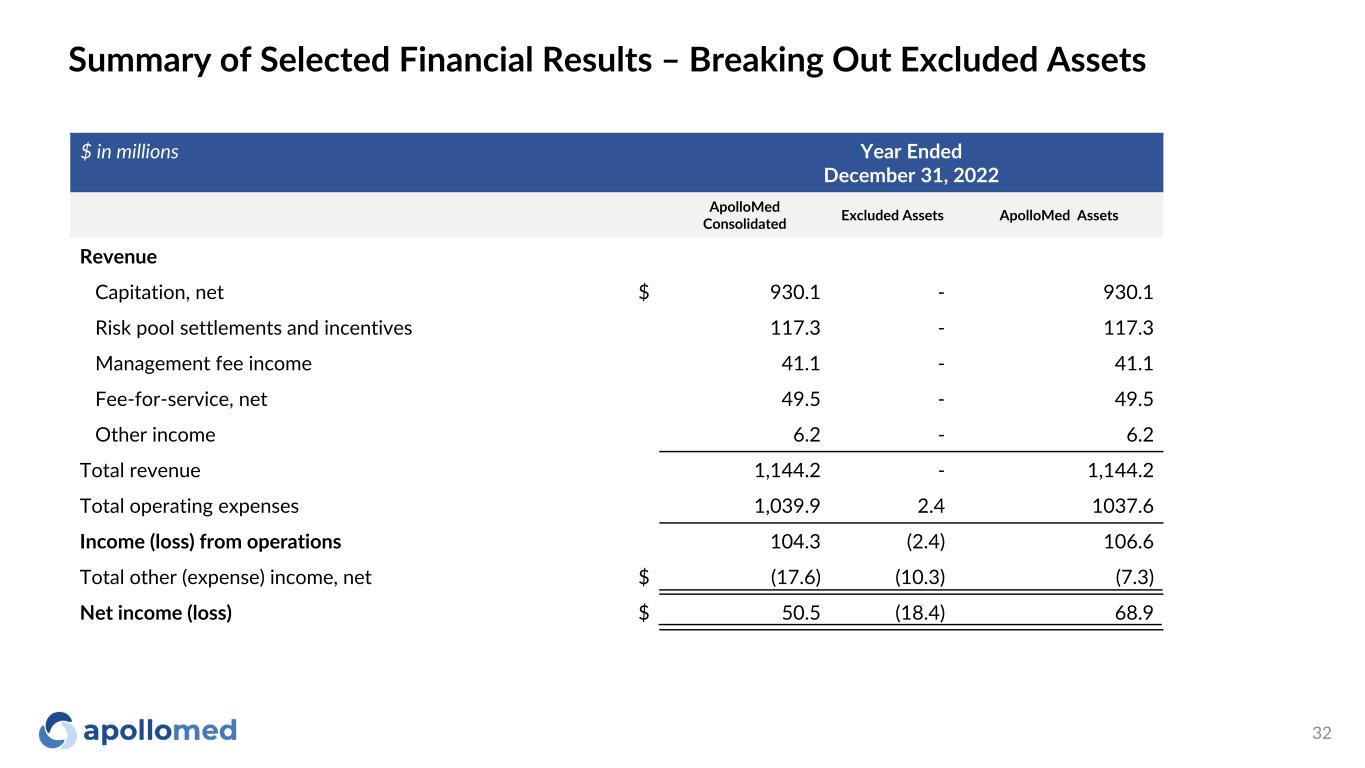

$ in millions Year Ended December 31, 2022 ApolloMed Consolidated Excluded Assets ApolloMed Assets Revenue Capitation, net $ 930.1 - 930.1 Risk pool settlements and incentives 117.3 - 117.3 Management fee income 41.1 - 41.1 Fee-for-service, net 49.5 - 49.5 Other income 6.2 - 6.2 Total revenue 1,144.2 - 1,144.2 Total operating expenses 1,039.9 2.4 1037.6 Income (loss) from operations 104.3 (2.4) 106.6 Total other (expense) income, net $ (17.6) (10.3) (7.3) Net income (loss) $ 50.5 (18.4) 68.9 Summary of Selected Financial Results – Breaking Out Excluded Assets 32

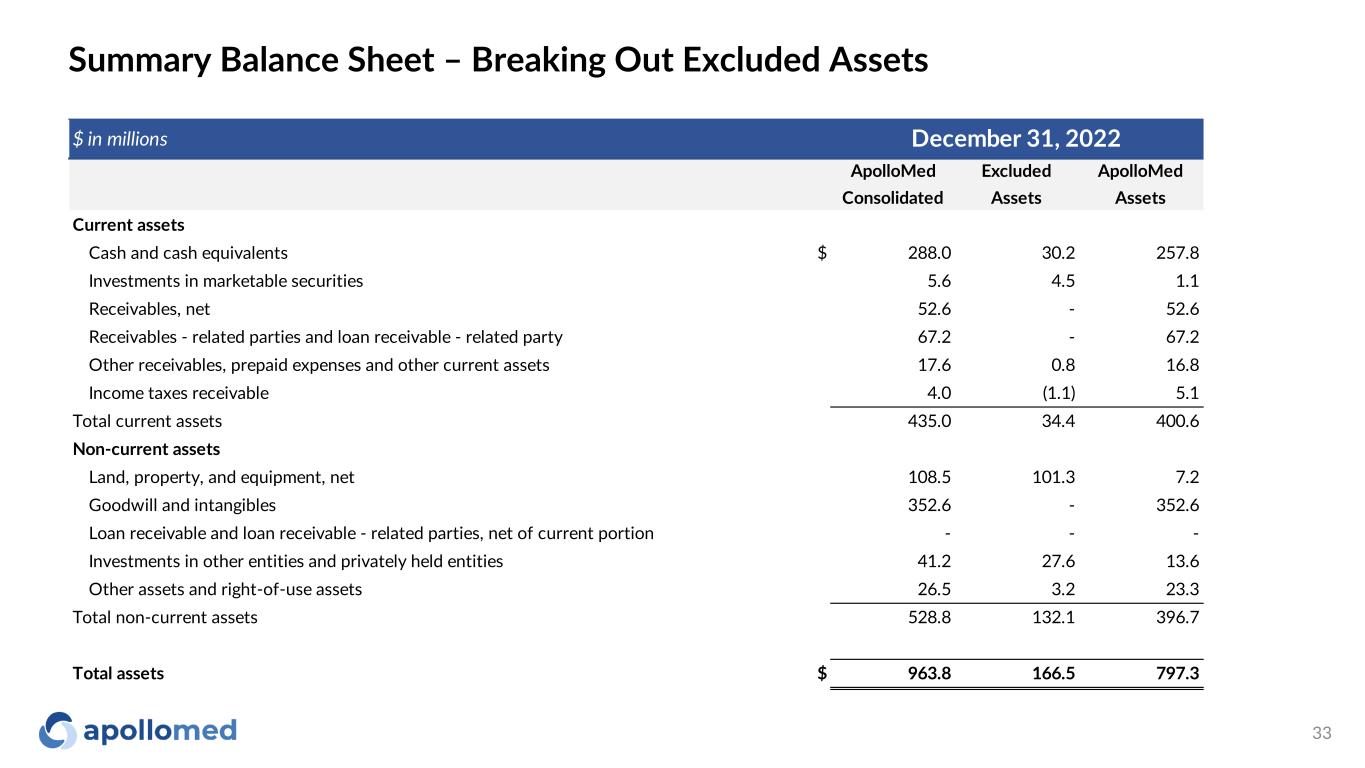

$ in millions ApolloMed Consolidated Excluded Assets ApolloMed Assets Current assets Cash and cash equivalents $ 288.0 30.2 257.8 Investments in marketable securities 5.6 4.5 1.1 Receivables, net 52.6 - 52.6 Receivables - related parties and loan receivable - related party 67.2 - 67.2 Other receivables, prepaid expenses and other current assets 17.6 0.8 16.8 Income taxes receivable 4.0 (1.1) 5.1 Total current assets 435.0 34.4 400.6 Non-current assets Land, property, and equipment, net 108.5 101.3 7.2 Goodwill and intangibles 352.6 - 352.6 Loan receivable and loan receivable - related parties, net of current portion - - - Investments in other entities and privately held entities 41.2 27.6 13.6 Other assets and right-of-use assets 26.5 3.2 23.3 Total non-current assets 528.8 132.1 396.7 Total assets $ 963.8 166.5 797.3 December 31, 2022 Summary Balance Sheet – Breaking Out Excluded Assets 33

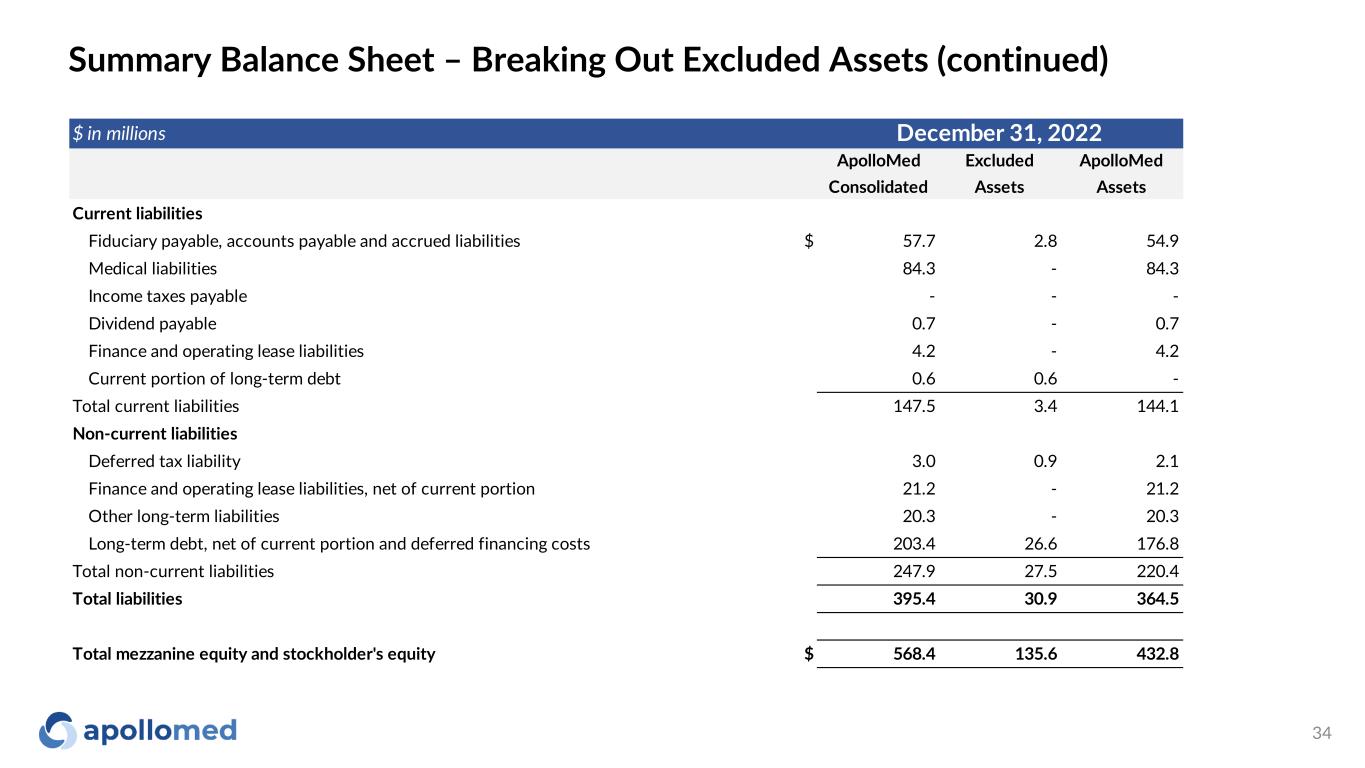

Summary Balance Sheet – Breaking Out Excluded Assets (continued) 34 $ in millions ApolloMed Consolidated Excluded Assets ApolloMed Assets Current liabilities Fiduciary payable, accounts payable and accrued liabilities $ 57.7 2.8 54.9 Medical liabilities 84.3 - 84.3 Income taxes payable - - - Dividend payable 0.7 - 0.7 Finance and operating lease liabilities 4.2 - 4.2 Current portion of long-term debt 0.6 0.6 - Total current liabilities 147.5 3.4 144.1 Non-current liabilities Deferred tax liability 3.0 0.9 2.1 Finance and operating lease liabilities, net of current portion 21.2 - 21.2 Other long-term liabilities 20.3 - 20.3 Long-term debt, net of current portion and deferred financing costs 203.4 26.6 176.8 Total non-current liabilities 247.9 27.5 220.4 Total liabilities 395.4 30.9 364.5 Total mezzanine equity and stockholder's equity $ 568.4 135.6 432.8 December 31, 2022

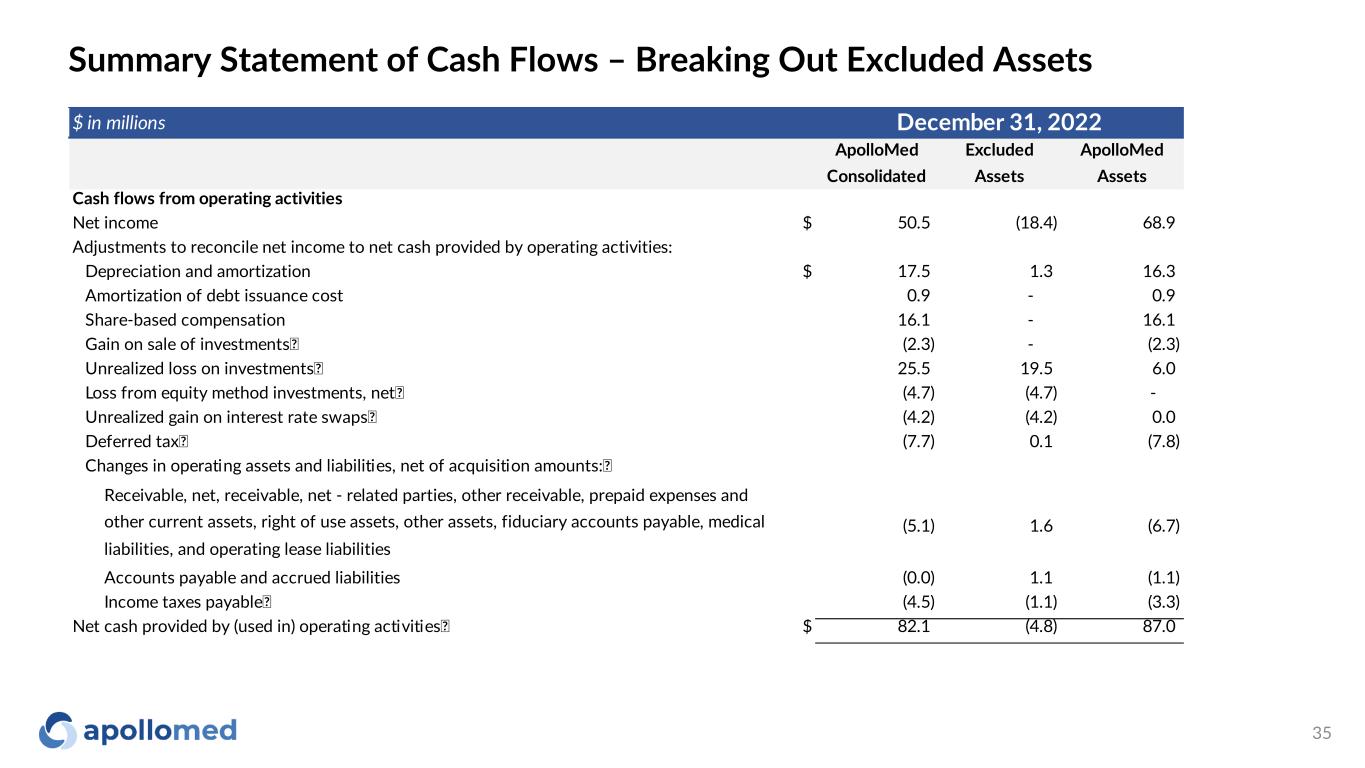

Summary Statement of Cash Flows – Breaking Out Excluded Assets 35 $ in millions ApolloMed Consolidated Excluded Assets ApolloMed Assets Cash flows from operating activities Net income $ 50.5 (18.4) 68.9 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization $ 17.5 1.3 16.3 Amortization of debt issuance cost 0.9 - 0.9 Share-based compensation 16.1 - 16.1 Gain on sale of investments (2.3) - (2.3) Unrealized loss on investments 25.5 19.5 6.0 Loss from equity method investments, net (4.7) (4.7) - Unrealized gain on interest rate swaps (4.2) (4.2) 0.0 Deferred tax (7.7) 0.1 (7.8) Changes in operating assets and liabilities, net of acquisition amounts: Receivable, net, receivable, net - related parties, other receivable, prepaid expenses and other current assets, right of use assets, other assets, fiduciary accounts payable, medical liabilities, and operating lease liabilities (5.1) 1.6 (6.7) Accounts payable and accrued liabilities (0.0) 1.1 (1.1) Income taxes payable (4.5) (1.1) (3.3) Net cash provided by (used in) operating activities $ 82.1 (4.8) 87.0 December 31, 2022

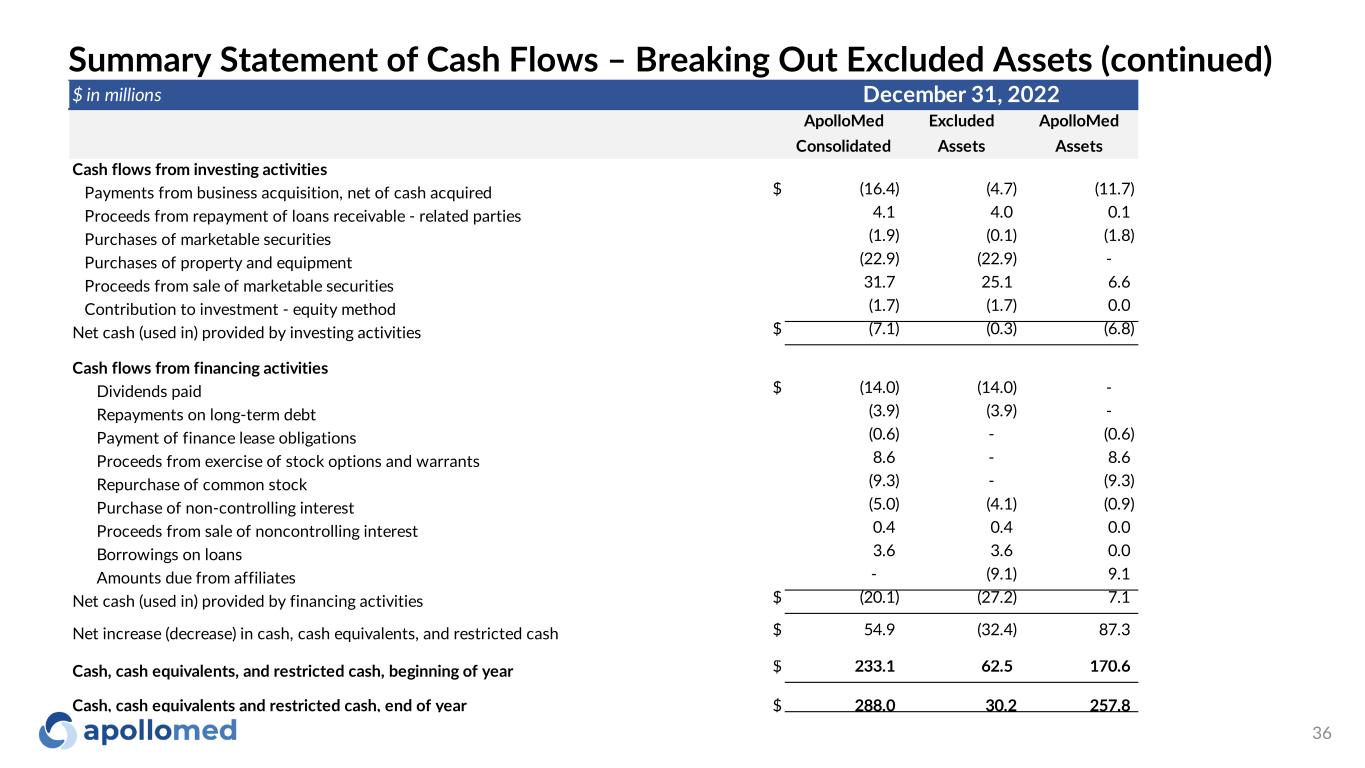

Summary Statement of Cash Flows – Breaking Out Excluded Assets (continued) 36 $ in millions ApolloMed Consolidated Excluded Assets ApolloMed Assets Cash flows from investing activities Payments from business acquisition, net of cash acquired $ (16.4) (4.7) (11.7) Proceeds from repayment of loans receivable - related parties 4.1 4.0 0.1 Purchases of marketable securities (1.9) (0.1) (1.8) Purchases of property and equipment (22.9) (22.9) - Proceeds from sale of marketable securities 31.7 25.1 6.6 Contribution to investment - equity method (1.7) (1.7) 0.0 Net cash (used in) provided by investing activities $ (7.1) (0.3) (6.8) Cash flows from financing activities Dividends paid $ (14.0) (14.0) - Repayments on long-term debt (3.9) (3.9) - Payment of finance lease obligations (0.6) - (0.6) Proceeds from exercise of stock options and warrants 8.6 - 8.6 Repurchase of common stock (9.3) - (9.3) Purchase of non-controlling interest (5.0) (4.1) (0.9) Proceeds from sale of noncontrolling interest 0.4 0.4 0.0 Borrowings on loans 3.6 3.6 0.0 Amounts due from affiliates - (9.1) 9.1 Net cash (used in) provided by financing activities $ (20.1) (27.2) 7.1 Net increase (decrease) in cash, cash equivalents, and restricted cash $ 54.9 (32.4) 87.3 Cash, cash equivalents, and restricted cash, beginning of year $ 233.1 62.5 170.6 Cash, cash equivalents and restricted cash, end of year $ 288.0 30.2 257.8 December 31, 2022

Path to Global Risk

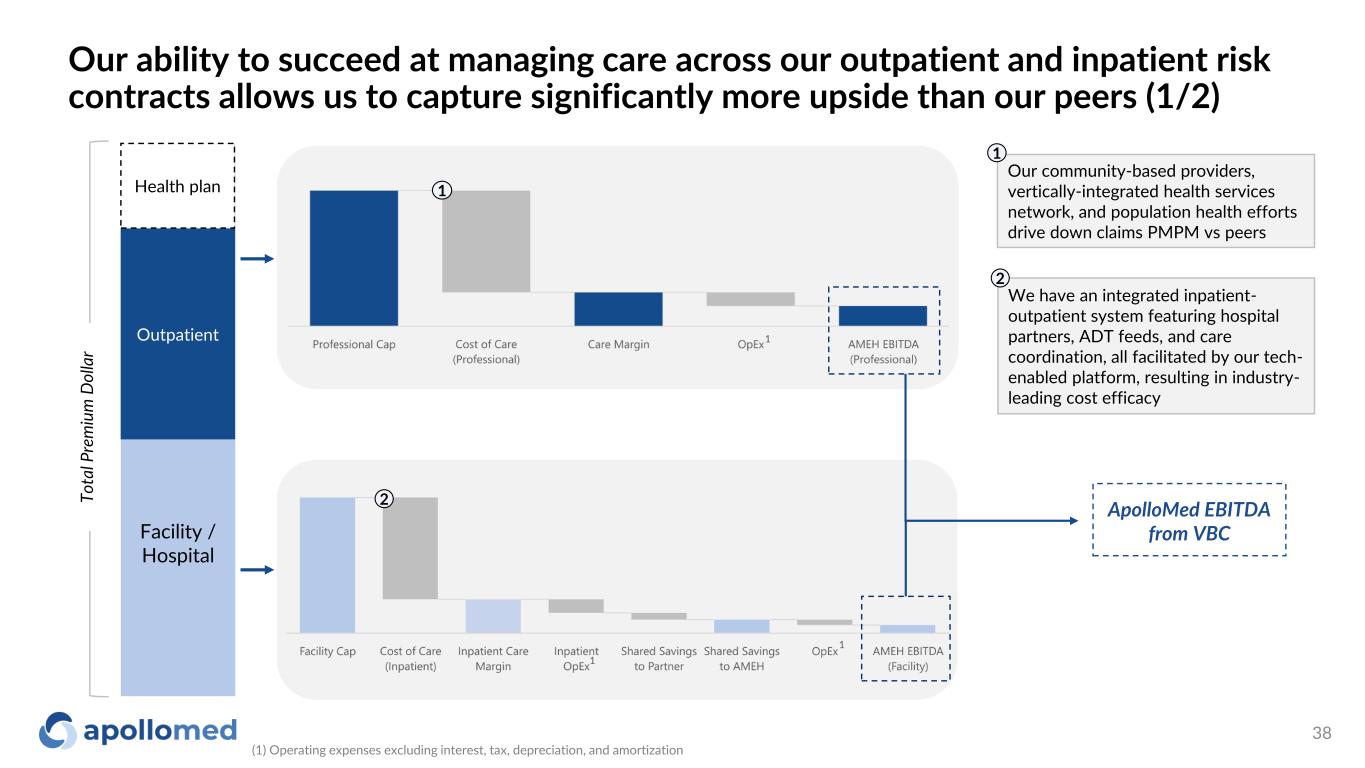

Our ability to succeed at managing care across our outpatient and inpatient risk contracts allows us to capture significantly more upside than our peers (1/2) Facility / Hospital Outpatient To ta l P re m iu m D ol la r ApolloMed EBITDA from VBC We have an integrated inpatient- outpatient system featuring hospital partners, ADT feeds, and care coordination, all facilitated by our tech- enabled platform, resulting in industry- leading cost efficacy 2 1 2 Health plan Our community-based providers, vertically-integrated health services network, and population health efforts drive down claims PMPM vs peers 1 1 1 (1) Operating expenses excluding interest, tax, depreciation, and amortization 1 38

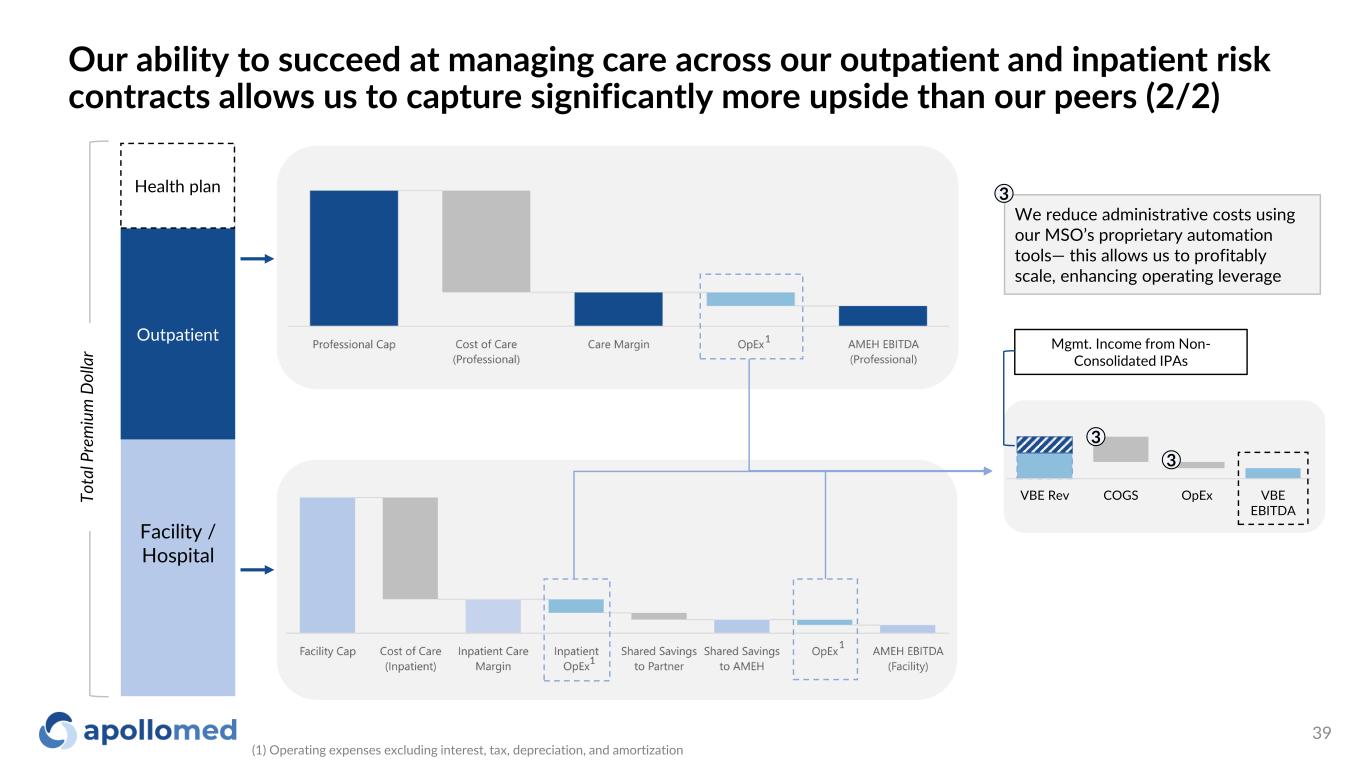

Facility / Hospital Outpatient To ta l P re m iu m D ol la r Health plan We reduce administrative costs using our MSO’s proprietary automation tools— this allows us to profitably scale, enhancing operating leverage 3 1 1 1 VBE Rev COGS OpEx VBE EBITDA 3 3 Mgmt. Income from Non- Consolidated IPAs Our ability to succeed at managing care across our outpatient and inpatient risk contracts allows us to capture significantly more upside than our peers (2/2) (1) Operating expenses excluding interest, tax, depreciation, and amortization 39

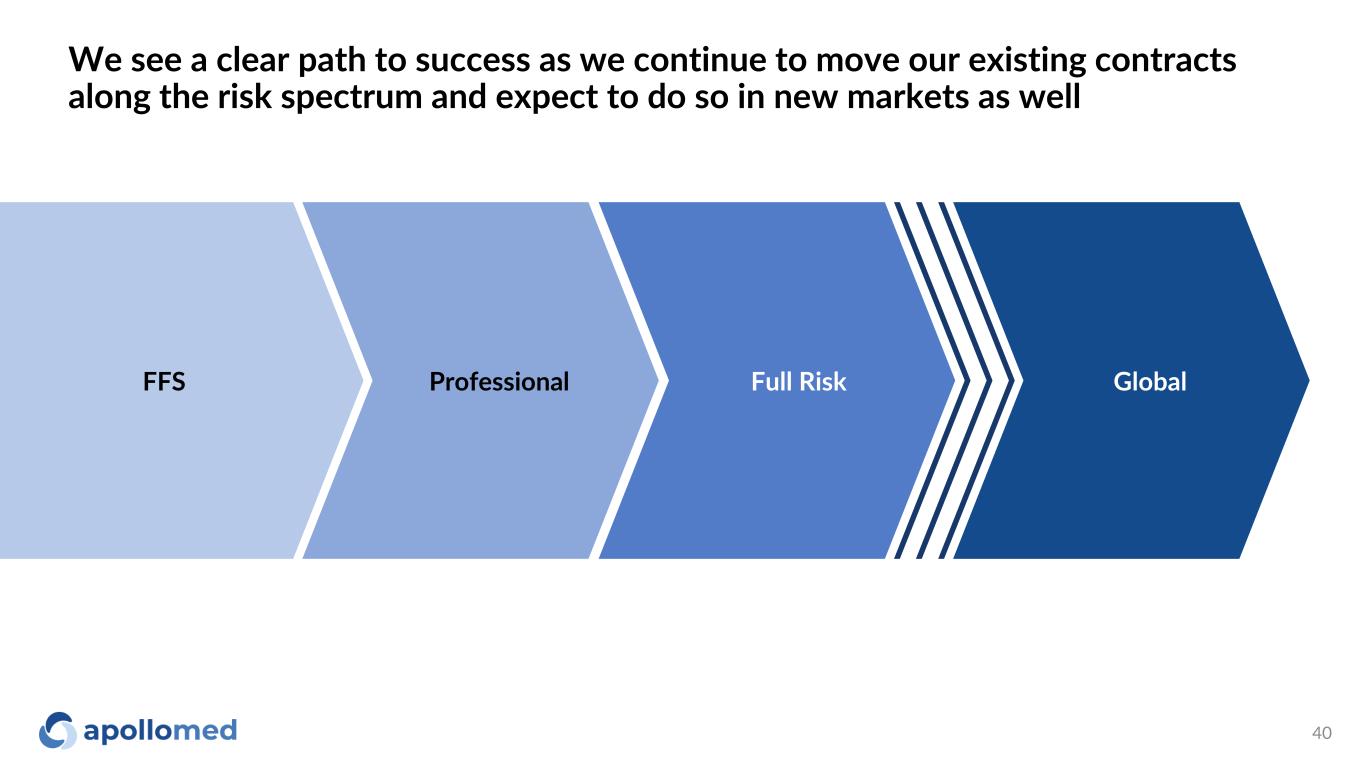

We see a clear path to success as we continue to move our existing contracts along the risk spectrum and expect to do so in new markets as well FFS Professional Full Risk Global 40

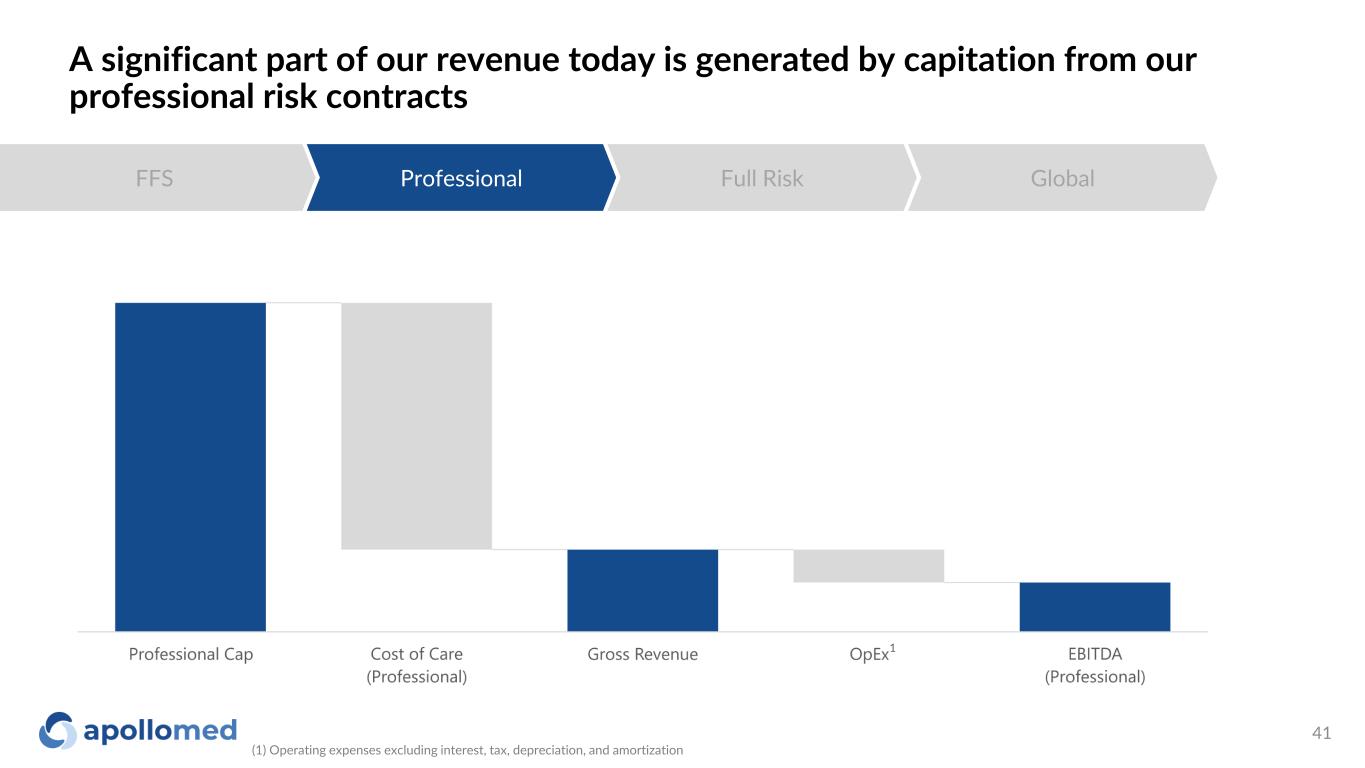

A significant part of our revenue today is generated by capitation from our professional risk contracts FFS Professional Full Risk Global 1 (1) Operating expenses excluding interest, tax, depreciation, and amortization 41

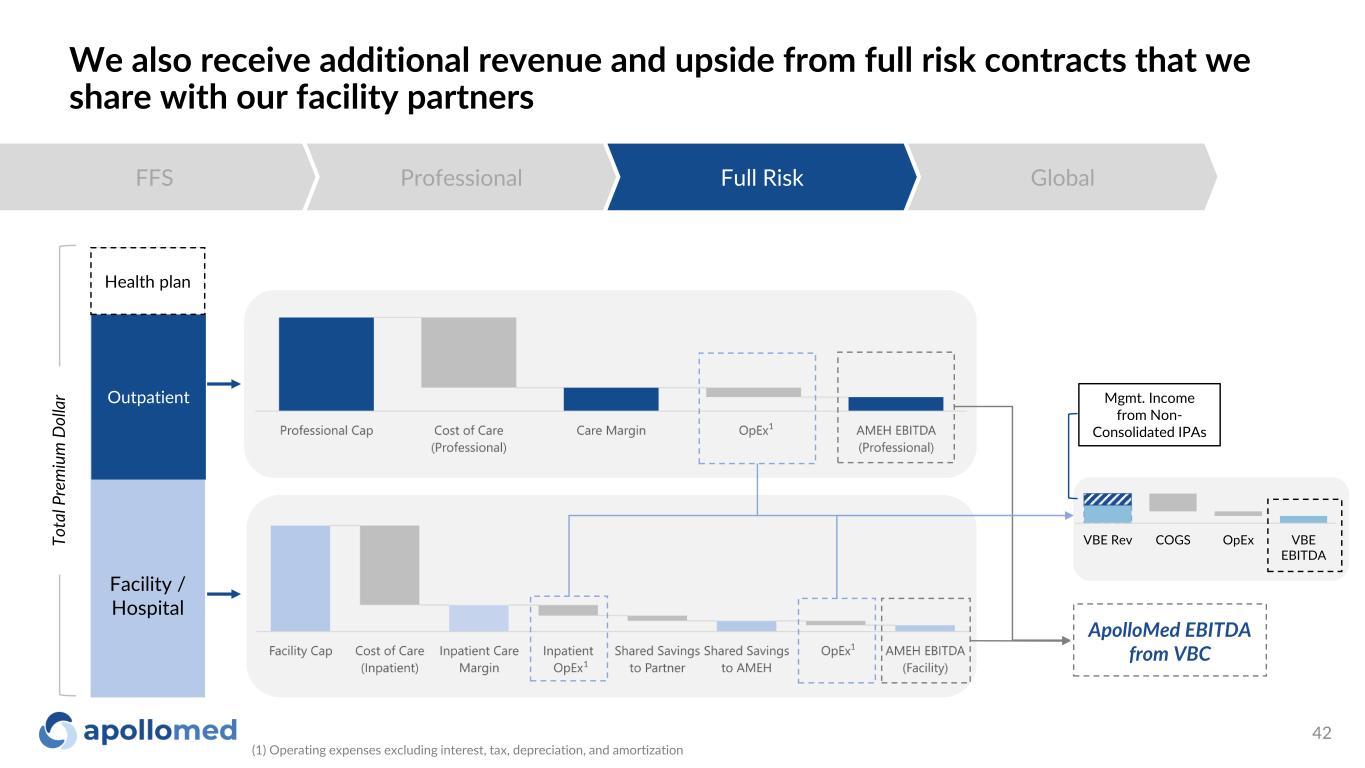

We also receive additional revenue and upside from full risk contracts that we share with our facility partners FFS Professional Full Risk Global Facility / Hospital Outpatient ApolloMed EBITDA from VBC Health plan 1 1 1 To ta l P re m iu m D ol la r VBE Rev COGS OpEx VBE EBITDA Mgmt. Income from Non- Consolidated IPAs (1) Operating expenses excluding interest, tax, depreciation, and amortization 42

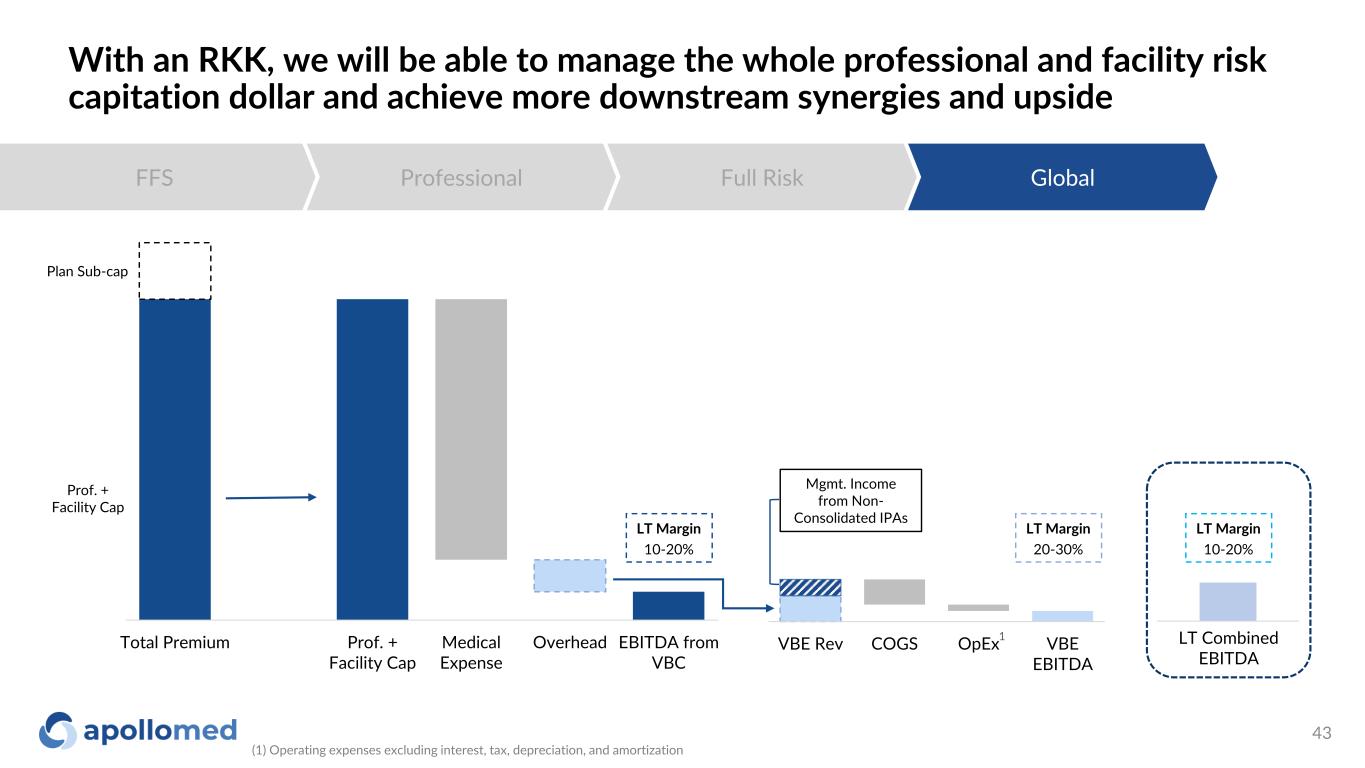

With an RKK, we will be able to manage the whole professional and facility risk capitation dollar and achieve more downstream synergies and upside FFS Professional Full Risk Global Total Premium Prof. + Facility Cap Medical Expense Overhead EBITDA from VBC VBE Rev COGS OpEx VBE EBITDA Plan Sub-cap Prof. + Facility Cap LT Margin 10-20% LT Margin 20-30% LT Margin 10-20% LT Combined EBITDA Mgmt. Income from Non- Consolidated IPAs 1 (1) Operating expenses excluding interest, tax, depreciation, and amortization 43

Key acronyms ◦ ACO: Accountable Care Organization ◦ ACO REACH: Accountable Care Organization Realizing Equity, Access, and Community Health ◦ AIPBP: All-Inclusive Population-Based Payments ◦ APC: Allied Physicians of California IPA ◦ CMMI: Centers for Medicare and Medicaid Innovation Center ◦ CMS: Centers for Medicare and Medicaid Services ◦ DC: Direct Contracting ◦ DCE: Direct Contracting Entity ◦ DME: Durable Medical Equipment ◦ Health Plan / Payers: Health Insurance Companies ◦ HMO: Health Maintenance Organization ◦ IPA: Independent Practice Association ◦ NCI: Non-Controlling Interest ◦ NMM: Network Medical Management, Inc. ◦ MSA: Master Service Agreement ◦ MSO: Management Services Organization ◦ NGACO: Next Generation Accountable Care Organization ◦ PCP: Primary Care Physician ◦ PMPM: Per Member Per Month ◦ SNF: Skilled Nursing Facility ◦ VIE: Variable Interest Entity ◦ RKK: Restricted Knox-Keene 44

Use of Non-GAAP Financial Measures This presentation contains the non-GAAP financial measures EBITDA and adjusted EBITDA, of which the most directly comparable financial measure presented in accordance with U.S. generally accepted accounting principles (“GAAP”) is net (loss) income. These measures are not in accordance with, or an alternative to, GAAP, and may be different from other non-GAAP financial measures used by other companies. The Company uses adjusted EBITDA as a supplemental performance measure of the Company’s operations, for financial and operational decision-making, and as a supplemental means of evaluating period-to-period comparisons on a consistent basis. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation, and amortization, excluding income from equity method investments, provider bonuses, stock-based compensation, APC excluded assets costs, impairment of intangibles, provision of doubtful accounts, and other income earned that is not related to the Company’s normal operations. Adjusted EBITDA also excludes non-recurring items, including the effect on EBITDA of certain recently acquired IPAs. The Company believes the presentation of these non-GAAP financial measures provides investors with relevant and useful information, as it allows investors to evaluate the operating performance of the business activities without having to account for differences recognized because of non-core or non-recurring financial information. When GAAP financial measures are viewed in conjunction with non-GAAP financial measures, investors are provided with a more meaningful understanding of the Company’s ongoing operating performance. In addition, these non-GAAP financial measures are among those indicators the Company uses as a basis for evaluating operational performance, allocating resources, and planning and forecasting future periods. Non-GAAP financial measures are not intended to be considered in isolation from, or as a substitute for, GAAP financial measures. To the extent this release contains historical or future non-GAAP financial measures, the Company has provided corresponding GAAP financial measures for comparative purposes. The reconciliation between certain GAAP and non-GAAP measures is provided above. 45